Bank Identification Numbers (BIN) - A Complete Guide

Studies have found that global cardholders make approximately 450 billion purchases per year. That’s 1.2 billion credit or debit card transactions each day. Or 14,000 purchases every second!

How is that possible?!

Transaction processing embraces the power of bank identification numbers.

Use this detailed guide to better understand BINs and how they could impact your business’s bottom line.

- What is a Bank Identification Number?

- How Do BINs Work?

- What are the BIN Ranges and Major Industry Identifiers?

- How are BINs Used For Transaction Processing?

- How are BINs Used For Fraud Prevention & Chargeback Management?

What is a Bank Identification Number?

A bank identification number BIN is the first four to eight digits printed on a payment card. BINs identify the bank or financial institution that issued the card to the cardholder.

BINs are included on most payment cards — credit cards and debit cards, prepaid cards, gift cards, and electronic benefits cards.

NOTE: The phrase ‘bank identification number’ was originally coined because most payment cards were issued by banks. But these days, an increasing number of payment cards are being issued by non-bank entities. For example, American Express® isn’t technically a financial institution, but the brand does provide credit cards to cardholders. Therefore, the phrase issuer identification number (IIN) might be a more accurate description.

However, these nuances aren’t all that important. BIN and IIN can be used interchangeably. What’s more important is understanding how these identifiers work and how they can help improve your business’s operations.

The remaining digits on the card are the cardholder’s account number and the check digit. These numbers each have a unique role to play throughout the lifecycle of a transaction.

The account number helps with the following:

- Identifying the unique account associated with the card

- Verifying the account is still in good standing (the card hasn’t been reported lost or stolen)

- Determining if the account has the funds to cover the transaction amount

- Withdrawing funds or charging the appropriate account

- Facilitating refunds if necessary

The last digit on a payment card is called the Luhn check digit or checksum. It is used to detect any errors that might have been made when communicating the account number in a card-not-present transaction.

The algorithm multiplies then adds the digits on the payment card with a complex calculation. If the solution to the equation is divisible by 10, the account number provided is valid.

The Luhn check digit acts as a final quality control checkpoint that validates the accuracy of all the numbers before it.

BIN assignments are influenced by organizations such as the American National Standards Institute and the International Organization for Standardization. The card brands are also involved.

How Do BINs Work?

The main function of a BIN is to convey identifying information such as:

- The bank, institution, or organization that issued the card

- The type of industry the issuer is in (travel, banking, etc.)

- The card brand that the issuer is associated with (Visa®, Mastercard®, etc.)

- The country where the issuer is located

- The phone number and/or website for the issuer

- The type of card issued (debit, credit, pre-paid, etc.)

- The length of the card number

Basically, a BIN acts like a postcode for your customer’s financial institution. It helps you, the merchant, route transactions to the right place so funds can be collected from the correct account.

What are the BIN Ranges and Major Industry Identifiers?

The first digit of the BIN is called the major industry identifier (MII). This digit helps identify the card issuer’s industry.

For example, the MII for Visa cards is 4 because most Visa issuers are in the banking or financial industry. American Express and Diners Club® originally started in the travel and entertainment industry, so some of their BINs have an MII of 3.

The following is an overview of the current BIN ranges and MII assignments.

| MII Digit Value | Issuer Category | Card Brand |

| 0 | ISO/TC 68 and other industry assignments | None |

| 1 | Airlines | UATP® |

| 2 | Airlines, financial, and other future industry assignments | MIR, Mastercard |

| 3 | Travel and entertainment | American Express, Diners Club Carte Blanche®, Diners Club International®, JCB |

| 4 | Banking and financial | Visa |

| 5 | Banking and financial | Mastercard, Diners Club US & Canada, Maestro®, Dankort |

| 6 | Merchandising, banking, and financial | Discover®, China UnionPay, InterPayment, InstaPayment |

| 7 | Petroleum and other future industry assignments | None |

| 8 | Healthcare, telecommunications, and other future industry assignments | None |

| 9 | Reserved for assignment by national standards organizations | N/A |

How are BINs Used For Transaction Processing?

There are dozens of different tasks involved when you charge cards for purchases — most happening in a matter of seconds. In order for those tasks to be completed accurately and on time, there needs to be a clear understanding of who is doing what.

