Improve Chargeback Management ROI with These 5 Tips

It’s common for Kount clients to report an increase in chargeback management ROI (return on investment) ranging from 800% to as much as 1,500%.

What are those merchants doing to yield such significant results? And how can you replicate their success?

Unfortunately, there is no silver bullet for chargeback management--no quick fixes. However, there are proven-effective ways to improve your outcomes.

Analyze data so you can solve problems at their source.

Do you want to know the most commonly overlooked chargeback management tip?

Here it is: analyze your data.

Robert Painter, Director of Chargeback Management at Kount, explained this idea perfectly.

I think too many merchants focus on moving paper from point A to point B, meaning they focus on trying to respond to the chargeback in the time frame and win back revenue. When they do that, merchants miss all the data that is inside the chargeback. That data explains why the chargeback occurred and what merchants could do differently to prevent future chargebacks from happening.

- Robert Painter, Director of Chargeback Management at Kount

If you collect and analyze pertinent data, you can monitor patterns--and detect anomalies that indicate hidden issues. These hidden issues are the real reason why cardholders are disputing transactions. If you resolve the hidden issues and solve problems at their source, you’re able to replace temporary fixes with long-term results.

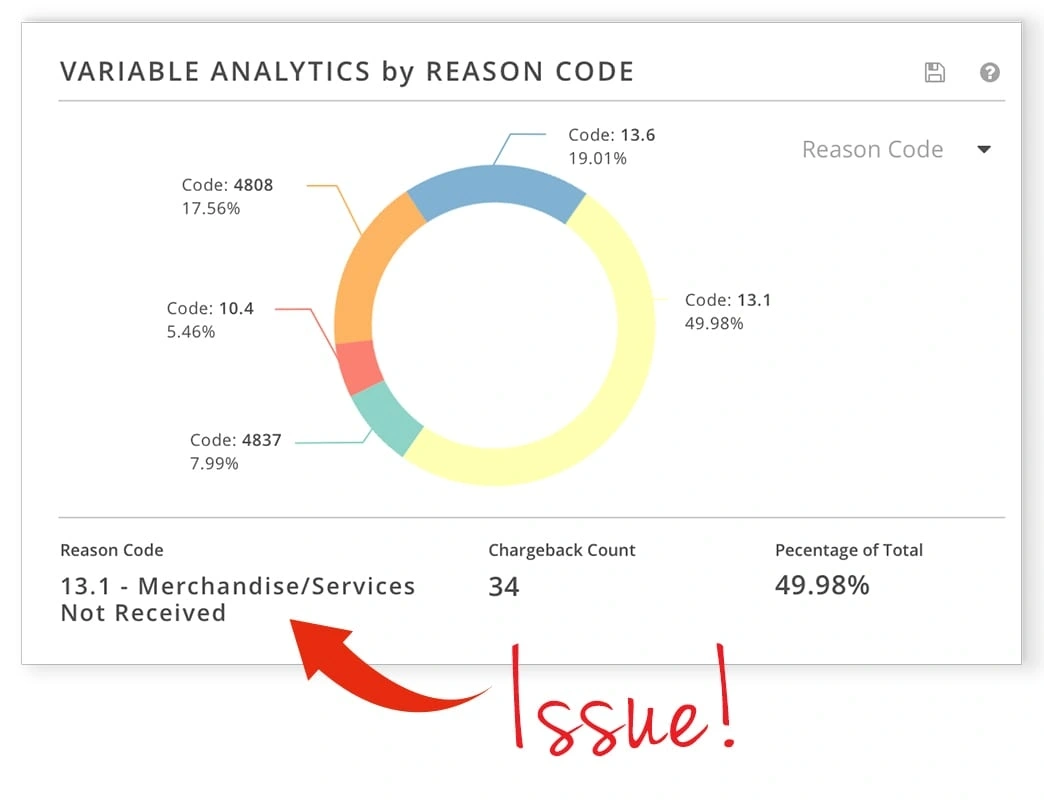

For example, in one case study, analyzing chargebacks by reason code revealed the majority of disputes were classified “merchandise not received.” This was surprising because, previously, the majority of chargebacks were “no cardholder authorization”.

