PROTECT CARD-NOT-PRESENT PAYMENTS

Prevent unauthorized transactions with payment fraud detection

You can’t do business without processing payments — but that can come with risks. How do you make sure the transactions made with your business are legitimate? And what can you do when they’re not? That’s where payment fraud protection comes in.

STOP ONLINE PAYMENT FRAUD

How Kount protects digital payments

Want to know the secret to success? It’s simple. The right data paired with intelligent machine learning yields the best results.

A user interacts with your site.

Once a customer interacts with your website — adding items to a cart, filling in payment information, etc. — Kount starts collecting information about the user. This data includes device information, location, IP address, email address, and more.

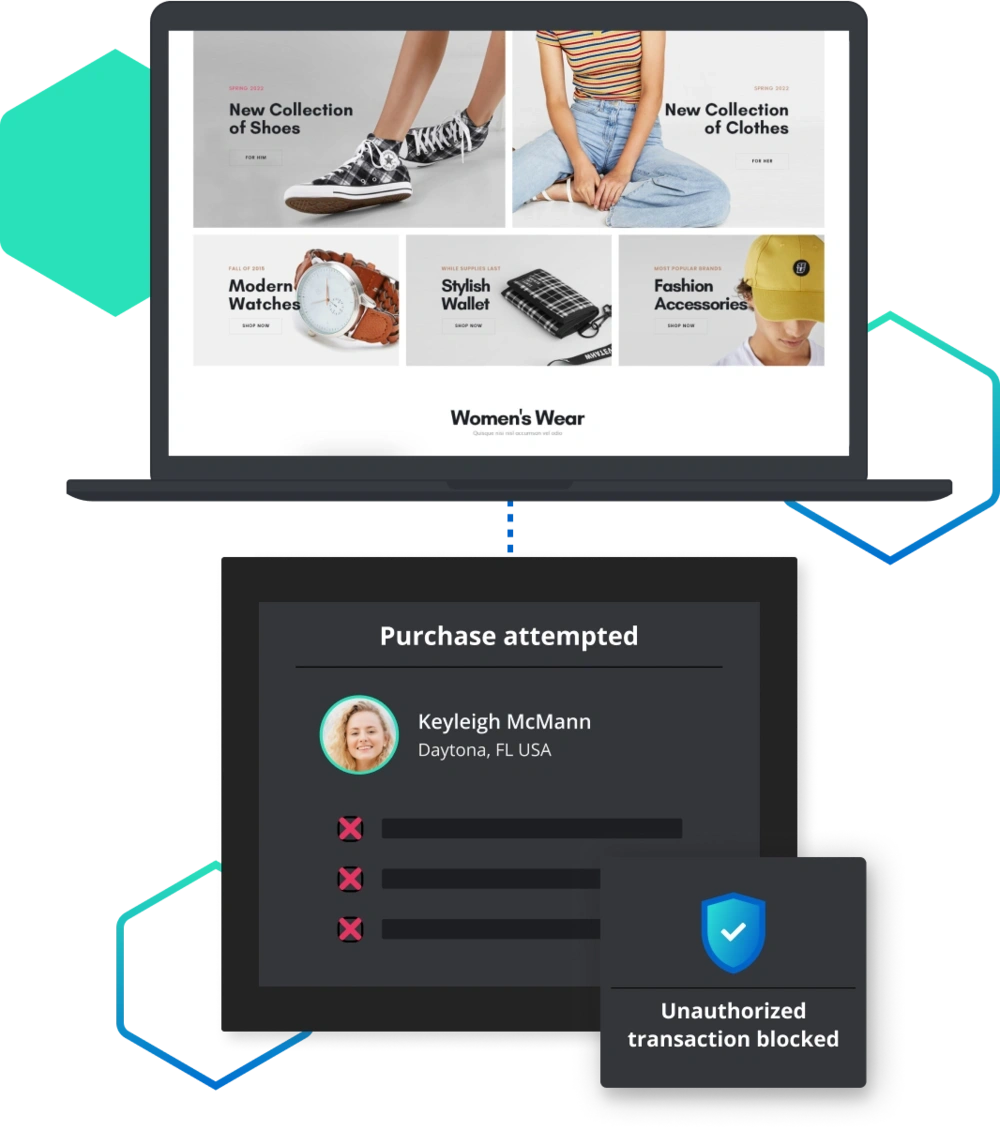

The user’s data is evaluated.

