THE ONLY WAY TO FIGHT

Stay ahead of threats with machine learning fraud detection

Struggling to stay on top of fraud issues? Are manual processes getting in the way of your success? Kount can help. Our machine learning-based fraud detection system can replace inefficient, error-prone, and time-consuming tasks with data-driven automation.

GO BEHIND THE SCENES

How machine learning-based systems stop fraud

Machine learning for fraud detection is the practice of using computers to analyze and learn from data to make informed decisions about fraudulent activity. It’s the most efficient, accurate way to achieve the results you’re looking for.

An interaction happens.

A user interacts with your business — anything from creating an account, requesting a quote, or making a purchase.

Data is collected.

The technology gathers information about the user — such as device type, IP address, location, shopping behavior, and more.

Data is reviewed.

The technology analyzes the data using two types of machine learning models — supervised and unsupervised.

Fraud risk is determined.

The technology looks for red flags that could signal fraud and determines the interaction’s level of risk.

Policies are consulted.

The technology consults your business policies to check acceptable risk thresholds.

Fraud is stopped.

The technology blocks, accepts, or flags an interaction for further review.

Interaction data is recorded.

The outcome of the interaction is recorded so that machine learning algorithms can learn and improve decision accuracy over time.

Supervised machine learning

Looks at historical behavioral patterns and trends to predict the outcome of the current interaction. For example, it analyzes past loan repayment, dispute history, and refund requests.

Unsupervised machine learning

Looks at the current attributes of the interaction to learn patterns that can indicate fraud. For example, it analyzes the types of devices being used and associated email addresses.

DETECTING FRAUD IN REAL TIME

Benefits of machine learning for fraud prevention

Manual processes are out. Automation is in. See what’s at stake if you stick to the old way — conducting manual reviews and creating rules — and if you opt for the new way — evaluating data and using machine learning.

The OLD way

- Decline legitimate customers.

- Create rules every time a threat emerges.

- Guess what prevention tactics are effective.

- Fall behind on fraud trends.

- Overwhelm fraud management teams.

- Make decisions based on outdated data.

- Experience gaps in protection.

The NEW way

- Reduce false positives.

- Update policies only as needed.

- Use data to drive decisions.

- Stay ahead of fraudsters.

- Reallocate resources for growth initiatives.

- Make decisions in real time.

- Protect your business at all times.

WHY CHOOSE KOUNT?

Fraud protection software that goes above and beyond

Why choose Kount’s technology for fraud prevention? See what sets us apart.

Multiple types of machine learning

We’ve accomplished what few providers have been able to do — successfully combined supervised and unsupervised machine learning into one system. As a result, you get the most accurate decisions possible — gaining more revenue while saving time and reducing the greatest amount of fraud.

Unmatched data analysis

For decades we’ve been collecting and analyzing data from all over the globe. We understand how fraudsters behave. That means we can better predict future events and trends than any other provider on the market. And we work with real-time data, so we can stop threats before they affect your business.

Customizable business policies

With Kount, you can change your policies any time, any way you want. There truly are no limits. For example, you can set up unique policies for specialty items or select services that may be more prone to fraud attacks. No matter what, you maintain full control over how the technology interacts with your business.

Seamless integration process

Our technology works with your existing processes and systems so that integration is smooth and effective right away. Plus, our team of experts guide you throughout the onboarding process. We make sure your business is set up for success right out of the gate.

CASE STUDIES

See how machine learning fraud detection can work for you

Automated efficiency

DisputeBee is a small, professional credit repair software company. So when card testers started attacking the business and customers began falsely disputing purchases, chargebacks quickly grew out of hand. The company was in danger of enrollment in a chargeback monitoring program.

With Kount, DisputeBee is able to completely automate fraud and chargeback management tasks — freeing up time for the company to focus on what matters most. Fraud is no longer a worry. The company maintains steady results without a lot of human intervention.