BINs help make that happen.

When a transaction is initiated, the corresponding BIN tells you, your gateway, your processor, your acquirer, and the card brand which issuing bank to bring into the conversation. Once you know which bank you are dealing with, you can do all the things that need to be done to facilitate a sale:

- Identify the card or unique account involved

- Run an address verification (AVS) check

- Request authorization approval (check the status of the account, make sure there are enough funds available, etc.)

- Withdraw funds or charge the cardholder’s account

- Move funds to your bank account

Without a BIN or IIN, it would take a lot of manual labor and a significant amount of time to process a transaction. But by quickly identifying which bank is involved, you can seamlessly accept payments from your customers.

How are BINs Used For Fraud Prevention & Chargeback Management?

The most effective fraud and chargeback management strategies are data-driven. The more insights you have, the more accurate your decisions and actions will be.

The information provided by BINs can be funneled into your overall risk management strategy, making it more effective.

BIN data can help stop fraudsters from making unauthorized purchases.

For example, if the BIN tells you the issuer is located in Canada but the merchandise is being shipped to India, that might be a red flag for fraud. Or if the purchase was made with a corporate card but items are being shipped to an apartment, you might want to investigate the authenticity of the shopper.

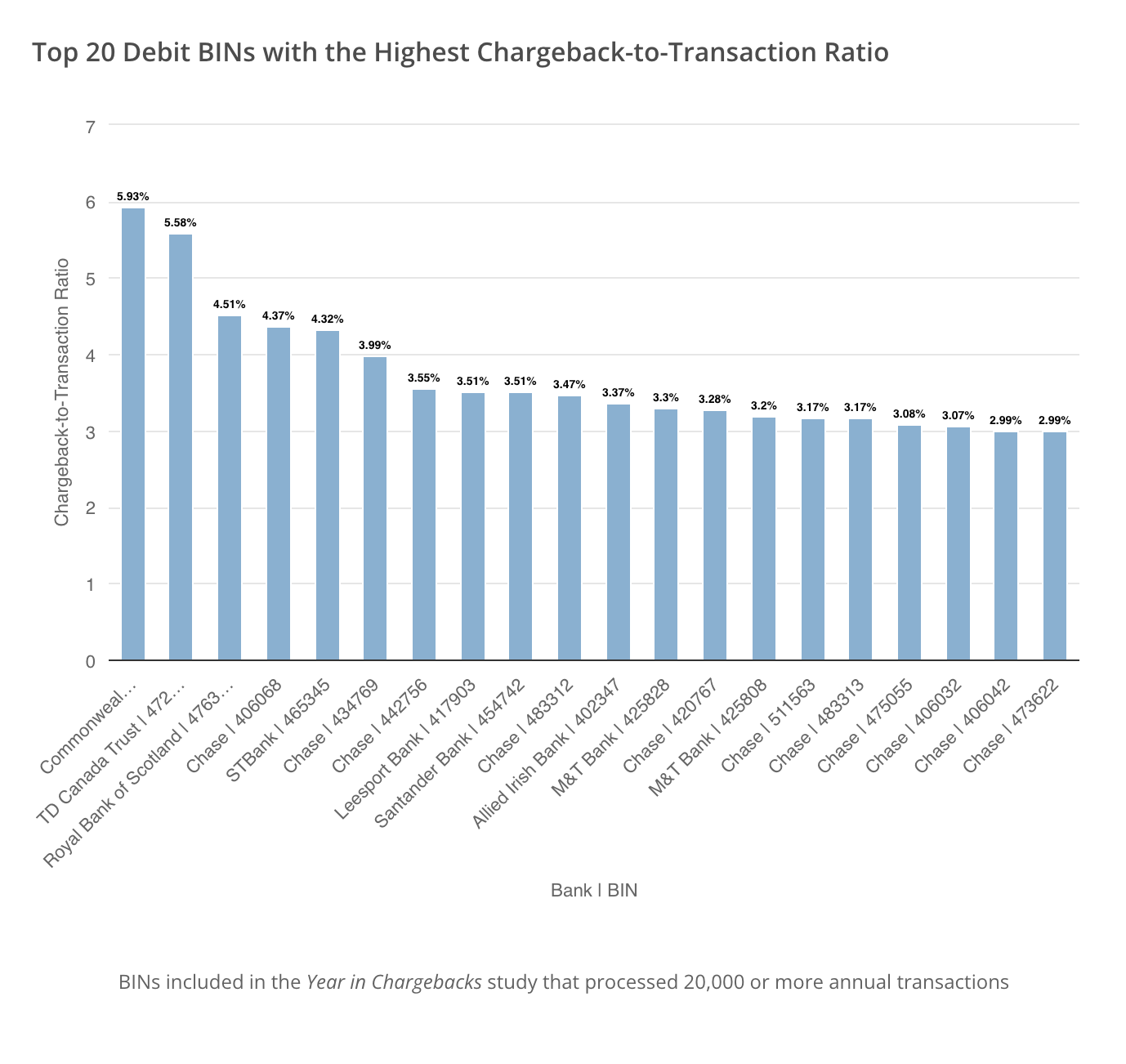

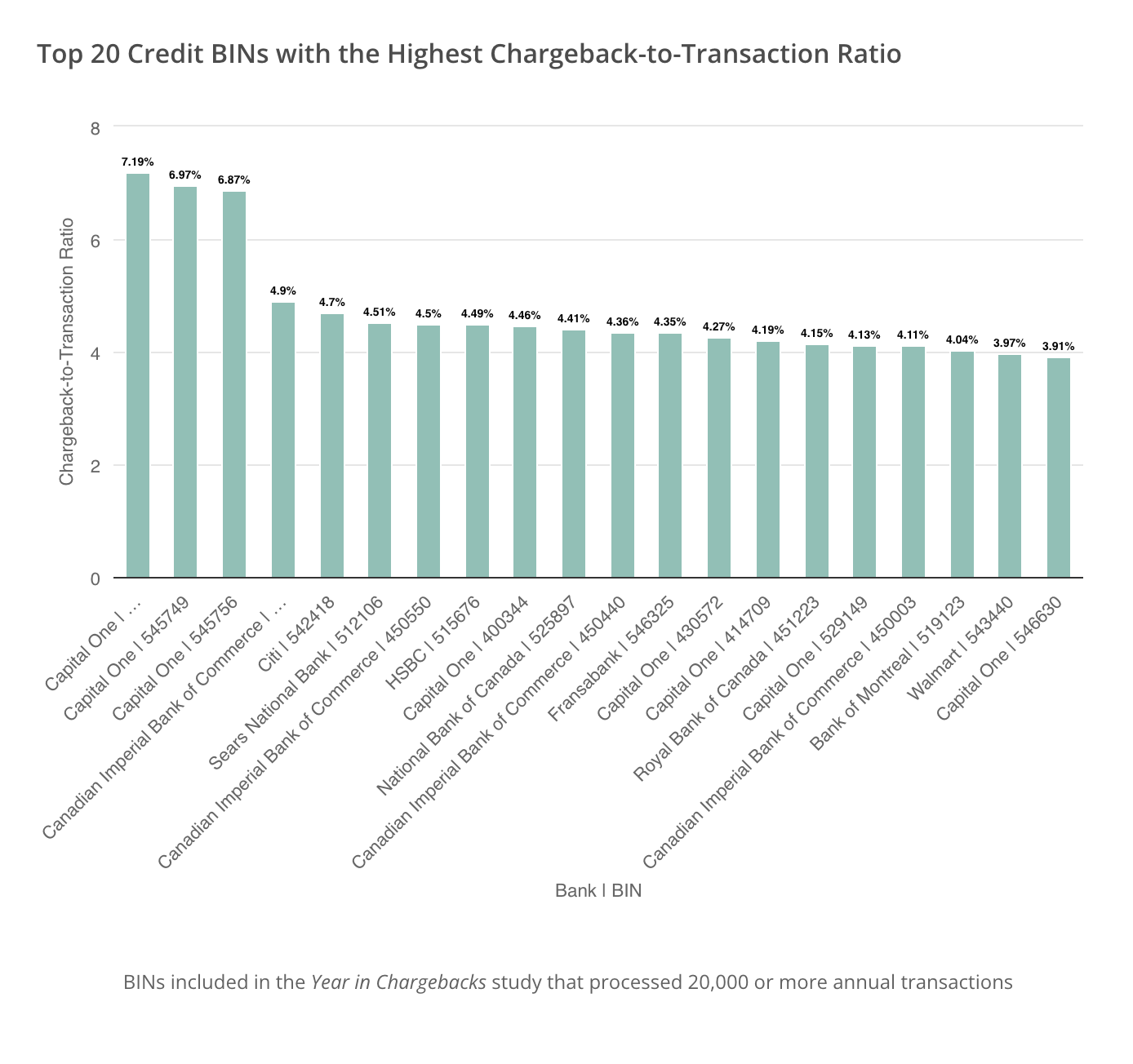

BINs can also help prevent chargebacks. Breaking down chargeback data by BIN usually reveals several useful insights.

For example, chargebacks might be more common with credit cards than debit cards. Or you might discover that some issuing institutions dispute transactions at a higher-than-average rate.

Consider a few real-world illustrations.

