Authorization & Settlement: The Impact on Chargebacks

When it comes to payment processing, things such as transaction authorization and settlement may seem like administrative busywork. Your goal might be to just check these items off your to-do list.

But the reality is that authorization can have a significant impact on your bottom line. There should be thought and strategy put into this task. And that begins with a detailed understanding of how credit card authorization works and the role payment authorizations play in chargeback management.

The Authorization & Settlement Process

When a customer makes a purchase with a credit or debit card, two things need to happen in order for you — the merchant — to get paid: authorization and settlement.

AUTHORIZATION

Authorization is a conversation between you and the issuer (cardholder’s bank) to determine if the transaction should be approved or declined.

SETTLEMENT

Settlement is the process of moving money from the cardholder’s account to your account.

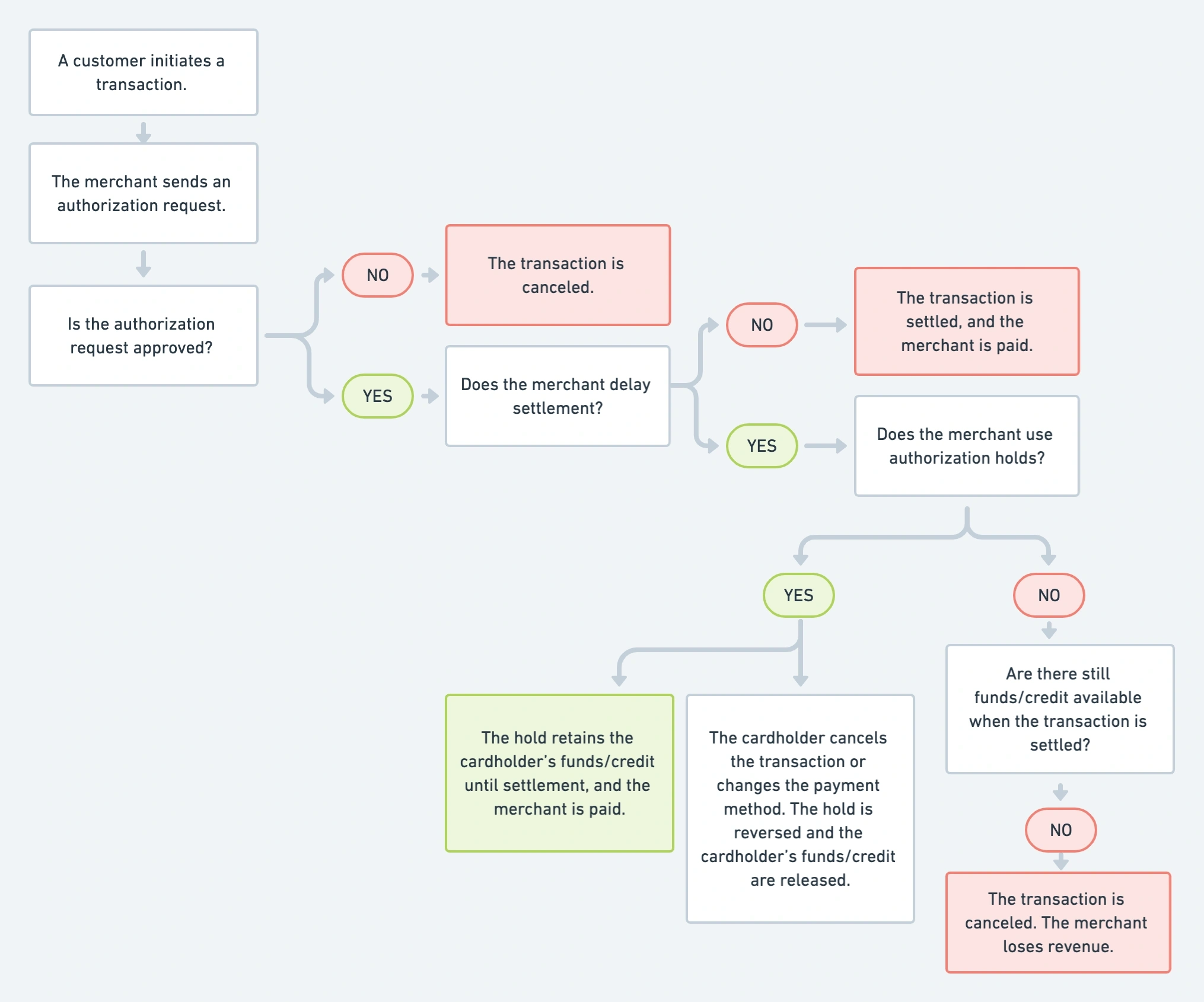

The two processes fit together like this:

- A customer uses a credit or debit card to make a purchase.

