NEW ACCOUNT CREATION

Technology built for

new account fraud prevention

New accounts can lead to valuable customer relationships — as long as they are created by legitimate customers. Fraudsters open fake accounts that expose your business to unnecessary risks and fraud schemes. Opportunistic customers open multiple accounts to take advantage of free trial and promotional offers, draining revenue from your business. That’s why we make sure you let the good customers in and keep the bad ones away.

NEW ACCOUNTS PROTECTED BY KOUNT

How new accounts are opened with confidence

When a new user signs up for an account with you, we help verify the user’s identity. So you only let legitimate, good users into your ecosystem — with the least amount of friction and greatest accuracy possible.

The user’s email risk and usage trends are evaluated.

The technology analyzes the age of an email, how often it has been used, and what it has been used for to identify any red flags or risks.

The user’s digital identity risk is evaluated.

The user’s identity attributes — such as name, address, and device ID — are compared to global network data to determine if the user is legitimate.

A trust score is calculated.

The data analysis reveals how risky a user’s identity is and the level of trust.

Policies are consulted.

The technology verifies that the user is following the policies you set around account creation.

A decision is made.

Within milliseconds, the technology gathers enough evidence to automatically approve or decline the user based on the policies you have in place.

Unique features deliver needed benefits

Kount technology provides the capabilities you need to elevate your new account fraud prevention strategy.

Passwordless Authentication

Verify identities with more secure features like biometrics or trusted devices so that users can log into accounts without a password.

Synthetic Identities

Block harmful, impossible-to-trace synthetic identities — accounts created with a real social security number or date of birth and fake information.

Identity Verification

Technology analyzes personal information provided — such as name, address, email — to confirm the identity of individuals interacting with your brand.

WHY NEW ACCOUNT PROTECTION MATTERS

Benefits you can’t afford to miss

Do you really need to worry about the trust level of new accounts? Here's what's at stake if you do — and if you don't.

WITHOUT protection

- Miss out on revenue

- Waste marketing spend

- Expose business to financial loss

- Lose customer loyalty and trust

- Pay penalties for failed compliance

WITH protection

- Increase revenue from good customers

- Improve customer retention

- Prevent unnecessary risks

- Maintain a positive brand image

- Ensure compliance with business regulations

WHAT MAKES KOUNT SPECIAL

Added value achieves better results

Kount has the most advanced technology in the industry. And it’s constantly evolving. That means already impressive capabilities are always expanding — consistently increasing accuracy and efficiency.

Global data network

Kount has decades worth of data — and the most robust data network you can find. As part of the Equifax family, Kount has access to global insights from both digital and physical interactions. And the better your data, the better your decisions will be.

Advanced screening

Kount technology can screen out fraudulent accounts, even ones created with synthetic identities — user personas made up of real and fake information. By blocking this type of fraud, Kount helps you avoid major revenue loss and damage to your brand reputation.

Complete identity verification

Our technology analyzes billions of data elements to build complete customer personas and produce the most accurate risk assessments. You don’t have to worry about blocking potentially good customers to keep the bad ones out.

TESTIMONIALS

What our clients are saying

QUESTIONS & ANSWERS

Frequently asked questions about new account fraud prevention

New account fraud is when fraudsters create fake accounts with the intention of committing fraud or abusing promotional offers. During the account opening process, fraudsters may use a combination of real and fake information — such as real social security numbers (SSN) and fake email addresses. In doing so, they create what’s known as a synthetic identity.

Synthetic IDs are most often used for creating financial accounts. And that’s because the long-term goal — taking out a high-dollar loan or maxing out a credit card — leads to higher rewards. Sadly, it’s a growing issue with new account openings, especially with deepfakes — technology used to impersonate someone else — becoming more widely available.

Though fraudsters are generally pretty good at masking their identities and their actions, they aren’t good enough to completely evade exposure. There are dozens of red flags for new account fraud. We’ll cover a few of them here.

1. Older applicants with little financial history.

By age 25, most people should have some financial records from either a credit bureau report or a bank. Unless the circumstances are extreme, it’s unlikely that a real person over the age of 25 would have little to no financial history. If you come across this scenario, it’s most likely new account fraud.

2. Mismatched information.

If the name of an applicant doesn’t match the name associated with the provided SSN, there’s a high chance that you could be dealing with a fraudster. Certain name discrepancies are normal. If someone gets married and doesn’t change their last name, their first name and spouse’s last name could show up on their credit bureau report. Technically, the name isn’t real, but the person associated with both names is.

Major discrepancies are those that have no logical explanation or evidence to explain the mismatch. And that’s when you should suspect fraud.

3. Suspicious email addresses.

Sometimes it’s easy to spot suspicious email addresses because they look like spam. But you can’t always assume fraud. When you come across an unusual email, check the date it was created and last used. Brand new email addresses could be a sign that someone is attempting new account fraud.

4. Newly issued primary identification.

If someone provides primary identification that’s been issued within the last 60 days, do your due diligence. Unless someone has recently moved to a new state or country, that ID should be older than 60 days. If there’s no reasonable explanation for the new ID, then it could be fraud.

