Chargeback Time Limits: Anticipating Risk and Beating Deadlines

When it comes to chargeback management, time is money. If you don’t understand chargeback time limits, you could suffer cash flow issues and lose a lot of revenue.

There are two categories of time limits. You’ll need to understand both if you want to effectively manage risk.

- How long can a customer wait to file a chargeback?

- How quickly do you need to respond to a chargeback?

CHARGEBACK TIME LIMIT #1

How long can a customer wait to file a chargeback?

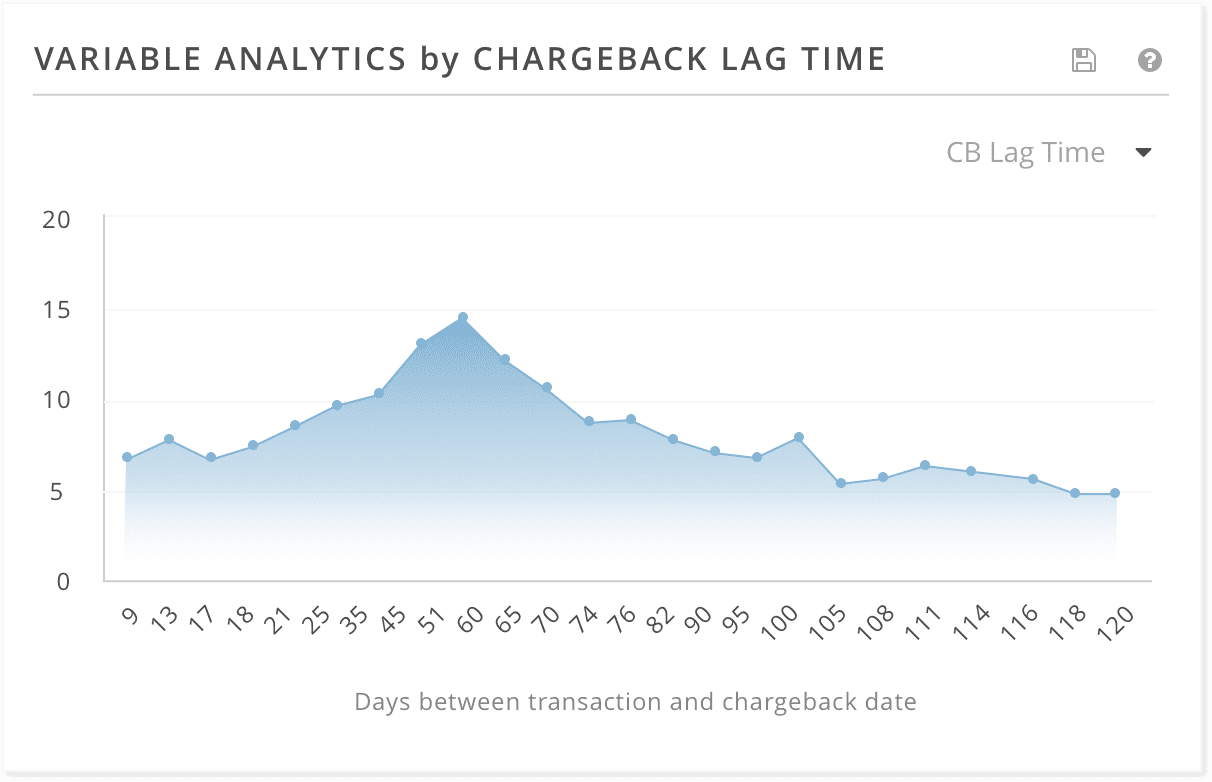

How much time can pass between the transaction processing date and the chargeback?

If you made a technical mistake while processing the original transaction, you will know about it relatively quickly. Chargebacks resulting from authorization and processing errors are managed with a fairly short timeline.

Chargebacks that result from consumer disputes, on the other hand, have a much longer time limit. These disputes often catch the merchant off guard because they seem to appear out of nowhere, sometimes hitting the merchant account more than four months after the transaction was processed!

Most chargebacks have a 75, 90, or 120 day time limit. |

The reason code used to describe the dispute will determine the chargeback time limit. Each code has a different timeline.

You’ll want to carefully review all chargeback reason codes so you are familiar with the very detailed regulations. Not only do you need to know how long the timeline is, but you also need to know when the clock starts ticking.

The following is a basic overview for the two biggest card networks — Visa and Mastercard.

