American Express Chargebacks: Your Policy Guide for Amex Disputes

Chargeback management can be confusing.

One thing that complicates the task is a lack of consistency: the chargeback process can change drastically depending on the card used to process the original transaction.

For example, American Express® handles payment disputes differently than Visa® and Mastercard®.

If you want to get the best chargeback management results possible, you need to understand the rules and regulations for each individual card brand.

The following is a high-level overview of American Express chargebacks. You can read all the information below, or you can click on the topic you are most interested in.

- Issuing Cards & Processing Transactions

- The Dispute Process

- Inquiries

- A Complete Listing of all American Express Chargeback Reason Codes

- Prohibited Business Types

- American Express Tools That Help Prevent Chargebacks

Issuing Cards & Processing Transactions

Visa and Mastercard create card networks of partners to work on their behalf with cardholders and merchants. They partner with issuing banks to issue cards to cardholders. And they partner with acquiring banks to process transactions for merchants.

Traditionally, American Express has done things differently. The card brand issues its own credit cards directly to cardholders without the assistance of issuing banks. And, American Express processes payments for merchants too.

Recently, American Express changed its practices just slightly. The brand still issues cards, but it also allows a few select banks to issue cards on its behalf. And while the brand still processes payments, certain merchants are allowed to run American Express transactions through the same processor that handles their Visa and Mastercard transactions.

Because there are fewer parties involved, AmEx chargebacks tend to be more straightforward with less back and forth.

The Dispute Process

American Express has a unique process for managing disputes. The most notable characteristics are:

- American Express handles nearly everything itself. For most Mastercard and Visa disputes, the card brand just acts as a go-between for the issuer and acquirer. But for American Express chargebacks, the card brand is much more involved.

- American Express will sometimes send an inquiry and request additional information before issuing a chargeback.

- There are no formal rules or guidelines for pre-arbitration or second chargebacks. The network does limit cardholders to two disputes per transaction, but there is no written explanation of what a second round would involve.