5. Established SSN but new name and address.

Fraudsters often steal the SSNs of newborn babies because it’s unlikely they will be caught. Of course, a newborn baby isn’t going to have an established credit history. If you come across an individual over the age of 25 using an established SSN but their name and address was only established within the last six months, be wary. It’s most likely fraud.

New account fraud and identity theft are not one in the same. For example, identity theft can happen when a fraudster tries to open a new account using someone else’s identity information. But new account fraud doesn’t always involve identity theft.

Sometimes, fraudsters and opportunistic customers will commit new account fraud by using completely made up personas — like fake email addresses, names, and other personal identifying information. Usually, these accounts are created to take advantage of free trials or promos.

However, identity theft is usually involved in higher-stakes new account opening fraud schemes. For example, if a fraudster is trying to open a bank account or apply for a loan, real information is provided to make the persona appear legitimate.

Truthfully, new account fraud can be really difficult to fight if you don’t use fraud detection technology. At the minimum, you’ll need to invest in some kind of technology to identify and stop fraudsters from opening new accounts.

Your biggest line of defense is making sure that the people interacting with your business are real. Second, you want to make sure that they’re genuinely doing business with you, not trying to scam you.

1. Use behavioral biometrics.

Behavioral biometrics is a technology that essentially helps determine if a user is real or AI. It analyzes the way users interact with their device — like how they hold the phone, how fast they type, etc. If a fraudster is using a bot to input information, this technology will be able to spot that anomaly.

2. Implement identity verification.

These days, it’s not enough to perform background checks or pull credit reports. You need to confirm that the individuals interacting with you are real using robust verification protocols. And you can do that using biometric data — that is, a fingerprint, facial scan, or voice. When new users sign up for an account with you, compare their ID photo with their selfie photo to confirm their identities.

3. Validate provided information.

It seems like common sense, but some organizations don’t check that the information a customer provides is actually valid. If they don’t suspect fraud, they don’t check for fraud. However, this approach is quite dangerous, and puts your business at severe risk.

When you get new customers, always check their information for inconsistencies and red flags. Cross-reference their identity data — such as name, address, and social security number — with trusted databases.

4. Get fraud technology

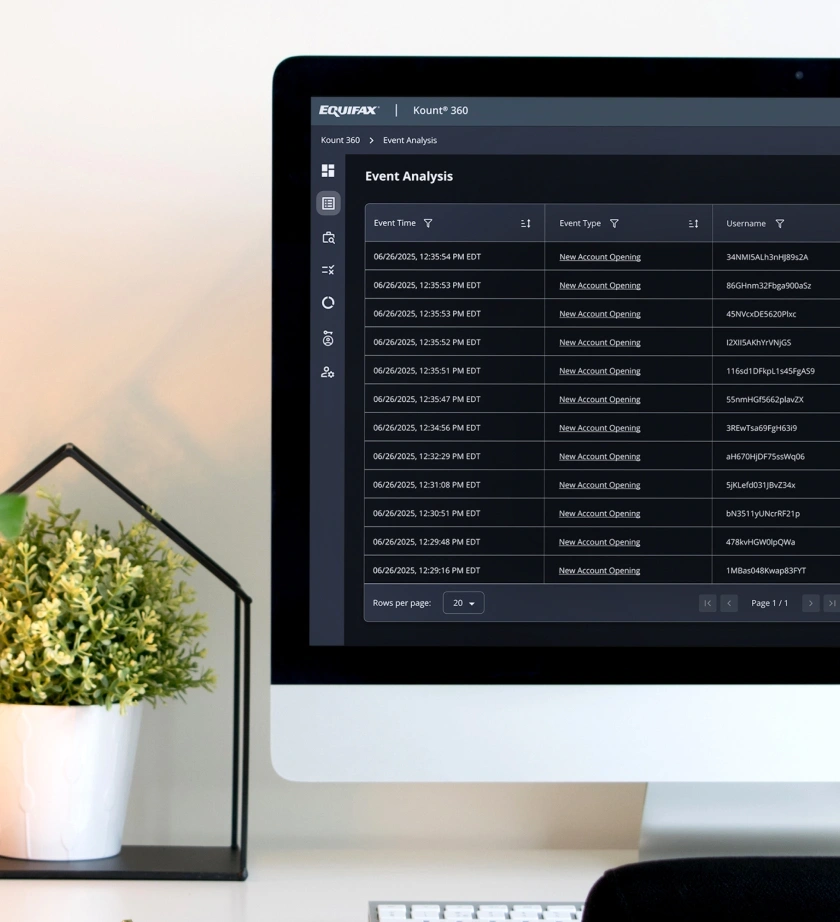

At the end of the day, your best option is to implement fraud software like Kount. And that’s because it can do all of the above — and more. You don’t have to put in all the manual labor to investigate suspicious new account openings. The technology will collect billions of data points, analyze them, and provide a decision — doing all the hard work for you. Plus, with Kount, you always have insight into how and why decisions are made.

Talk to an Expert

GET STARTED TODAY

Implement new account fraud prevention

Thousands of companies from all over the world use Kount’s trust and safety technology to protect the process of creating new accounts. Will you be next? Sign up for a demo today, and see what it’s like to have confidence in every interaction.