Credit & Debit Card Authorization Holds

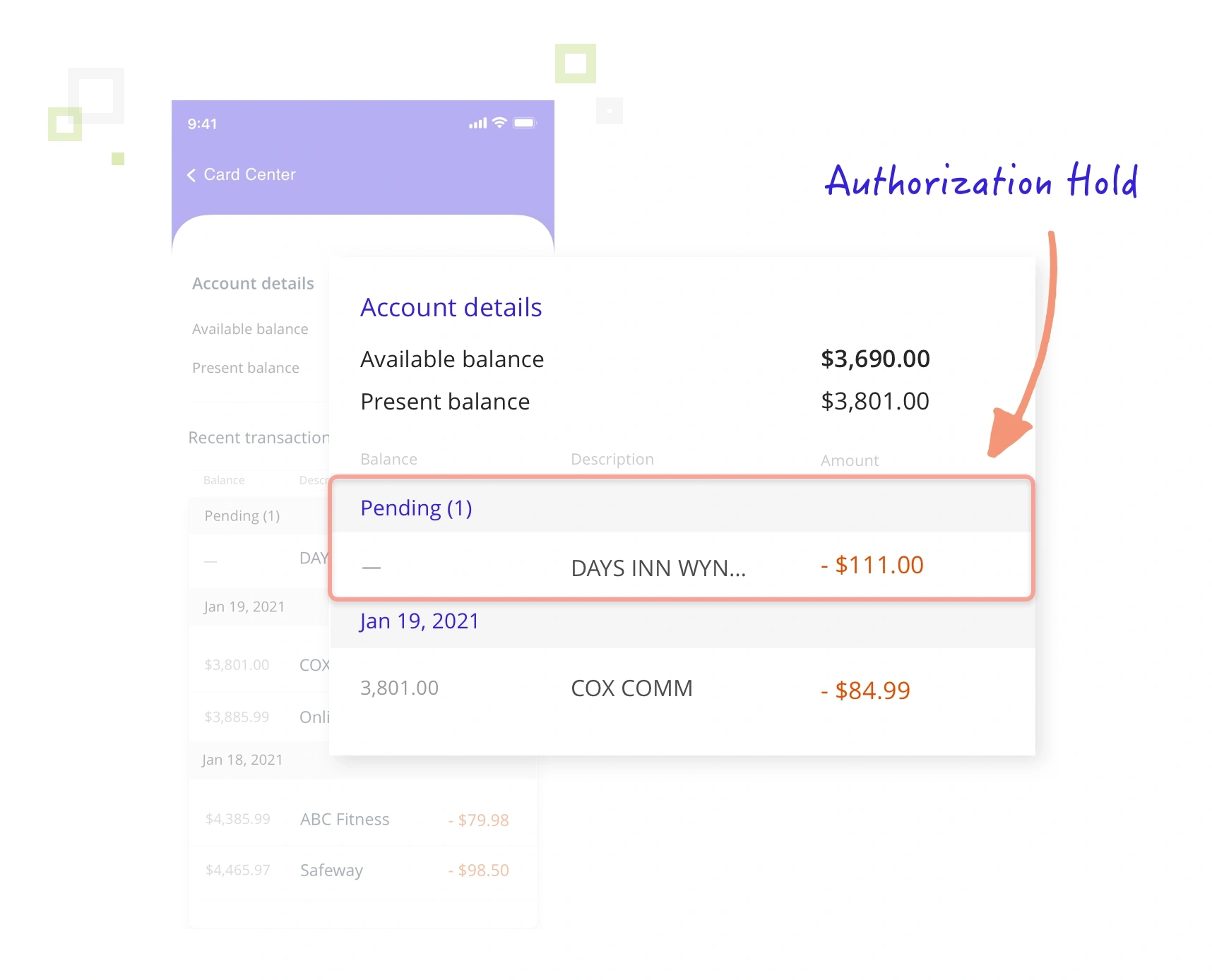

Debit and credit card authorization holds temporarily freeze money or credit in a cardholder’s account. These go into effect after a transaction is authorized and typically last until the issuing bank transfers the funds to the merchant’s account.

Essentially, an authorization hold helps ensure a merchant gets paid for goods or services that are sold by preventing the customer from spending the promised money somewhere else.

For some merchants, authorization holds offer several benefits. But for others, the technique can be risky. How do you know if authorization holds are right for your business? Find out here.

- Incorporating Holds Into the Authorization Process

- How Long Do Holds on Credit & Debit Cards Last?

- Why Use Authorization Holds?

- What are the Drawbacks of Authorization Holds?

Incorporating Holds Into the Authorization Process

Many businesses choose to hold authorized funds for a defined period of time prior to settling a transaction.

RELATED READING

For a detailed overview of the authorization and settlement processes, check this article.