Data from the annual Year in Chargebacks report reveals how chargeback-to-transaction ratios can vary significantly from BIN to BIN — and reach surprisingly high levels.

And this real-life story shows just how valuable BIN data can be to a chargeback prevention strategy.

A merchant experienced a sudden and unexpected spike in chargebacks. By analyzing the data, the merchant was able to trace the unusual activity to one individual BIN. Temporarily blocking transactions from that BIN instantly lowered the merchant’s chargeback-to-transaction ratio.

After the issue had been resolved with the bank, Sadie updated her pre-sale screening tool one more time. She stopped blocking the BIN and started accepting purchases from those customers again. Sadie’s chargeback-to-transaction ratio stayed within a safe range. In the span of a single month, Sadie’s ratio went from 0.64% to 76% and back to 0.71%.

— Client case study

Without BIN data, it would have been extremely difficult — maybe impossible — to figure out why chargebacks had spiked so drastically. But with those valuable insights, the merchant was able to discover the error and stop the unnecessary chargebacks from happening.

New 8-Digit BINs & Chargebacks

Traditionally, a BIN is expressed as the first four to six digits in the cardholder’s account number. However, Visa is in the process of changing BINs from six digits to eight.

Visa has already begun issuing eight-digit BINs, and by April 2022, all new Visa BINs will use the extended identification process.

This change will likely impact many processes throughout the transaction workflow, including chargeback management.

PRO TIP: Review your internal processes to identify and proactively address potential issues. The primary concern will probably be how BINs influence risk decisioning.

The following are some situations that might be impacted by the BIN migration. Consider how you’ll want to handle these changes.

Recurring Transactions

Visa has asked all issuers to migrate their current 6-digit BINs to 8-digits. This means cardholder account numbers will change. If you process recurring transactions, you’ll likely experience an increase in declined authorizations.