Protected growth

Aftermarket Auto Parts started out as a brick-and-mortar operation but eventually moved into a digital marketplace. New to ecommerce, the company had very little fraud controls in place. So once they started getting fraudulent orders for thousands of dollars, they quickly developed a chargeback problem. They relied on manual processes to combat fraud, but they were ineffective.

After implementing Kount, Aftermarket Auto Parts saw a significant decrease in chargebacks and manual reviews. They can confidently rely on Kount’s machine learning to identify and block suspicious orders without causing false positives or disruptions to the customer experience.

QUESTIONS & ANSWERS

Frequently asked questions about machine learning

Do you want more education about machine learning fraud detection? Check out our most commonly asked questions below. If you still have further concerns, reach out to us!

Both systems utilize rules and policies to inform fraud decisioning. The main difference is that a machine learning system doesn't require any human intervention whereas a strictly rules based system does.

For a machine learning system, rules and policies are initially set, then the technology operates accordingly. Rules can be updated, but it isn’t necessary because machines constantly learn from interactions, collect data, and improve processes on their own. Humans can intervene, and likely should when a sudden threat, economic event, or natural disaster happens.

For example, if a hurricane is predicted to hit a town on the east coast, hundreds of citizens might start booking up flights and hotels in nearby towns to escape the natural disaster. Let's say you operate one of these hotels. Under typical circumstances, this activity might look suspicious, and your fraud prevention software might block some of these transactions.

But, if you manually update rules and policies just for that event, you'll avoid declining all these legitimate transactions. And making those updates are as simple as pressing a few buttons. There's no manual coding or research required.

On the other hand, in a rule based fraud detection system, humans have to continually monitor fraud trends and update rules. For example, if a new threat emerges, you would first need to catch it, then modify the system to account for new indicators of fraud. And if a major event happened, like a hurricane, you would have to create brand-new rules that account for surges in transactions.

Yes, our fraud detection software uses rules. But it also uses multiple types of machine learning and data. Combined, these three elements are what make our solution efficient, accurate, and powerful.

Almost all fraud solutions on the market today use some combination of rules and machine learning. Together, they make up a complete solution. A system that only uses one element is subpar and might make a lot of errors.

While machines can be intelligent and learn on their own, rules help them towards the right path. They need some guidelines to follow in order to achieve the results you want.

Let’s think of it another way.

Could you drive your car from your office place to your house without traffic laws, driving laws, road markings, and signs? Probably. But you might make some errors along the way and face a variety of obstacles that slow you down. You’ll get to your destination faster and safer if there are rules and guidelines that you can follow.

Want to know more about fraud detection rules? Check out our blog.

Machine learning can pick up on trends and patterns that the human brain simply can’t catch during manual reviews. Not only that, but machines learn constantly from data, picking up subtle indicators of fraud that influence decisioning. As a result, you get far more accurate results with a machine learning based fraud detection system. In fact, on average Kount helps businesses reduce false positives by 70% while still blocking the greatest amount of fraud.

No. Switching to a machine learning system from a manual process will not take control away from you. Machine learning is meant to replace long, error-prone manual processes. But you still get control over how the system makes decisions. That’s where rules and policies come into play.

For example, machine learning can look for fraud indicators and block or accept interactions. But it needs a set of rules or guidelines to reference in order to make those decisions. And that’s where you shine. You set the policies, you create the rules, you control the outcomes.

Plus, you can still set aside certain interactions and orders for manual review. Essentially, you get to decide how involved you are with the whole fraud decisioning process.

At the end of the day, you’re the expert on what works for your business. Our software is meant to supplement and improve upon your existing processes, not take over them.

Yes. You can set up policies that flag certain transactions for manual review. The best part is that this kind of system can also speed up the manual review process by providing a baseline of information — such as risk scores, historical data, consumer information, and more — that you don’t have to look up yourself.