- You send an authorization request to the card issuer.

- The issuer sends you an authorization response.

- If the transaction is approved, you can attempt to settle it.

Authorization Request Responses

Every authorization request receives a response from the card network. Responses are shared as codes, which are usually either two digits (like 00) or a letter and number (like N4).

There are more than 50 different authorization response codes, and you can view the full list here.

Despite the fact that there are dozens of different response possibilities, there are really only two things the issuer suggests you do: either decline the transaction or approve it.

Declined Transactions

There are several reasons why the issuer would suggest you decline a transaction. Some examples include:

There isn’t enough money in the account (or available credit) to pay for the purchase.

The cardholder claims the card is lost or was stolen so the transaction is likely fraud.

The technology isn’t working as it should so the issuer is unable to provide a definitive response.

Important information was entered incorrectly or was omitted from the request.

Only transactions that receive an approved authorization response should be settled. If you receive any other response code, you’ll probably want to decline the transaction and ask for a different form of payment.

If you re-attempt to authorize the card within 12 hours of the first attempt, the transaction will be eligible for a declined authorization chargeback.

Approved Transactions

You will receive an approved authorization response if both of the following are true:

The cardholder has sufficient funds (or available credit) to pay for the purchase.

The card hasn’t been reported lost or stolen.

Settlement: Immediate vs. Delayed

After a transaction has been approved, it can advance to settlement.

Settlement timelines can vary. In some situations, transaction settlement will happen immediately after authorization. Other times, it will be delayed by hours, days, or weeks.

Here are some examples of different settlement strategies and the merchants who might use them:

- A grocery store settles a transaction immediately after it’s authorized since the shopper will be walking out the door with the purchased items.

- A restaurant authorizes a transaction as the customer dines but waits until after the tip is added to settle it.

- An ecommerce merchant authorizes a transaction during checkout, but it isn’t settled until the next day when merchandise availability is confirmed and items are shipped.

- A hotel authorizes a transaction when the customer makes a reservation and settles it a week later after the guest checks out.

IMPORTANT

An authorization response is a real-time reflection of the account’s status. It confirms that there is enough money available at that exact moment, but there might not be tonight, tomorrow, or next week when you try to settle the transaction.

If your business delays the settlement process, you run the risk of losing revenue — unless you use an authorization hold.

Incorporating Holds Into the Authorization Process

Many businesses that delay settlement incorporate authorization holds into the payment processing workflow.

RELATED READING

For a detailed explanation of authorization holds, check this article.

