Credit Card Chargeback vs. Debit Chargeback

What’s the difference between credit card chargebacks and debit card chargebacks? How does each threat impact your business?

We’ve created this simplified guide to help you understand a complex topic.

- Credit Cards and Debit Cards Explained

- Credit and Debit Dispute Rules

- Preventing Debit and Credit Chargebacks

- Credit and Debit FAQs

Credit Cards and Debit Cards Explained

While both credit and debit cards eliminate the need to pay with cash, they are not the same.

The primary difference is where the funds come from.

A credit card provides a line of credit to the cardholder. The issuer essentially loans money to the cardholder for every purchase that is made, and the cardholder is expected to repay the issuer at the end of each billing cycle.

When a purchase is made with a debit card, funds are immediately withdrawn from the associated checking or savings account.

Credit card purchases are charged against a line of credit.

Debit card purchases withdraw money directly from a bank account.

It’s important to understand these differences because the source of the funds may determine which law governs the transaction.

Credit and Debit Dispute Rules

Before we outline the different dispute rules, let’s first review where the rules come from.

There are three different sets of regulations that govern transaction disputes.

The Electronic Funds Transfer Act (Regulation E) establishes the rules associated with debiting a bank account.

The Consumer Credit Protection Act (Regulation Z) establishes the rules associated with managing consumer credit.

The card brand regulations establish rules for using brand-endorsed payment cards (Visa®, Mastercard®, etc.).

Issuing banks must abide by federal laws, so all Regulation E and Regulation Z requirements should be upheld when transactions are disputed. However, extending additional card brand chargeback rights is optional.

Card brand rules typically offer even greater consumer protections than the legal regulations. Issuers may choose to extend this coverage to their cardholders, but they technically don’t have to.

WHAT THIS MEANS FOR MERCHANTS

The term ‘chargeback’ is often thought to be synonymous with ‘transaction dispute’. Technically, the two aren’t interchangeable.

All chargebacks are transaction disputes, but not all transaction disputes are chargebacks.

Regulations E and Z give cardholders the right to dispute transactions, but only the card brands offer a chargeback process.

Why does that matter?

Think about your dispute management strategy. What does it entail? Are you focused solely on activity facilitated by the card brands — prevention alerts, order validation, and chargebacks? If so, you might not have a complete understanding of the customer experience.

Chargeback data is incredibly valuable. It can help you identify hidden issues and resolve problems at their source. However, there are several reasons why a consumer complaint might not ever make it to a chargeback — an issuer’s choice to limit protections is just one of the reasons. Therefore, chargebacks shouldn’t be the only metric you use to gauge customer satisfaction, the effectiveness of your processes, and the risk of potential revenue loss.

Focus on creating an exemplary customer experience — one that ensures satisfaction and resolves issues without the need of a chargeback.

The following is a high level overview of the dispute rules associated with the three different sets of regulations.

Regulation E (Debit Cards) | Regulation Z (Credit Cards) | Card Brand Regulations (Debit and Credit Cards) | |

| Type of issues regulated |

|

| All potential disputes, including:

|

| Maximum amount of cardholder liability & time limits | The cardholder may be liable for:

| The cardholder may be entitled to a full credit if billing errors (goods or services not provided, credit not issued, and accounting errors) are reported within 60 days of the statement being issued. The cardholder may be responsible for paying up to $50 for unauthorized transactions if the fraud is reported within 60 days of the statement being issued. | If the merchant accepts the chargeback, the cardholder won’t have any financial liability. But if the merchant responds, the cardholder or issuer could be liable for the full transaction amount. Time limits vary based on the chargeback reason code, but most disputes must be filed within 75 days, 90 days, or 120 days of the purchase. |

The nuances of these rules mostly impact cardholders. However a cardholder’s actions could, in a roundabout way, potentially impact your business.

WHAT THIS MEANS FOR MERCHANTS

Again, an issuer doesn’t have to offer the extended protections provided by the card brands to the cardholder when disputes arise. If the Regulation E or Z stipulations don’t apply, the issuer may choose to simply close the case.

If that happens, the cardholder may try other methods to recover the money — like reaching out to you, the merchant, directly.

The following is a hypothetical example.

