How to Calculate Chargeback Win Rates

Chargeback win rate is a calculation that compares the number of successful chargeback responses to the number of cases fought. This key performance indicator (KPI) is commonly used to evaluate the effectiveness of a chargeback management strategy.

We’ve created a detailed guide to help you understand how to measure — and improve — your chargeback win rates.

- Why Win Rates Matter

- Win Rate Equations Explained

- Good Win Rates vs. Bad Win Rates

- Tips for Maximizing Your Win Rate

Why Win Rates Matter

Do you want to know one of our most valuable tips? It’s a suggestion we include in nearly every conversation we have about chargeback management.

Here it is: analyze your chargeback data.

Why? Because it is that important!

WITHOUT DATA, your strategy is...

Based on hunches, guesses, and assumptions

- Capable of producing short-term, sporadic success

- Reactive

- Highly susceptible to unnecessary revenue loss

WITH DATA, your strategy is...

Based on intelligent, data-driven decisions

- Capable of generating sustainable success

- Proactive

- Optimized for maximum return on investment

Win rates are one of the many chargeback variables you’ll want to monitor. They help you understand your overall performance so you can keep the techniques that are working well and improve the processes that aren’t achieving the desired results.

For example, win rates can help you determine things like:

- The ideal balance between fighting and not fighting.

- Which types of evidence are most compelling.

- How to format and order the documents in your response so it has the best chance of acceptance.

- The reason codes that are easiest to win.

- Which issuing banks are least likely to file pre-arbitration.

- The regions or countries that have the highest success rate.

- The amount of time, effort, and money that need to go into a winning response.

- The team member or technology platform that wins the most.

Don’t just fire off responses and hope you’ve done everything right. Take the time to dig into your data so you know what it takes to win.

Win Rate Equations Explained

At Kount, we use three different equations to calculate win rates. By providing multiple metrics, we enable our clients to monitor what matters most for their businesses.

The calculations are based on a few different variables. Here’s a brief overview of what those variables are and how we define them:

- Fought - You exercised your chargeback rights and responded to the invalid dispute.

- Did Not Fight - You chose not to respond to the chargeback.

- Won - You fought the chargeback and won. The issuer thought your argument was compelling, so the cardholder was held responsible for payment.

- Lost - You fought the chargeback and lost. The issuer didn’t think your evidence was strong enough. The chargeback stands.

- Pre-Arbitration - You fought the chargeback and initially won. But the cardholder disputed the transaction a second time, so your win turned into a loss.

NOTE: There is no official win rate calculation or definition endorsed by the card networks (Mastercard®, Visa®, etc.). So the process we use isn’t universal — someone else in the industry might use a different equation.

However, we think the following metrics are the most accurate and useful. And by giving you different ways to calculate your win rate, you can analyze the metrics that are most relevant to your business.

Win Rate

We call the most basic calculation the Win Rate equation. It is applied pretty consistently throughout the industry and is the calculation most commonly used when anyone refers to ‘win rates’.

Win Rate is the ratio of chargebacks won versus the number of cases lost.

Win Rate = Chargebacks Won / (Won + Lost)

The reason this equation is most commonly used to monitor outcomes is because it is the purest reflection of success — whether that’s the success of your in-house team or the capabilities of the technology you use.

Win Rate evaluates the effectiveness of your chargeback responses without being influenced by other factors outside your control — like cardholder actions or return on investment (ROI).

Win Rate+

We use a second calculation, Win Rate+, to compare the number of chargebacks that were won against cases that were either lost or went to pre-arbitration.

Win Rate+ = Chargebacks Won / (Won + Lost + Pre-Arbitration)

At Kount, we usually encourage merchants to accept liability if a case advances to the pre-arbitration phase (unless it is a Visa allocation dispute — those we think merchants can fight).

So if you don’t respond, pre-arbitration is essentially a type of loss. Therefore, this equation can help you estimate the amount of money you’ll win back (since both losses and pre-arbs mean revenue won’t be recovered).

Win Rate++

We call the third equation Win Rate++, and it compares cases that were won against all disputes filed.

Win Rate++ = Chargebacks Won / (Won + Lost + Pre-Arbitration + Did Not Fight)

We provide this chargeback ratio because it is the most comprehensive and reflects every possible outcome.

However, it isn't the best way to evaluate the effectiveness of your chargeback responses. It doesn’t give the transparency you need to figure out what it takes to win.

Good Win Rates vs. Bad Win Rates

A question we commonly receive from merchants is: “What will my win rate be?”

Win rates are a great metric to help you measure and improve your own abilities. But it can be difficult to compare your success to someone else — there are so many variables that fluctuate from one business to another.

Looking at data from similar merchants in similar industries with a similar mix of reason codes and a similar amount of compelling evidence can give you a pretty accurate estimate of what your win rate could be.

