How AI Is Influencing Fraud and Empowering the Fight Against It

There's no question that artificial intelligence (AI) is changing the world around us — especially when it comes to fraud. Fraudsters are using AI to target your business in new and deceptive ways. At the same time, experts on the cutting edge of fraud prevention use AI to fight back and beat fraudsters at their own game. What we’ve learned in the fight on the front lines can help keep criminals at bay and, hopefully, strengthen our allies in the war on AI-powered fraud.

“Welcome to the AI Arms Race.”

- Matthew Jones, Director of AI Science at Kount

- AI use in fraud attempts, detection, and prevention today

- Criminals use artificial intelligence to simplify fraud

- Experience: Fraud prevention through supervised machine learning

- Fraudsters deploy AI to automate large-scale attacks

- Intuition: Using unsupervised machine learning to detect and prevent fraud

- Artificial intelligence facilitates new types of fraudulent activity

- The future lies in AI answers to AI challenges

AI use in fraud attempts, detection, and prevention

Forty years ago, fraudsters used telephone scams and fake mail orders to steal money and private information. Twenty years later, email and text messaging provided rich new inroads for criminals. These days, the tools are more sophisticated and fraudsters seem smarter than ever. Artificial intelligence lies at the heart of effective modern fraud technology.

In 2019, the Federal Reserve warned of the fast-growing threat of synthetic identity fraud. Fraudsters were using pieces of personally identifiable information to create entirely new, fake people and companies. By 2021, this threat became a major reality in the fraud detection and prevention world. The next year saw the release of ChatGPT and similar services, putting generative AI into the hands of everyday users.

As more people get their hands on AI technology, it begins to power more attempts at fraud. Criminals invested in fraud seek to outsize their returns through AI and machine learning. Those “returns” come from stealing the revenue of real businesses. However, fraud analysts began to harness the power of AI and machine learning almost two decades ago. We’ve got real experience fighting AI with AI.

“Gone are the days of low-velocity, time-intensive, repetitive, error-prone, manual attacks — these have become significantly less lucrative for fraudsters.”

- Matthew Jones, Director of AI Science at Kount

AI FRAUD

Criminals use artificial intelligence to simplify fraud

Fraudsters have discovered the power of AI when it comes to bypassing initial checks. They now use advanced technology to simplify much of the manual work that went into creating and executing scams to steal from your businesses and your customers. AI empowers criminals to better hide their tracks and thwart basic detection systems.

Using artificial intelligence, criminals obfuscate and rework information. Generative AI simplifies the process of masking identities to bypass initial fraud checks, even if those changes would seem obvious to experienced managers and fraud experts. Criminals find it easier than ever to appear as legitimate customers or attempt fraudulent transactions without revealing much of their operations.

EXAMPLE

AI-influenced promotion abuse fraud

Fraudsters abuse artificial intelligence for promo use fraud. They seek to undermine your well-intentioned efforts to reward new customers and drive sales. When you set up a discount code for new users, or any limited-use coupon, you expect it to capture new sales and build loyalty. Fraudsters see it as an opportunity to get unearned discounts and enrich themselves at your expense.