After collecting the user’s data, Kount technology compares it with data in our network. The technology looks for patterns and behaviors that could be suspicious.

The technology identifies potential fraud risk with risk scoring.

Once the evaluation is complete, the technology provides a safety score. Essentially, this score indicates whether the user is high risk or low risk.

The interaction is accepted or blocked.

The technology consults your business policies to decide whether to block, challenge, or accept the interaction.

Protect multiples types of payment with confidence

No matter the type of CNP payment method, we got you covered.

Credit and debit card

Keep traditional payment methods safe from fraudsters who obtain card numbers online.

Payment apps

Whether your customers pay with Venmo, Cash App, or Square, all transactions are secured.

BNPL

Offer new and innovative payment methods without worry of any additional type of fraud risk.

Digital wallets

Keep stored payment information and digital wallets safe from account takeover and theft.

WHY PAYMENT FRAUD PREVENTION MATTERS

Benefits you can’t afford to miss

Do you really need to invest in payment fraud prevention software? Here’s what’s at stake if you do and if you don’t.

WITHOUT protection

- Increase chargebacks.

- Risk failing compliance with regulations.

- Allow attacks on customer accounts.

- Let in debit and credit card fraud.

- Loose customer trust.

- Work with poor fraud management.

- Take guesses and hunches.

- Block legitimate customers.

WITH protection

- Reduce unauthorized transactions.

- Adhere to online safety regulations.

- Create safer customer experiences .

- Secure online payments.

- Improve customer relationships.

- Develop effective risk management.

- Perform data analysis in real time.

- Accept more good orders.

WHY CHOOSE KOUNT?

Detect and prevent fraud at every stage of the buying journey

Various fraud detection softwares can protect payments. So what makes Kount different? Here’s what sets us apart.

Complete solution

Our solution offers protection at every stage of the customer’s buying journey. That includes protecting customer accounts from card and loyalty points theft as well as preventing fraudsters from making payments with stolen card numbers.

Customisable strategy

Your business is unique. What works for one business may not work for you. We can help you create a fraud prevention strategy that works with your current business processes. With Kount, you have multiple options to choose from to build a solution portfolio that fits your needs.

Fair pricing

We make sure you only pay for what you need. We offer per-transaction pricing on many of our solutions. Plus, we offer discounts when you bundle multiple solutions or increase processing volume. As a result, you get the best value for your money.

Layered protection

We offer solutions that protect multiple points in the customer journey — all on one platform. With Kount, you get the benefit of protection from a variety of fraud issues — card testing, friendly fraud, account takeover fraud, payment fraud, and more — without having to manage multiple interfaces.

Unmatched data

Data is crucial to the success of any fraud solution. Our data spans over two decades — which means we have a more expansive set of information and understanding than any of our competitors. As a result, our technology produces more accurate decisions and thus, better fraud protection.

Flexible technology

Our technology uses two types of machine learning so that we can deliver the best results possible. We continually innovate our solutions to adapt to new fraud trends so that you can always be one step ahead.

TESTIMONIALS

Hear from our clients

Check out these real-life stories of how Kount has helped merchants in different industries manage online payment fraud.

Protecting Cineplanet's online experience

Cineplanet is a leading chain of cinemas in Latin America. And the reason they lead the industry is because of their focus on the customer experience. From ordering online and picking up at the theater to reserving tickets, Cineplanet ensures a unique and safe experience.

And Kount helps them accomplish that goal. By providing protection on Cineplanet’s ecommerce platform, the company is free to continually revolutionize the way they do business without worry of the potential risks.