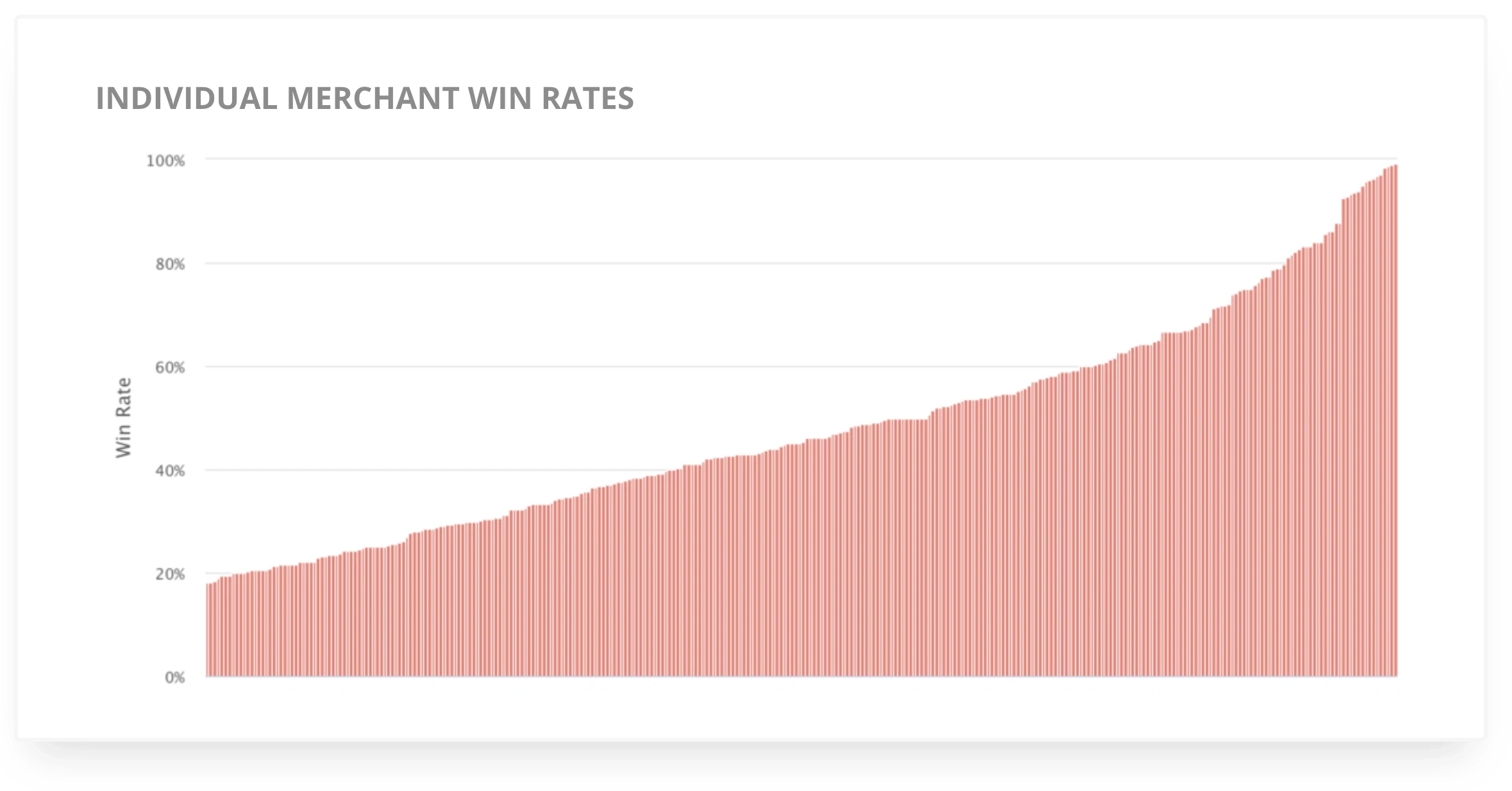

In general, our merchants have an average chargeback win rate between 40% and 85%. However, the annual Year in Chargebacks report reveals there are individual businesses that fall well outside that average.

But the win rates that differ from the norm aren’t good or bad — they’re just different. They are the result of how those businesses choose to operate.

Rather than worry about whether your win rate is ‘good’ or ‘bad’, evaluate your outcomes in these two ways:

- How is your win rate impacting ROI?

- How can you improve your win rate and — more importantly — your ROI?

And we have several suggestions to help you improve your odds of winning.

Top Tips for Maximizing Your Win Rate

Improving your win rate — or more accurately, increasing the amount of money you recover — should be a top priority. Here are some helpful tips that will likely have the biggest impact on your outcomes.

Use chargeback prevention tools.

The average merchant uses chargeback prevention solutions to lower chargeback rates and reduce the risk of threshold breaches. And that’s great.

But there’s an added bonus. The more chargebacks you can prevent, the fewer you’ll have to fight!

Check out the following options:

- Order validation allows you to share purchase information in real time when a transaction is disputed. If you can empower the issuing bank to clarify the transaction, you could stop the cardholder from filing a chargeback.

- Prevention alerts and Rapid Dispute Resolution (RDR) allow you to refund disputed transactions — eliminating the need for chargebacks.

Use identify verification tools.

Several things can impact your win rate, but the availability of relevant compelling evidence is often the most influential. If you don’t have evidence to support your claims, the chargeback can’t be won.