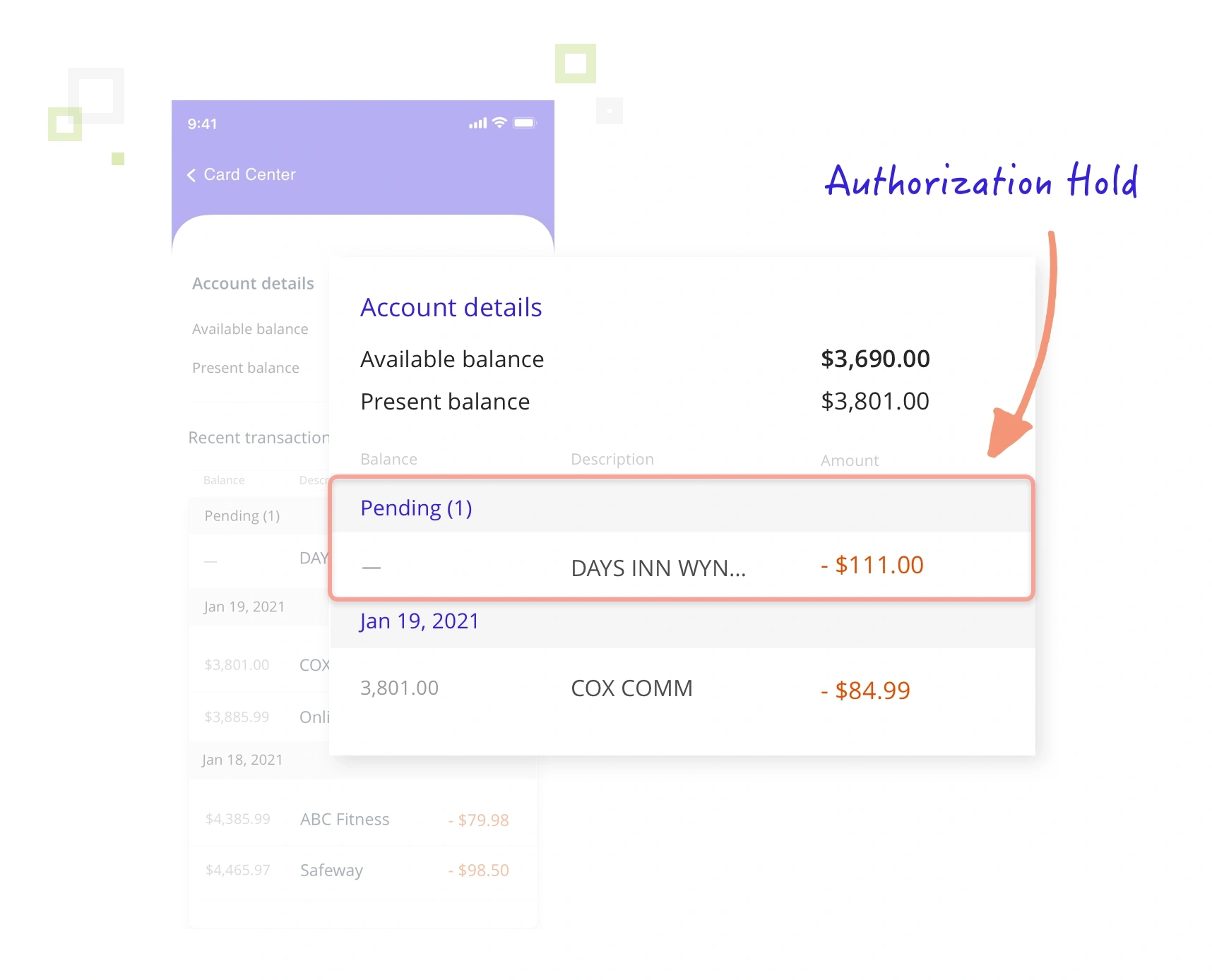

After you’ve authorized a transaction, you can put a hold on the cardholder’s account. The hold will freeze the authorized amount of money (or credit), preventing the cardholder from spending the allotted funds somewhere else. This ensures the money or credit is still available when you are ready to settle the transaction.

The complete payment process — incorporating authorization, an authorization hold, and settlement — looks like this.

7 Things to Know About Authorization & Chargebacks

The authorization process can have both a direct and indirect impact on your business’s chargeback situation.

1. Billing descriptors are important.

Billing descriptors describe payment card activity and help cardholders identify transactions on their bank statements.

Descriptors play a significant role in chargeback management. Among other things, descriptors help customers understand what they purchased. If they don’t recognize a transaction, they might suspect fraud.

It’s important to create unique, easily-identifiable descriptors, but that can be a difficult task. Billing descriptors are dynamic — they can change based on certain transaction variables such as:

- The card brand (Mastercard®, Visa®, etc.)

- The issuer (cardholder’s issuing bank)

- The type of card used (debit, credit, prepaid, etc.)

- The item purchased

- The stage of the transaction lifecycle (pending, settled, refunded, etc.)

It’s this last variable — the stage in the transaction lifestyle — that ties back to the authorization process.

Your billing descriptor may say one thing while the transaction is pending, but appear completely different after it has settled.

SUGGESTION

Run several test purchases with different cards so you can see how your descriptor changes. Test as many variables as you can, and note the different descriptor variations.

Don’t forget to review your billing descriptor at both the pending and settled stages.

If you have any descriptor variations that aren’t clear and easy to recognize, update them. Contact your payment processor to discuss editing options.

2. The authorization process can help stop criminal fraud.

When you submit an authorization request, you’ll receive an authorization response code. There are dozens of different response possibilities, all of which can advise you on how to proceed.

Some of the codes advise that you ‘pick up card’. This means the cardholder has reported the card as lost or stolen, flagged the credit card number, and the transaction you are trying to process is likely fraud.

Declining these transactions reduces the risk of processing unauthorized transactions and can avoid the resulting chargebacks.

SUGGESTION

Consider submitting an authorization request for every transaction you process.

Card brands allow some transactions to be settled without authorization. However, if you skip this step, you miss out on the benefits the process offers.

3. Authorization errors can cause chargebacks.

Just like many other parts of the payment processing workflow, authorization is thoughtfully regulated by the card brands. There are several rules governing how and when you should request authorization.

If you do not comply with expectations, you could be penalized. One of the most common courses of action is to initiate a chargeback when an authorization error occurs.

Here are some examples of authorization-related chargebacks:

- Discover Reason Code AT - You were supposed to request authorization but didn’t.

- Mastercard Reason Code 4808 - You authorized the transaction, but didn’t settle it within the time limit.

- American Express Reason Code A01 - The settled transaction amount was more than the authorized transaction amount.

SUGGESTION

Review the authorization requirements for each brand so you know what’s expected. You can check with your processor to make sure your workflows and data entry are compliant.

You should also carefully monitor your chargeback data. Analyze the data by reason code so you know if your business is making authorization mistakes.

