Compelling Evidence 3.0: What new Visa requirements mean for merchants

In response to the unparalleled growth of digital commerce, Visa has changed its requirements for how much and the types of evidence a business must submit to resolve customer disputes pre-chargeback.

Often, when a customer doesn’t recognize a purchase, they notify their bank or credit card company and report it as fraudulent. These acts of friendly fraud (also known as “first-party misuse” or “first-party fraud”) can happen for any number of reasons: confusing billing descriptors, forgotten subscriptions or other recurring payments, accidental transactions from kids using parents’ devices, etc.

In many cases, friendly fraud is accidental. Unfortunately, though, many consumers aren’t above committing friendly fraud intentionally to get money back on goods and services. Regardless, Visa and other card brands don’t consider confused or intentionally forgotten purchases as “unauthorized.”

So, to reduce all types of fraud, Visa announced changes to its dispute program, developed in partnership with the Merchant Risk Council (MRC) and Merchant Advisory Group (MAG). These changes will go into effect on April 15, 2023.

Explore our guide to catch up on the evolution of compelling evidence, Visa’s latest changes, and how you can use digital fraud and dispute management tools to meet CE3.0 requirements and prevent chargebacks.

What is compelling evidence 3.0?

Compelling evidence is “proof the cardholder participated in the transaction, received the goods or services, or benefitted from the transaction,” according to Visa’s guidelines. Typically, banks and credit card companies are inclined to side with cardholders in the event of a dispute. Banking siding with cardholders is especially prevalent in the age of cardholder-friendly, no-liability policies.

So the more detailed and compelling the evidence, the better a merchant or acquirer can support that the cardholder participated in the transaction, received goods or services, or benefitted from the transaction. Traditionally, compelling evidence can include correspondence between customers and merchants, proof that the cardholder used the products, signature receipts, delivery confirmations, and more.