Once the transaction is approved, a hold can be put on the cardholder’s account. The hold will freeze the authorized amount of money (or credit) until you settle or cancel the transaction.

The process works like this:

- A cardholder uses a credit or debit card to make a purchase.

- You send an authorization request to the debit or credit card issuer (cardholder’s bank).

- The issuer approves the transaction and puts a hold on the cardholder’s account.

- When you are ready, you submit the transaction for settlement.

- The issuer replaces the temporary hold with a debit to the cardholder’s account.

- Your account is credited for the final transaction amount.

How Long Do Holds on Credit & Debit Cards Last?

The duration varies for each type of credit card hold.

Card brands set regulations that try to balance the amount of time it might take for finalizing transactions with the amount of time that cardholders are willing to have their money or credit card limits tied up.

Generally, timelines depend on variables such as:

- The card brand (Mastercard®, Visa®, etc.)

- Your merchant category code (MCC)

- The issuer’s requirements

- The type of card used (credit or debit)

- The payment method (single sale or recurring transaction)

- The transaction type (card-present or card-not-present)

- The items or services that are purchased

The following examples provided by Visa explain how long certain hold types are valid:

- 1 day - Most card-present transactions (authorization and settlement on same day)

- 3 days - U.S. commuter transportation ( buses, railways, etc.)

- 7 days - Most card-not-present transactions

- 31 days - Lodging, vehicle rentals, and cruise lines

If you haven’t settled the transaction before the hold on a credit card or debit card expires, you’ll probably need to cancel it.

Why Use Authorization Holds?

There are several benefits of using authorization holds. The following outlines some of the most common reasons why merchants choose to incorporate holds into the payment processing workflow.

Holds help reduce revenue loss.

An authorization hold ensures there is still money or credit available when the transaction is settled. It prevents the cardholder from spending the promised funds somewhere else before you get paid.

As a result, fewer transactions will need to be canceled and you’ll earn more revenue.

Holds can ensure you are paid in full.

Some merchants don’t know the final transaction amount when it is first initiated. For example:

- Hotel guests might order room service or extend their stay.

- Car rental, bike shares, leased equipment, etc. might be returned late or damaged.

- Gas stations don’t know how full a tank is when the customer begins fueling a vehicle.

- Cruise lines offer excursions and in-transit services.

- Grocery stores with online ordering don’t know the weight of certain items until they are weighed.

- Restaurant and bar employees often receive tips.

- Parking garages and charging stations don’t know how long customers will leave their vehicles.

Card brands allow merchants like these to submit an authorization request with an estimate for the transaction amount. That way, merchants can err on the side of caution and hold funds just in case they are needed.

If your business is in an industry that provides goods or services before transactions are settled, authorization holds can help ensure you are able to collect on both the expected and unexpected payments.

Holds help you save money.

Transaction processing involves several different fees paid to different parties at different stages of the transaction lifecycle.

Some fees are charged after the transaction is settled. But if you never settle the transaction, you won’t have those expenses.

Authorization holds help you identify potential issues — such as fraud or out-of-stock merchandise — before you settle transactions. If you don’t discover those problems until after settlement, you needlessly pay additional fees for transactions that are canceled without revenue.

Holds help reduce refunds.

If a customer has a problem with a purchase after the transaction has been settled, your only option is to issue a refund.

Unfortunately refunds come with additional fees. And, high refund rates can negatively impact your reputation and threaten your payment processing capabilities.

Payment processors carefully monitor your number of refunds as a metric to measure potential risk. Too many refunds could indicate your business isn’t fulfilling its obligations.

On the other hand, with an authorization hold, you can simply reverse the hold instead of issuing a refund.

Holds help prevent chargebacks.

Perhaps the best reason for using authorization holds is that they can help you prevent chargebacks.

An authorization hold is like pushing pause on a process that can otherwise become too rushed. Urgency often leads to mistakes and oversight.

But with a hold, you buy yourself some time. You — and the cardholder — have the chance to carefully review the situation and address any issues before they become chargebacks.

For example, the following experiences could have resulted in a chargeback, but they were easily resolved because the transactions had authorization holds.

You notice two orders, both from Dwight and both for the same tie. You call Dwight to investigate. He says there is an error in your checkout process. He didn’t receive a confirmation message, so assuming the transaction didn’t go through, Dwight tried again. All you have to do is reverse the hold on the second transaction and avoid a ‘duplicate processing’ chargeback.

Michael checks his statement and sees a pre-authorized transaction that he doesn’t recognize. He calls you to report the suspected fraud. Because you haven’t settled the transaction yet, it is easy to reverse the hold and resolve the problem without a ‘no cardholder authorization’ chargeback.

