CASE STUDY

How SmartTalk Uses Kount to Reduce Fraud and Chargebacks

SmartTalk Mobile* is a multinational telecommunications company that offers phone and internet services. A key component to the company’s success is delivering superior customer experiences through their products and customer service.

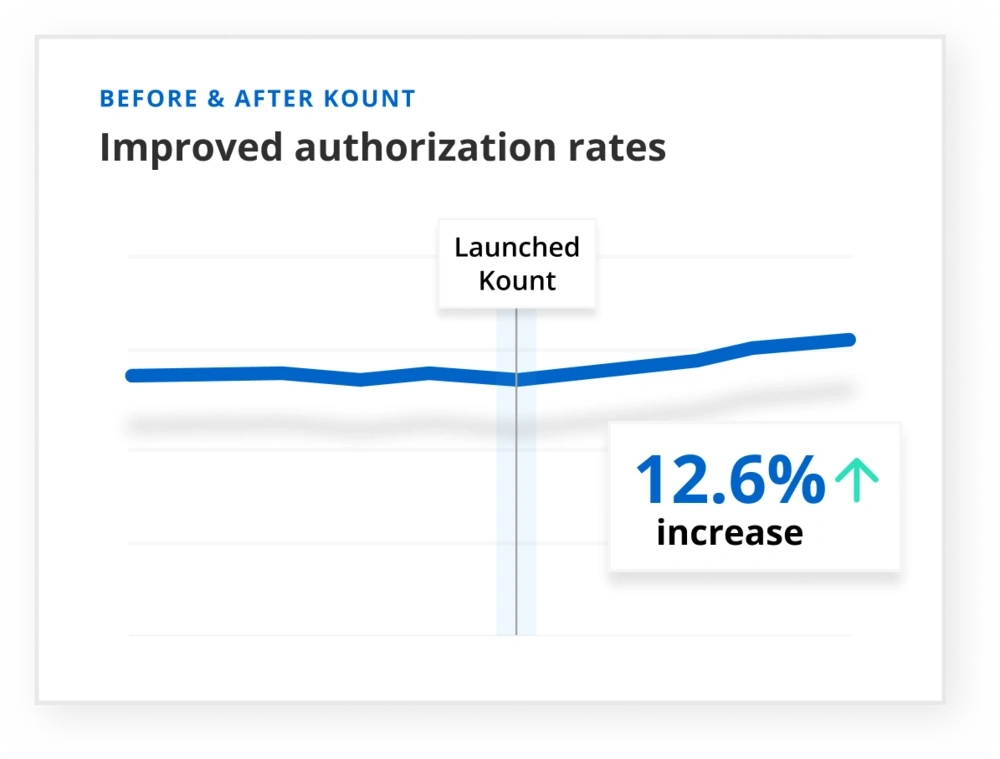

12.6%

increase in authorization approval rate since 2019

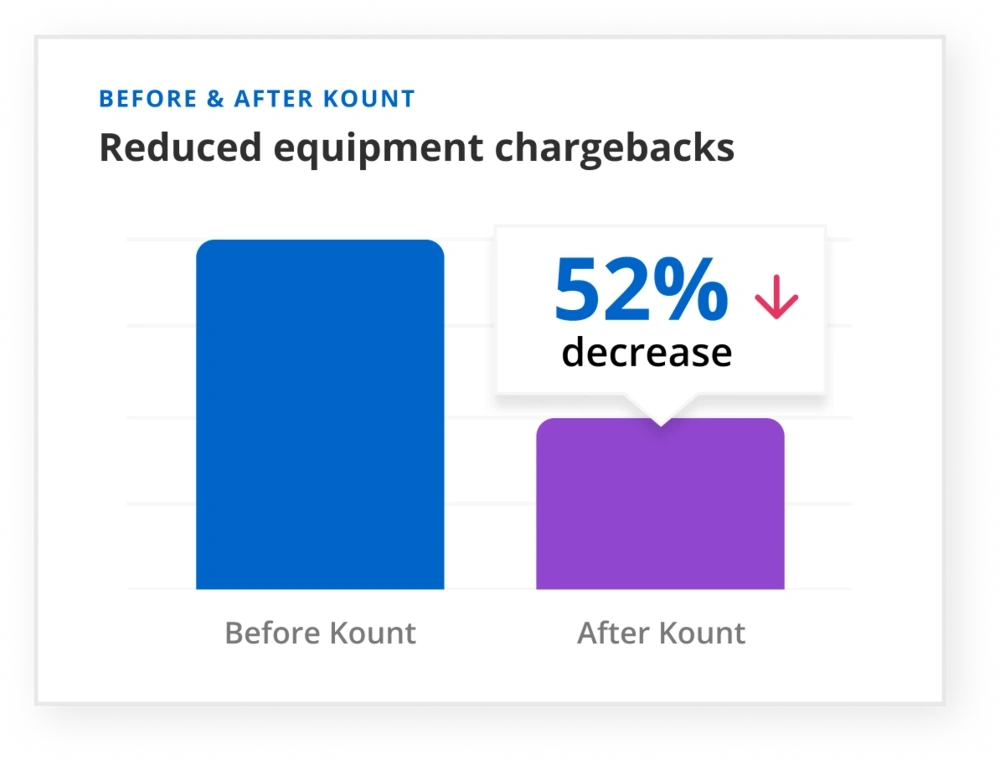

52%

