Mastercard Collaboration: A New Way to Prevent Chargebacks

Based on first-hand experience with other card brand updates that have taken place in recent years, we’ve discovered that unexpected challenges are inevitable during rollout — despite Mastercard’s best efforts to establish guidelines and expectations. It will be awhile before processes are fully defined, easily understood, and consistently applied.

Therefore, it is important that you monitor the situation closely. Kount leaders have a direct line of communication with the Mastercard team. As details are shared with us, we’ll share them with you.

Use this detailed guide to better understand Collaboration. If you have any questions, our team of experts is happy to help.

- What is Collaboration?

- How Does Collaboration Work?

- What’s the Difference Between Prevention Alerts and Collaboration?

- Do I Need Both Prevention Alerts and Collaboration?

- Is Collaboration the Mastercard Equivalent of Visa’s RDR?

- How Will Collaboration Impact Me?

- What are the Benefits of Collaboration?

- Should I Use Collaboration?

TL;DR

A Short Summary

Only interested in a high-level overview? Don’t want to read all the nitty-gritty details? Here’s an abbreviated version of the latest initiative to prevent chargebacks.

WHAT

Mastercard Collaboration gives you, the merchant, a chance to refund a disputed transaction so a chargeback is no longer necessary.

HOW

The cardholder’s issuing bank notifies you that a transaction has been disputed. You can respond in one of several ways: you could empower Mastercard to refund the transaction for you, you could handle the refund yourself, or you could let the case advance to a chargeback and then fight back.

PRICE

Fees depend on the type of business you have and how you choose to use the dispute resolution process.

PROS

Refunding disputed transactions will help keep your chargeback-to-transaction ratio low. And an advanced warning of a dispute could give you time to stop fulfillment and save the cost of goods or services.

CONS

Implementing the Collaboration initiative involves a significant amount of effort for your bank (acquirer). It’s possible that some acquirers will choose not to participate — at least initially. Even if an acquirer does participate, there’s no telling what the experience will be. So there are no universal guidelines for merchants. The simplest solution — for a variety of reasons — will probably be to access Collaboration through a third-party solution provider like Kount.

What is Collaboration?

Collaboration is a chargeback prevention technique offered by Mastercard.

It acts like a warning system, alerting you when a transaction has been disputed. The advance notification gives you the chance to review the situation and see if there is a way to resolve the cardholder complaint — such as issuing a refund. If so, a chargeback can be avoided.