To compensate for the decrease in revenue, should you migrate towards more lenient fraud decisioning? Or would that decision double your losses with less revenue and more chargebacks?

Auto-Declining High-Risk BINs

Some merchants occasionally choose to automatically decline transactions from certain high-risk BINs to prevent chargebacks. Is that a tactic you currently use?

If so, you’ll need to constantly update your risk management rules as BINs change. Do you have a system in place to map the old BIN for high-risk issuers to the new BIN?

Cardholder Blacklists

Merchants who blacklist cardholders after initiating a chargeback could face new management challenges. Blacklists generated from account numbers will soon be based on data that is no longer valid.

Will repeat offenders slip through previously secure defenses? Or will you use other characteristics, besides the account number, to identify high-risk customers?

These are only a few of the potential issues merchants could face. Other challenges will likely arise as the conversion process continues.

PRO TIP: If you are worried about how the 8-digit BIN conversion could impact your business’s risk management strategies, reach out to our team of experts. We’re happy to share our insights and answer any questions you may have. You can contact us by scheduling a demo here.

Continuing Your BIN Education

Bank identification numbers are just one of many nuances that impact transactions and chargebacks.

The more you know about these detailed processes, the better prepared you’ll be to handle any challenges that may arise.

Take some time to check out our related resources, and begin building a foundation of knowledge to protect your business.

If you’d like to learn more about incorporating BIN data into your chargeback management strategy, sign up for a demo. We’ll show you how to break down your chargeback data by different variables — including bank identification number — so you can solve problems at their source and prevent future disputes.