Kount customers that prefer to review some orders see a significant reduction in the amount of time it takes their teams to complete manual reviews. For example, for one review, it might take an employee a half hour to an hour to complete. But with Kount, that same review may take around 30 seconds or less.

The short answer is yes, machine learning in fraud prevention systems can help reduce your chargeback rate. But there are different kinds of chargebacks, and therefore different ways of solving for each.

Machine learning engines monitor overall fraud activity and are trained to detect suspicious interactions. So, they can help stop chargebacks related to fraudulent activity, or unauthorized transactions.

However, not all chargebacks are fraud-related. Chargebacks can happen because a customer forgot about a purchase and disputed the charges with their bank. This kind of chargeback is tied to friendly fraud. And machine learning alone can’t determine when or if a customer is making a false claim.

What machine learning can do is collect data about each transaction — data that you can then use as evidence to respond to false fraud claims and potentially win the dispute.

Nope, not at all! We believe everyone should have easy access to the best fraud protection available. So, we do all the hard work and coding for you! You don’t need to be a math expert, data scientist, or engineer. Anyone on your team can use and update our software with ease and confidence.

We provide access to the system through a user dashboard. The dashboard is where you can monitor activity and update policies as needed. And updating policies is as simple as clicking a few buttons. No complex coding required!

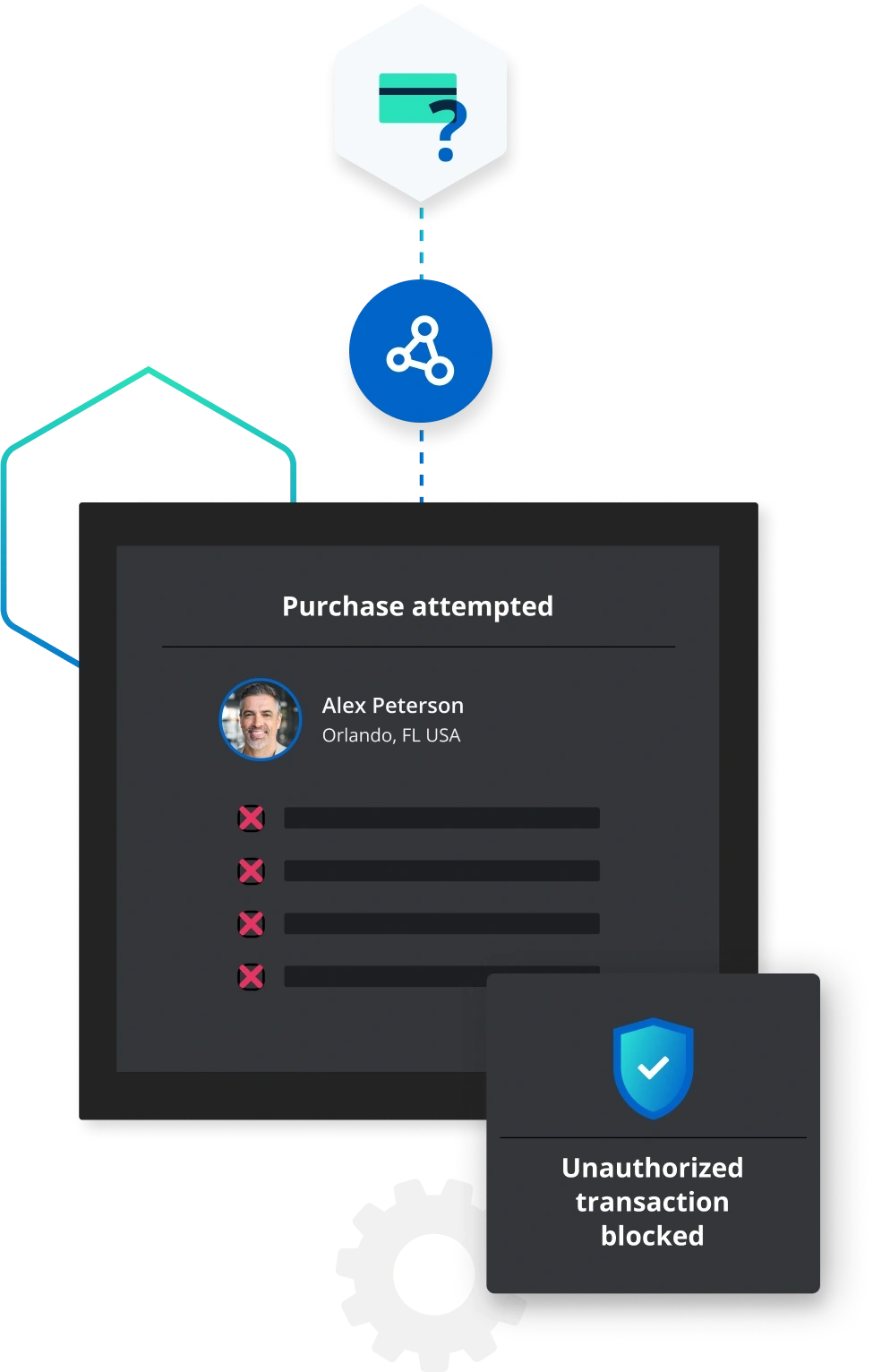

Credit card fraud is an easily detectable and preventable fraud threat when you use a machine learning-based fraud detection system. And that's because machine learning systems continually collect and analyze transaction data — such as card numbers, billing and shipping addresses, location, device information, and more. As a result, the software can quickly recognize unusual credit card transactions.

Here’s how it works.

When a card transaction is attempted, the system immediately goes to work evaluating billions of data points to determine whether the interaction is legitimate or fraudulent.

First, the software collects data about the transaction. Then, the system connects those data points to patterns of behavior associated with the cardholder to predict whether a fraudster or the cardholder is making the purchase. Finally, the system consults business policies and accepted risk thresholds to determine whether to block or accept the transaction.