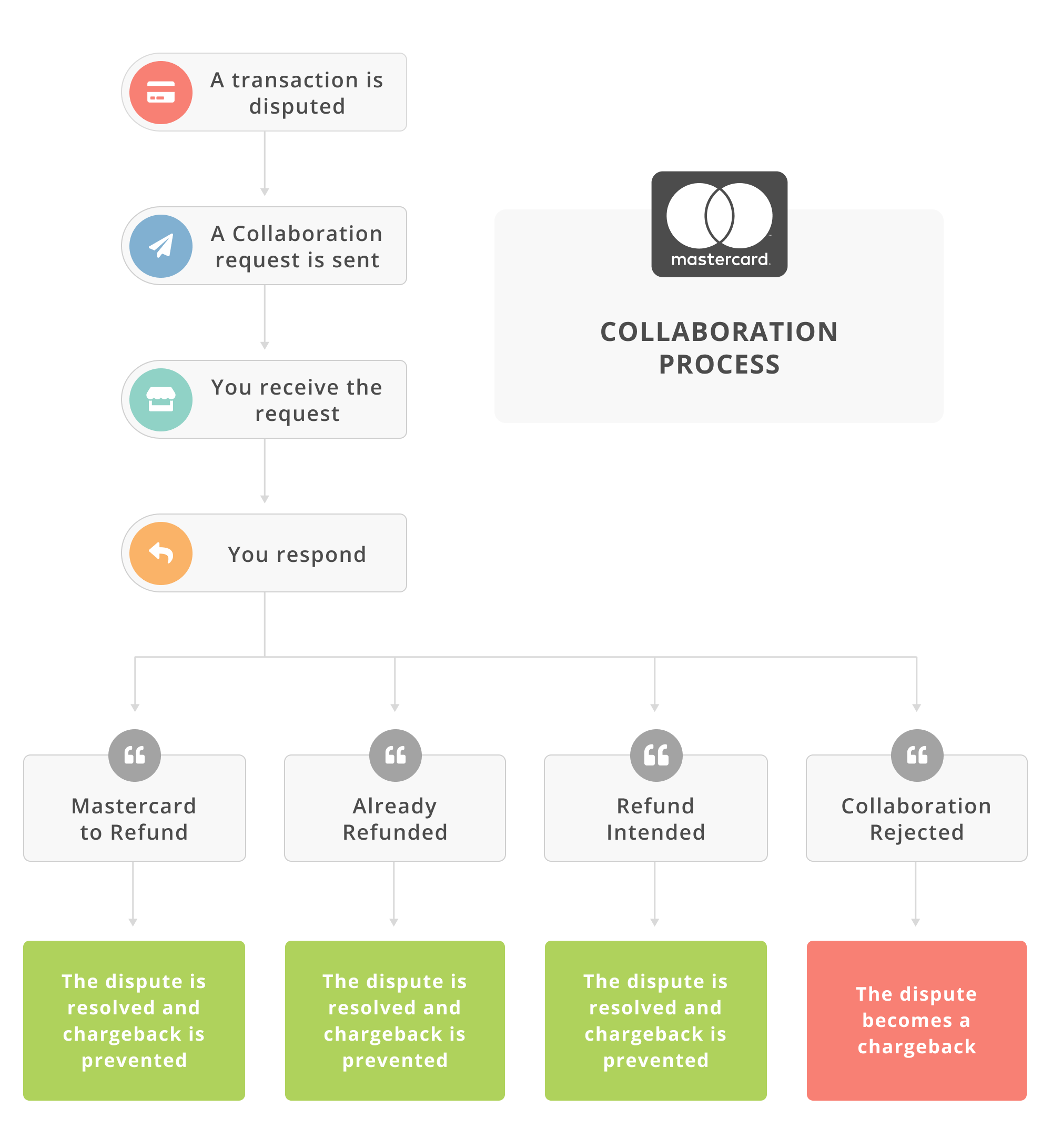

How Does Collaboration Work?

The goal of Collaboration is to resolve disputes without using the chargeback process. And in nearly all cases, the way to do that is to refund the disputed transaction.

TL;DR

How Collaboration Works

Collaboration gives the opportunity to refund a disputed transaction. If the transaction is refunded, a chargeback is no longer necessary. If a refund is not processed, the Collaboration process ends and the case advances to a chargeback.

The functionality of Collaboration depends on three key components.

1. The request

When a transaction is disputed, the issuer will notify you and give you a chance to refund the transaction.

The notification can follow one of two paths to reach you.

If you are enrolled in Ethoca alerts, the request will come to you as an alert. You’ll receive it the same way you normally do — either through the Ethoca portal or your solution provider.

If you don’t use Ethoca alerts, the Collaboration request will be sent to your acquirer.

2. The response

Once the Collaboration request is received, a response needs to be given within 72 hours. There are four different response options.

RESPONSE CODE A: Funds Movement Request

Mastercard can issue the refund on your behalf.

You are willing to accept liability for the dispute and want Mastercard to handle the refund process.

RESPONSE CODE B: Refunded

The transaction has already been refunded.

You have already acknowledged the issue and refunded the transaction before the Collaboration request was received.

RESPONSE CODE C: Initiating Refund

You plan to refund the transaction yourself.

You are willing to accept liability for the dispute and want to refund the transaction through your CRM or order management system within the next five days.

RESPONSE CODE E: Reject Collaboration

The transaction will not be refunded.

You either want to challenge the dispute or haven’t made a decision within the time limit.

If you send response code C — initiating refund — you must follow up with response code B after the refund has been issued. In that response, you’ll need to include the refund transaction ID so Mastercard can accurately match the Collaboration case to the issued refund.

