Visa Claims Resolution (VCR)

Visa Claims Resolution (VCR) is an initiative to streamline workflows and standardize rules for chargeback and dispute resolution. VCR went live in April 2018. The initiative impacts all payment industry stakeholders — issuers, acquirers, processors, and merchants.

The reason for the VCR is because Visa recognized that legacy processes for managing chargebacks and disputes were outdated. VCR ushered in a more modern era for dispute resolution with a simplified, streamlined, cost-effective workflow that relies heavily on automated technology.

The initiative is broken down into two different workflows and several different steps.

VCR Terminology: New Phrases & Definitions

About the time that “chargebacks” gained widespread understanding, Visa changed everything. Here’s what you need to know about new terminology brought about by the Visa Claims Resolution initiative.

- Allocation - VCR introduced a new dispute resolution workflow called allocation. Allocation enables Visa to use internal data and automation to determine who is responsible for a dispute (learn more about allocation in the next section).

- Associated Transactions - Visa responds to a transaction inquiry with a list of associated transactions (previous credits, reversals, adjustments, etc.) that could proactively make the dispute invalid.

- Collaboration - The legacy dispute resolution workflow is referred to as collaboration. It is a litigation-based process (learn more about collaboration in the next section).

- Dispute - Visa phased out the word chargeback and replaced it with dispute.

- Dispute Condition - Visa phased out 22 reason codes and replaced them with 24 dispute conditions.

- Dispute Category - The newly-established dispute conditions are divided into four dispute categories: fraud, authorization, processing error, and consumer disputes.

- Dispute Response - Visa phased out the word representment and replaced it with dispute response.

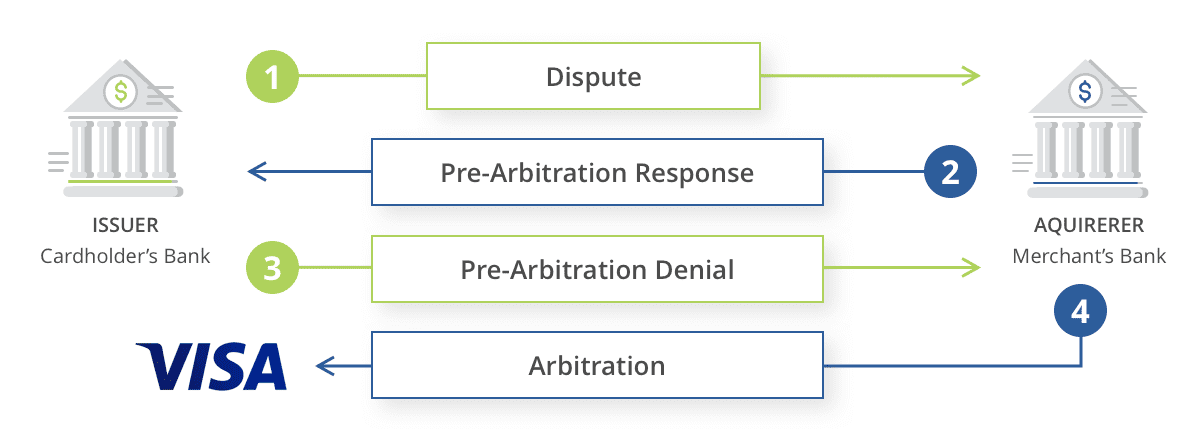

- Pre-Arbitration - Because liability has already been assessed with allocation disputes, there technically isn’t a dispute response opportunity. Instead, merchants respond with pre-arbitration. Even though merchants still share compelling evidence just like they would with a dispute response, the process is considered pre-arbitration for cases classified as fraud and authorization issues.

- Transaction Inquiry - When a cardholder initiates a dispute, the issuer submits a transaction inquiry to Visa Resolve Online (VROL) to determine which transaction or transactions are being challenged.

New Dispute Resolution Process: Allocation vs. Collaboration

VCR features two distinct dispute resolution styles: allocation and collaboration. Allocation uses Visa’s internal data to automatically assign liability. Collaboration is essentially an updated version of Visa’s legacy workflow.

