Mastercard Excessive Chargeback Program

Mastercard’s Excessive Chargeback Program (ECP) is used as both a penalty for excessive chargebacks and a corrective effort to help manage chargebacks more effectively.

Acquirers must carefully monitor the risk that individual merchants pose to the Mastercard brand. If certain risk metrics exceed predetermined thresholds, acquirers must enroll merchants in the Excessive Chargeback Program and classify them as either a chargeback-monitored merchant or an excessive chargeback merchant.

How Does Mastercard Measure Risk?

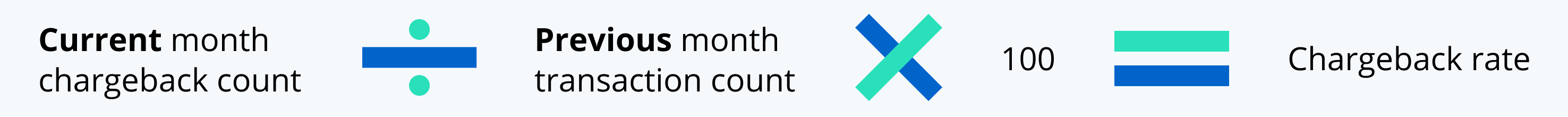

Mastercard uses two benchmarks to evaluate risk: number of chargebacks and the chargeback rate.

Merchants who breach both of these thresholds are enrolled in the Excessive Chargeback Program.

Chargeback-Monitored Merchant

Classification as a chargeback-monitored merchant is essentially a warning. The merchant is on pace to breach thresholds and has chargeback metrics that are considered “excessive”.

A chargeback-monitored merchant receives 100 or more chargebacks in a calendar month and has a chargeback-to-transaction ratio of 1% or above.

Mastercard does not assess fees to CMMs.

Chargeback-monitored merchants exit the program when their monthly count and ratio remain below the thresholds for two consecutive months.

Excessive Chargeback Merchant

An excessive chargeback merchant receives 100 or more chargebacks each month and has a chargeback-to-transaction ratio of 1.5% or above for two consecutive months.

Mastercard assesses fees to ECMs, and the merchant must create an action plan to reduce their risk exposure.

Excessive chargeback merchants exit the program when their chargeback-to-transaction ratio is below 1.5% for two consecutive months.

The ECM timeline is broken up into two tiers. Penalties and fees depend on how long the merchant remains in the program. Length of time is both consecutive and non-consecutive months.

- Tier 1: Months 1 – 6

- Tier 2: Months 7 – 12

The acquirer’s liability increases significantly when the merchant advances to tier 2, incurring more responsibilities, costs, and penalties. Acquirers are considered non-compliant if they continue to provide payment processing privileges to a merchant who has been an ECM for more than 12 months.

In reality, the acquirer will likely be interested in severing ties much sooner than the 12-month deadline.

RELATED READING

Mastercard Chargeback Monitoring Program: How to Manage Enrollment

Mastercard Chargeback & Dispute Resolution Guide