When Carter — Carli’s son — turned 18, she called her issuing bank and gave permission for Carter to use one of her credit cards. But she didn’t do a good job of monitoring the account. When she checked her credit card statement months later, Carli discovered that Carter had made dozens of purchases that she hadn’t anticipated.

Frustrated, and reluctant to pay the credit card bill, Carli contacted her issuing bank and tried to claim the transactions were unauthorized. But Carli’s case didn’t fit within the Regulation Z rules for two reasons. First, she attempted to dispute the transactions after the 60 day deadline, and second, her son was technically authorized to use the card.

Since it costs the bank about $30 to process each chargeback and Carli was attempting to dispute nearly a dozen transactions, the bank decided not to honor her chargeback requests.

Since the bank wouldn’t initiate chargebacks, the only way Carli could get her money back would be to call each individual merchant and request a refund.

This may not be an extremely common situation, but it is possible. Therefore, you’ll want to balance an exceptional customer experience that proactively prevents chargebacks with a revenue-retention strategy that thoughtfully considers all potential outcomes.

Preventing Debit and Credit Chargebacks

Chargeback management techniques aren’t generally divided up into tips for debit card transactions and tips for credit card transactions.

Instead of basing a strategy on the type of card the customer used, it would be more accurate to focus on the type of transaction: card-present or card-not-present.

Preventing Card-Present Chargebacks

A card-present transaction takes place when the cardholder’s card is physically present at the time of the purchase. The card is handed over to a sales associate to be read with a point-of-sales (POS) terminal. These in-person interactions typically occur within a brick-and-mortar store.

In these encounters, fraud is the most common threat and cause for chargebacks. Therefore, detecting and blocking unauthorized transactions is the primary strategy for avoiding chargebacks.

- Only use EMV-compliant terminals.

- Use fallback options — like manually entering card payment details — as a last resort.

- Always use the correct cardholder verification method (signature or PIN).

- Make sure you differentiate between card-not-present and card-present transactions during clearing by noting internet, phone, or mail orders.

- Train your staff to identify counterfeit cards, detect suspicious behavior, and impediment fraud protection strategies.

Preventing Card-Not-Present Chargebacks

A transaction is considered card-not-present when you, the merchant, do not have access to the physical card at the time of purchase. Instead, the shopper usually communicates the card details to you. This may be done via an online store, over the phone, through the mail, or from a mobile wallet like Apple Pay.

Since card-not-present transactions are far more complex than card-present, there are dozens of different techniques and tools you should be aware of.

Check out these articles and guides:

- 30 Telltale Signs of Fraud: How to Recognize High-Risk Orders

- How to Manage Friendly Fraud

- How to Use Credit & Debit Card Authorization Holds to Prevent Chargebacks

- How to Use Data Analysis to Prevent Chargebacks

- How to Improve Customer Service to Avoid Chargebacks

- 13 Tips to Improve Your Return Policy (with Examples!)

Credit and Debit FAQs

Managing credit and debit card chargebacks is an important task. These are some of the most common questions we’ve encountered from merchants trying to manage the different threats.

Don’t see your question listed here? Reach out and we’ll help you any way we can!

Which card type — credit or debit — is used most often for online purchases?

