Complete Guide to Visa Compelling Evidence Update CE 3.0

Visa® has launched the CE 3.0 initiative to update compelling evidence requirements for dispute reason code 10.4. The goal is to reduce ‘friendly’ fraud chargebacks, helping sellers protect more of their hard-earned revenue.

New Visa CE 3.0 rule changes take effect April 15, 2023.

Use this detailed guide to better understand the new compelling evidence updates. If you have any questions, our team of experts is happy to help.

A Short Summary

Only interested in a high-level overview? Don’t want to read all the nitty-gritty details? Here’s an abbreviated version.

WHEN

The new rule change is effective April 15, 2023. However, one of the stipulations is that certain pieces of information have to be collected 120 days prior to their use. That means you should start making updates now so the information will be ready when the new processes begin.

WHY

Visa recognizes that transaction disputes are an ever-present and growing concern for online sellers. The new rules will hopefully reduce the likelihood of invalid chargebacks and help you save money.

WHAT

CE 3.0 revolves around a simple but effective assumption: if a cardholder has made other purchases with your business and those purchases weren’t disputed, the current dispute isn’t actually fraud.

HOW

The CE 3.0 initiative does two things. First, it introduces a way to prevent chargebacks from happening — guaranteed. Second, it provides a new way to respond to chargebacks with improved odds of winning.

Both of these things are dependent on available compelling evidence. If you can prove the same data elements involved in the current dispute (like device ID/fingerprint and IP address) are also associated with two previously undisputed transactions, the fraud claim will be denied.

PROS

If you have the evidence required to validate the transaction, Visa guarantees the case won’t advance. If you share the evidence early in the dispute process (through the Order Insight workflow), the dispute won’t become a chargeback (and your chargeback ratio won’t be impacted). If you share the evidence in your chargeback response, the case won’t advance to arbitration.

Bottom line: you'll retain revenue, reduce fraud ratios, reduce chargeback ratios, avoid fraud and chargeback monitoring programs, lower operational costs, and reduce dispute-related fees.

Regardless of when you share the information, overturning the cardholder’s fraud claim reverses the damage done to your fraud ratio.

CONS

Results can be impacted by a number of variables such as industry, products type, available data, and more. The impact for your business may not be as significant as it is for other merchants.

NOTE: A few years ago, Visa made widespread changes to the way the brand manages transaction disputes. Everything from workflows to terminology changed.

One of the noteworthy updates was replacing the term ‘chargebacks’ with the word ‘disputes’. Even though this article relates to Visa policies, we will primarily use the more commonly-adopted phrase of ‘chargebacks’.

Why are the Rules Changing?

Over the years, Visa has made several attempts to minimize the impact of friendly fraud. Refining policies and introducing new technologies helps the brand keep pace with the growing, evolving threat.

The most recent rule enhancement — the third change to compelling evidence requirements — has been dubbed CE 3.0 and applies to reason code 10.4 (card-not-present fraud).

WHAT IS COMPELLING EVIDENCE?

Compelling evidence is documents that prove a transaction is valid or otherwise contradict the cardholder’s claim.

“Compelling” is a somewhat subjective term, and relevance depends on the reason for the dispute.

For example, if a cardholder claims your merchandise is counterfeit, you’d need evidence that proves the item is genuine. However, certifying the authenticity of your merchandise is irrelevant if the cardholder claims it was never received.

When it comes to fraud claims, your compelling evidence needs to prove the transaction was authorized.

The update came about because of a painful reality: friendly fraud is an ever-present concern that is getting more and more difficult to manage.

In 2021, 77.5% of Visa disputes were classified as 10.4, making it the most commonly used reason code out of the dozens of available options. It also, unfortunately, has a lower-than-average win rate.

To address this inconsistency, Visa launched CE 3.0.

What is Visa’s CE 3.0 Initiative?

Verifying fraud claims and determining liability is a tricky balancing act.

No one wants to mistakenly assign liability to a cardholder if the transaction really was unauthorized. But, merchants are unfairly losing money when cardholders make false fraud claims.

So what is a risk-free way to decide whether or not a transaction was authorized?

CE 3.0 revolves around a simple but effective assumption: if a cardholder has made other purchases with your business and those purchases weren’t disputed, the current dispute isn’t actually fraud.

The initiative builds upon that idea to do two things:

1. It redefines how to link a new dispute with previously undisputed transactions. This enhanced strategy improves the odds of successfully refuting invalid fraud claims.

2. It introduces a new way to stop chargebacks from happening — guaranteed. We’ll discuss this new option in greater detail later in the article.

Old vs. New: What Has Changed?

Challenging fraud claims is not a new process. For decades, merchants have had the right to fight invalid chargebacks. CE 3.0 simply enhances existing capabilities with the hopes of improving outcomes.

The following is a high-level overview of what the current rules are and how requirements will change.

