How Kount Analytics Help Merchants Sell in More Countries with Less Risk

Selling products internationally is an enticing opportunity. After all, the more countries you sell in, the more customers you reach, and the more revenue you generate.

But there are other outcomes to consider too.

Another possibility is this: the more countries you sell in, the more risks you take, and the more chargebacks you receive.

These risks can be minimized though — if you have the right tools and insight.

The Story of How a Merchant Overcame Challenges to Optimize the Profitability of International Sales

This is the story of how a merchant used Midigator’s detailed analytics to detect country-specific risks, resolve issues at their source, prevent chargebacks, and increase the profitability of new markets.

THE SITUATION

Pete’s Pet Plaza* is an online pet store, offering everything from food to toys to bedding for a wide variety of animal species. Most merchandise is sold with a straight (one-time) sales method, but Pete’s Pet Plaza also offers recurring subscriptions for merchandise like dog and cat food.

For years, Pete’s Pet Plaza only sold to customers in the United States. But since local brand awareness was so significant, the company decided to build upon their stellar reputation and expand to international markets.

Pete decided to start the global expansion with three new markets: Australia, Canada, and the UK.

As expected, sales took off. International customers were just as pleased with Pete’s products as local customers had always been.

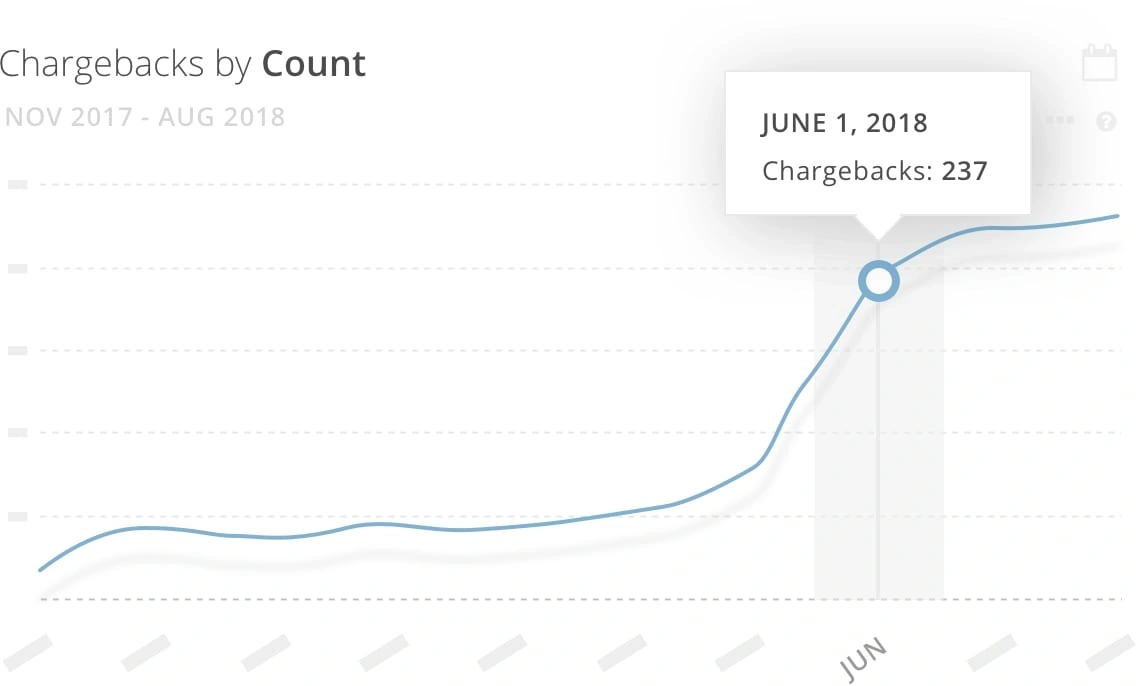

But a few months after going global, Pete’s Pet Plaza saw a significant increase in chargebacks.

Pete suspected the spike in chargebacks was somehow tied to the new markets — it couldn’t be a coincidence! But which markets were high risk? Would Pete be able to tell? Or should he go back to doing business locally and just forget about selling in other countries?