The merchant contacted the fulfillment center and discovered orders weren’t being shipped. A glitch in the checkout page was causing a breakdown in communication.

Because the merchant analyzed data, this issue was easily detected and resolved. But without data, the real reason for disputes could have remained hidden indefinitely.

Best Practices for Data Analysis

To achieve the best chargeback management results, you have to know why cardholders are disputing transactions — you can’t guess or assume. And to make those intelligent, well-informed, data-driven decisions, you need...data!

Examples of some of the variables you could analyze include the following:

- Reason code

- Country

- BIN

- Price point

- Product type

- Lag time

- Marketing source

- Subscription cycle (if applicable)

Know what is happening at any given moment.

The old adage, “What she doesn’t know won’t hurt her,” might apply to your mom and the cookies you stole as a kid. But when it comes to chargeback management, you must know what is happening at all times.

This means you’ll need real-time data. You can’t set up a system and refresh your reports once a month. Because, the longer you wait to address an issue, the worse it becomes.

Best Practices for Real-Time Data Monitoring

Two things will help improve the efficiency of your real-time data analysis.

FIRST, put all your data in one place. Segmented and siloed data decreases transparency.

Consolidate data from your prevention alerts, order validation, and chargebacks (with comprehensive activity insight from transaction processing to dispute response outcome) into one access point.

SECOND, make sure your data is relevant.

You want to be able to see and monitor your key performance indicators (KPIs), but more data doesn’t always translate to more insight.

Skip the irrelevant stuff so you don’t lose the forest for the trees.

Use chargeback management tools that can prevent the preventable.