Legacy rule until April 2023 | New rule after April 2023 | |

| Required number of previously undisputed transactions | 1 | 2 |

| Required evidence | All of the following: • IP address • Email address • Physical address • Telephone number | At least two of the following: • Customer account or login ID • Delivery address • Device ID or device fingerprint • IP address |

| Additional stipulations | None | One of the two data elements must be either the IP address or the device ID/fingerprint. The same two data elements have to match for all three transactions (the two previous and the currently disputed transaction). All transactions must be processed with the same payment method (PAN). |

| Time limits | There are no date requirements for previously undisputed transactions. | Previously undisputed transactions must be processed at least 120 days prior to the disputed transaction but not more than 365. |

| Usage | Evidence is only sent after the chargeback (in the dispute response) | Evidence can be sent before the chargeback (through Order Insight) or after the chargeback (in the dispute response) |

WHY IS THERE A 120-DAY WAITING PERIOD?

Current compelling evidence rules have a loophole that cardholders are exploiting.

When issuing banks present cardholders with evidence of a previously undisputed transaction, cardholders simply say, “Yeah, that was fraud too and also needs to be disputed.”

Therefore, the ‘evidence’ that is used to challenge the most recent dispute is no longer compelling — and the merchant’s attempt to overturn the chargeback isn’t successful.

CE 3.0 adds the 120-day stipulation to prevent cardholders from easily dismissing a merchant’s argument.

Dispute reason code 10.4 has a 120 day time limit. If a transaction hasn’t been disputed within 120 days, it is no longer eligible for a chargeback. And if the cardholder hasn’t disputed a transaction within the given time limit, it does serve as evidence of friendly fraud.

How Does It Work?

This is how you can incorporate the new CE 3.0 rules into your workflows.

STEP 1

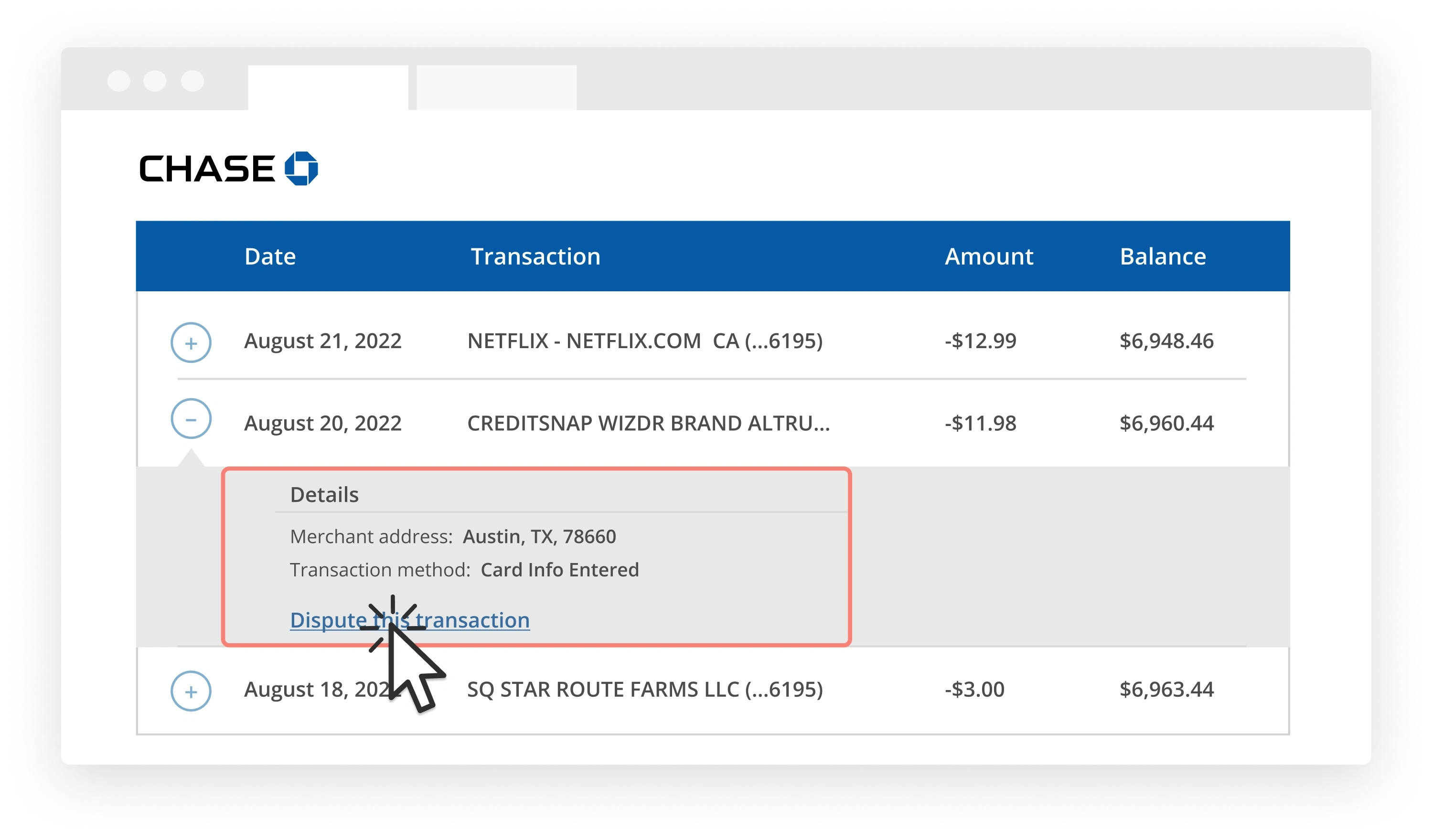

The cardholder claims a transaction was unauthorized.

