AUTHORISATION OPTIMISATION WITH KOUNT

How authorisation optimisation works

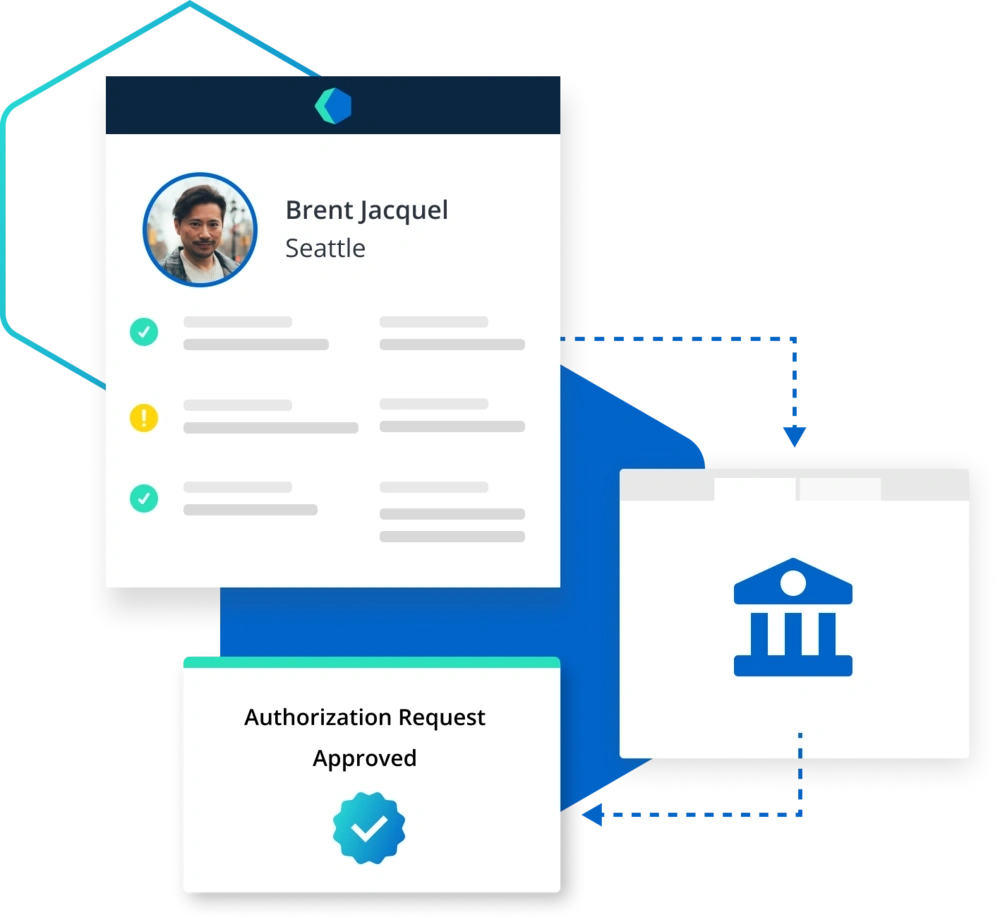

We provide the data. You build that data into your authorisation process. Together, more orders are approved.

An authorisation request is sent to the issuing bank.

When the authorisation request is received, the issuing bank consults Kount’s database — which provides additional details about the transaction.

A decision is made.

The issuing bank makes a final decision to approve or decline the payment. With greater insights, the bank can approve more transactions with less risk.

Approval rates increase.

The more transaction details issuing banks have, the more informed their decisions are. In turn, more orders get approved and fewer false positives happen.

WHY AUTHORISATION OPTIMISATION MATTERS

Benefits you can’t afford to miss

Does your current authorisation process only check for the basics like an expired card and the account balance? See what happens if you just meet the bare minimum for payment processing.

WITHOUT optimisation

- Make hunches and guesses

- Decline legitimate customers

- Risk fraudulent transactions

- Frustrate good customers

- Needlessly sacrifice revenue

WITH optimisation

- Trust data-driven decisions

- Increase authorisation rates

- Safely decrease chargeback rates

- Improve customer satisfaction

- Boost your bottom line

WHAT MAKES KOUNT SPECIAL

Added value achieves better results

Why choose Kount to improve authorisation rates? Here’s what sets us apart.

Merchant network

Thousands of merchants use Kount to manage risks associated with digital payments. A large network means stronger data and more accurate risk assessments.

Issuer relationships

As part of the Equifax family, Kount has an established connection with dozens of notable issuing banks — which makes better authorisations easier to achieve.

Real-time data

Kount’s data works in real time, so accurate decisions are made within milliseconds. You won’t experience delays that can harm the authorisation process.

Robust technology

Kount technology uses multiple machine learning models to filter and interpret data — thus providing the most accurate results possible.

TESTIMONIALS

What our clients are saying

Talk to an Expert

GET STARTED TODAY

Increase approval rates with authorisation optimisation

Thousands of companies from all over the world use Kount for trust and safety. Will you be next? Sign up for a demo today, and see what it’s like to have confidence in every interaction.