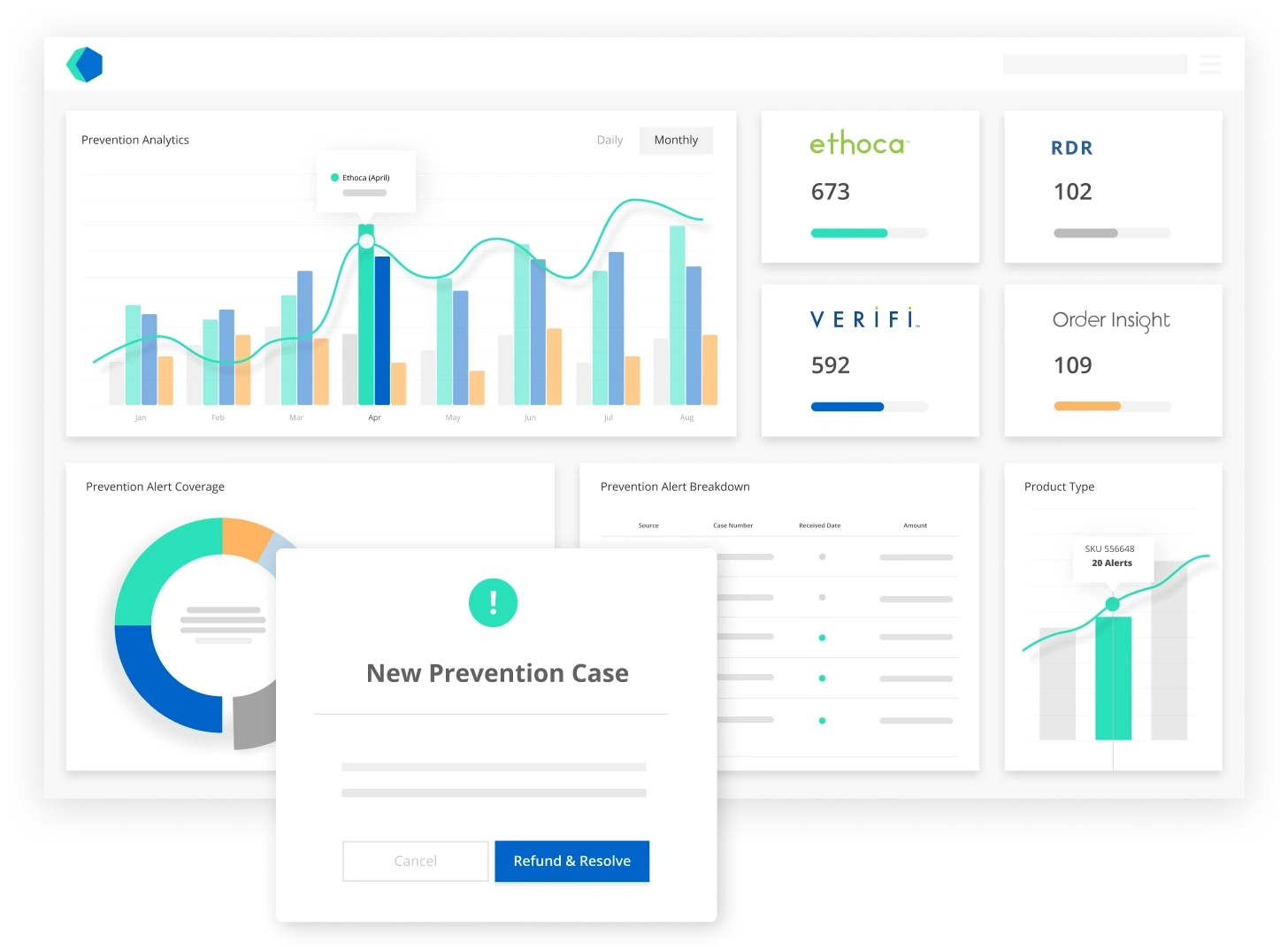

There are several chargeback prevention tools available. Often, creating multiple layers of protection with various tools reduces the risk and produces the best results.

If you aren’t using any of these tools, now is a good time to reevaluate their potential ROI.

Chargeback Prevention Alerts

Prevention alerts are sent by participating issuers, notifying merchants in real time that a cardholder has disputed a transaction. If the merchant refunds the transaction in question within the 24-hour time limit, the full chargeback process might be avoided.

If managed properly, prevention alerts can reduce chargeback rates by 30-35%.

Best Practices for Prevention Alerts

FIRST, determine which prevention solutions vendor to work with.

Use Verifi™ if...

...the majority of your chargeback reason codes are for consumer disputes (merchandise not received, credit not issued, etc.).

...you sell to a predominately US customer base.

Use Ethoca™ if...

...the majority of your chargeback reason codes are for unauthorized transactions (legitimate fraud or friendly fraud).

...you sell to customers within the US, but also globally.

Use both if...

...you receive a mixture of both fraud and non-fraud or friendly fraud chargebacks.

...you want the most comprehensive protection possible.

SECOND, make sure alerts are being managed 24 hours a day, seven days a week. You either need an in-house employee to monitor alerts and provide instant refunds, or you need to automate the process. Otherwise, alerts could expire before they are refunded, meaning you double your expenses.

THIRD, collect useful data. Prevention alerts are often issued within a couple of days of the transaction, but chargebacks reach the merchant weeks or even months later. As a result, prevention alert data is a tip-off for the chargeback trends you can expect to see 2-5 weeks later. Analyze prevention alert data so you can identify problems earlier and resolve issues sooner.

Order Validation

Visa’s Order Insight and Mastercard’s Consumer Clarity allow merchants to share transaction information with issuers in real time. The objective is to equip issuers with information to clarify the original transaction with the cardholder and potentially resolve the dispute.

Order Validation is a relatively new chargeback management tool, but research has already shown it to be effective. Early adopters have reported a minimum of 14% reduction in the number of chargebacks they receive.

Best Practices for Order Validation

In order to participate in order validation, you must be able to share data in two seconds or less. And, you’ll need to undergo an arduous integration process.

If your business doesn’t have idle development resources at its disposal to handle an ancillary project like order validation integration, you might consider integrating through a Visa facilitator.

Integrating through a genuine Visa facilitator (like Kount) can simplify the process significantly, ensure adherence to the 2-second requirement, and provide a wealth of analytics that wouldn’t otherwise be available.

However, you should use caution when selecting a facilitator. Not all vendors can respond in time, and helpful data isn’t a guarantee. Thoroughly investigate a facilitator’s capabilities before signing on the dotted line.

Identity Verification Solutions

Incorporating CVV2, AVS and 3D Secure into your checkout process can help prevent certain types of chargebacks.