STEP 2

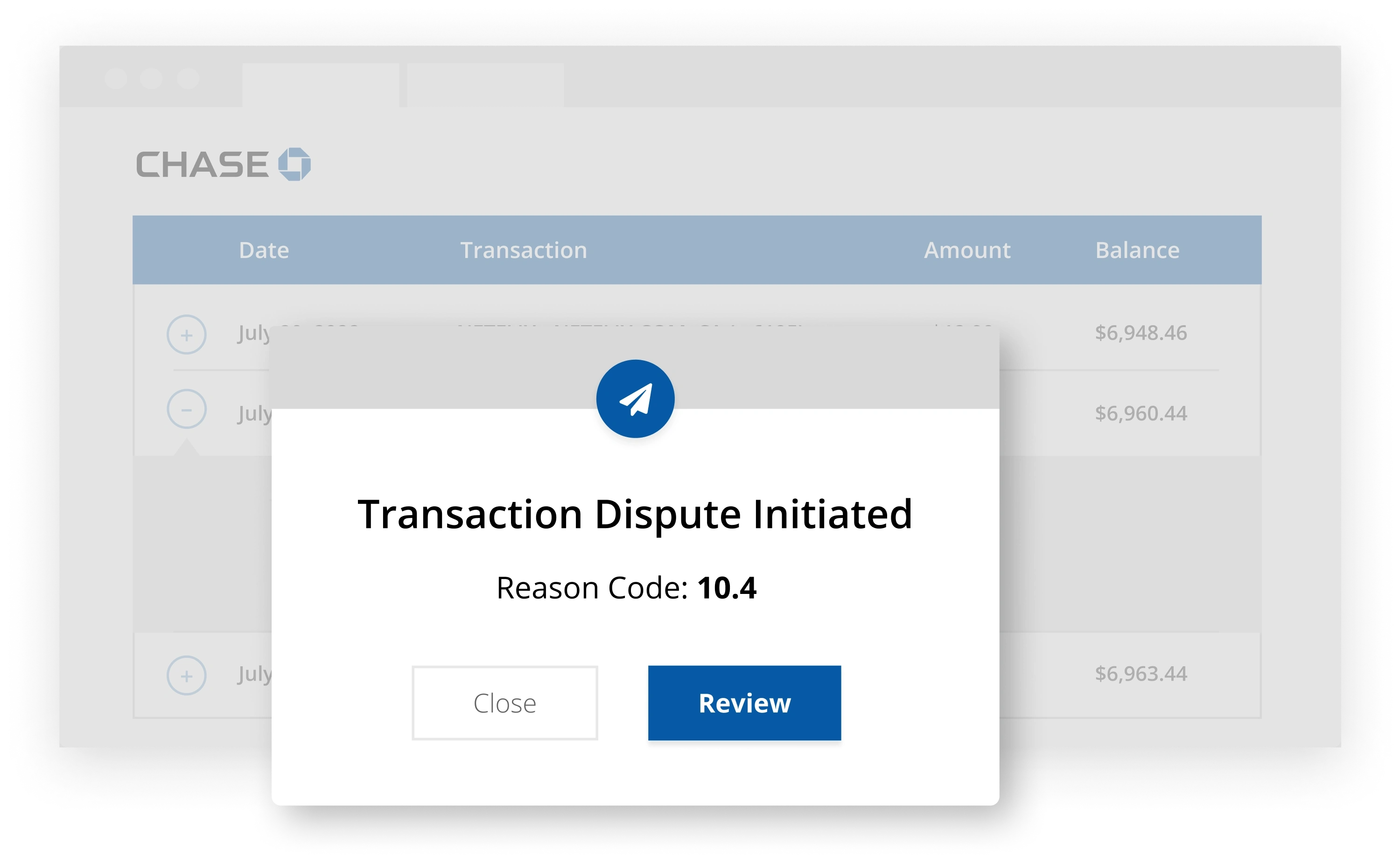

The bank initiates a dispute and classifies it as 10.4.

