What is a Chargeback Fee?

A chargeback fee is a fine charged by the acquiring bank anytime a merchant receives a chargeback. This fee helps an acquirer cover the costs associated with processing the chargeback.

Fees and policies vary by acquirer, however, there are a few common characteristics regardless of the bank.

- How Much Do Chargeback Fees Cost?

- Are Fees Higher for High-Risk Merchants?

- How Do Chargeback Monitoring Programs Impact Fees?

- Are Chargeback Fees Refundable?

- How Can I Avoid Chargeback Fees?

How Much Do Chargeback Fees Cost?

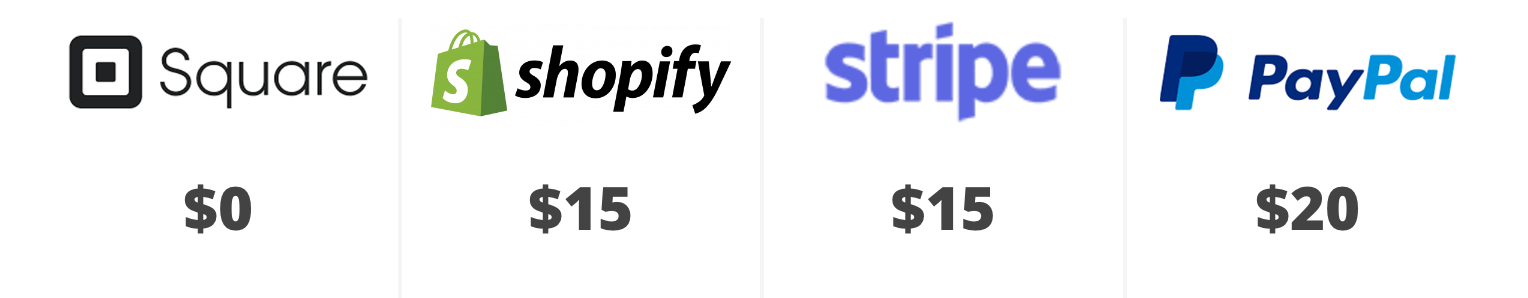

Generally, fees are between $10 and $50 per chargeback. Here are a few examples from popular payment processing platforms:

There are a few things to note about fees and how they are managed:

- If you accept credit cards, you’re susceptible to chargebacks — and the accompanying fees. No business is immune.

- Chargeback fees vary depending on the payment processor or acquirer (merchant bank).

- Fees are outlined in the merchant agreement and should be reviewed before the contract is signed.

- The chargeback fee, along with the chargeback amount, is usually withdrawn automatically from your merchant account.

- If you use the right chargeback management tools, you’ll have a grace period between the time when cardholders request a chargeback and the time when the bank actually initiates a chargeback. If you resolve the issue during this window, you can avoid the chargeback — and the fee. Visit our chargeback prevention page to learn more.

Are Fees Higher for High-Risk Merchants?

Some merchants are classified as “high risk” because it is risky to do business with them. These merchants could potentially cause acquirers or card networks to lose money.

Since the acquirer’s bottom line is in jeopardy, it needs some sort of insurance or protection against financial loss. One way acquirers reduce the risk of working with high-risk merchants is to increase fees.

If your business has been identified as high risk, you can assume that all fees — including the chargeback fee — will be higher than the norm.

How Do Chargeback Monitoring Programs Impact Fees?

The debit and credit card networks (Mastercard, Visa, etc.) use monitoring programs as both a penalty for excessive chargebacks and a corrective effort to help merchants manage chargebacks more effectively.

Chargeback monitoring programs include fees. These fees are in addition to a chargeback fee the acquirer charges. Unlike acquirer fees that are charged per chargeback, monitoring program fines are usually a once-per-month cost that can be thousands of dollars.

However, the monitoring programs typically include a few months grace period — fees don’t usually start immediately after enrollment.

If you’ve been enrolled in a monitoring program, aim to get your chargeback situation under control before fees go into effect. To do that, you’ll need a quick and probably drastic reduction in chargebacks. If you’d like help, Kount offers chargeback prevention tools that can help lower your chargeback ratio and count so you can exit the monitoring program.

Sign up for a demo to see if these tools could positively impact your chargeback rate and help avoid unnecessary chargeback fees.

Are Chargeback Fees Refundable?

Chargeback fees are not usually refundable. Even if you fight the chargeback and win, recovering the revenue you lost, you won’t be able to recover what you spent in fees.

How Can I Avoid Chargeback Fees?

Unfortunately, you will be fined every time you receive a chargeback — there aren’t any secret tips or tricks to dodging this cost. So if you want to avoid the chargeback fee, you have to avoid the chargeback process.

Preventing customer disputes is the only way to eliminate both the acquirer’s fee and the chargeback monitoring program penalties.

However, in reality, your goal probably isn’t to avoid just the chargeback fee. Your real goal is to avoid the financial losses associated with chargebacks.

Every time a transaction amount is disputed, you lose the time, effort, and expenses that went into making the debit or credit card charge happen. Think of all the costs that can go into a single transaction:

|

|

If you want to avoid losing money, you need to prevent as many chargebacks as possible and then fight the rest. Fighting chargebacks is what enables you to recover costs and protect your bottom line.

Need Help Eliminating Chargeback Fees?

Managing chargebacks — and the fees associated with them — can be a confusing, time-consuming, and costly task.

At Kount, we aim to remove the complexities of payment disputes. We think you should focus on delivering great products or services, not managing payment risk.

If you’d like a simplified approach to chargebacks, Kount is happy to help. Sign up for a demo today, and we’ll help you get started.