Allocation

VCR allocation is the newly adopted management style that takes advantage of Visa’s internal data and automated technology.

Visa consults internal data in an effort to assign liability to either the issuer or merchant.

If liability is assigned to the issuer, the case is closed and the bank or cardholder is responsible for paying the transaction. If liability for the dispute is assigned to the merchant, the merchant can either accept responsibility or respond.

However, because liability has already been assessed for allocation disputes, there technically isn’t a dispute response opportunity for merchants. Instead, the response is considered pre-arbitration.

Visa’s intent was for allocation to reduce workloads and costs for issuers, acquirers, and merchants. However, certain challenges remain. If your business is struggling to understand or manage allocation disputes, contact Midigator. We’re happy to discuss the implications for your organization.

- Managed with liability-assessment model

- Visa consults internal data and assigns liability to either the cardholder or the merchant

- Fraud and authorization dispute categories

Collaboration

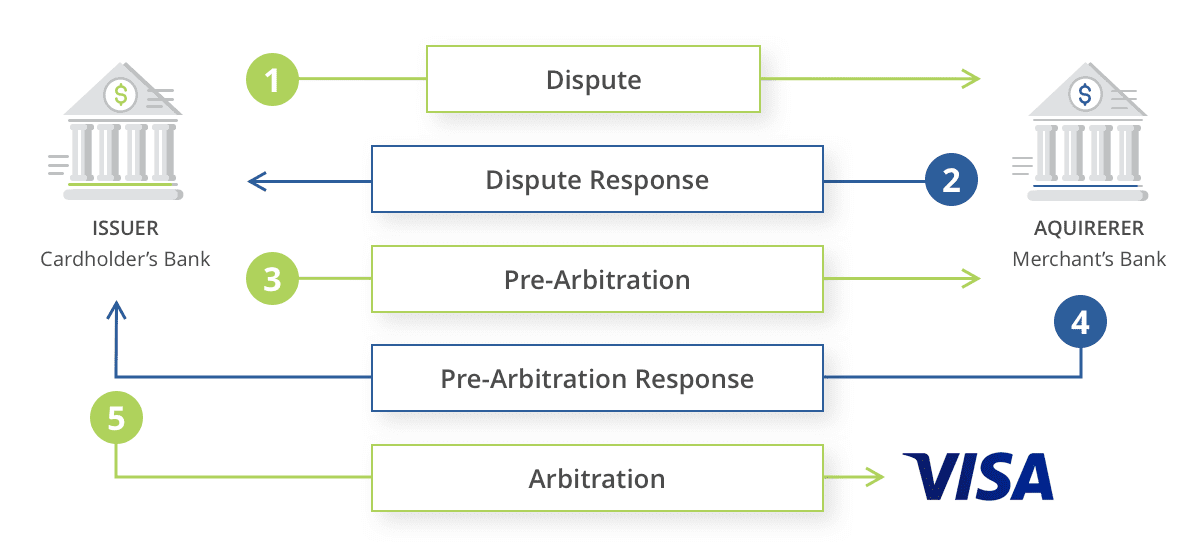

The VCR collaboration process is essentially the same workflow that Visa used for decades (and which other card brands still use today).

The issuer submits a dispute to the acquirer. The acquirer passes the dispute to the merchant. The merchant can challenge the validity of the dispute, if desired. Pre-arbitration and arbitration may follow.

- Managed with litigation-based model

- The merchant has a chance to respond to the dispute with compelling evidence; the issuer will determine the outcome

- Customer dispute and processing error dispute categories

Visa Dispute Conditions

VCR created four dispute categories: fraud, authorization, processing error, and consumer dispute.

The categories fraud and authorization are managed with the allocation workflow. The categories processing error and consumer dispute are managed with the collaboration workflow.

Within those four categories, there are additional subcategories which are intended to provide greater clarity around the reason for the dispute. The 24 subcategories are called dispute conditions. A complete list of Visa dispute conditions can be found here.

RELATED READING

Improve Chargeback Management ROI with These 5 Tips

Protect your revenue with chargeback management