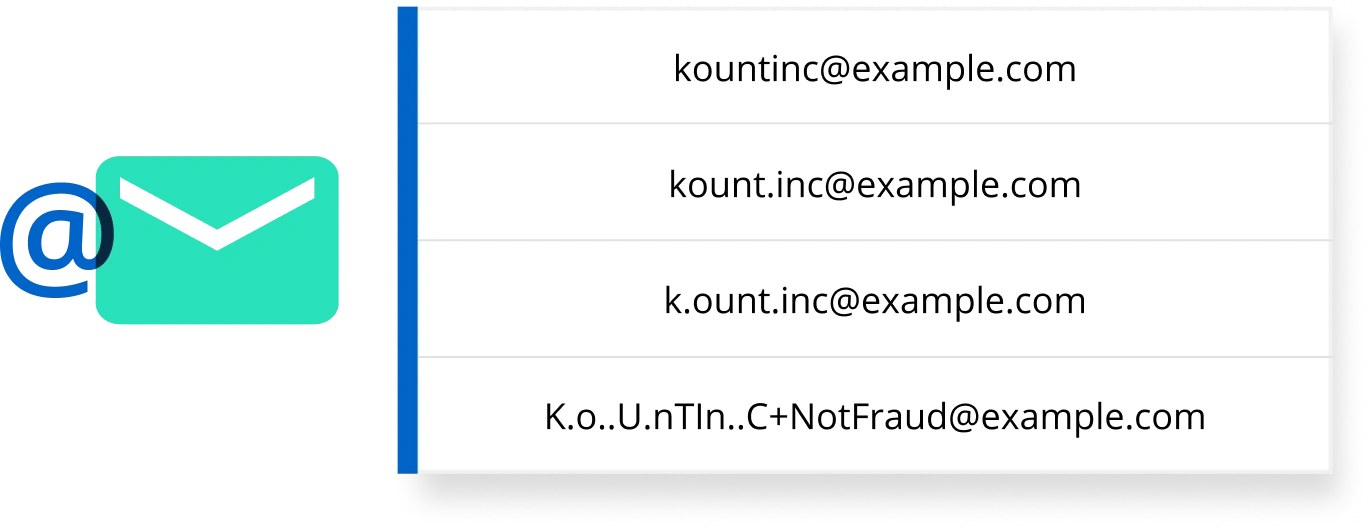

By masking emails, fraudsters sign up for unlimited single-use promotions. Using AI, they rapidly generate hundreds or even thousands of email and mailing addresses in seconds. Without AI defenses, these can pass initial checks and evade blacklists. AI masking — at its most basic — looks similar to this:

Mail servers recognize all of these as the same address and deliver email to the same account. Yet, to many basic detection systems, each represents a unique identity and a new customer in the system. Such simple masking tools can be deceptively effective, especially when deployed at scale. When they work, suddenly your business is regularly giving away huge discounts or promotional items meant for only a single use.

Methods of stopping this abuse

Such a series of attempts may seem obvious to you as an experienced business owner or manager. Few have the time to monitor each transaction for simple tricks, however. The time it takes fraudsters for each attempt can be measured in fractions of a second, while manually correcting the problem takes far longer. Here’s a few things you can do to help thwart promo abuse before deploying AI.

- Educate and train your team. It’s imperative to identify and shut down this type of fraud before it hits your bottom line. Teach your team how to recognize and report promo abuse.

- Set clear terms and conditions for promotions. Add provisions to limit discounts and rewards to a single person or physical address. Include a note that masking violates these terms.

- Go beyond basic email or physical address checks. Turn to modern tech that verifies device IDs, geolocation, and other factors to help filter illegitimate attempts.

These important safeguards help protect your revenue during any type of promotional campaign. You rely on your experience to inform your detection systems and your team, even if you can’t personally evaluate every transaction. Now, AI can deliver a similar element of “experience” in a timely and effective manner.

RELATED READING

FRAUD PREVENTION

Experience: Fraud prevention through supervised machine learning

While you may not be able to personally evaluate all transactions, AI can. It starts with the information you impart when customizing fraud detection and prevention for your company’s needs. Your fraud prevention solutions provider further trains detection systems with their knowledge. That experience creates a baseline for artificial intelligence to review incoming information and make near instantaneous decisions.

Supervised machine learning delivers further “experience” by looking over the history of failed or fraudulent transactions to determine risk going forward — on each and every attempt. This way, it learns from the myriad of attempts and gains experience that protects your business. This type of machine learning is all about studying the past to predict future risk.