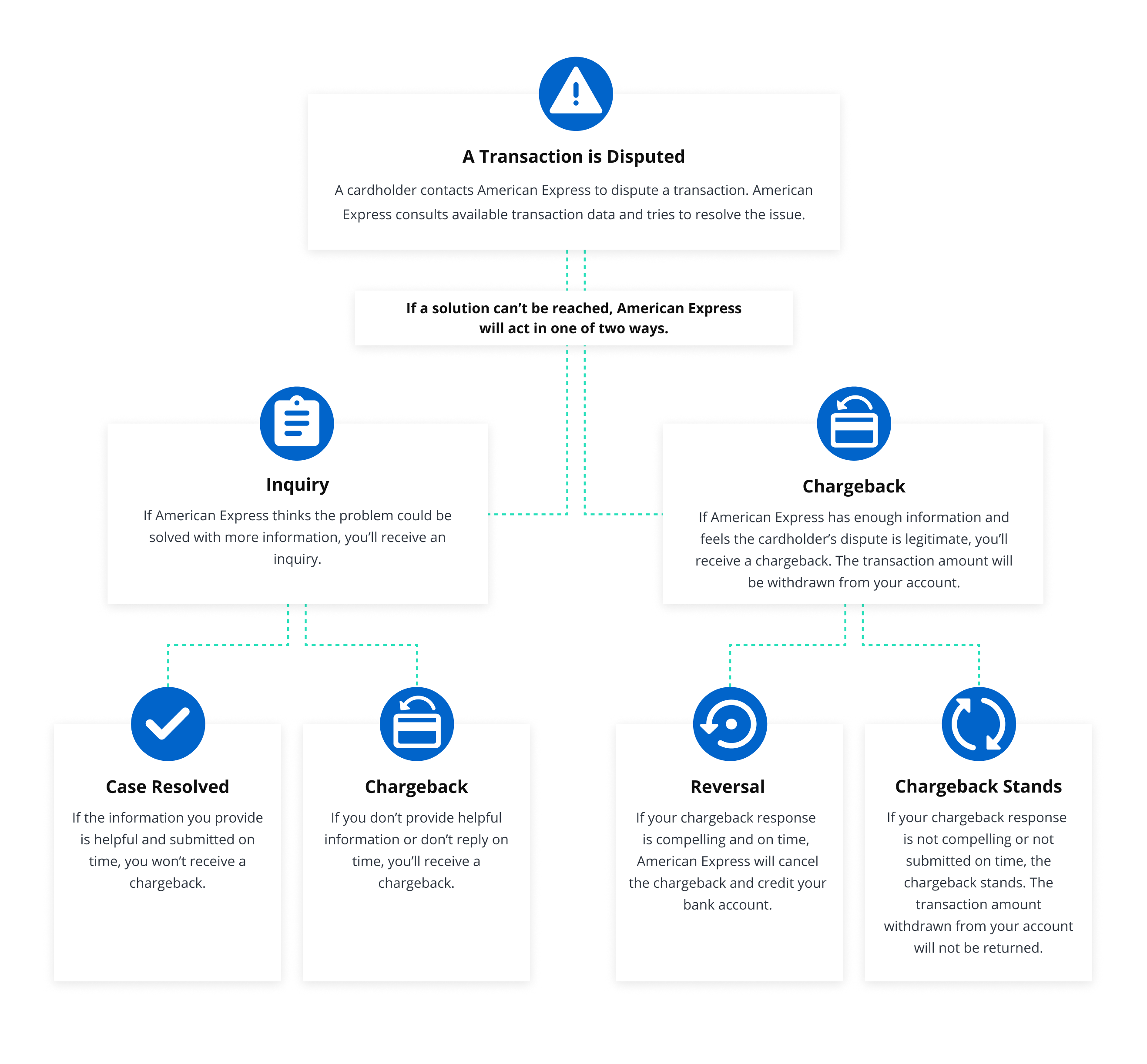

The following flowchart explains the American Express dispute process:

A word of warning: The chance of winning an American Express dispute is pretty low. The brand is famous for providing card members with outstanding service. If you do choose to fight a chargeback, there are a couple things to keep in mind.

- Check the submission due date for chargeback disputes. Before you take the time to build out a chargeback response and rebuttal letter, check to make sure the case hasn’t expired. Usually, processors give merchants between 2 and 20 days to respond. If the case has already expired, don’t bother responding. It’s impossible to win if the deadline has passed.

- Check your compelling evidence. Each reason code has its own requirements for evidence. If you don’t have the supporting documents needed to prove your case, it is best to just accept the chargeback and the revenue loss. Fighting without sufficient evidence could lead to negative ROI.

Inquiries

When a cardholder contacts American Express to dispute a transaction, the American Express customer service team will first consult internal data. Since American Express operates as card issuer and sometimes processor, there is usually a lot of transaction data available to review.

The card brand will use this information to try to resolve the issue with the cardholder. If American Express and the cardholder can’t come to an agreement, the case advances to the next phase of the dispute process. This could mean sending you an inquiry.

An inquiry is a request for additional documentation. If you provide the information that American Express is looking for, you may be able to resolve the dispute and avoid a chargeback.

You won’t receive an inquiry for all disputes. There are a couple situations where American Express would skip this step and go straight to a chargeback. For example, you likely won’t receive an inquiry if:

- American Express feels there is enough evidence available to support the cardholder’s claim.

- You are classified as a high risk merchant.

- You are enrolled in a chargeback monitoring program.

There are several reasons why American Express might send an inquiry. The following table lists the inquiry reasons and the suggested documents you should send in response.

| INQUIRY REASON | RESPONSE DOCUMENTS |

| The cardholder ordered something, but it hasn’t been received. | Provide proof that merchandise was delivered or services rendered. |

| The cardholder canceled services or tried to cancel and was unable to. | Provide proof that a refund has been issued. If a refund isn’t allowed, provide a copy of the cancellation policy that the cardholder agreed to and explain why credit is not due. |

| The merchandise was damaged or defective and the cardholder is requesting a refund. | Provide proof that a refund has been issued. If a return is not allowed, provide a copy of your return or refund policy and explain why credit is not due. |

| The merchandise was damaged or defective and the cardholder is requesting a repair or replacement. | If a replacement or repair is allowed, provide the cardholder with any necessary instructions. If the merchandise can not be repaired or replaced, provide a copy of the return policy the cardholder agreed to and explain why additional services are not due. |

| A charge should have been processed as a credit. | Provide proof that a refund has been issued. If credit is not due, explain why the charge is valid. |

| The goods or services were not as described and the cardholder would like a replacement or credit. | Provide proof that a replacement has been given or credit has been issued. |

| The cardholder doesn’t recognize the transaction. | Provide information that explains the transaction. If merchandise was purchased, provide proof of delivery. If you do not have documentation available to explain the purchase, issue a refund and provide proof that the account has been credited. |

| Merchandise was returned to your business, but the cardholder hasn’t received a refund. | Provide proof that a refund has been issued. If a refund isn’t allowed, provide a copy of the cancellation policy that the cardholder agreed to and explain why credit is not due. |

| The cardholder is requesting a refund for a duplicate charge. | Provide proof that credit has been issued. If a refund is not due, explain why the charge is valid. |

| The cardholder believes the charge was unauthorized. | If the purchase was a card-present transaction, provide a copy of the transaction receipt and an imprint of the card. If the purchase was a card-not-present transaction, provide a copy of the transaction receipt and any details associated with the purchase (such as signed contracts or proof of delivery). |

| The amount charged to the card differs from what was agreed upon. | Provide proof that a refund has been issued. If a refund is not due, explain why the charge is valid. |

| The cardholder claims to have used a different form of payment. | If the refund request is valid, provide proof that credit has been issued. If the charge is unrelated to the other payment that was made, provide proof that both transactions are legitimate. If there was no other payment made, provide proof that the charge is the only transaction you have on file. |

| The cardholder isn’t disputing the purchase, but would like additional information. | Provide the requested documents. |

| A charge relating to damages, theft, or loss is being questioned. | Provide proof that credit has been issued. Or, provide the following: the rental agreement, an itemized explanation of the charge, proof the cardholder agreed in writing to accept responsibility for the transaction, and proof the cardholder agreed in writing to use American Express to pay the charge. |

If you don’t respond to inquiries within the given time limits or you don’t respond with the correct information, the case will advance to the next phase: a chargeback.