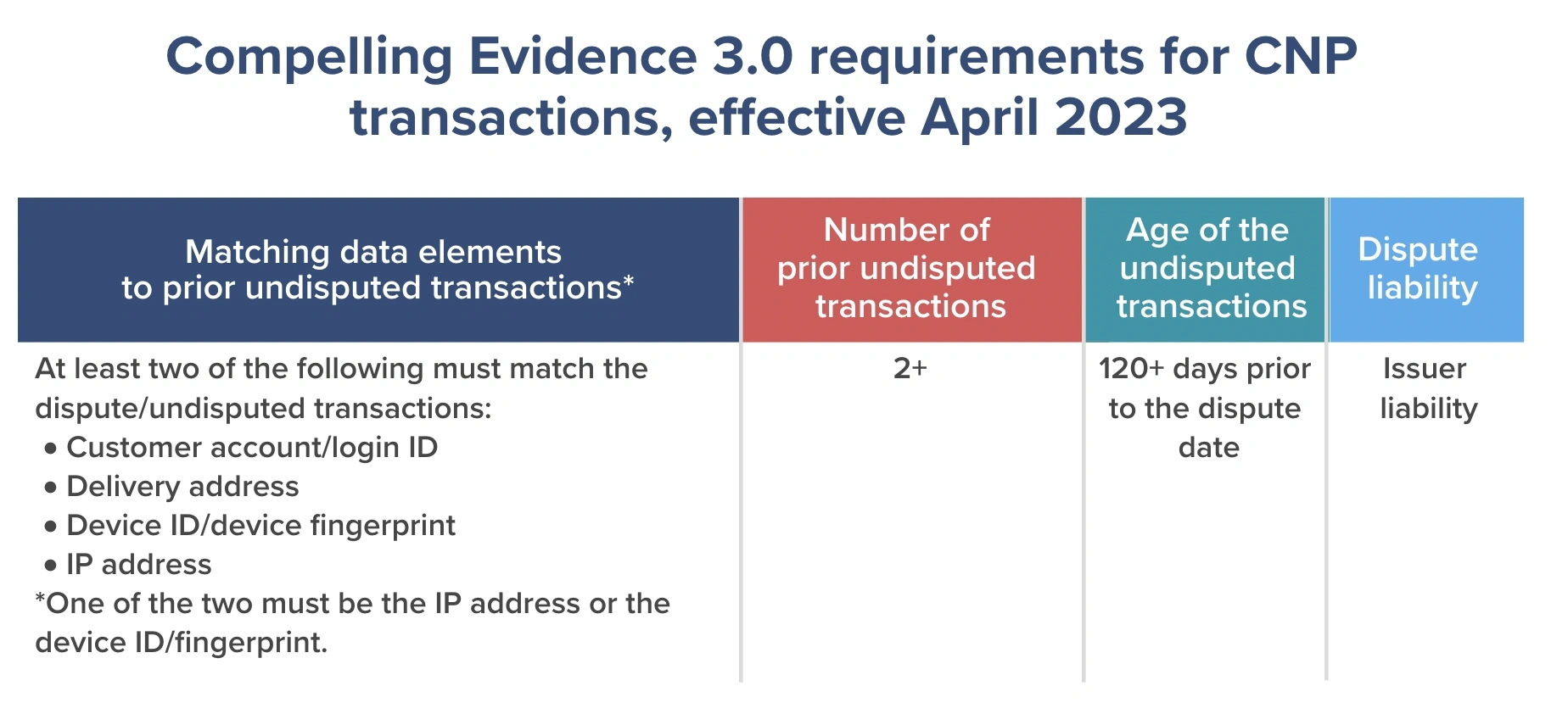

Compelling Evidence 3.0 is Visa’s latest evolution of these requirements, which the company hasn’t formally updated since 2015. The new requirements change the meaning of what Visa considers compelling evidence, including:

- The data elements that must match prior undisputed transactions

- The number of prior undisputed transactions

- The ages of prior undisputed transactions

- The dispute liability

As of April 2023, in addition to the customer account/login ID or the delivery address, compelling evidence will need to include the device ID/device fingerprint or the IP address. At least two pieces of this evidence must match the disputed transaction and previous undisputed transactions.

From there, compelling evidence must include two or more prior undisputed transactions the customer made at least 120 days before the current disputed transaction. Finally, under CE3.0 guidelines, liability shifts to the issuer.

Until CE3.0 takes effect, compelling evidence must include the IP address, email address, physical address, and phone number associated with the transaction. And compelling evidence for digital downloads must include two of the following: IP address, device ID, and the purchaser name and email address associated with the customer account.

Merchants need only supply one prior undisputed transaction of any age. And the dispute liability falls to the acquirer if the issuer provides a valid explanation for why the customer continues to dispute transactions.

How Visa reason codes affect compelling evidence

When it comes to proving a customer made a legitimate transaction, the evidence must fit the reason for the customer’s dispute. That’s where reason codes come into play. A reason code is a number assigned to a dispute that tells a merchant why a customer has disputed a purchase.

