How Kount Analytics Reveal the Most Unexpected Reasons for Chargebacks

If you figure out why transactions are being disputed, you can fix the problem, stop the chargebacks, and go on with life.

That sounds like a pretty straightforward chargeback prevention strategy, right?

But how do you know what the underlying reason is for your chargebacks? There are hundreds of potential things that could be to blame. How do you determine the exact cause?

With Kount, it’s easy to trace chargebacks to their source — even the most random, obscure, and unexpected reasons!

The Story of How a Merchant Identified the Reason for Disputes & Stopped Chargebacks from Happening

This is the story of how a merchant used Kount's detailed analytics to uncover the strange and unexpected reason for a massive spike in chargebacks.

THE SITUATION

Things at Sadie’s Share Shop* were going great.

Sure, launching Canada’s first online consignment shop for gently used women’s clothes had been a risk. Would there be any interest from potential shoppers? And if there was, would there be enough supply to keep up with the demand?

But Sadie was so glad she’d gone through with it. The first few years were a little rocky, but things had finally evened out. Sales were steady, and life was pretty uneventful.

Just when Sadie was starting to relax, her world turned upside down.

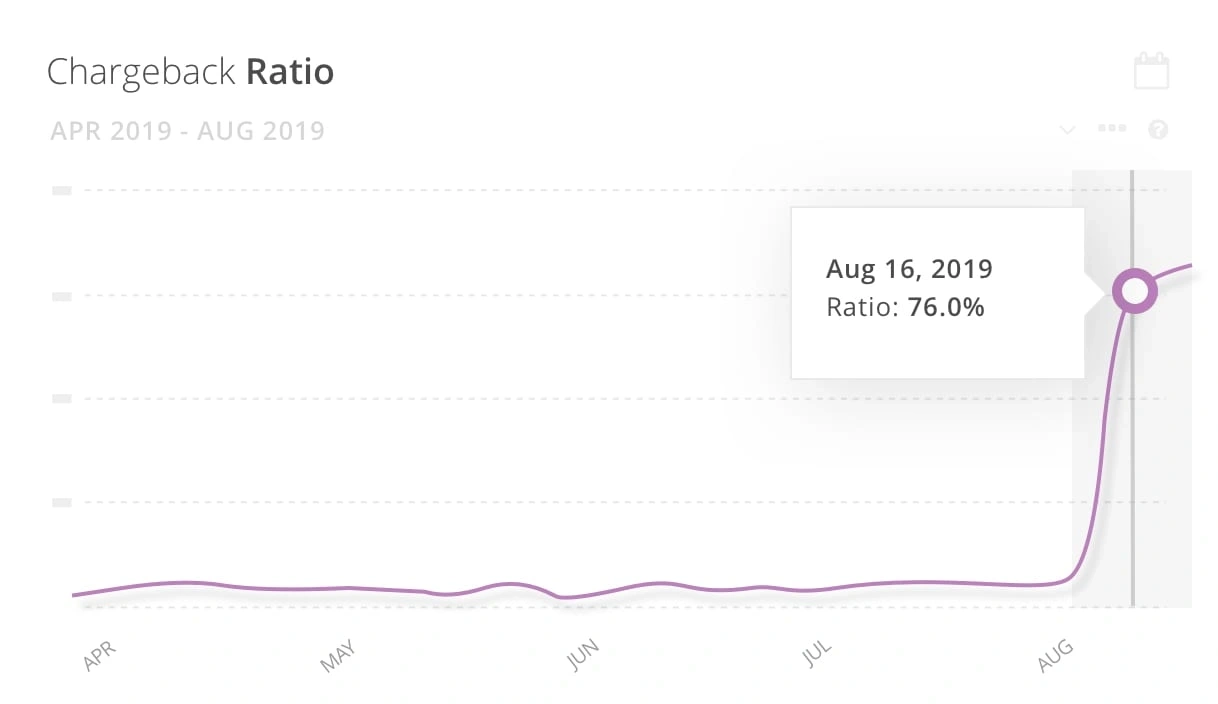

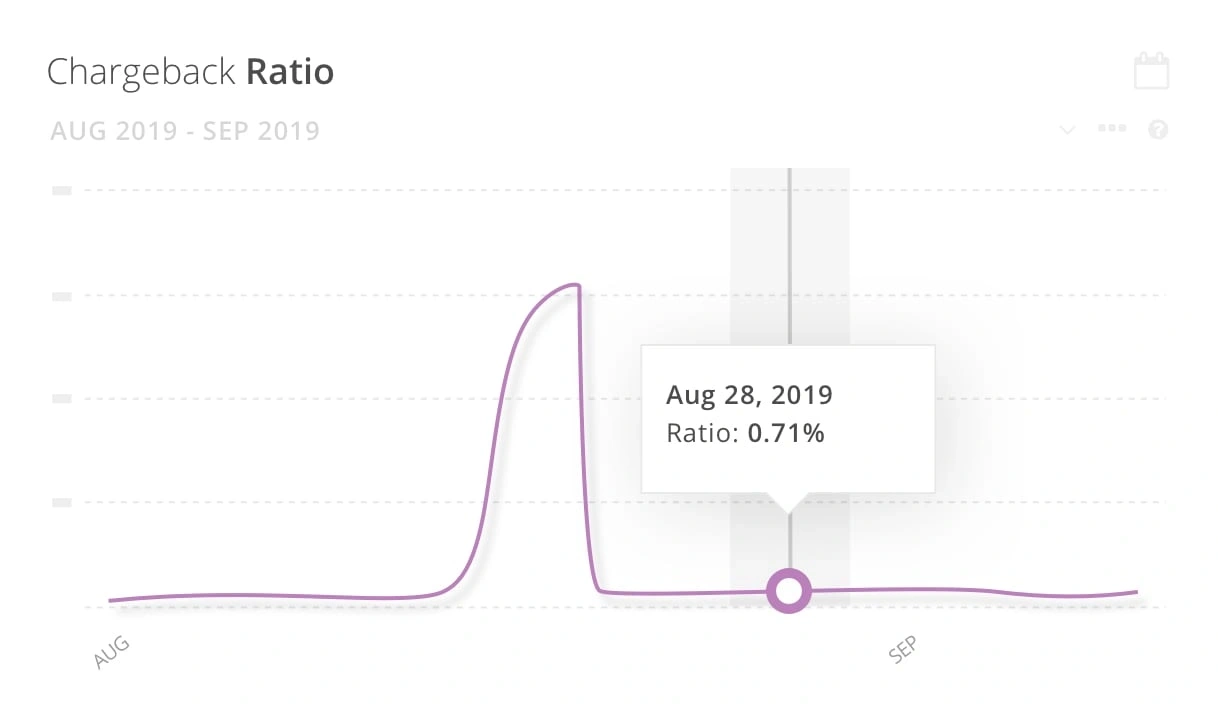

Sadie received a notification from Kount; her chargeback-to-transaction ratio had gone up — a lot. Sadie’s Share Shop typically had a monthly chargeback-to-transaction ratio of about 0.64%. But that day, her ratio was 7.4%!

Sadie thought it was just a fluke. Surely a ratio that high wasn’t even possible! But she was wrong. Each day, her ratio spiked again and again. By Friday, Sadie’s Share Shop had an unprecedented chargeback-to-transaction ratio of 76%.

What happened?! Sadie had no idea but knew she had to figure it out fast. If her chargeback-to-transaction ratio was still so high at the end of the month, she’d probably be in danger of losing the business.

Sadie turned to Kount's detailed analytics for help. What she found was both surprising and confusing.