This extra step adds an additional layer of effort, risk, and cost. You’ll have to remember to send not one but two responses within the 72 hour time limit. If you don’t get everything done by the deadline, the case will probably advance to a chargeback. Meaning any effort you did put into the case will have been a waste. Additionally, both responses involve a fee. So you’ll pay twice.

In light of these challenges, it might be best to avoid response code C all together. When you receive a Collaboration request, refund it immediately and respond with code B.

3. The outcome

The outcome of a Collaboration case depends on the response.

Either you refunded the transaction and a chargeback is no longer necessary. Or you didn’t refund the transaction and the case advances to a chargeback.

Plus, there may be additional drawbacks to consider for each response type.

RESPONSE CODE A: Funds Movement Request

Mastercard can issue the refund on your behalf.

PROS

- You don’t have to be involved in the refund process.

- A chargeback should be prevented.

CONS

- Mastercard charges a fee for receiving this response.

- Mastercard charges a fee for issuing the refund on your behalf.

- You’ll have to manually update your CRM or order management system to note the refund.

RESPONSE CODE B: Refunded

The transaction has already been refunded.

PROS

- The refund has already been issued.

- A chargeback should be prevented.

CONS

- Mastercard charges a fee for receiving this response.

- You have to include the refund transaction ID with your response so the Collaboration case can accurately be matched to the credit that was issued. If you don’t share this information, the case could potentially advance to a chargeback.

RESPONSE CODE C: Initiating Refund

You want to issue the refund yourself.

PROS

- If you refund the transaction within five days, the chargeback should be prevented.

CONS

- Mastercard charges a fee for receiving this response.

- It’s possible that you won’t issue the refund within the time limit. If that happens, the case has a strong probability of advancing to a chargeback. Your ratio is impacted and you have to pay an additional Collaboration non-compliance fee.

RESPONSE CODE E: Reject Collaboration

The transaction will not be refunded.

PROS

- You can fight the chargeback. If you win, you have the greatest revenue protection possible.

CONS

- There is a very strong chance the case advances to a chargeback and your ratio is impacted.

What’s the Difference Between Prevention Alerts and Collaboration?

On the surface, it might seem like Collaboration is simply a different name for prevention alerts. After all, the goal — to refund disputed transactions so they don’t become chargebacks — is essentially the same.

However, there are differences between the two.

| PREVENTION ALERTS | COLLABORATION |

| Available for disputes from all major card networks (Mastercard, Visa®, American Express®, and Discover®) | Available for Mastercard disputes |

| Provided by Ethoca and Verifi | Provided by Mastercard |

| Managed through direct connections to Ethoca and Verifi or through a solution provider | Managed directly through participating acquirers, processors, and solution providers |

| Refunded by the merchant or a solution provider | Refunded by the merchant or Mastercard |

| Fees for each alert issued | Fees for each attempt to prevent the chargeback plus potential non-compliance fees |