Helping PetMeds expand to new markets

When it comes to care for your pets, PetMeds has everything you need — prescription medications, food, bedding, treats, vitamins, and more. And when it comes to their customers, they treat every pet owner with care and attention, no matter the issue.

One thing PetMeds doesn’t have to worry about is fraud. While medications typically deter fraudsters from scams, retail items don’t. But with Kount, those risks are minimal and profits are higher than ever.

FREQUENTLY ASKED QUESTIONS

Common concerns about payment fraud detection software

Payment fraud happens when a fraudster obtains unauthorized access to payment details and makes purchases online. Often, fraudsters buy stolen card numbers on the dark web or hack into customer accounts to steal payment info.

Generally, our solutions are billed on a per-interaction basis. Check out our pricing page for more information.

One thing to keep in mind when shopping for fraud protection software is that you’re making an investment for your business. So you want to make sure you get the best value for your money without sacrificing quality.

Keep in mind that a chargeback guarantee or a chargeback insurance plan might seem like an effective, economic way to protect your business. But that’s not always the case. Make sure you understand what is and isn't covered. Usually, long-term success is sacrificed for quick wins and temporary gains.

Building a fraud solution on your own is no easy task. It’s possible to do, but it takes time, resources, and money. Plus, once you have a solution built, you still have to maintain the system by continually updating the software.

In general, it can be a lot more expensive to build an in-house solution than to buy a pre-built one from a fraud provider and personalize it to your business.

Not to mention there are additional benefits to working with a provider — such as continual support and guidance from experts, software updates, data networks, and more.

Let’s be honest: no tech-driven process is perfect. From a mobile app that glitches to a refrigerator that dies in the middle of the night, we’ve probably all experienced undesirable outcomes of one kind or another.

And fraud technology is no exception. There is a risk of false positives — which means legitimate transactions are falsely classified as fraud. However, at Kount, the risk is very small. Our margin of error is less than a fraction of a percent. We do everything in our power to make sure you are blocking real fraudsters without jeopardizing sales from good customers.

While the risk of false positives is very low at Kount, that’s not the case for all fraud detection systems. If you are shopping for a new solution, you’ll want to critique the six elements that influence accuracy the most:

- Historical data: How long has the service provider been in business? How much data is in the database? Are decisions based on a couple years’ of insights? Or has intelligence been gathering for decades?

- Machine learning: Is machine learning a part of the technology? How many different types are used? Will you have the most basic capabilities? Or is the technology more advanced?

- Experience: Does the team have enough experience? Will you have access to experts who can help you create an effective strategy? Or will you be left to figure everything out on your own?

- Client involvement: Does the technology automate everything without your input? Is it a one-size-fits-all black box? Or can you customize the technology to fit your unique needs?

- Timeliness: How long does it take for changes to be made? Will you have to suffer bad results for days before the problem can be fixed? Or does the technology operate in real time?

- Negative-event data: Will the technology know about past bad behavior — like chargebacks and excessive returns? Or does it assume threats only come from fraudsters?

Click here to see how Kount ranks in all six areas.

Even though technology can make mistakes from time to time, it is still far more accurate than manual processes — for a variety of reasons.

- Technology offers never-ending protection — even when employees are out of the office.

- Technology acts on facts, not subjective biases, assumptions, or opinions.

- Technology can detect patterns and trends unidentified by the human eye.

Bottom line: there are drawbacks to any fraud management strategy, but technology is the safest, most accurate, and most efficient option available.

In addition to investing in a full fraud solution, there are some things you can do to add security to your site. These steps can help identify fraudulent activity and mitigate unauthorized purchases.

You can add web security protocols such as firewalls to monitor the traffic on your site. Firewalls can help block traffic from bots that can perform a card testing attack.

You can also add authentication tools like CAPTCHAs during checkout to verify that users interacting with your site are actual humans.

Additionally, you can invest in verification tools like 3D Secure or address verification service (AVS) that will help verify that your customers are who they say they are. And requesting the card verification value (CVV) during checkout helps confirm the shopper has possession of the physical payment card.