THE TAKEAWAY

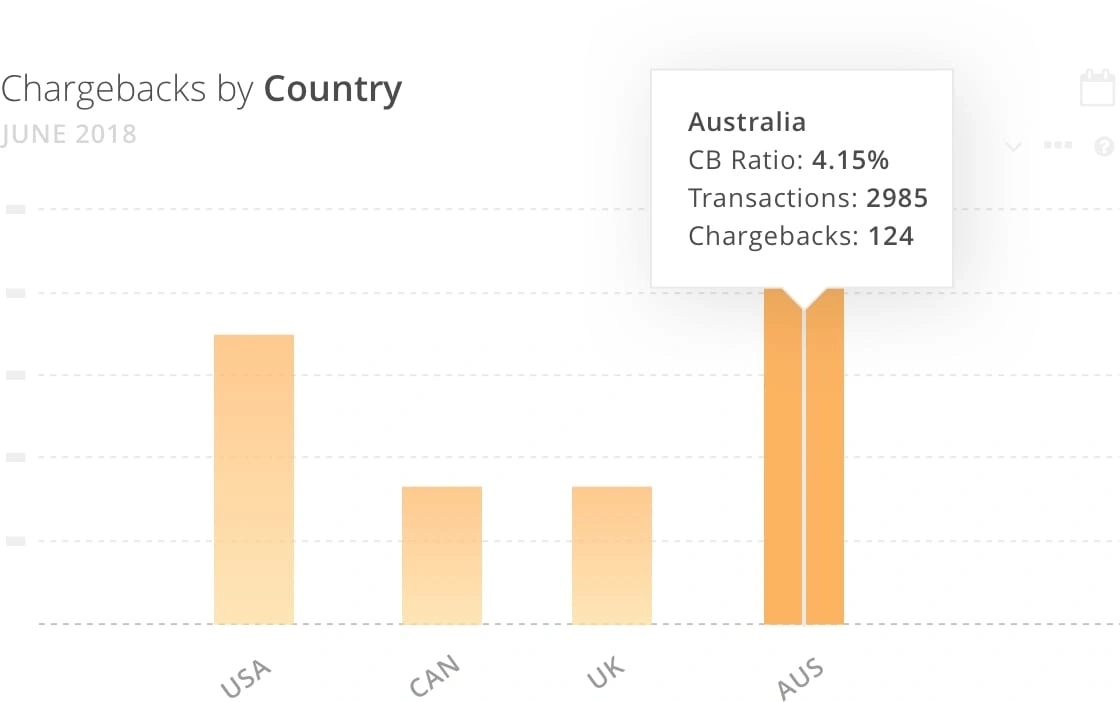

Pete turned to Midigator’s analytics for help. The Chargebacks by Country chart made it incredibly easy to see what was going on.

Of the four countries that Pete’s Pet Plaza sold in, one had a noticeably higher chargeback-to-transaction ratio: Australia.

Pete was relieved — only one of his new markets was high risk. But why? Why were so many Australian sales turning into chargebacks?