STEP 3

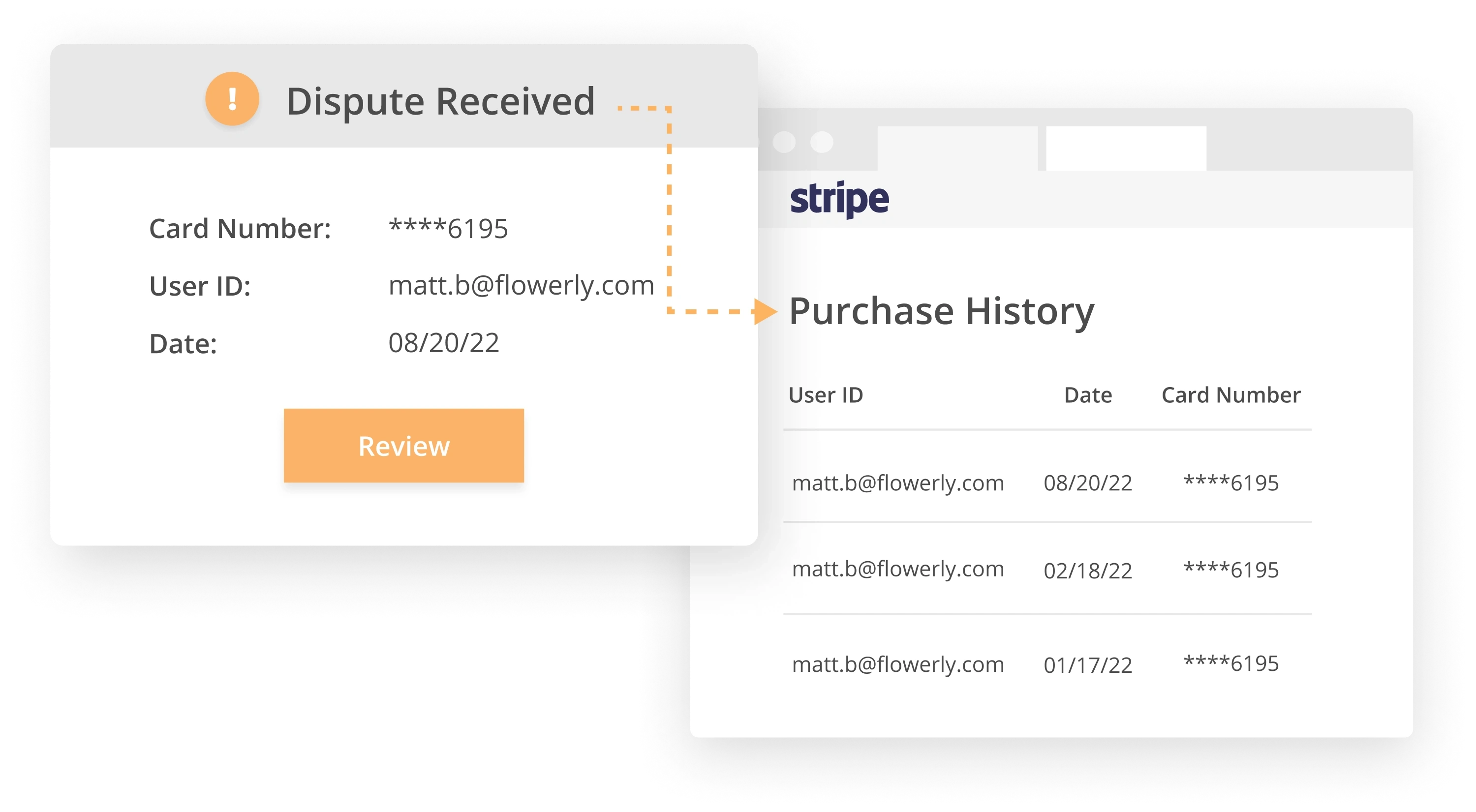

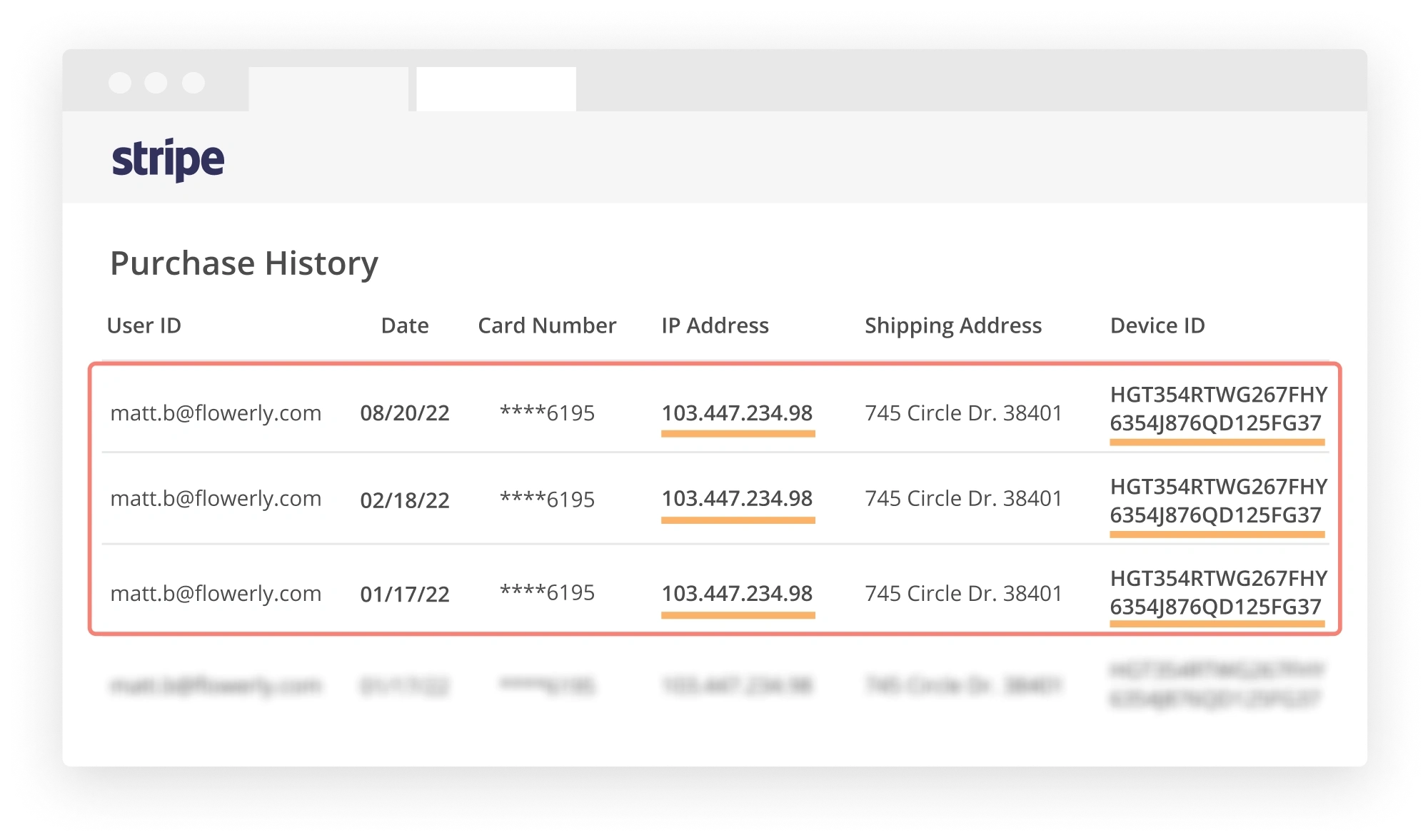

You receive the dispute and review the cardholder’s purchase history.

STEP 4