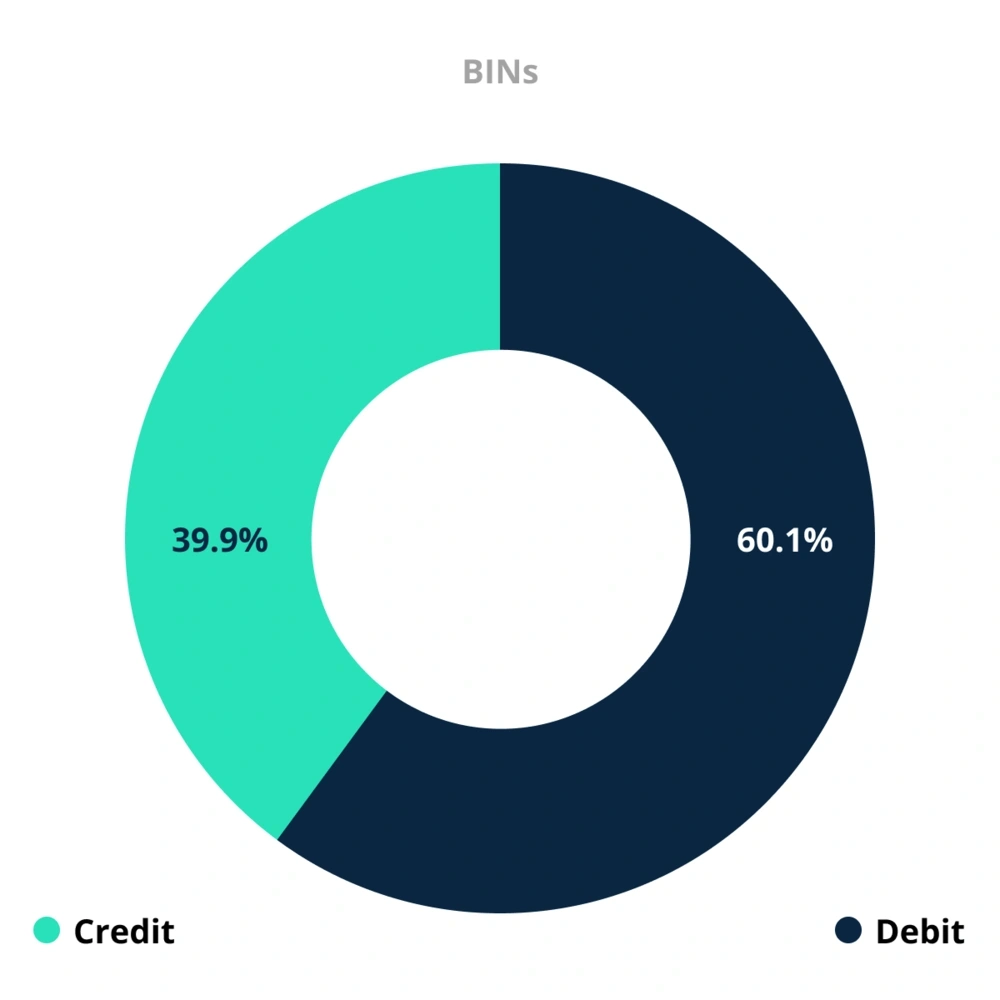

Each year, our partner Midigator analyzes merchant data to create the annual Year in Chargebacks report. As part of the 2021 report, Midigator included an analysis of bank identification numbers (BINs).