Kount makes it easy to analyze chargeback data. We offer detailed reporting and in-depth analytics that can help you identify why disputes are happening so you can solve problems at their source. Sign up for a demo today to learn more.

4. Authorization errors can lead to additional fees.

Because the authorization process includes multiple tasks completed at different stages of the transaction lifecycle, there are multiple opportunities to make mistakes. And different mistakes warrant different penalties.

While some errors are addressed with chargebacks, others are fined.

For example, Visa charges a ‘misuse of authorization system’ fee for every approved transaction that isn’t reversed or settled through its credit card networks.

SUGGESTION

It can be challenging to trace costs to their source because there isn’t usually a lot of transparency around fees nor why you are charged certain amounts.

Talk to your processor, and ask if you are being fined for non-compliance with authorization rules. See if it is possible to minimize these costs.

5. It’s important to balance risk with revenue.

Unless you use an authorization hold or a ‘pre-authorization’, you have to settle the transaction within seven days. If you don’t, the transaction may be eligible for a late presentment chargeback.

However, authorization-related chargebacks are only valid if you made an authorization error and the card is no longer ‘open to buy’.

If the account has been closed or there are no longer sufficient funds to cover the charge, the issuer can initiate a chargeback for a transaction settled outside the timeframe.

But, if the account is still in good standing, the transaction could go through without a problem — even if it is settled late. A chargeback isn’t automatic.

SUGGESTION

If you make a mistake and haven’t settled the transaction within the time limit (but less than 180 days have passed), consider your options. You might not have to cancel the transaction and sacrifice revenue.

For example, if the cardholder has made another purchase recently and the authorization request was approved, the account is likely still ‘open to buy’.

If threshold breaches aren’t a concern for your business, it might be worth the risk of a chargeback to complete the transaction after the deadline.

6. Cardholders can dispute approved transactions.

It’s important to note that issuer approval and cardholder approval are two different things.

An approved authorization simply tells you that the account is in good standing. It doesn’t confirm that the cardholder has given permission to process the transaction.

Therefore, it’s possible for an issuer to approve a transaction during the authorization process and the cardholder dispute it as an unauthorized (or fraudulent) purchase.

Sometimes, these chargebacks are legitimate; criminals might have committed fraud. But another possibility is that your customers are making false fraud claims. Click here to learn more about this ‘friendly’ fraud.

SUGGESTION

If you are receiving chargebacks because your customers claim their purchases are unauthorized, contact Kount today.

First, Kount will help you determine the real reason for the disputes. Then, we’ll help you solve the underlying problems.

For disputes that really are the result of criminal activity, we’ll help you analyze which tools you should use for detecting and preventing fraud.

For disputes that are friendly fraud, Kount can help you fight back. We make it easy to respond to invalid disputes and recover the revenue that has been lost.

7. Authorization holds can help prevent chargebacks.

As part of the authorization process, you can put a hold on your customer’s account until you are ready to settle the transaction.

Not only does a hold help ensure you are paid for the purchase, it also helps prevent a chargeback by acting as a warning for the customer.

Once alerted to the upcoming charge, the customer has a chance to review the pending transaction. If an error or fraudulent activity is discovered, the issue can easily be fixed before the transaction is finalized.

The following are examples:

- Richard signs up for a monthly subscription. After looking at his credit card statement, he realizes he used the wrong card. He calls and switches to a different form of payment before the charge actually hits his account.

- Emily doesn’t recognize a pending transaction on her statement and suspects fraud. She calls the number listed in the billing descriptor to clarify the purchase.

With an authorization hold, you also buy yourself some time. You can likewise review the situation and address any issues before they become chargebacks.

Here are some examples:

- Two charges come through, both from Luke and both for the same baseball hat. A call to verify the purchases reveals there is a glitch in the checkout process. Luke didn’t receive an order confirmation message, so he tried again. Canceling the duplicate transaction solves the problem.

- Lorelai ordered a pizza for delivery, but her topping of choice is sold out. After discussing the alternatives, Lorelai changes her order to a salad and the transaction amount is updated.

SUGGESTION

Consider the pros and cons of authorization holds. If the chargeback prevention benefits outweigh the potential drawbacks, they could be a valuable addition to your business’s payment processing workflow.

Need Help Managing Chargebacks?

The authorization process can have an effect on your chargeback management strategy — but it is just one of many things that impacts outcomes.

There are hundreds of factors that go into an effective management strategy. However, understanding and mastering all those variables can be overwhelming.

That’s why Kount believes the challenge of running a business should be delivering great products or services, not managing payment risk. We remove the complexity of payment disputes so businesses can get back to business.

If you’d like help managing disputes — everything from authorization to chargeback response — contact Kount today.