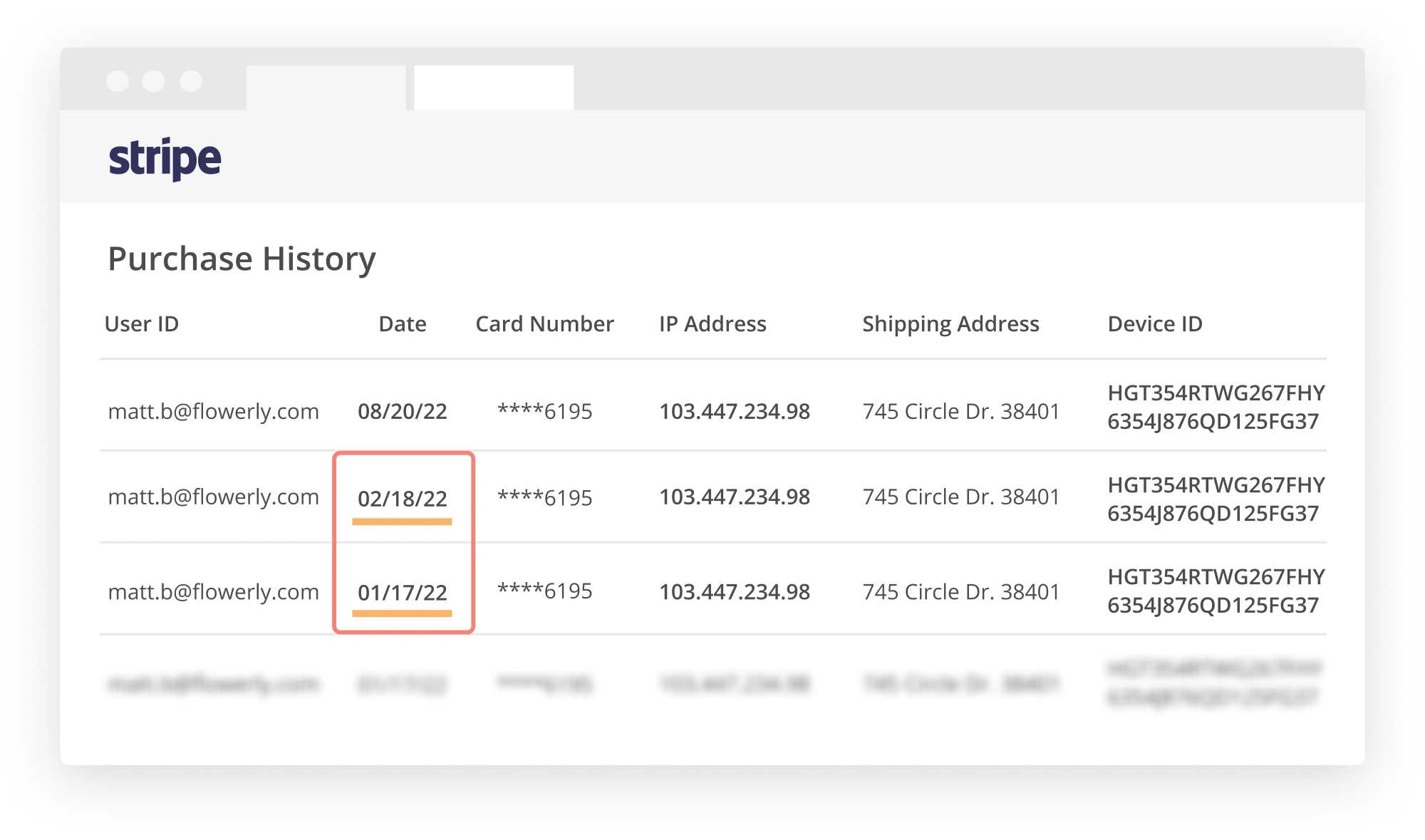

You locate two or more transactions that were processed at least 120 days prior (but not more than 365) and weren’t disputed.