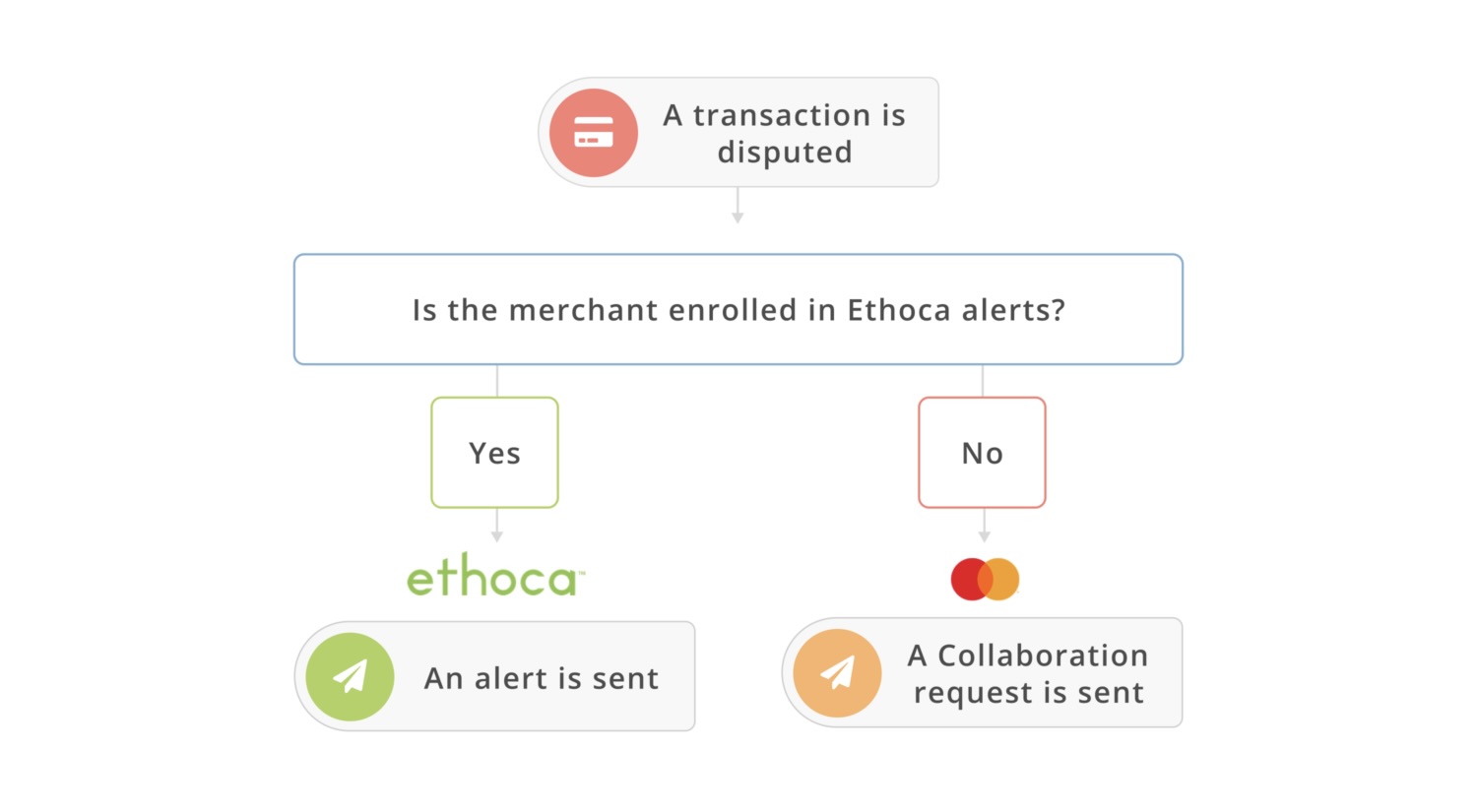

Do I Need Both Prevention Alerts and Collaboration?

In general, we usually advise merchants to create multiple layers of protection. The more solutions you use, the greater your protection will be.

But there is a stipulation when it comes to prevention alerts and Collaboration.

You don’t need both Ethoca alerts and Collaboration.

When a Mastercard transaction is disputed, the issuer will first check to see if you use Ethoca alerts. If you do, an alert will be issued. If you don’t, the case will advance to Collaboration.

It’s an either-or situation; you’ll either receive an Ethoca alert or a Mastercard Collaboration request — not both.

However, Collaboration is only capable of resolving Mastercard disputes. So you still need to address disputes from other card brands (Visa, American Express, and Discover).

That means to prevent the maximum amount of chargebacks, you need Ethoca alerts (which can address both Mastercard and non-Mastercard disputes) or Collaboration — and Verifi CDRN alerts and RDR.