EXAMPLE

Malicious fraud resulting in chargebacks

Criminals actively seeking to defraud your business rely on masking to attempt multiple transactions from many accounts. They then make purchases with stolen or compromised debit or credit cards, even digital payment options. After you ship the goods, the owner of the compromised payment method reports it as unauthorized with the issuing bank.

The card owner gets their money back. Your business takes the hit on lost revenue, logistics expenses, and time spent dealing with the situation. You even get chargeback fees. The fraudster gets your goods.

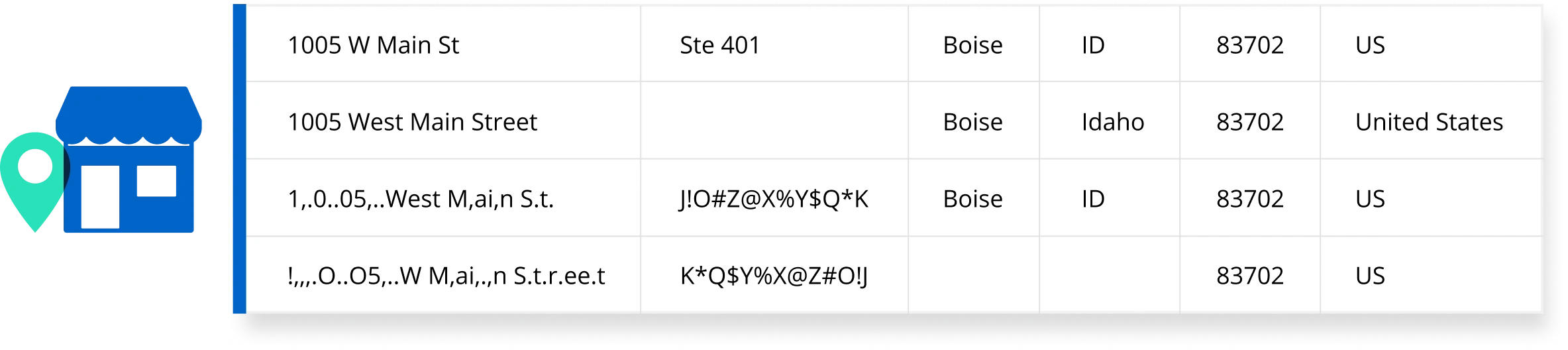

Since you can’t fight chargebacks from malicious fraud and get your money back, prevention is the surest method of protecting your bottom line. Elements that would stand out when reviewed by an experienced manager can tip AI off to a high-risk situation. Let’s look over a list of physical addresses similar to those generated by AI-using fraudsters:

A postal employee could most likely get a package to the recipient using the information provided in each of these examples. Some label systems may even standardize and correct the addresses prior to shipment. But we need to catch this type of situation before that point.

Fraud detection tools can standardize the addresses, recognizing additional risk due to attempts at masking. Identifying and refining these early on makes it much clearer when someone tries to make multiple purchases using different cards with goods going to the same address. AI-empowered systems then flag and review or decline the transactions, keeping your goods and revenue where they belong.

Using supervised machine learning, fraud detection systems learn from the history of previous purchases from your company and those protected by your solutions provider. This example is supervised because it gains experience by reviewing previous interactions where customers initiated a chargeback, but these systems can evaluate almost any situation with a known outcome. That’s part of what makes them so powerful in the fight against fraud.

“We’re able to quickly shut down attacks using fabricated or obfuscated data.”

- Matthew Jones, Director of AI Science at Kount

AI FRAUD

Fraudsters deploy AI to automate large-scale attacks

Criminals looking for outsized gains turn to AI automation to operate at scale. AI tools for automation handle much of the tedious — and often risky — distribution aspects of fraud and scams. These advanced bots do far more than their predecessors. The most dangerous also employ machine learning to refine their techniques.

EXAMPLE

AI automated card testing fraud

AI automation is highly prevalent in card testing fraud. Fraudsters obtain lists of card numbers and attached identities, then begin reviewing them for validity. AI automation simplifies this process by making hundreds or even thousands of small charges near-simultaneously from publicly available businesses like yours.