A Complete Listing of all American Express Chargeback Reason Codes

There are a number of reasons why customers dispute transactions. American Express uses unique codes to explain those reasons to merchants.

American Express chargeback reason codes are divided into five categories: authorization, cardmember disputes, fraud, processing errors, and miscellaneous.

Each chargeback reason has its own, individual prevention techniques. And, each code has unique compelling evidence requirements if you choose to fight. Click on the categories below to view the American Express chargeback reason codes and access tips to help manage each one.

A01 - Charge Amount Exceeds Authorization Amount

A02 - No Valid Authorization

A08 - Authorization Approval Expired

C02 - Credit Not Processed

C04 - Goods/Services Returned or Refused

C05 - Goods/Services Canceled

C08 - Goods/Services Not Received or Only Partially Received

C14 - Paid by Other Means

C18 - "No Show" or CARDeposit Cancelled

C28 - Cancelled Recurring Billing

C31 - Goods/Services Not as Described

C32 - Goods/Services Damaged or Defective

F10 - Missing Imprint

F24 - No Cardmember Authorization

F29 - Card Not Present

F30 - EMV Counterfeit

F31 - EMV Lost/Stolen/Non-Received

P01 - Unassigned Card Number

P03 - Credit Processed as Charge

P04 - Charge Processed as Credit

P05 - Incorrect Charge Amount

P07 - Late Submission

P08 - Duplicate Charge

P22 - Non-Matching Card Number

P23 - Currency Discrepancy

R03 - Insufficient Reply

R13 - No Reply

M01 - Chargeback Authorization

Prohibited Business Types

Some businesses are not allowed to accept American Express cards as a form of payment. Eligibility is based on several things; one factor is the type of goods or services being offered.

The following is a list of prohibited business types:

- Adult Entertainment

- Check Cashing

- Debt Collection (payday loans, bail bonds, bankruptcy litigation, etc.)

- Door-to-Door Sales (unsolicited vendor sales)

- Escort Services

- Non-Licensed Massage Parlors

- Financial Services (mutual funds, foreign exchanges, etc.)

- Future Services (investments in the future maturity of goods like the stock market, wine, horse breeding, precious metals, etc.)

- Gambling (casinos, betting or wagering at race tracks, internet gambling, etc.)

- Marijuana-Related Business (manufacturing, processing, distributing, dispensing, etc.)

- Multi-Level Pyramid Sales

- Timeshares (selling partial ownership of a property for use at regularly fixed times)

If your business is a mixed business — meaning you sell some of these goods or services along with other non-prohibited items — you should not allow customers to use an American Express card to pay for anything that’s been banned. If you do, you’ll receive a chargeback with no option for a chargeback reversal.

You will probably also be enrolled in a chargeback monitoring program. Chargeback monitoring programs include penalties and additional fees.

American Express Tools That Help Prevent Chargebacks

There are dozens of things you can do to prevent chargebacks. For example, we have suggestions on how to improve your business practices, return policy, and customer experience — all to help reduce your risk of disputes.

American Express has even more tactics to prevent chargebacks.

For card-present transactions, American Express encourages merchants to upgrade to EMV or chip-enabled POS terminals. This helps reduce the risk of processing transactions on counterfeit cards.

For card-not-present transactions, American Express urges merchants to share as much information as possible with the card brand. This helps American Express identify legitimate transactions and easily resolve customer disputes. It can also help detect and block fraud.

There are four opportunities for merchants to share transaction information with American Express:

- Enhanced Authorization - This authorization process gives merchants the opportunity to send additional data elements, such as email, IP address, and shipping information. American Express checks this information in the background for potential indicators of fraud.

- SafeKey - This identity verification tool uses the industry standard 3D Secure (similar to brand-specific products like Verified by Visa and Mastercard SecureCode). If you authenticate transactions with SafeKey, you will not be liable for any fraud-related disputes.

- American Express Token Service - This secure payment method eliminates the need for you to store real card account information. This reduces your risk exposure.

- Verify-It - This web-based tool validates billing name and address information so you can cancel suspected fraudulent transactions before sending merchandise to the customer.

Want Help Managing American Express Chargebacks?

American Express chargebacks are different than Visa and Mastercard’s. And managing multiple processes can be stressful.

But the reality is...these differences aren’t something you should have to worry about!

At Kount, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Concerns about brand-specific expectations shouldn’t occupy another second of your time.

Your focus should be growing your business — Kount can handle your chargebacks. Sign up for a demo today, and find out how Kount can remove the complexities of payment disputes.