GET STARTED TODAY

Prevent threats with machine learning fraud detection

Thousands of companies from all over the world use Kount’s technology to detect fraudulent transactions and prevent emerging threats. Will you be next? Sign up for a demo today, and see what it’s like to have confidence in every interaction.

Talk to an Expert

Please enjoy your unlocked content below!

Related content

USE CASES FOR MACHINE LEARNING

Protect your business from today’s biggest fraud threats

No matter the threats you’re facing, we got your back. Our technology solves a variety of issues with the greatest accuracy possible.

Account takeover fraud

Protecting consumer accounts is more important than ever. Between stored payment information, loyalty points, and account balances, there’s a lot at stake. Our technology identifies and challenges suspicious logins, then continually monitors accounts for unusual behavior to provide maximum security for your customers.

Payment fraud

Digital payments keep expanding. With so many options now available, it’s hard to keep up. How do you adapt to consumer demand for a variety of accepted payment types without adding more risk to your business? That’s where we come in. Our technology is always learning and can fight off new threats as they emerge.

Refund fraud

It’s a common practice for consumers to make false claims to get goods for free. But you don’t have to let those schemes hinder you. We understand consumer behavior. And our solutions can help you make better decisions about how to handle fraudulent refund requests and who to do business with in the future.

New account opening fraud

Booking new customers is a great way to boost revenue. But without the right protections, it can be risky. We help mitigate potential threats by verifying consumer identities with robust verification protocols and data analysis. Keep fraudsters out and let only the good customers in.

Card testing fraud

Most card testing attacks are carried out by bots. So those hundreds of small test purchases can lead to thousands of lost dollars in chargebacks very quickly. Our technology not only identifies suspicious transactions but also detects and blocks high-velocity activity indicative of bots.

Friendly fraud

Customers misuse the dispute process for a variety of reasons — buyer’s remorse, purchases made by a spouse, forgetting about a subscription service, and more. But you shouldn’t have to pay the price. Our solutions help you automatically deflect these disputes and save your hard-earned revenue.