Visa Claims Resolution (VCR) incorporates a new dispute-resolution workflow. For disputes managed with the allocation workflow, Visa will assign liability to either the issuer or the merchant. Liability will be determined, in part, by CVV2, AVS, and 3D Secure outcomes.

Using these tools could mean you won’t be held liable, thus receiving fewer disputes. If you do receive an allocation dispute and you have used these tools, you’ll have the necessary compelling evidence to submit a response and hopefully overturn the liability assessment.

Best Practices for CVV2, AVS, and 3D Secure

Ask your processor to turn these tools on, but disable the auto-decline function.

Manually review transactions that have a mismatch instead of automatically declining them. Then, you’ll have supporting evidence available if a dispute does arise, but you won’t increase false declines.

Fight...strategically.

If you don’t fight illegitimate chargebacks, you won’t recover revenue. If you don’t recover revenue, your bottom line will tank.

But, you can’t just fire off representments and expect the money to come rolling in.

You have to be strategic.

Best Practices for Representments & Dispute Responses

Dispute responses (also referred to as representments) will have a significant impact on your chargeback management ROI.

To ensure that ROI is positive, do these three things.

FIRST, know what you should and shouldn’t fight.

ROI will decrease instead of increase if you are wasting resources on cases that can’t be won. Some examples of ROI-draining efforts include:

- Fighting chargebacks that have already exceeded the time limit

- Fighting legitimate fraud

- Fighting allocation chargebacks without the approved compelling evidence

- Fighting low-dollar chargebacks that generate more expenses than revenue recovery

The best way to distinguish between what should and shouldn’t be fought is to use technology. Intuitive fight rules can help protect your ROI.

SECOND, create an air-tight case that has the best possible chance of winning.

To do this, you’ll want to customize each dispute by certain characteristics.

- Check which reason code is assigned to the chargeback. Then, check card brand regulations to determine which compelling evidence is required for that reason code. Include all the applicable evidence you have, but only what is requested.

- Find out how your processor wants the representment package constructed. Order documents according to preferences.

Again, an automated solution can handle this customization much easier, quicker, and more efficiently than manual processes.

THIRD, monitor your outcomes.

It’s challenging to get dispute response outcomes from processors, but it is important to try. You need to know what is and isn’t working so you can adjust and try different techniques based on your win rates.

Increase efficiency.

We saved the best tip for last because this is ultimately what it all comes down to.

You could, theoretically, prevent all the preventable chargebacks and recover revenue from every chargeback you fight. But if the system you use to do the preventing and fighting isn’t efficient, your expenses will far outweigh your revenue. Thus, destroying any potential for ROI.

Labor is probably one of your biggest chargeback management expenses. Use your in-house team more efficiently, reduce costs, and ROI is guaranteed to increase.

Best Practices for Labor Management

If you want to increase efficiency, focus on three things.

FIRST, increase transparency. You can’t measure success if you don’t have insight into what is happening.

This relates to a previously mentioned suggestion: don’t guess or assume. You need to know what is happening. Otherwise, you could be devoting resources to problems that aren’t actually problems.

SECOND, decrease manual processes and increase automation. The efficiency of technology has the unique ability to both reduce expenses and increase revenue--making it a key component in any efforts to boost ROI.

Consider the following:

- The more manual touch points you have, the more chances for mistakes. Streamlining processes with technology could eliminate all potential for errors.

- Technology can accomplish more in less time. With newly shortened expiration time limits, manual processes struggle, but technology guarantees compliance.

- Due to its efficiency, technology should reduce costs. A Kount case study found technology cost 45% less than manual chargeback management.

THIRD, reallocate team members to revenue-generating roles.

If you switch from manual processes to chargeback management services, your employees’ responsibilities will change.

There will be no more mind-numbing, paper-pushing tasks like submitting representments and refunding prevention alerts. Instead, employees can try their hand at things like data analysis and A/B testing. Not only will this increase ROI, but it will also increase job satisfaction.

More Revenue. Fewer Expenses. Better ROI.

With the right tools and strategies, you can expect your chargeback management ROI to consistently improve over time.

If you would like help incorporating any of these five tips into your chargeback management strategy, contact Kount today. Our team members would be happy to schedule a demo and show you how other merchants are using the technology to achieve satisfactory results.