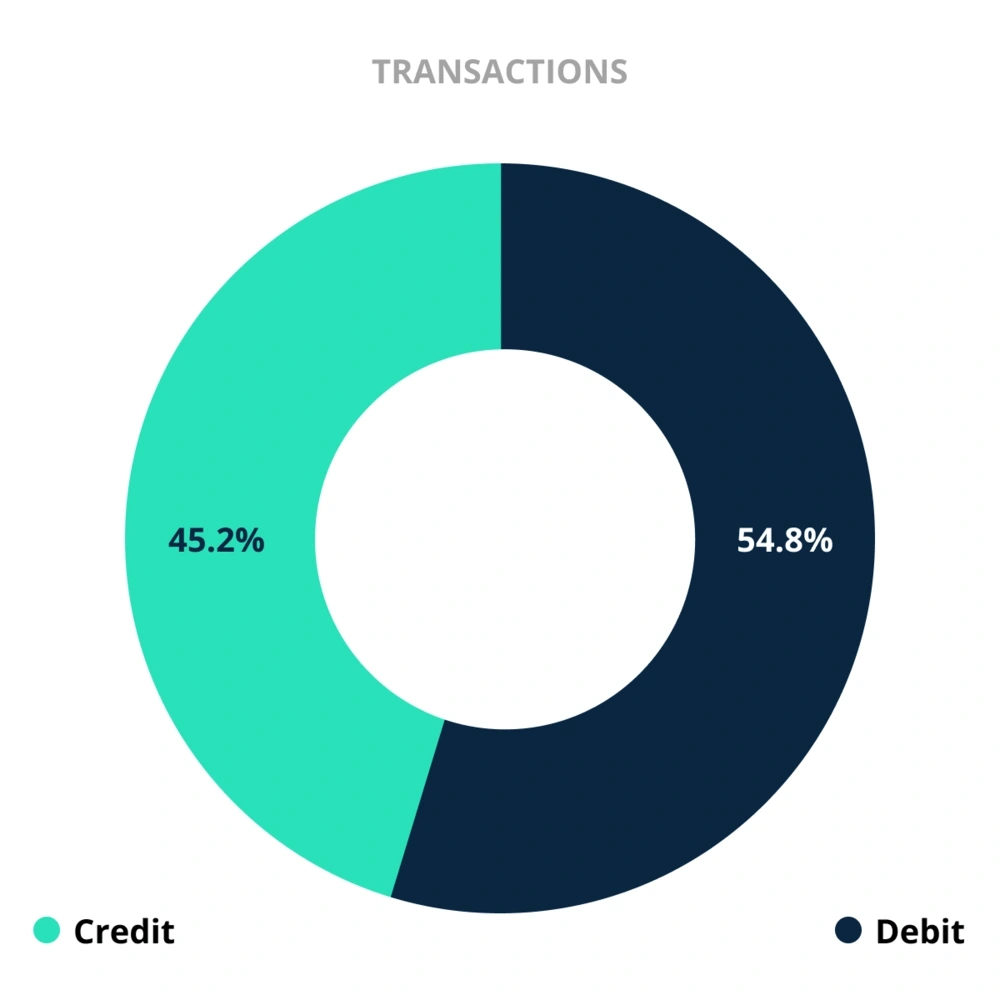

Analyzing data from BINs that processed 20,000 or more transactions revealed that 60.12% of BINs were associated with debit cards. However, only 54.79% of transactions were processed on debit cards.

The slight discrepancy between debit card usage and transactions processed provides interesting insights.

Debit cards are a popular payment method, but they aren’t the preference in all situations. Debit cards have less protections and more liability than credit cards. Therefore, cardholders tend to be more cautious with their use because it may be harder to initiate a chargeback.

As a result, credit cards — the safer option with less liability — are used more frequently for subscriptions where there is a greater risk for potential fraud. Thus, merchants that sell goods or services through a recurring billing model tend to process more credit card payments than debit.

It’s important to note the frequency of use for each card type because the risk of chargebacks varies slightly between debit and credit.

Which card type has the highest chargeback-to-transaction ratio — credit or debit?

Analyzing BIN data revealed some interesting insights about the average chargeback-to-transaction ratio (or the percent of transactions that become chargebacks).

Despite the fact that the majority of transactions were processed on debit cards, credit cards actually posed a greater risk for chargebacks.

5.93%

Chargeback Ratio for Debit Cards

7.19%

Chargeback Ratio for Credit Cards

The primary reason for the difference is because consumers tend to be more aware of the protections available for credit cards than debit. So credit cardholders exercise their chargeback rights with greater frequency.

This means you’ll want to keep an eye out for credit card transactions — those processed by the card brands as opposed to the electronic fund transfer (EFT) network. For credit card purchases, you may want to take a more proactive approach to chargeback prevention. That might involve strategies such as tightening your fraud detection rules for credit card transactions or reaching out to customers to gauge satisfaction.

How often do card issuers opt out of using the chargeback process?

Unfortunately, most issuers tend to use the chargeback process quite frequently — even if the cardholder doesn’t have a case based on Regulation E or Z rules.

One reason is because chargebacks tend to require less effort and invoke limited liability if handled incorrectly.

Regulation Z, for example, requires that issuers conduct a thorough investigation if the cardholder disputes the charge and is held liable for any amount of the unauthorized transactions.

If a card issuer seeks to impose liability when a claim of unauthorized use is made by a cardholder, the card issuer must conduct a reasonable investigation of the claim.”

- Regulation Z

This extra effort may seem overwhelming or even impossible for many issuers — especially small financial institutions.

Card brand regulations have similar requirements. However, the liability for potential non-compliance is significantly less. Failing to abide by Regulation E or Z requirements mean the issuer is breaking a federal law, whereas overlooking or falling short of card brand expectations may merely invoke a fine.

Another reason why issuers may tend to favor chargebacks — even in cases of potential friendly fraud — is because banks need to provide great customer service too. Banks are as interested in customer retention as you are!

Managing Credit and Debit Chargebacks with Kount

Understanding the difference between credit and debit chargebacks can be challenging.

But here’s the reality: regulatory details aren’t something that you should have to worry about!

At Kount, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Concerns about chargeback technicalities shouldn’t occupy another second of your time.

You focus on growing your business. We’ll worry about the chargebacks.

Sign up for a demo of Kount today, and see how technology can remove the complexities of payment disputes.