decrease in equipment chargebacks since 2020

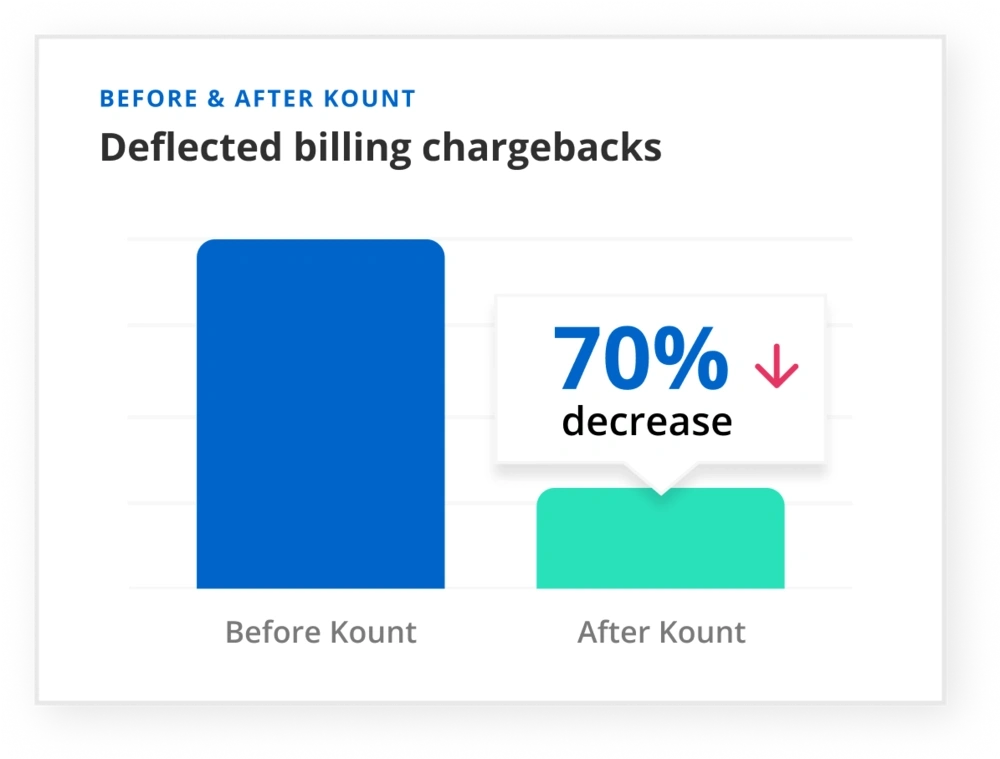

70%

deflected bill pay chargebacks since 2023

THE PROBLEM

Lack of data. Segmented teams. Inefficient risk management.

Before Kount, SmartTalk was managing fraud with numerous tools and a variety of processes. Multiple teams handled different aspects of fraud and payments. While one team wanted to focus on reducing fraud, the other focused on increasing approval rates.