This is especially true in situations where ‘friendly’ fraud is masquerading as criminal fraud. If you want to fight friendly fraud and win, you need to prove the actual cardholder — and not a criminal — made the purchase.

One of the best ways to do that is to share approval codes from identity verification tools:

- Address verification service (AVS)

- Card security codes (CVV2, CVC2, etc.)

- 3D Secure 2.0

But despite their impact on win rates, many merchants choose not to use these tools because they are focused on providing the smooth and simple checkout process that today’s customers demand.

If you opt out of identity verification because you want fewer false positives and lower cart abandonment, then you might forfeit chargeback response rights. Less friction during the checkout process will likely result in a lower-than-average win rate.

But if you can find the perfect balance of friction and ease, you can provide a great customer experience and have the compelling evidence needed to fight friendly fraud — which translates into higher win rates and more recovered revenue.

Know what you are analyzing.

We’ve provided you with three win rate calculations. Here’s a refresher:

- Win Rate = Chargebacks Won / (Won + Lost)

- Win Rate+ = Chargebacks Won / (Won + Lost + Pre-Arbitration)

- Win Rate++ = Chargebacks Won / (Won + Lost + Pre-Arbitration + Did Not Fight)

To achieve the most comprehensive, most insightful analysis possible, it’s a good idea to consider all three calculations. Because if you look at just one equation, you’ll be judging your results without context — which will give you an incomplete understanding of the situation.

For example, looking at the Win Rate equation alone could give you a false sense of confidence in your processes and ROI. Here’s a hypothetical example:

EXAMPLE #1

Jerry pats himself on the back because he has a 94% win rate. He assumes that means his responses are super effective and he’s recovering nearly all of his lost revenue. But in reality, Jerry’s strategy isn’t as effective as he thinks. His Win Rate++ is just 16% because Jerry is only fighting a very small portion of disputes — just the ones that are easy to win. His responses might be as great as he assumes, but it’s hard to tell because he isn’t fighting many cases. Plus, Jerry is leaving a lot of money on the table.

Conversely, you might look at a low Win Rate++ and be unnecessarily discouraged. Here’s another hypothetical example:

EXAMPLE #2

Elaine is upset that her Win Rate++ is only 27%. She feels like a failure! All that money, lost forever! What is she doing wrong?! But Elaine’s Win Rate is 71%. Her responses are strong, she just doesn’t realize it. What’s distorting her reality is the high number of ‘did not fight’ chargebacks. Elaine filtered out a ton of cases because they were for low dollar amounts — she would have spent a lot more to fight than she could have recovered. Elaine is letting her low fight rate overshadow her impressive ROI.

Remember, the goal of fighting chargebacks is to recover revenue. Your win rate can help you gauge effectiveness, but only ROI reveals the impact your efforts have on the bottom line.

Analyze your data at the just-right time.

Analyzing your win rate can help you improve your outcomes — but only if the timing is right.

If you run the numbers too early, the results may not be accurate. But if you analyze the data too late, undetected issues could cause lower-than-necessary rates for a longer-than-necessary time period.

The best time to analyze win rate is about 60 to 90 days after the chargeback was issued.

If a case is lost, the outcome is usually reported right away. But it can take several weeks — usually a month or more — to acknowledge a win. Any wins that are reported within 30-60 days aren’t a guarantee. A case isn’t officially won until the pre-arbitration filing deadline has passed.

So wait until the results are final, but don’t wait so long that you miss opportunities to make improvements. You want to detect potential shortcomings as soon as possible.

Optimize your response for success.

More than anything else, these two things influence your probability of success:

- Submitting your response before the deadline

- Creating an accurate, professional, compelling response

The documents you submit and the argument you craft is the very heart of your response. Make it the very best it can be. Here’s how:

- Understand submission expectations. Ask your processor if there is a preferred file type for submission. And see if you need to order or format your documents in a certain way.

- Create a professional, easy-to-read case. If no one can understand what you are trying to say, you’ll have a hard time winning! Check for spelling errors, typos, run-on sentences, grammar mistakes — basically, anything that could confuse your message.

- Customize your response. There is no one-size-fits-all when fighting chargebacks. Each response needs to be unique. Make sure the evidence you include and the claims you make are relevant to the chargeback reason code, the product purchased, the cardholder’s claims, the type of transaction processed, etc.

- Make sure your entire team is on the same page. Create policies and procedures to help guide your team so cases are managed consistently from one person to the next. Everyone needs to adhere to the same high standards.

Use a technology platform to fight chargebacks.

Our number one tip for maximizing your win rate is to use chargeback management technology.

You are a highly skilled professional. An expert. No one can do your job quite like you. But chargeback management is complicated. And there are tons of detailed, time-consuming, error-prone tasks involved. You can do a lot, but you can’t be a master of everything — and no one expects you to!

That’s where chargeback management services can help. Free up your team’s valuable resources by using technology to streamline workflows, automate redundancies, and optimize efficiency.

If you’d like to learn more, contact Kount today. We’ll help you pick a strategy that is just right for your business so you’ll have the best win rates with the maximum amount of revenue and the least amount of effort.