STEP 5

You identify at least two data elements that are the same for all of the transactions (such as IP address and device ID/fingerprint).

STEP 6

You send the evidence to the cardholder’s bank.

STEP 7

The fraud claim is overturned and the case is closed.

The CE 3.0 initiative offers several potential benefits. However, navigating the new processes and complying with expectations could be challenging.

If you want the best results possible with the least hassle, let Kount help. Our intelligent technology increases efficiency, decreases costs, and protects more revenue. Sign up for a demo today to learn more.

Applying CE 3.0 Two Ways: Before and After the Chargeback

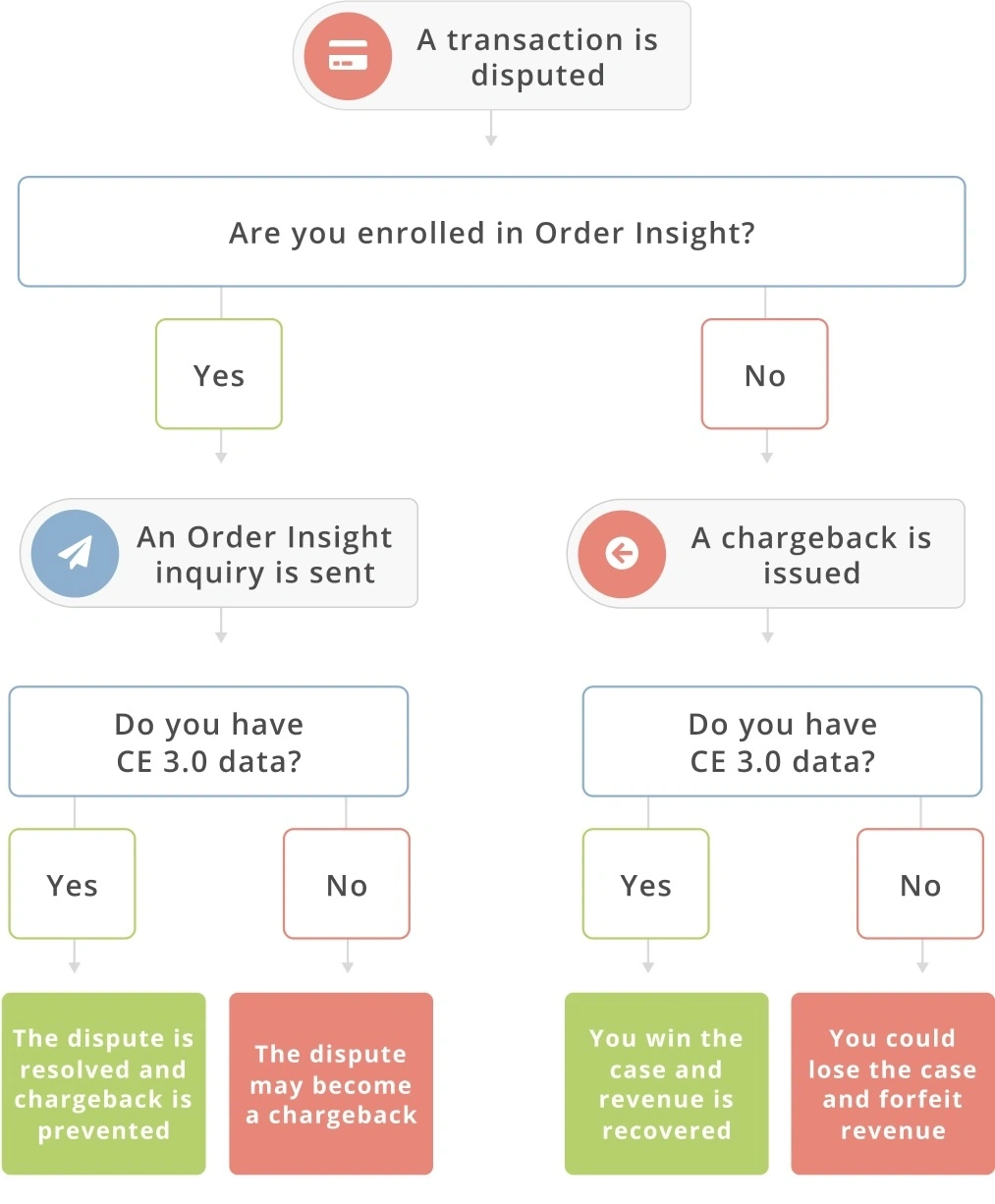

The CE 3.0 initiative does two things. First, it changes compelling evidence requirements. Second — and most significant — it introduces a new way to prevent chargebacks from happening.

You have always had the ability to fight invalid chargebacks if you have the appropriate compelling evidence. But now, Visa is also giving you the opportunity to share your compelling evidence before a chargeback is filed.

If you sign up for Order Insight — a process Verifi classifies as real-time, systematic dispute deflection — you can send CE 3.0 compelling evidence in your inquiry response. And if the data elements you send meet all the evidence requirements, a chargeback will be blocked. The issuer won’t be allowed to advance the cardholder’s fraud claim.