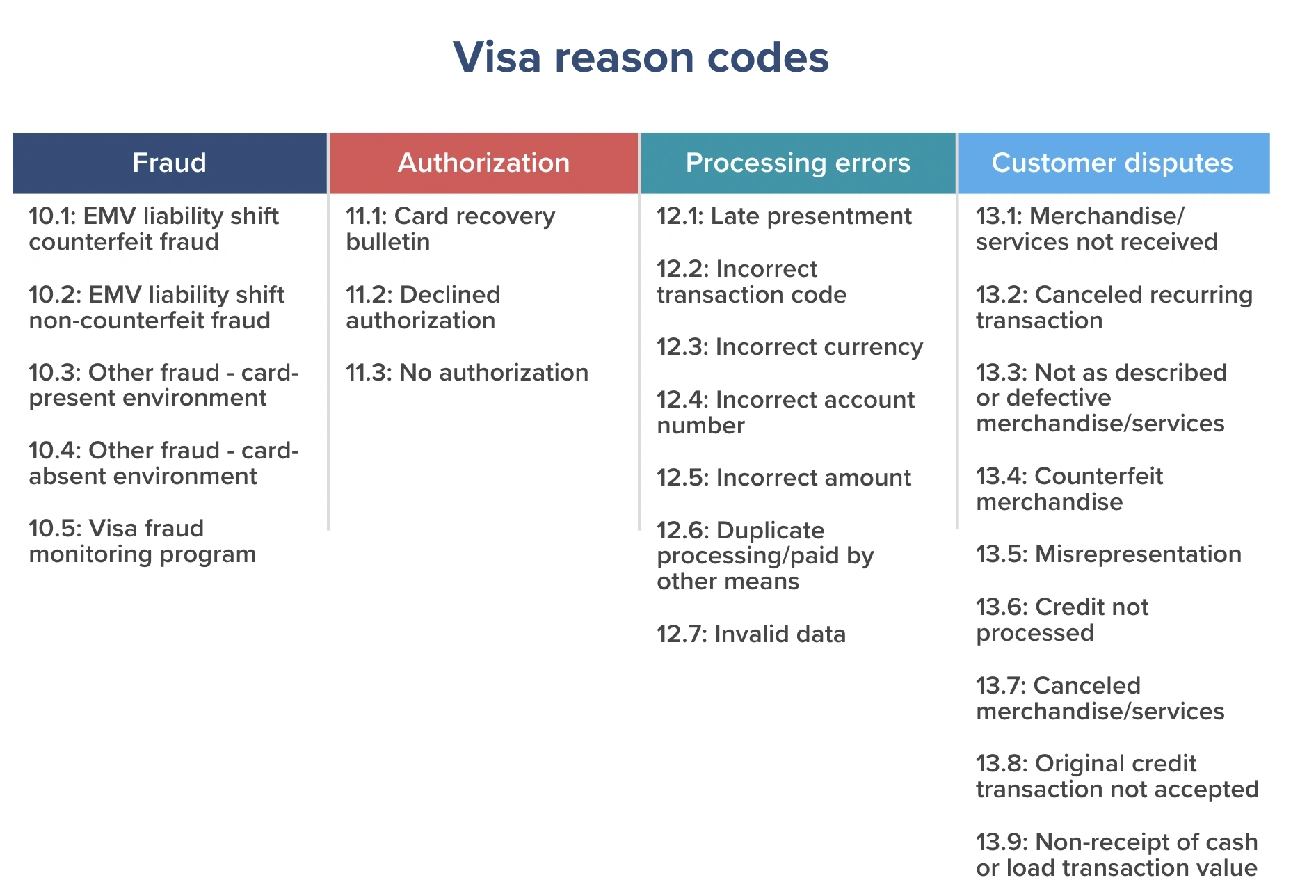

Each card brand has its own set of reason codes and evidence criteria. For example, Visa splits its reason codes into four categories: fraud, authorization, processing errors, and consumer disputes.

10.1-10.5 fraud reasons codes

Visa’s fraud reason codes list dispute reasons from 10.1 to 10.5 and, more or less, associate the dispute with an issue related to a stolen credit card. For example, reason code 10.4 — other fraud – card-absent environment — asserts the merchant processed a card-absent, card-not-present, or digital payment for a customer who used the cardholder’s account fraudulently.

If the transaction is fraudulent because the cardholder reported their card missing or stolen, the merchant can provide documentation that they reversed the charge. However, if the merchant believes this to be friendly fraud, their compelling evidence would have to show the customer made a similar purchase previously and didn’t dispute it.

11.1-11.3 authorization reason codes

Visa’s authorization reason codes list dispute reasons from 11.1 to 11.3. Visa associates authorization reason codes with how or when the merchant authorized the transaction.

Sometimes, the merchant forced a declined authorization to post without attempting another authorization request (reason code 11.2). In other cases, the merchant failed to obtain authorization to cover a given transaction (reason code 11.3).

12.1-12.7 processing errors reason codes

Visa’s processing errors reason codes list dispute reasons from 12.1 to 12.7. Visa associates these reasons with errors in currency processing, account numbers used, data entry errors, duplicate processing, etc. Take reason code 12.5 — incorrect amount — for example.