If the card testing works, the AI compiles a list of valid payment options the fraudster then uses for criminal purposes. Even if the testing alerts a cardholder, your company is likely to pay processing and chargeback fees for any resulting dispute. Your business may well lose the respect of that customer.

Successful AI card testing fraud results in:

- Loss of revenue - Even small transactions can add up alongside relevant fees.

- Weaknesses in security - AI machine learning discovers your site has clear vulnerabilities.

- Loss of time - Dealing with small transactions that turn out to be fraud can be very labor intensive.

- Potential high-risk classification - Banks and card brands may increase fees, decline future transactions, or require chargeback monitoring programs.

- Possible outsized losses - Now that the fraudster understands the vulnerability, they may go for higher-ticket items and recognize your business as a source of easily resold goods.

Preventing card testing fraud

The worst part is that most of this is preventable. Modern fraud detection systems provide a bevy of options that protect your business. Malicious artificial intelligence may try to spoof browser validation or fail to recognize proxy and VPN connections. The more security you have in place, the more difficult it becomes for criminals.

- Deploy relevant security checks: Require CVV codes and Address Verification Service checks.

- Add a Captcha and botnet prevention: These tools can identify and stop many common bots.

- Limit guest checkout and checkout attempts: Gather more data and thwart brute-force attacks.

These may seem like simple fixes, and they should be part of any card testing fraud solution. However, fraud prevention AI truly shines when it comes to fending off these types of large-scale attacks. And it does it using a form of intuition.

RELATED READING

FRAUD PREVENTION

Intuition: Using unsupervised machine learning to detect and prevent fraud

Intuition offers a solution for problems that experience can’t handle. In terms of modern AI, unsupervised machine learning provides that source of intuition. Computers may not have a gut to rely on when things “don’t look right,” but advanced machine learning checks for emerging patterns that may indicate fraud.

Unsupervised machine learning isn’t tracking which attempts complete, get declined, or result in chargebacks. It’s focused on underlying patterns and elements that go beyond using the past to predict future results. For example, you probably think there’s just innately something risky about a large number of transactions with the same or similar attributes. Intuition agrees.

EXAMPLE

Account takeover and unauthorized activity

Criminals engaging in fraud for profit often put the most effort into account takeover. By getting credentialed access to systems, they steal sensitive information, make purchases, alter account settings, and reveal stored debit or credit card numbers. Detecting compromised accounts remains one of the greatest challenges in fraud prevention. Experience, and supervised machine learning, only helps avoid security errors made in the past. It doesn’t predict potential future avenues of attack.

That’s where the intuition aspect of unsupervised learning comes into play. By looking for patterns of use that emerge from the data, it becomes clearer when a credentialed user acts “out of character” and suddenly tries to make large purchases of easily resold goods or changes to their accounts. Systems powered by AI recognize this and challenge or lock out the user for additional verification. Intervention can prevent huge data breaches and stop tens of thousands of dollars in unauthorized purchases.

Intuition aids similarly in preventing card testing. Even if each stolen identity uses different credentials, it would be very strange for so many different people to be tied back to the same locations, devices, or networks. Identifying this “strangeness” as risky activity helps shut down mass attacks quickly and effectively.

“Combining both supervised and unsupervised machine learning allows us to identify and prevent multiple fraud vectors efficiently.”

- Matthew Jones, Director of AI Science at Kount

AI FRAUD AND PREVENTION

Artificial intelligence facilitates new types of fraudulent activity

The rapid and widespread adoption of generative AI put new tools in the hands of fraudsters. Criminals have developed new and innovative ways to use this technology, transforming the work of fraud analysts and putting additional pressure on legitimate businesses like yours. We’re in a new future where artificial intelligence allows criminals to:

- Fake voices to deliver believable telephone calls and texts using bots.