Here’s an overview of how to use CE 3.0 evidence before and after the chargeback.

| Before the Chargeback | After the Chargeback | |

| Method | Data is sent via Order Insight | Data is sent in a chargeback response |

| Goal | Prevent a chargeback from happening | Recover revenue that's been lost |

| Merchant responsibilities | Retrieve applicable CE 3.0 information and send it within the Order Insight response time limit (currently 2 seconds) | Identify the previously undisputed transactions and supply CE 3.0 information in the chargeback response |

| Available assistance | Visa will initiate Order Insight inquiries on 2-5 qualified historical transactions | None available at this time |

| Validated by | Visa | Visa |

| Benefits | • Liability for the 10.4 chargeback shifts to the issuer | • Liability for the 10.4 chargeback shifts to the issuer • Fraud ratio will not be impacted • Revenue is retained |

| Drawbacks | The Order Insight response time limit has not been extended, so more work has to be completed in the same amount of time. | The chargeback ratio is impacted. |

The two response options fit into the dispute lifecycle like this:

Granted, CE 3.0 data isn’t the only evidence you can send through Order Insight and a chargeback response. You can successfully resolve a dispute and fight a chargeback without CE 3.0. However, it greatly improves your chance of success.

NOTE: Being able to share CE 3.0 evidence before a chargeback happens is a really big deal.

Order validation (Order Insight and Mastercard’s Consumer Clarity) has always been an alluring concept with the potential for significant value. It is the only chargeback prevention tool on the market today that stops a chargeback without sacrificing revenue through a refund.

However, there was no guarantee that it would work. You could share the most compelling, insightful information in the world, but if the cardholder continued to dispute the transaction, a chargeback was inevitable.

Now, if you fully comply with CE 3.0 requirements and send the requested data in an Order Insight response, Visa guarantees the fraud claim will be denied. Unless the cardholder changes the reason for the dispute, the case should be closed.

If you receive a significant amount of chargebacks with reason code 10.4 and you haven’t already signed up for Order Validation, it’s time to reconsider.

Granted, the success of the initiative won’t fully be known until it has been implemented and there is data available for analysis. But the potential benefits indicate it is definitely worth a try.

If you’d like to learn more about Order Insight, sign up for a demo today.

How Could Visa CE 3.0 Impact Your Business?

Once the CE 3.0 initiative goes live, data will become available for analysis. Pros and cons will be backed by solid facts.

Until that time, any implications are speculative. However, our team of experts anticipates the following outcomes based on experience with similar initiatives.

Potential Benefits

New compelling evidence options will likely bring about several noteworthy benefits.

BENEFIT

Your chargeback ratio could decrease.

Chargebacks can cause a lot of damage.

- Card brands carefully monitor your chargeback-to-transaction ratio (the percent of transactions that turn into chargebacks). Penalties — including the loss of payment processing privileges — are doled out if your chargeback activity becomes excessive.

- Managing chargebacks is a time-consuming, labor-intensive process. And you have to scale your efforts as your business grows — which demands even more resources.

- Each chargeback you receive causes revenue loss. Lose enough and the business won’t be able to survive.

So it is important to make chargeback prevention a top priority. If you can stop chargebacks from happening, you can avoid the headache that comes with them.

There are dozens of different approaches to reducing chargebacks. One of the many is using order validation. And now, thanks to CE 3.0, the technique will become even more effective.

Adding CE 3.0-compliant data elements to your Order Insight response guarantees the dispute won’t become a chargeback.

BENEFIT

Your fraud ratio could decrease.

Just like your chargeback ratio, card brands also monitor your fraud ratio (the percent of transactions that are classified as unauthorized). So also keeping that KPI in check is important — and Visa’s new update can help.

If you share CE 3.0 data elements and the dispute is successfully overturned, the count against your fraud ratio will be reversed.

BENEFIT

Your win rate could increase.

Fighting chargebacks is a very subjective process. Even if you provide all the evidence needed to disprove the claims that have been made, a cardholder can continue to dispute the transactions.

But if you validate the transaction with CE 3.0, the cardholder is not allowed to continue the fight. Visa will block the dispute from continuing to the next phase of the chargeback process.

Potential Drawbacks

Despite the abundance of benefits, CE 3.0 does have some drawbacks.

DRAWBACK

The process of fighting chargebacks could become more time consuming.

The more evidence you provide, the greater the chance of winning a chargeback response. However, collecting data takes time.

Before, reason code 10.4 required proof of just one previously undisputed transaction processed at any time. Now, you’ll have to locate two transactions and make sure both are at least 120 days old but not more than 365.

The extra requirements could take extra time.

How to overcome this challenge

The best way to overcome this challenge is to use chargeback technology — such as Kount’s technology, Midigator.

With automation and simplified workflows, clients reduce the amount time spent fighting chargebacks by an average of 84%. If you’ve never considered intelligent chargeback technology before, now is the perfect time. Sign up for a demo today.

DRAWBACK

You need technology platform to use Order Insight.

Adding CE 3.0 data elements to Order Insight responses has the potential to significantly reduce your chargeback count. But to use Order Insight, you need technology.

Order Insight responses have to be sent within two seconds of receiving the request. So you’ll need the help of technology to make that happen.