Jim places an online order for a pair of shoes, but your fulfillment team discovers they are actually out of stock. Rather than make Jim wait for something he’s paid for but can’t have — and risk a ‘merchandise not received’ chargeback — you reverse the hold and encourage Jim to try something different.

Pam signs up for your meal delivery service. After scheduling next week’s delivery, Pam realizes she used the wrong card. Since there is only a hold on her account, you easily reverse it and run a replacement transaction with a different card — and avoid a ‘canceled recurring transaction’ chargeback.

What are the Drawbacks of Authorization Holds?

There are both pros and cons of using authorization holds. Make sure you consider these drawbacks before you change your payment processing strategy.

IN SUMMARY...

There are a couple drawbacks of using authorization holds, but they can basically be summed up like this: you could potentially damage your reputation.

When used correctly, authorization holds can be a frictionless — sometimes even helpful — part of the customer experience. But if used incorrectly, they can cause understandable frustration for everyone involved.

Remember, when you put authorization holds on customers’ accounts, you are freezing their funds. You are preventing them from making other purchases. Holds give you a lot of control over someone else’s money. Be conscious of how you are using that control.

Data has to be consistent, complete, and accurate.

All authorization holds should eventually be removed from the cardholder’s account — either because the transaction is settled or canceled.

In order to take the appropriate action, the issuer needs to be able to match the settlement or reversal request to the applicable authorization hold. That means the information you send in both the initial and follow-up message needs to be consistent and complete.

However, that can be difficult to do.

In a recent study that analyzed thousands of authorization reversals, Visa discovered the following:

“Many merchants were sending incomplete or incorrect information in the authorization reversal message...Because of the missing or non-matching data elements, issuers were not able to match the reversal request to the original authorization.“

It can be a time-consuming, challenging task to ensure your payment processing messages are accurate. But even worse, errors could negatively impact the customer experience.

Visa went on to explain that administrative issues could cause the authorization hold to last up to eight additional days. Customers will likely be upset if you continue to freeze their money even after they’ve asked you to release it.

You could accidentally place duplicate holds for a single transaction.

It’s possible to place multiple authorization holds for a single transaction. This could be caused by:

- Not using the incremental authorization feature correctly

- Using multiple identify verification tools such as card security code and address verification service (AVS)

- Authorizing $1.00 test transactions instead of using 3D Secure 2.0 to verify an account

- Not reversing holds for canceled transactions

Considering legitimate, accurately-managed holds can sometimes cause customer frustration, freezing funds that you’re not entitled to could lead to justifiable concern.

Discrepancies between the authorization amount and transaction amount could cause confusion.

Some industries are allowed to place authorization holds before the final transaction amount is known. And oftentimes, the amount of the settled transaction is different than the amount that was held.

These authorizations — referred to as pre-authorizations, undefined authorizations, or estimate authorizations — can cause confusion if the customer isn’t properly informed about the fluctuation.

For example:

- A restaurant submits an authorization for 20% above the transaction amount to cover the tip. However, the customer received poor service and tipped low. Seeing the hold amount, the customer worries that the waiter will receive more than he is due.

- A hotel guest forgets about the room service she ordered and is concerned when the amount charged to her card is more than the amount that was authorized.

- An international traveler calculates the currency conversion before making a purchase. But because the currency exchange rate changed after the transaction was authorized, he assumes the merchant charged him too much.

Even if you think you’ve explained the process accurately and clearly, there’s always the chance that your customers will misunderstand your actions.

If you make a mistake, you could pay more in fees.

Regardless of how difficult it can be to understand and comply with processing regulations, card brands expect you to do your part to maintain the integrity of their systems. If you don’t, you could be fined.

When it comes to Visa transactions, penalties come in the form of a ‘misuse of authorization system’ fee — you’ll be fined for every approved or partially-approved authorization that hasn’t been reversed or settled.

In order for authorization holds to help you earn more than you spend, you’ll need to make sure you are complying with all card brand regulations. Otherwise, you’ll have to pay these avoidable fees.

You could receive more chargebacks too.

Authorization holds can be difficult to manage. There are several different mistakes that might be made. And different mistakes warrant different penalties. Some are fined; some lead to chargebacks.

For example, a transaction can be disputed if you don’t settle it within the time limit. And you could receive a chargeback if the settled transaction amount is more than the authorized transaction amount.

If you want the benefits of authorization holds without the drawbacks, you need to fully understand card brand regulations. Check with your processor to make sure your workflows and data entry are compliant.

When Authorization Holds Aren’t Enough, Contact Kount

For many merchants, authorization holds are a valuable chargeback prevention technique. But they are just one small piece of a bigger dispute management puzzle.

There are dozens of different prevention techniques, tools, and strategies to consider. But figuring out which ones are right for your business isn’t something you should have to worry about.

At Kount, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Let us remove the complexity of payment disputes so you can focus on growing your business.