- Generate realistic images of fake receipts or shipping confirmation.

- Create videos to support phishing scams and social engineering.

- Use unsecured chatbots to gather account information.

Each of these represents a real threat to security, which demands comprehensive protection. New types of fraud continue to emerge as AI becomes more commonplace. The goal of these criminals remains the same — to steal revenue and goods from your business or customers — but we now face constantly evolving threats that grow with each iteration.

EXAMPLE

Synthetic identities

Criminals don’t just attempt to mask who they are or impersonate real customers, fraudsters use artificial intelligence to create entirely new individuals. These synthetic identities draw from data on real people, most of which may be publicly available through social media and other obvious online engagements.

Fraudsters use real photos of people to generate highly realistic fake portraits. Addresses and phone numbers all check out to real residential locations. These synthetic identities could even have their own social media accounts and friend or follower networks. Each level of detail added to a synthetic person becomes a new challenge for business owners and fraud solutions providers working to keep criminals at bay.

While fake accounts are nothing new, the level of sophistication now reaches previously unseen levels. And the potential for loss is staggering. Analyzing customer profiles of one credit issuer revealed more than 62,000 accounts tied to synthetic identities, driving over $8 million in losses each year. Prevention tools that don’t include AI or machine learning struggle to deal with this type of situation.

Fighting AI with AI

At the intersection of experience and intuition, AI fraud prevention shines. Advanced systems engage in behavioral analytics to deliver near-instant anomaly detection. Piecing together the clues that reveal synthetic identities requires cutting-edge technology. By combining experience, intuition, and the work of real fraud analysts, the best modern systems maintain an edge over even unconventional fraudsters.

This is where the proverbial arms race really heats up. Each attempt provides feedback for tools that track, identify, and thwart fraud. Identifying patterns in attempts and anomalies in user behavior further refines these tools. And this goes both ways. Criminals who rely on fraud continue to develop new systems and try to find new ways to get away with nefarious activity. Those systems in turn push modern detection and prevention to new heights.

“The most prolific and economically damaging fraud is facilitated by advanced automation and AI, which requires a more comprehensive suite of multi-pronged methodologies to identify and effectively combat.”

- Matthew Jones, Director of AI Science at Kount

The future lies in AI answers to AI challenges

Modern fraudsters continue to work on masking, automation, and even the generation of whole new identities. Meanwhile, artificial intelligence empowers defenders with the tools they need to not only thwart attempts but also protect against future attacks in new ways.

Machine learning delivers a form of experience and intuition that acts as a bulwark in real time. It also provides actionable insight through analysis, empowering us as real, human experts to further refine protections. Fraud analysts use this highly effective cycle to create some of the strongest protection available and drive the development of new machine learning technology.

As fraud remains a challenge almost as old as commerce itself, there’s no one-size-fits-all solution now or realistically around the corner. The accelerated evolution of artificial intelligence will no doubt continue to transform fraud and prevention efforts. Fraudsters will likely make more attempts than ever, with greater levels of sophistication. One of the greatest advantages we have against this threat is the ability to learn and grow from literally every attempt, turning their zealous, continuous onslaught against them.

Kount protection stands at the forefront of AI innovation

Everyone has their own, slightly different definition of what AI is. But regardless of differences in nomenclature, it should be clear to all of us that the fraudsters are coming at us faster than ever before. If we hope to stay ahead in this high-stakes game, we need comprehensive solutions that leverage:

- Best-in-class standardization and canonicalization

- Event-level supervised machine learning: “Experience”

- Event-level unsupervised machine learning: “Intuition”

- Behavioral analysis for advanced risk management

- Ever-ready support and continuous improvement

Kount combines these methodologies into our Kount 360 platform and delivers it to you through our product suite, so that you can always stay one step ahead. Learn how our solutions seamlessly integrate with your existing processes to deliver industry-leading fraud prevention and protect your business.