How to overcome this challenge

Fortunately, this is an easy challenge to overcome. Kount offers Order Insight as part of our complete trust and safety strategy. We have everything you need to prevent, fight, automate, and analyze chargebacks. So you can take advantage of CE 3.0 options both before and after the chargeback.

Sign up for a demo to learn more.

DRAWBACK

The impact may not be as significant for you as it is for other merchants.

The overall concept of CE 3.0 is very encouraging. Addressing friendly fraud should be a top priority for everyone involved.

However, results will vary on a merchant by merchant basis. And for some businesses, outcomes might not be as dramatic as they are for others.

CE 3.0 guidelines stipulate that at least one of the two data elements must be the IP address or the device ID/fingerprint. If your sales are primarily generated from mobile commerce, IP address might not be a consistent data element. As shoppers are out and about, their IP address will change.

Similarly, merchants that sell digital goods probably won’t be able to use delivery address as one of the data element options.

How to overcome this challenge

There are a couple ways to address these shortcomings.

First, make sure you are collecting all the CE 3.0 data elements. Don’t rely on just a couple. That way, if one element doesn’t match across the three transactions, you have others to consider.

Second, don’t forget about other compelling evidence options.

CE 3.0 is just one of dozens of ways to disprove friendly fraud. Outside of CE 3.0, address verification service (AVS) and card security code responses are the most compelling options. If you can’t verify transactions with CE 3.0, consider adding AVS and CVV to your checkout process.

How to Prepare for the Compelling Evidence Update

CE 3.0 has the potential to have a significant impact on the chargeback lifecycle and your bottom line. How can you prepare for the update so you’ll experience all the available benefits?

Make sure you are collecting all the data elements.

The Visa CE 3.0 rule change will go into effect April 15, 2023. So there are still a few months before you can start benefiting from the new initiative. However if you want the perks to begin the moment the process goes live, you need to start preparing now.

In order for a previous transaction to be considered as evidence, it must be filed at least 120 days prior to the disputed transaction. If you wait until the rules go into effect to make changes to your data collection processes, it will be another 120 days before CE 3.0 will be relevant for your business.

So start today.

Try to collect all of the applicable data elements for every transaction you process. You only need two data points to be consistent across the three transactions. But the more data you have, the more chances of getting a match.

- Customer account or login ID

- Delivery address

- Device ID or device fingerprint

- IP address

Make sure the data can be incorporated into your chargeback responses.

It should be easy to incorporate the new data elements into your chargeback responses — whether you are fighting yourself or you use a service provider.

However, not all chargeback processing companies are agile enough to make necessary updates. And some aren’t knowledgeable enough to understand requirements and implications.

If you think your current service provider won’t be able to incorporate the CE 3.0 data elements, it may be time to make a change.

Kount's technology, Midigator is intelligent chargeback management capable of evolving with industry updates — including CE 3.0 — so merchants always have the very best results.

Sign up for Order Insight.

Adding CE 3.0 information to your chargeback responses will improve your win rate. But sending it with Order Insight responses can stop chargebacks from happening in the first place.

If you don’t already use Order Insight, you might want to consider incorporating it into your chargeback prevention strategy. And if you complete the integration process now, you’ll be ready when CE 3.0 goes live.

Sign up for a demo today and one of our chargeback experts will walk you through the pros and cons of using Order Insight.

FAQs about CE 3.0

The new Visa updates have already sparked several conversations about what’s in store for the future. The following are some of the questions that have been asked.

If you have a question that hasn’t been answered here, feel free to reach out to our team of experts. We’re happy to help in any way we can.

Will the chargeback really be blocked if I send CE 3.0 evidence through Order Insight?

Yes!

According to Visa resources, a benefit of sending CE 3.0 data through Order Insight is a “liability shift” from the merchant to the cardholder’s bank (issuer). It also states that the evidence “prevents chargeback from being submitted”.

However, it’s important to note that cardholders sometimes change their stories. CE 3.0 offers protection against fraud. If the cardholder switches the reason for the dispute, then the case might advance despite your air-tight argument.

What if I don’t have any of the new evidence?

If you want to receive the benefits of the CE 3.0 initiative, you have to fully comply with the new requirements.

However, you don’t have to send CE 3.0 data elements. If you want, you can keep your existing processes just the way they are for both Order Insight and chargeback responses.

How do I handle IP address changes with mobile commerce?

CE 3.0 policy updates require at least two data elements to be consistent across all three transactions (the current dispute and the two previously undisputed transactions). One of the two data elements has to be either the IP address or the device ID/fingerprint.

If your customers don’t have a consistent IP address, you’ll need to meet the requirement with the device ID/fingerprint and one other piece of evidence.

Managing Industry Updates With Kount

Industry updates bring about both anticipated changes and unexpected surprises. Let Kount help minimize the impact that CE 3.0 has on your business.

Consider using Kount’s trust and safety technology to manage fraud and chargebacks. Whether you are trying to navigate the new compelling evidence requirements or simply survive day-to-day operations, Kount will achieve the best results possible with the least amount of effort and fewest costs.

Sign up for a demo of Kount to learn more. Don’t wait for CE 3.0 to take effect — be proactive and start reaping the rewards today.