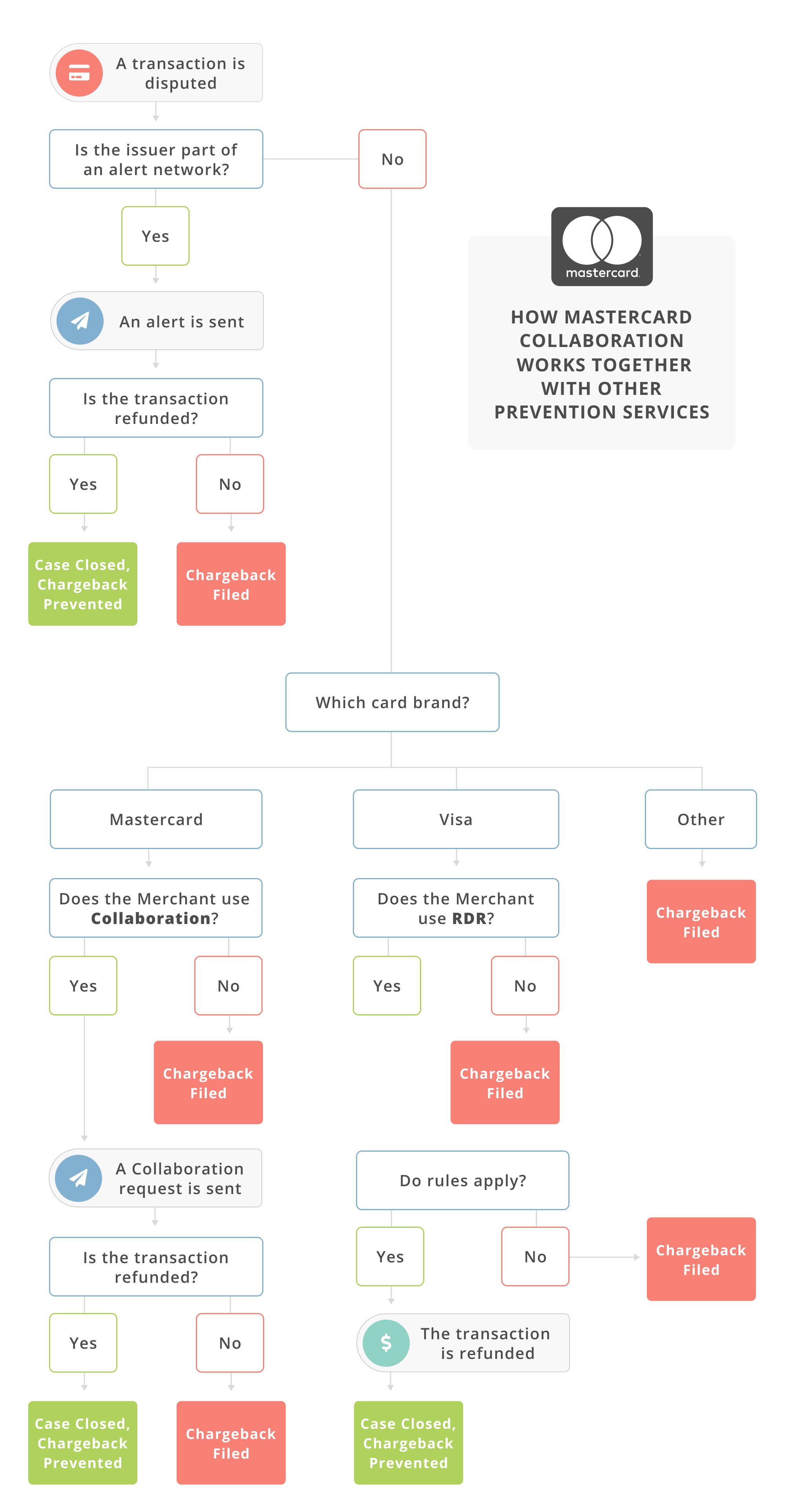

This is how all those prevention solutions work together:

Is Collaboration the Mastercard Equivalent of Visa’s RDR?

Rapid Dispute Resolution, or RDR, is another chargeback prevention tool.

There are a few similarities between Collaboration and RDR. For example, they are both brand specific (Collaboration for Mastercard and RDR for Visa). And both solutions are built into the card brand’s technology, making them available to all brand issuers and acquirers (and an acquirer’s merchants).

But that’s where the similarities end. There are more differences than likenesses.

| RDR | COLLABORATION |

| Automatic refunds | Manual refunds |

| Real time resolution | Resolution could take up to 72 hours |

| Pre-set rules govern what is and isn’t refunded | No pre-set rules; flexibility to review each case individually if desired. |

| All cases need to be reconciled in CRM or order management system | Some cases need to be reconciled in CRM or order management system; but reconciliation tasks can be avoided |

| Guarantee that refunded transactions won’t become chargebacks | Guarantee that refunded transactions in certain situations won’t become chargebacks |

The differences can be a nuisance. If you use both solutions, you’ll need to understand and optimize two different workflows.