THE TAKEAWAY

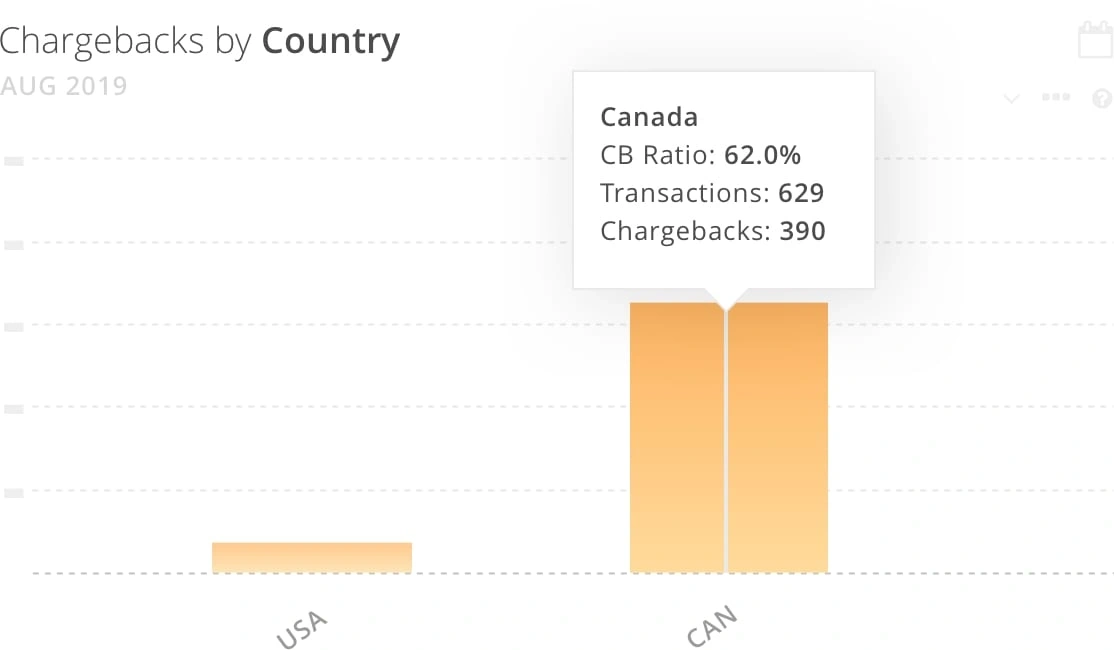

Sadie clicked through Kount's analytics charts one by one. Several were normal, but the Chargebacks by Country chart caught her eye.

Sadie sold to customers in the U.S. and Canada. Usually, the U.S. had a higher chargeback-to-transaction ratio than Canada. But that day, the two countries had switched, and Canada was much higher than normal.

