Help! I Breached the Chargeback Thresholds! Now What?!

Preventing chargebacks is a difficult job, and sometimes, your efforts might not be as successful as you'd like them to be. It's not uncommon for merchants to exceed the chargeback thresholds set by the card networks.

If you've gone over the chargeback limits for debit or credit card transactions, there are seven things you'll want to do.

STEP #1

Understand what “breaching thresholds” means.

There are two chargeback benchmarks: chargeback count and chargeback-to-transaction ratio.

The card networks (Visa, Mastercard, etc.) use a formula to calculate chargeback rates. Rates are calculated by dividing the total number of transactions by the total number of chargebacks. However, there are slight brand-specific adjustments to the calculations.

Visa compares the number of chargebacks received in the current month to the number of transactions processed in the current month.

Here’s an example of a Visa chargeback ratio:

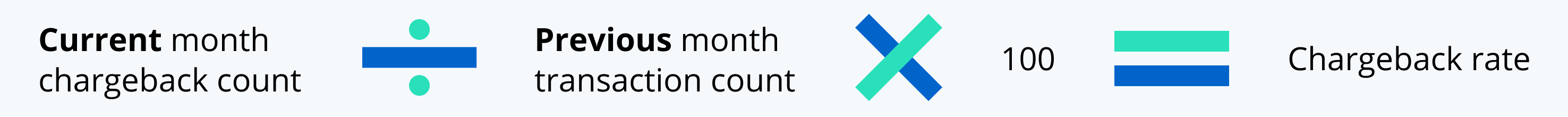

But Mastercard compares the current month’s chargeback count to the previous month’s transaction count.

So it looks like this:

NOTE: Ratios are calculated on brand-specific activity. The Visa ratio only includes Visa chargebacks and transactions. And the Mastercard ratio only includes Mastercard chargebacks and transactions. You might be interested in a combined ratio. But your payment processors and the card brands typically only pay attention to brand-specific metrics.

The card networks have set thresholds for both of these benchmarks and monitor them on a month-by-month basis. There are a few exceptions to the rule, but the chargeback thresholds for most merchants are:

Image  Mastercard chargeback thresholds | Image  Visa chargeback thresholds | |

| Chargeback count | Less than 100 each month | Less than 100 each month |

| Chargeback ratio | Less than 1% for the month | Less than 0.9% for the month |

If you go over both of these limits there will be consequences. Those consequences are managed with network-specific chargeback programs.

If you’ve been enrolled in an excessive chargebacks program, you’ll want to carefully review the regulations and understand how you’ll be impacted.

STEP #2

Accept the fact that there will be a lot of unknowns.

Unfortunately, if you’ve breached the card networks’ chargeback thresholds, there is no hard and fast rule on what comes next.

The reason for all the unknown is because the card networks regulate and assign liability to the acquiring bank. The acquiring banks then choose how much liability they are willing to accept on their merchants’ behalf.

An acquirer’s reaction to a threshold breach could be lenient or strict — it all depends on the merchant in question. Your acquirer (via your processor) is entitled to handle your case however it chooses, but there are a few things you can do to encourage grace:

- Reduce your count and ratio quickly — and keep them below thresholds. There are lots of tools that help prevent chargebacks — like prevention alerts, order validation, and RDR.

- Try not to simultaneously breach other thresholds, like the fraud-to-transaction ratio (the percent of transactions that cardholders report as fraud).

- If your acquirer reaches out to discuss the issue, respond accurately and promptly.

STEP #3

Get ready to pay more in fees.

There are two repercussions for merchants who breach chargeback thresholds. The first is extra fees.

There are fees associated with the chargeback programs, but depending on your merchant category code (MCC), those fees might not begin until your fifth month in the program.

However, your acquirer (or processor) likely included additional fees in your merchant service agreement that will go into effect the moment you breach the chargeback thresholds. You may wake up one morning and discover thousands of dollars have been withdrawn from your merchant account.

STEP #4

Prepare yourself for potential account closure.

In addition to paying fees, there is another penalty for breaching chargeback thresholds — account closure.

If you remain in a chargeback program for more than 12 months, your acquirer is required to close your merchant account and terminate payment processing privileges.