But ultimately, the goal is to prevent as many chargebacks as possible. Both tools are capable of keeping chargeback activity to a minimum — even if they do go about it in different ways.

How Will Collaboration Impact Me?

The new process could have a significant impact on your business — or it might not change anything at all.

There are two reasons why the impact could be minimal.

THE IMPACT COULD BE MINIMAL IF

You already use Ethoca prevention alerts.

Prevention alerts are the first stage in the dispute resolution workflow.

If the issuer (cardholder bank) is part of the Ethoca prevention alert network, alerts will keep being sent like normal. And you will keep receiving and managing them the same way you do now.

THE IMPACT COULD BE MINIMAL IF

Your acquirer doesn’t offer the solution to merchants.

All acquirers (merchant banks) must be able to receive Collaboration requests. However, there are no regulations on how or if those requests are shared with merchants.

Before acquirers and processors can offer the Collaboration service to merchants, they have to build a mechanism to facilitate responses. And that’s a big undertaking! Some acquirers might not have enough employees or development resources to create the needed technology.

So if your acquirer hasn’t developed Collaboration functionality, you might not be able to participate. And if you can’t participate in Collaboration, your existing processes probably won’t change.

However, acquirer adoption is the only way to ensure Collaboration operates at its fullest potential and offers the biggest benefits to everyone involved.

Kount is currently partnering with acquirers and processors to provide the technology needed to enable Collaboration (along with prevention alerts and chargeback management features).

Once Collaboration does gain adoption, your business will probably be impacted in some way — even if the changes don’t happen immediately.

There are still a lot of unknowns, but the following are possible outcomes of the Collaboration initiative.

POSSIBLE OUTCOME

You may be required to participate.

Mastercard only regulates the official partners in its network: issuers and acquirers. Each acquirer then gets to choose if and how those regulations are passed down to merchants. Therefore, participation requirements will vary based on the processor or acquirer you work with.

It’s probable that if a chargeback prevention solution is available, your processor or acquirer will expect you to use it. This is especially true if you have a high-risk merchant account.

POSSIBLE OUTCOME

You may be asked to use a third-party service provider for Collaboration.

Implementing the new Collaboration process will be a significant undertaking for acquirers and processors. Some might not have enough resources to fully comply.

Since chargeback companies — like Kount — are accustomed to managing such workflows and have already been involved in the alert process for years, they are perfectly positioned to help merchants with Collaboration.

If you are interested in using Collaboration, your acquirer may ask you to sign up through a Collaboration solution provider.

POSSIBLE OUTCOME

You may be asked to use Ethoca prevention alerts instead of Collaboration.

Again, implementing Collaboration could be a challenge for acquirers. Some might choose to avoid the hassle altogether by opting for prevention alerts instead.

Prevention alerts and Collaboration use the same technique to achieve the same outcome — refunding a disputed transaction to eliminate the need for a chargeback. But there is one major difference between the two services: most acquirers do not currently participate in the prevention alert process.

In order to fulfill Mastercard’s issuer-merchant collaboration expectations, your acquirer or processor might require that you use Ethoca prevention alerts. This will help keep chargeback activity to a minimum, but your acquirer won’t have to build the technology to make it happen.

POSSIBLE OUTCOME

You may have to juggle multiple different expectations and workflows.

There is no standardization for how acquirers and processors implement Collaboration. So if you have more than one processor, you’ll probably have different rules and expectations for each.

Managing the differences could be an administrative nightmare, prone to mistakes and increased labor costs.

POSSIBLE OUTCOME

You may be charged a fee.

The Collaboration process includes several fees applied at different stages of the workflow. These fees vary based on the type of business that processed the transaction (pricing tiers are dictated by the merchant category code or MCC) and the response that is given.

Fees will be charged to the acquirer — and the acquirer will probably pass the costs along to you.

POSSIBLE OUTCOME

Decisions might be made without your input.

There are four different Collaboration response options. The Collaboration process was designed so that you, the merchant, can choose how cases are handled.