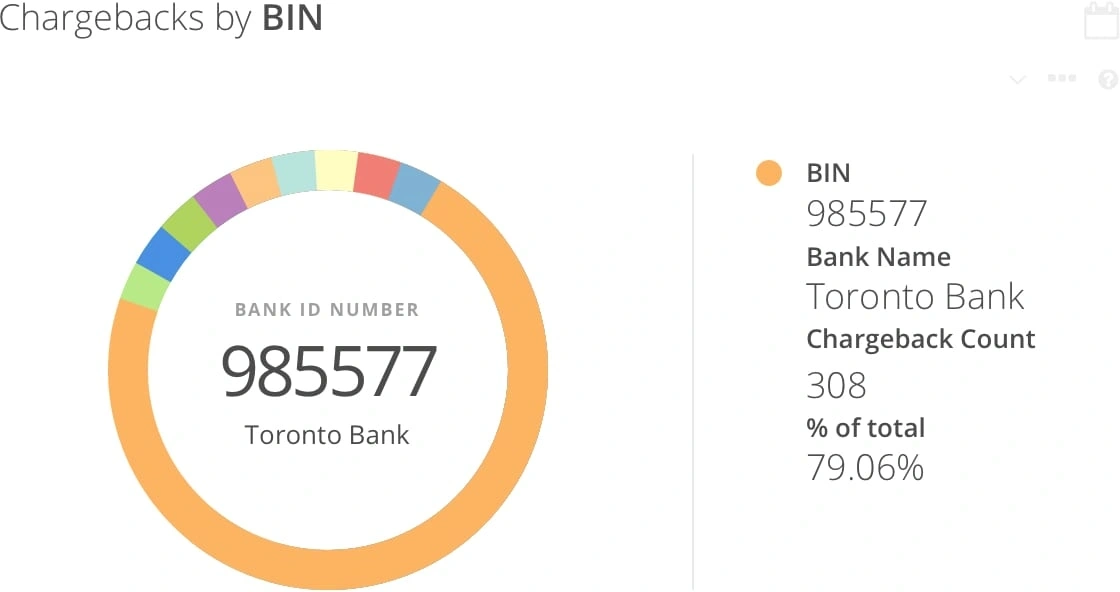

Next, Sadie checked the Chargebacks by BIN chart.

Of all the analytics that Kount provides, Sadie used this one the least. She knew the BIN, or bank identification number, was the first six digits on a customer’s card. And she knew the BIN identified the bank that issued that card to her customer. But she didn’t understand how it could be helpful to monitor chargeback activity on an issuing bank level. Who cared which bank disputed the most purchases?!

But one glance at the Chargebacks by BIN chart showed Sadie just how important this information is. One bank had a 100% chargeback-to-transaction ratio for the month. Every single purchase made with that particular BIN had been disputed!

Sadie did some research and discovered the BIN with the high chargeback ratio — BIN 985577 — was assigned to Toronto Bank*, one of the largest banks in Canada.

Sadie updated her pre-sale screening tool to temporarily block transactions from that BIN while she figured out what was happening. Immediately, her chargeback-to-transaction ratio returned to normal. And after a few phone calls and emails with the bank, Sadie knew why.