Imagen  Mastercard chargeback time limits |

4808 - Authorization-Related Chargeback: 90 days 4834 - Point-of-Interaction Error: 120 days 4837 - No Cardholder Authorization: 120 days 4840 - Fraudulent Processing of Transactions: 120 days 4849 - Questionable Merchant Activity: 120 days 4853 - Cardholder Dispute: 120 days 4863 - Cardholder Does Not Recognize - Potential Fraud: 120 days 4870 - Chip Liability Shift: 120 days 4871 - Chip Liability Shift - Lost/Stolen/Never Received: 120 days |

Imagen  Visa chargeback time limits |

10.1 - EMV Liability Shift Counterfeit Fraud: 120 days 10.2 - EMV Liability Shift Non-Counterfeit Fraud: 120 days 10.3 - Other Fraud – Card-Present Environment: 120 days 10.4 - Other Fraud – Card-Absent Environment: 120 days 10.5 - Visa Fraud Monitoring Program: 120 days 11.1 - Card Recovery Bulletin: 75 days 11.2 - Declined Authorization: 75 days 11.3 - No Authorization: 75 days 12.1 - Late Presentment: 120 days 12.2 - Incorrect Transaction Code: 120 days 12.3 - Incorrect Currency: 120 days 12.4 - Incorrect Account Number: 120 days 12.5 - Incorrect Amount: 120 days 12.6 - Duplicate Processing/Paid by Other Means: 120 days 12.7 - Invalid Data: 75 days 13.1 - Merchandise/Services Not Received: 120 days 13.2 - Canceled Recurring Transaction: 120 days 13.3 - Not as Described or Defective Merchandise/Services: 120 days 13.4 - Counterfeit Merchandise: 120 days 13.5 - Misrepresentation: 120 days 13.6 - Credit Not Processed: 120 days 13.7 - Canceled Merchandise/Services: 120 days 13.8 - Original Credit Transaction Not Accepted: 120 days 13.9 - Non-Receipt of Cash or Load Transaction Value: 120 days |

Other things to know about debit and credit card chargeback time limits:

- It’s important to note that these chargeback time limits are for initiating a chargeback. If you haven’t received a chargeback by day 120, it doesn’t mean that you are in the clear. Several additional days will pass while the issuer submits accompanying documents and the acquirer reviews the case.

- The card networks use different phrases to describe the same thing. And terminology is usually a lot of industry jargon that’s hard to understand. For example, Mastercard bases time limits on the “central site business date” — which basically means the day the transaction was processed.

- At this phase in the dispute process, Discover and American Express chargeback time limits are usually non-existent. Rules might be slightly different if cardholders obtain their credit cards through issuing banks. However, when working directly with Discover or AmEx, there is no time limit for when a cardholder disputes a charge.

Why is it important to know how long customers and issuers can wait to initiate a chargeback?

This helps you anticipate chargeback trends and predict when risk will escalate. Then, you can act preemptively.

For example, an increase in sales during the holidays will likely result in a proportional increase in chargebacks. By the end of January, you’ll want to have a few extra people on hand to work on chargeback responses. And, you’ll want to try to increase sales for the next few months to compensate for the lost revenue. But by April or May, the risk will probably taper off.

For maximum insight, calculate and monitor the number of days that pass between the transaction processing date and the chargeback date. This helps you determine which timelines are normal for your business.

CHARGEBACK TIME LIMIT #2

How quickly do you need to respond to a chargeback?

If you receive a chargeback, how much time do you have to submit a response?

Imagen  | Imagen  |

| If the acquiring bank challenges a Mastercard chargeback, the response must be submitted within 45 days of receiving the chargeback. | If the acquiring bank challenges a Visa chargeback, the response must be submitted within 30 days of receiving the chargeback. |

It is essential to understand that chargeback time limits for acquirers are vastly different than those for merchants.

Included in those 30 or 45-day schedules are several days the acquirer uses to complete administrative tasks. These tasks eat up significant amounts of time at both the beginning and end of the process, leaving you with a very small window in between.

The amount of time you have for a chargeback response depends on your processor. Some processors only give their merchants 3 days! |

You will only have a fraction of the regulated timeline to:

- locate necessary compelling evidence

- create a response

- submit your case

How can you beat these short deadlines?

Understanding the requirements of the different stages of the chargeback process — and the timelines for each — is an important first step. You need to be realistic about what your team can and can’t accomplish in such a short time frame.

If you manage chargebacks with manual processes, it is very challenging to respond within the allotted time limit. There are so many tasks to complete and rarely enough time to accomplish them. Cases will likely expire and you’ll forfeit revenue.

Even if you are able to respond in time, your chances of winning aren’t great. If you’re rushed, you run a greater risk of omitting necessary components or failing to comply with regulations. You’ll increase expenses without increasing revenue.

If you’ve ever considered switching from manual processes to automated technology, now is the time to do it! |

Visa recently shortened chargeback time limits from 45 days to 30. The network plans to reduce response times even further to just 20 days in the near future. Mastercard has plans to follow suit.

As chargeback time limits get shorter and shorter, automated technology will become more and more valuable.

- Technology can easily locate necessary compelling evidence and customizes packages to ensure the highest win rate possible.

- Submitting responses in near real time eliminates the risk that cases will expire.

- Efficient technology costs less than manual labor so ROI is greater.

- Technology can seamlessly scale as your business grows and chargeback volume increases.

- Timely responses help you avoid costly fees associated with late responses.

But the reality is...chargeback time limits are a regulatory detail that you shouldn’t even have to worry about!

At Kount, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Concerns about chargeback time limits shouldn’t occupy another second of your time.

Your focus should be growing the business — technology can handle your chargebacks.

Sign up for a demo of Kount today, and see how technology can remove the complexities of payment disputes.