However, you might not actually be included in the decision making process. If your processor or acquirer struggles to adapt to the new requirements, steps may be taken to simplify the process. And making all responses universal for a merchant — or even an entire portfolio of merchants — might be easiest.

POSSIBLE OUTCOME

Your results might not be what you expect.

In theory, if you use the solution as intended, you can completely eliminate the risk of a chargeback. But processes don’t always work as expected.

For example, maybe you refunded the transaction. But you don’t include the refund transaction ID. So Mastercard doesn’t recognize the refund and initiates a chargeback.

Maybe you say you are going to issue a refund, but you forget. Or an employee is on vacation. Or there is a holiday. Or your system goes down.

Whatever the reason, failure to resolve the issue will result in a chargeback.

What are the Benefits of Collaboration?

There are definitely challenges and complexities associated with the new Collaboration process. But there are also potential benefits.

Collaboration helps keep your chargeback rate low.

The card brands carefully monitor merchant risk. If your chargeback activity becomes excessive, you could be penalized with additional fees or the termination of your payment processing privileges.

Collaboration reduces chargebacks which can help you avoid penalties.

RELATED READING |

Collaboration helps identify and resolve issues quicker.

With Collaboration, you’ll be notified of a potential dispute within hours of the cardholder’s complaint. But with a chargeback, you wouldn’t know about the issue for several weeks.

The sooner you know about a problem, the quicker you can fix it. And the quicker you fix a problem, the faster you can stop chargebacks from happening.

RELATED READING |

Collaboration could help save the cost of goods or services.

If you receive notice of the dispute before you’ve fulfilled the order, you may have enough time to cancel it. This could save you from losing money on things like fulfillment, shipping, and the product or service costs.

Collaboration helps improve the customer experience.

When a refund is issued, the funds will be returned to the cardholder’s account within a matter of days. But resolving a chargeback could take months.

Cardholders will appreciate the quick resolution. And positive experiences could save you from challenges like negative online reviews.

Should I Use Collaboration?

What is Kount’s stance on merchant adoption of Collaboration?

Chargebacks are a costly, confusing, labor-intensive problem. In general, we recommend merchants consider any solution that makes chargeback management more efficient and effective.

And Mastercard’s new mandates put a heavy emphasis on issuer-merchant collaboration that shouldn’t be ignored.

However, it’s challenging to give guidance before the workflow has gained widespread adoption. So for the time being, here’s what we suggest.

KOUNT'S ADVICE

We recommend you consider using prevention alerts as an alternative to Collaboration — at least for the time being. There are five reasons why we are making this suggestion.

- Ethoca prevention alerts fulfill Mastercard’s collaboration expectations. Mastercard’s aims are to shorten the dispute timeline and reduce costs for everyone involved. The card brand recognizes those goals can be met with either Collaboration or Ethoca prevention alerts.

- You’ll have better coverage. Collaboration is only applicable for Mastercard transactions. But Ethoca alerts can address both Mastercard and non-Mastercard disputes. More than 45% of Ethoca alerts are for Visa and American Express disputes.

- There are fewer unknowns. Prevention alerts have been in use for over a decade. Any associated challenges are well known and steps have already been taken to overcome those challenges.

- You can have all your solutions and data in one place. Until service providers — like Kount — are able to offer Collaboration, all data and responsibilities will be maintained by your acquirer or processor. Which means your chargeback management efforts will be segmented by different platforms. But if you use prevention alerts instead, Kount can offer everything you need — preventing, fighting, and analyzing — in a single platform.

- Intelligent technology can make the process easier and more accurate. Kount already has automation and guided workflows in place to manage prevention alerts. The technology is specifically designed to reduce the risk of errors, increase efficiency, and improve results.

Once more data becomes available and implementation issues have been solved, it’s possible that Collaboration will prove to be the more viable chargeback prevention solution. And if that’s the case, it will be easy to transition from prevention alerts to Collaboration.

If you’d like to learn more about prevention alerts and find out if they are a good fit for your business, sign up for a demo of Kount. Our team of experts can explain the different prevention solutions that are available and help create a strategy that is just right for you.