A CLOSER LOOK

The layers of artificial intelligence and machine learning

Machine learning may seem like a complex topic. After all, how does it relate to artificial intelligence? And what is deep learning? When you break it down, however, the concepts are relatively simple. Take a look.

You may hear machine learning and artificial intelligence (AI) used interchangeably all the time. While they’re closely related, they’re not the same thing. Artificial intelligence is a broad field that refers to programming machines to think and act like humans. Think of it as the head of a hierarchy.

Machine learning is a subset of AI that acquires its own information and knowledge to make predictions. It uses algorithms rather than coding to analyze data, learn from it, and then make informed decisions. In essence, it is “intelligent” technology — able to improve on its own over time.

Furthermore, deep learning is a subset of machine learning. It’s a method of learning that teaches computers to process data similarly to the human brain. Models are trained by using large datasets and a layered structure of algorithms or neural networks to make intelligent decisions.

It’s important to note that machine learning is extremely effective, but results can be limited by the data it receives. The more data it processes, the more it learns. Over time, decisioning consistently improves.

When it comes to fraud detection and prevention in today’s ever-evolving digital world, machine learning is essential. You need a solution that can predict threats before they strike and continually learn from past outcomes to improve accuracy. It’s incredibly difficult to do all of that manually and achieve long-lasting results.

DEEP DIVE

Machine learning: only as good as the team behind it

We’ve briefly touched on this point about how results can be limited by the data machine learning receives. But there’s more to the story than that. Every aspect of a machine learning fraud detection system is important — from the development team that builds the solution to the data that feeds it.

Data is what allows machines to learn and improve results over time. Think of data as the fuel that cars use to function. Without fuel, your car can’t go anywhere. Without data, machine learning doesn’t have a path forward. Not only that, but machine learning models constantly need new, updated data to give the most accurate predictions and outcomes possible.

And the data needs to be robust. You need to be able to collect billions of data points from hundreds of industries across the globe. That includes things like transaction history, customer identity information, device information, location data, and more.

But data is only one part of the whole picture. The other part of the equation is the team that works behind the scenes perfecting machine learning algorithms and updating the software. To get a machine learning solution that excels in today’s fraud world, you need to have a team of experts that knows what they’re doing. You need a team that can build software that gives you a competitive advantage in your industry.

Ideally, you would also want a support team that can address any concerns or questions you might have once you implement a solution. Often, the individuals on these teams are fraud experts who can give you tips and advice on your fraud management strategy.

Fraud prevention software is a major investment for your business. And making the decision to buy a solution can be extremely difficult. You want to make sure you get the right fit for your needs. When shopping around, you’ll want to keep in mind that data and expertise are what separate a good solution from an exceptional solution. Most fraud software solutions on the market already use machine learning.

Below is a list of questions you might consider asking when you’re talking to different providers.

DATA

- How old is your database?

- How many years have you been collecting data?

- What data sources do you use (in-house vs. a network)?

- If you use an in-house data source, how often do you update it?

- Do you collect data points from any partners or parent companies?

- How many industries do you work with?

EXPERTISE

- Is there a team I can reach out to whenever I have questions?

- How quickly will I get a response if I reach out to your team?

- Have you ever come across unique use cases for your solution not originally intended when the software was developed?

- What kind of extra services or consultations are available?

- Who will help me during the onboarding process?

- Can I meet with one of your engineers?

TECHNOLOGY

- How often is your software updated?

- What kind of machine learning do you use?

- Do you offer any pre-built integrations?

- Is your software easy to use? Do I need to hire new team members to manage the system?

- Have you worked with other businesses in my industry? What kind of results did they get by using your software?

- Is your software flexible? Can I make changes to the policies I originally set up whenever I need to?

GET STARTED

Want to see Kount's fraud detection solutions for yourself?

Sign up for a demo today. We'll show you how our technology uses machine learning for fraud detection and achieves the best results possible.