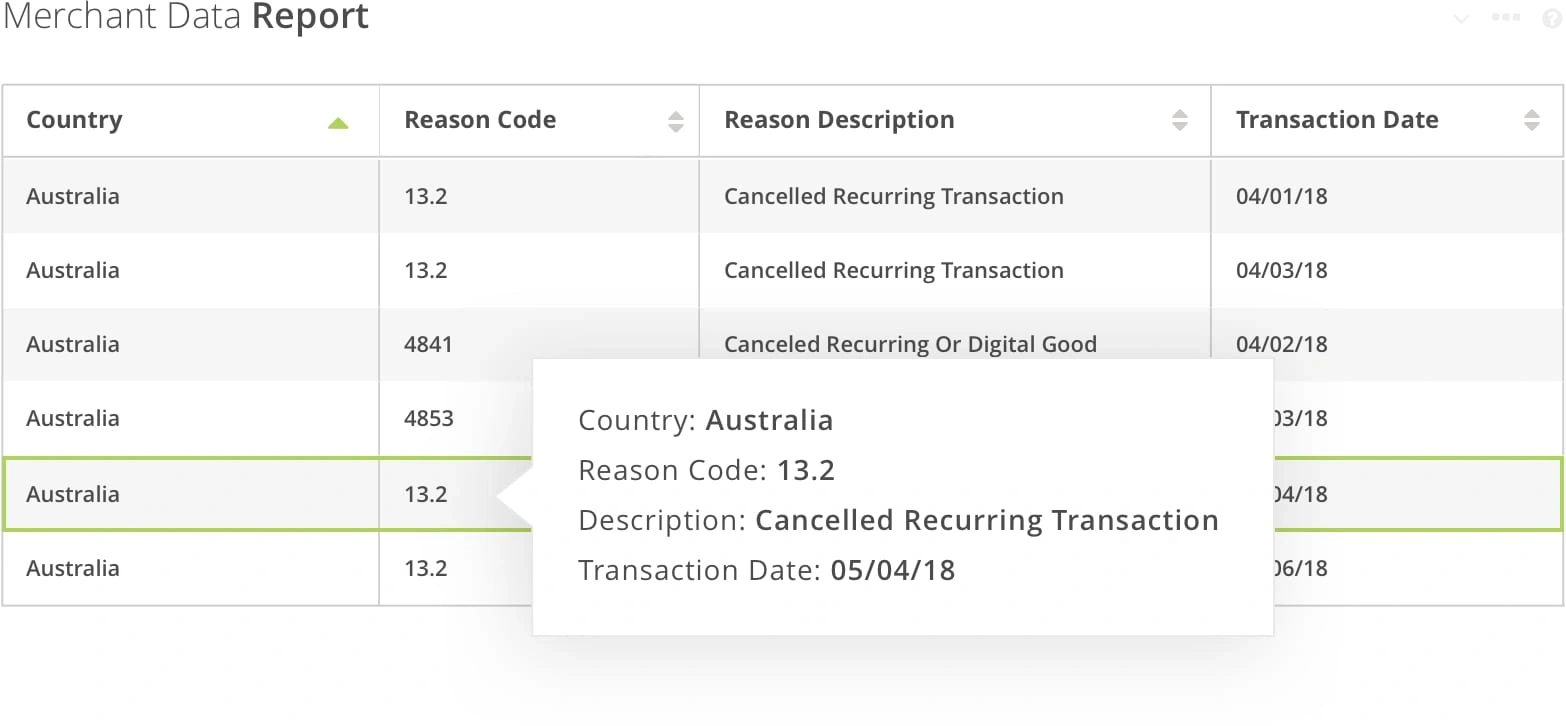

Next, Pete took a look at Midigator’s detailed reporting for the Australian chargebacks.

He discovered that the vast majority of chargebacks were associated with recurring transactions. The straight (one-time) sales had a much lower chargeback-to-transaction ratio.

The data suggested that customers in that region had an objection to the sales method being used, not necessarily the products or customer experience that Pete’s Pet Plaza offered.

To test this hypothesis, Pete removed all dog and cat food subscriptions from the Australian storefront and only used straight sale for those products.

THE OUTCOME

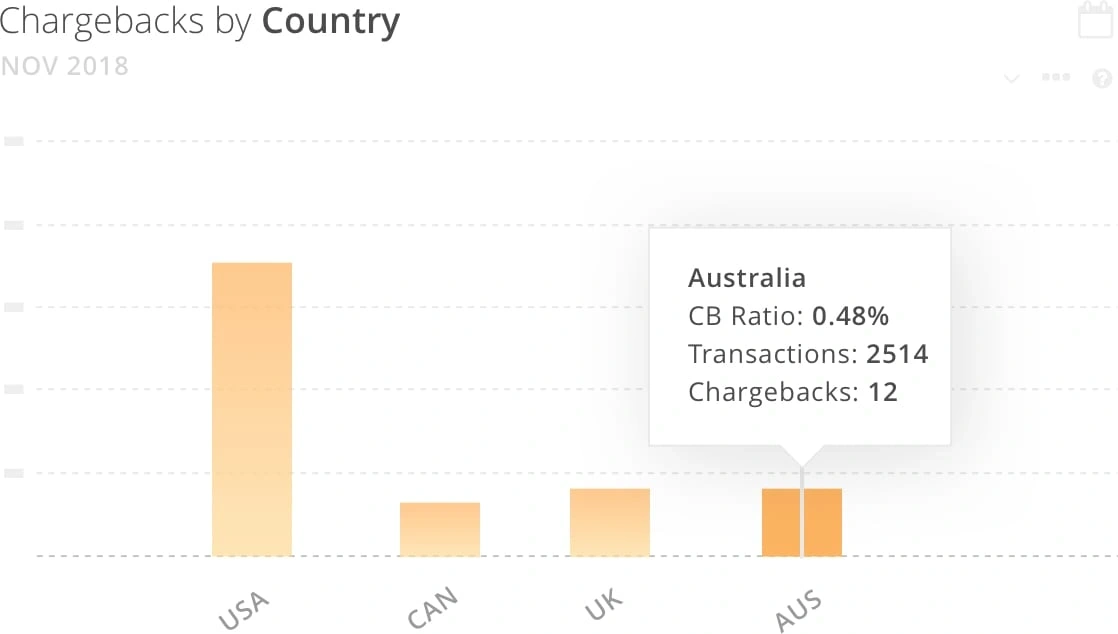

Within a few months, the company was experiencing the results they had expected from a global sales strategy.

Chargebacks decreased.

Customers unfamiliar with recurring billing were no longer surprised by unexpected charges to their account. Shoppers were happy with their one-time purchases, so the chargeback-to-transaction ratio for Australian sales dropped to an acceptable level.

Net revenue increased.

Selling in other countries led to more sales and an increase in gross revenue. Chargebacks also increased, but the influx was proportional since Pete’s Pet Plaza was able to keep risk in check with Midigator analytics. Therefore, net revenue increased as desired.

Pete realized that different regions have different preferences and expectations. Without insight about what does and doesn’t work in a particular country, risk can quickly outweigh reward. But with Midigator’s in-depth analytics and real-time data, Pete’s Pet Plaza was able to detect risks, solve problems at their source, and capitalize on the earning potential of a global sales strategy.

*Our client requested their actual name remain anonymous

Do You Want Access to Chargeback-Preventing Data Too?

At Midigator, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Midigator has helped Pete’s Pet Plaza and countless other businesses remove the complexity of payment disputes so they could get back to business.

If you would like a simplified approach to preventing chargebacks and stopping unnecessary revenue loss, Midigator can help you too. Sign up for a demo today.