However, the reality is, your acquirer will likely be interested in severing ties much sooner than the 12-month deadline.

Some merchants are given a chance to resolve their chargeback issues before they face closure, while other merchants are terminated the second thresholds are breached. Again, the response is subjective and varies by each acquirer or processor.

If your account is closed, you’ll want to do these things:

- Ask your processor if you were placed on the MATCH List. If so, ask for the specific reason (probably for being a high excessive chargeback merchant, but double check).

- Begin to look for a new payment processor. You’ll need a processor that offers high-risk accounts (even if your MCC is technically a low-risk category). Don’t waste your time reaching out to standard merchant account providers — they won’t be able to accept you.

- Don’t try to hide your MATCH List placement during the application process. Be honest and forthcoming with information.

- Find your processing statements for the last six months so you can share them when your prospective processor asks.

- Be patient. If you’ve lost a merchant account, your record is tarnished. Don’t expect immediate acceptance.

STEP #5

Figure out what caused you to breach the chargeback thresholds.

Try to determine what caused the spike in chargebacks.

The most likely cause is fraudulent transactions — fraudsters making purchases without the cardholder’s permission.

Unless you have a reporting platform with analytics — like Kount — this could be a challenging task. However, the more successful you are, the more leniency and assistance you will probably receive from your processor going forward. If you can pinpoint what went wrong, you’ll have a better chance of preventing it from happening again.

STEP #6

Create a plan to get chargebacks under control.

Once you know what caused the threshold breach — or suspect you know — put a plan in place to solve those underlying issues.

The goal is to save your merchant account and eliminate excessive fees as soon as possible. To do that, you need an immediate reduction in chargebacks.

Because you are essentially in a state of emergency after breaching thresholds, your initial actions might need to be extreme. There will be time for things like reducing customer friction, manual reviews, and costs later.

These tips in particular will get you the most significant and rapid results:

- Use Address Verification Service (AVS). If you are already, tighten your acceptance rules. Only accept complete matches.

- Ask for the card security code (CVV2) during checkout.

- Reach out to your fraud solution provider. See if you need to update your fraud rules. If you aren’t already working with a vendor, consider Kount. We have one-click integration options for most ecommerce platforms.

- Sign up for prevention alerts.

- Use order validation.

- Integrate with RDR (if you breached Visa’s thresholds).

- Make sure your billing descriptor (the short description that appears on the cardholder’s statement) is easy to understand and accurately explains what was purchased.

STEP #7

Implement your plan and monitor the results.

After you breach thresholds, the card network will ask you to create and submit a chargeback reduction plan as part of your enrollment in the chargeback program.

You’ll need to write out specifically what you plan to do to get your chargebacks under control — the strategies you decided on in step #6.

But you shouldn’t think of the plan as administrative busy work. You can’t write out a plan and then just file it away. You need to actually do what you said you would do!

After you put your plan into action, carefully monitor your results. Is it working?

If your plan doesn’t seem to be effective — if you remain in the chargeback program for several consecutive months — the card network or your acquirer may ask you to try new tactics.

If you’ve been monitoring your outcomes, you’ll have a better idea of what is and isn’t working. You’ll know which tactics you should keep and which should be replaced with something new.

Do You Need Help Managing Chargebacks?

Are you feeling overwhelmed? Think there are too many details to worry about? Let Kount help. Kount’s machine learning platform has end-to-end chargeback and fraud solutions.

Kount’s comprehensive technology has all the tools you need to reduce chargebacks and keep them low.

- Blacklist: Flag purchases made by customers who have previously charged back and cancel transactions that are likely to result in chargebacks.

- Order validation: Order validation enables you to resolve customer disputes by providing issuers with real-time transaction information to stop chargebacks from happening.

- Prevention Alerts and RDR: Both prevention alerts and RDR refund transaction disputes before they become chargebacks. Manage all cases from a single portal for the most complete protection possible.

- Reporting: Monitor counts for chargebacks or disputes in real time. Be notified the instant thresholds are in danger.

- Analytics: Determine why customers are charging back so you can solve problems at their source.

- Notifications: Enter the threshold you want to monitor and the technology will notify you when risk escalates.

If you’ve breached chargeback thresholds, or think you will, now is the time to act. Sign up for a demo of Kount today.