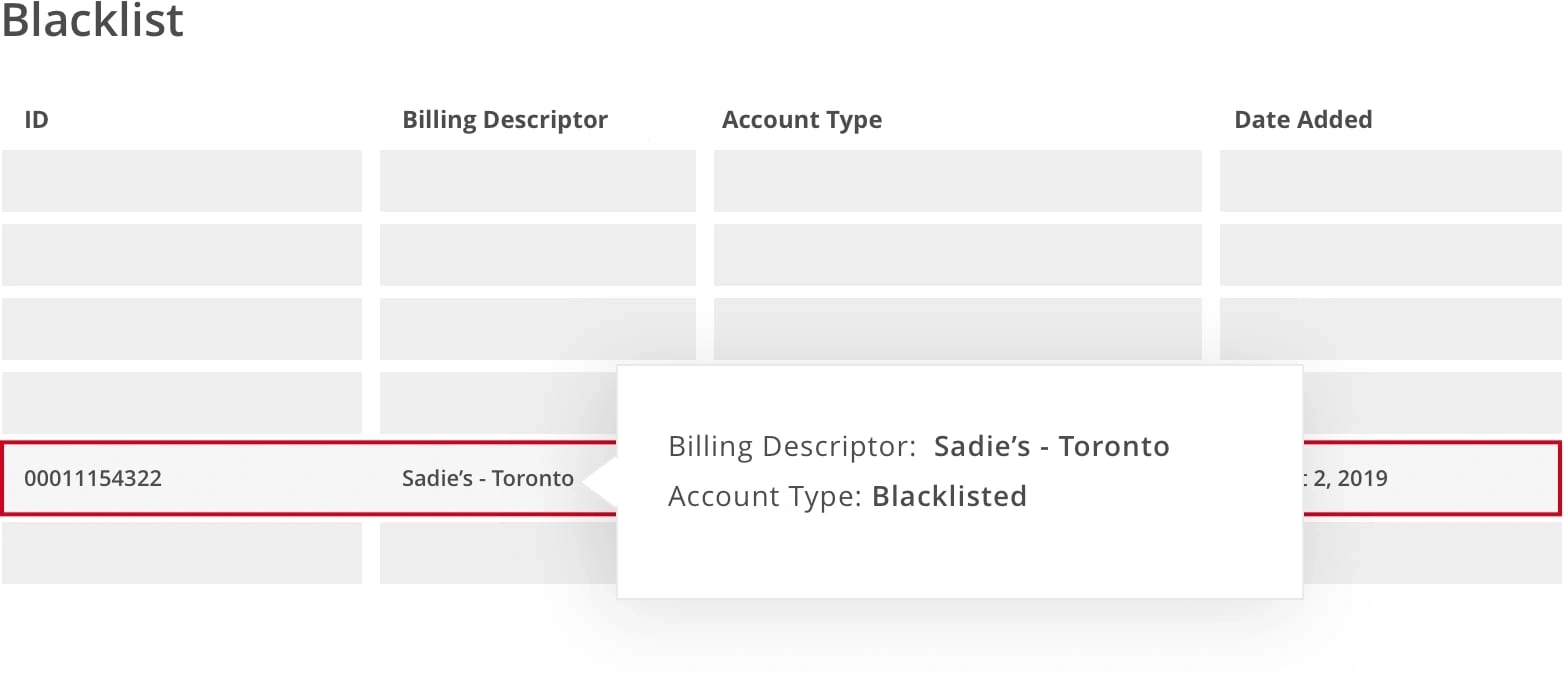

Toronto Bank had determined that a company called Sadie’s Shore Shoppe* was scamming its customers. Sadie’s Shore Shoppe guaranteed first-rate housing accommodations along Lake Ontario but failed to deliver on those promises. To protect its customers from the scam, Toronto Bank decided to automatically charge back any purchase made at Sadie’s Shore Shoppe.

Unfortunately, when setting up the blacklist, the bank accidentally entered the wrong billing descriptor. Instead of penalizing Sadie’s Shore Shoppe, the bank blocked Sadie’s Share Shop!

THE OUTCOME

After the confusion had been cleared and the bank’s blacklist fixed, Sadie updated her pre-sale screening tool one more time. She took the ban off BIN 985577 and started accepting purchases from those customers again.

Sadie’s chargeback-to-transaction ratio stayed within a safe range. In the span of a single month, Sadie’s ratio went from 0.64% to 76% and back to 0.71%.

This experience taught Sadie many valuable lessons:

- Chargebacks can happen for lots of reasons. Previously, Sadie thought chargebacks were a measure of success. If she had a lot of chargebacks, she assumed it was because she was making mistakes. She felt she was failing at business. This experience taught Sadie that chargeback causes are much more extensive than she previously thought. A better measure of success is how Sadie reacts when chargebacks do happen.

- Merchants are liable for all chargebacks. Even though Sadie hadn’t done anything wrong, she was still responsible for the chargebacks.

- Chargeback management demands constant vigilance. Without Kount's notifications, Sadie might not have known there was a problem until it was too late. Real-time data and insights are incredibly valuable.

- Problems need to be solved at their source. When Sadie noticed the spike in chargebacks, there were dozens of different actions she could have taken. But only one of them would have made a difference.

- Analytics make it incredibly easy to figure out what’s happening. Without Kount, it would have been extremely difficult to figure out why chargebacks had spiked so drastically. Sadie would have had to entirely stop accepting sales while she spent days digging through countless spreadsheets. Even if she was eventually able to trace the chargebacks to their source, she would have lost a lot of revenue in the meantime. Sadie was grateful that she was able to quickly identify and solve the problem without costly side effects.

*Our client requested that actual business names remain anonymous.

Do You Want Access to Chargeback-Preventing Data Too?

At Kount, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Kount has helped Sadie’s Share Shop and countless other businesses remove the complexity of payment disputes so they could get back to business.

If you would like a simplified approach to preventing chargebacks and stopping unnecessary revenue loss, Kount can help you too. Sign up for a demo today.