GET STARTED TODAY

Stop fraudulent transactions and secure online payments

Thousands of companies from all over the world use Kount for payment fraud detection and prevention. Will you be next? Sign up for a demo today, and see what it’s like to have confidence in every interaction.

Talk to an Expert

Please enjoy your unlocked content below!

Related content

What’s included in payment fraud detection software?

There’s more to our solution than making sure your online payments are protected. We provide the tools and security you need to take your business to the next level.

Fraud detection

First and foremost, our payment solution detects emerging threats and quickly intervenes — providing around-the-clock protection from any kind of fraud attack.

We offer solutions for card testing fraud, gift card fraud, new account opening fraud, and more.

Chargeback management

Chargebacks are an unfortunate part of running a business. But we believe they shouldn’t hinder your success.

With Kount's payment solution, you get chargeback prevention as well as resources to recoup losses from chargebacks that are unavoidable.

Regulatory compliance software

Make sure you aren’t facilitating payments that support organized crime or terrorist organizations. Use Kount's compliance features to protect your business.

Our compliance solutions include sanctions screening, global watchlist search, customer due diligence, portfolio monitoring, and more.

Authorization optimization

A common concern for merchants is that payment fraud protection software will cause an increase in order declines. Fortunately, Kount has a solution.

We understand this issue and have built technology to help increase transaction approvals from banks. Thus, less declined orders for good customers.

Industries we work with

We work with a variety of businesses in all industries. Find out more about how Kount can address your specific needs.

Fintechs and financial institutions

We mitigate risk for entire merchant portfolios with digital identity verification, authorization optimization, regulatory reporting, and chargeback management software solutions.

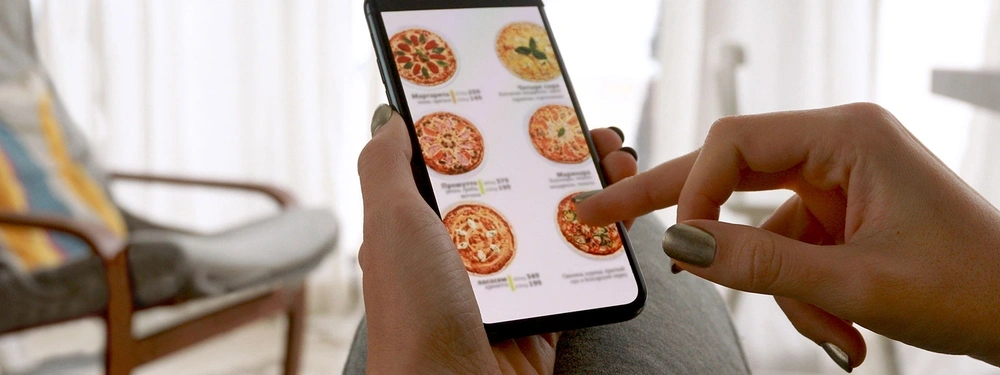

Expand revenue opportunities with safe online ordering and mobile app payments

In many industries, mobile ordering and payments are becoming commonplace. They bring in newer generations of consumers, make the checkout process quick and easy, and offer businesses loads of revenue potential.

However, mobile apps are vulnerable to fraud because most aren’t created with built-in fraud detection features.

But did you know Kount can help protect your mobile apps — and optimize that protection specifically for the platform?

It’s true! We offer software development kits (SDKs) that integrate fraud technology into the development of mobile apps.

Why go through all the trouble of releasing an app only for it to bring in high levels of risk? We believe it’s best to incorporate fraud prevention into the app from the start.

The Main Benefits of SDKs

- An SDK gives you complete and accurate insights about who you are interacting with.

- With an SDK, you have multiple layers of protective technology — which means multiple points for detecting suspicious behavior and transactions.

- Customers can have zero friction during mobile login.

- Customers will have a faster checkout and smoother process.

Talk to one of our team members to learn more.