However, they didn’t have a universal source of high-quality data to work from. So each team’s goals would often compete with one another. And they didn’t know how to work together to solve fraud problems when they arose.

Eventually, SmartTalk recognized the need to close the gap between their teams with a solution that could streamline fraud processes and data reporting. That’s when they started looking at Kount.

“If you don't have a good source of data you will never find the root cause and might be focusing on the wrong issues.”

— Associate Director, Payment Fraud & Automation, SmartTalk

THE SOLUTION

Seamless integration. Smarter workflow.

The main criteria SmartTalk was looking for in a fraud solution provider were:

- Easy implementation. SmartTalk wanted a solution that was easy for developers to install and could be running shortly after onboarding.

- Simple workflow. With a company as large as SmartTalk, the fraud teams needed a solution that could easily work with their existing processes.

- High-quality data. SmartTalk often had difficulty finding the root of their fraud problems. So they specifically wanted to work with a provider that had a robust data network.

Kount was the only provider that could meet these needs exactly — and offer integration with Ethoca's chargeback prevention tool.

Ethoca Alerts connect merchants with issuers to share fraud and dispute data. This allows merchants like SmartTalk to receive notifications of disputed transactions in near real time, allowing them to stop the fulfillment of fraudulent orders and prevent the need for a chargeback altogether.

Once the solution was implemented, SmartTalk set up automated workflows to manage both fraud and chargebacks.

“Kount’s flexibility has made a big difference. Having the ability to easily enable and disable third parties has allowed us to try stuff out over the years and hone in on what works best for our business. There are not a lot of solutions that can provide that level of flexibility.”

— Associate Director, Payment Fraud & Automation, SmartTalk

THE RESULTS

Automated processes pave the way for less fraud, more wins.

With the help of Kount and Ethoca, SmartTalk has found huge success in four key areas.

Fraud prevention

Kount’s fraud prevention capabilities have significantly reduced the company’s risk of unauthorized transactions. By leveraging Kount’s extensive data network and consolidating multiple solutions into one end-to-end strategy, SmartTalk is able to detect fraud attacks that would otherwise go undetected.

For example, a single Ethoca Alert led to the discovery of 307 additional fraud orders and 86 impacted customer accounts. By cross referencing data elements from the Ethoca alert with Kount’s global database, SmartTalk was able to proactively identify the attempted fraud and stop any additional losses.

Chargeback reduction

SmartTalk leverages the unique ability of Kount + Ethoca to prevent chargebacks both pre- and post-authorization to create the most complete protection possible. And, because Kount’s solutions are flexible and customizable, the company is able to reduce risk for all their product offerings — equipment purchases and service billing.

To date, SmartTalk has experienced a 52% decrease in equipment chargebacks and a 70% deflection on bill pay chargebacks.

Merchandise recovery

Ethoca Alerts enable SmartTalk to identify issues within seconds of a cardholder dispute rather than waiting 2-5 weeks for a chargeback notice. With advance warning, SmartTalk is able to stop fulfillment on fraudulent orders or recall shipments before the merchandise reaches fraudsters.

Authorization rate improvement

Better fraud management keeps SmartTalk’s fraud rates low and steady — which helps improve how issuers assess transaction approval requests. Since 2019, SmartTalk has increased their authorization approval rate 12.6%. Approving more orders means more business, more revenue.

With less time and energy spent on fraud chargebacks, the company can focus on strategizing for growth and finding new ways to improve customer experiences.

“The reporting makes it a lot easier to monitor and find correlated fraud. We're able to share those reports with other systems, which impacts multiple teams. Overall, it cuts out the busy work and lets us focus on the more meaningful work.”

— Associate Director, Payment Fraud & Automation, SmartTalk

“The partnership we have with Kount is incredibly valuable. The ease of implementation, the support we get, the data, and the flexibility of the technology make Kount an integral part of our fraud strategy.”

— Associate Director, Payment Fraud & Automation, SmartTalk

GET STARTED TODAY

Looking for a way to get results like SmartTalk?

Your business is important. And it’s worth protecting. Let us show you how.

Related case studies

* Not Company's real name. Our Customer has asked that their name be anonymous.