This reason code asserts the merchant altered the transaction amount after the transaction was completed without the cardholder’s consent. Compelling evidence for disputing this reason code might include correspondence with the customer or a signed receipt that matches the transaction amount processed.

13.1-13.9 customer dispute reasons codes

Visa’s customer dispute reason codes list dispute reasons from 13.1 to 13.9. Visa associates these reasons with errors in order processing. For example, reason code 13.1 — merchandise/services not received — asserts that the customer didn’t receive goods or the merchant failed to provide services.

Customer dispute reason codes are tricky because they’re highly associated with intentional friendly fraud and even some forms of refund fraud. In some cases, the dispute is legitimate but results from a misunderstanding or something outside of the merchant’s control.

For example, a 2021 digital payments survey found that 45% of merchants surveyed said delivery delays were responsible for increased chargebacks. And 29% said interrupted supply chains were responsible for increased chargebacks. Compelling evidence should show that the items were delivered to the address received or that the merchant communicated processing delays with the customer.

Why Visa is changing its compelling evidence 3.0 requirements

The consequences of too many customer disputes and fraud chargebacks can devastate businesses. As soon as a merchant’s dispute-to-sales rate or fraud-dollar-to-sales rate passes 0.9% in a single month, they enter a Visa fraud monitoring program.

In such a program, merchants incur additional fees, must take additional steps to solve their fraud and dispute problems, and get their rates below acceptable thresholds. But staying out of a program, at least if the merchant isn’t using a chargeback protection solution, means engaging in the representment process and disputing their own chargebacks.

Among businesses that don’t dispute chargebacks, 36% claimed they don’t win representments enough to justify the dispute process, according to 2021 chargeback risk statistics. But Visa’s Compelling Evidence 3.0 requirements, the company says, can significantly reduce chargebacks by helping merchants validate charges pre-dispute.

“Reducing the impacts of first-party misuse on small businesses requires industry-wide support,” says Julie Fergerson, CEO at MRC. “We stand with Visa in their commitment to ensuring the entire ecosystem is taking the right steps against inaccurate chargeback disputes and protecting merchants from bearing the weight of these costs.”

Visa hopes to empower merchants to protect themselves against fraud and non-fraud disputes by asking them to submit additional evidence that a customer made a legitimate purchase.

“We’ve seen firsthand how first-party fraud is a financial burden for merchants,” says John Drechny, CEO at the MAG. “The updates Visa is making will help improve protection for small businesses and merchants against friendly fraud.”

There are a few things you can do to meet current compelling evidence and new CE3.0 requirements — and increase your chances of dispute success.

How to meet Visa’s compelling evidence requirements

1. Collect and share new remedy criteria for all transactions with Order Insight®

Visa suggests all merchants start collecting CE3.0 remedy criteria — the data elements of IP addresses, device ID or fingerprints, shipping addresses, and account login IDs — now. The more evidence you collect now, the better prepared you’ll be in the event of a dispute.

When a customer initiates a dispute, you can quickly share that data using Order Insight. This Visa tool helps merchants share business and purchase details with issuers and customers in real time at that point of inquiry to clarify confusion and prevent disputes.

These details can help cardholders recognize purchases while encouraging them to self-serve. As a result, businesses can stop friendly fraud at customer inquiry, keep dispute ratios below Visa’s thresholds, promote brand loyalty by clarifying transaction confusion, and cut down on call center inquiries that drive up operational costs.

2. Implement an AI-driven, pre-authorization criminal fraud solution

Reason code 10.4 is one of the most common among merchants that accept CNP or card-absent payments. And it’s true what they say about an ounce of prevention. One of the best ways to prevent criminal fraud disputes and chargebacks is to stop bad actors before authorizing a bad transaction.

A digital fraud prevention solution, like Kount Command, can accurately identify fraudulent activity using advanced AI, two types of machine learning, and a global data network of billions of fraud and trust-related signals. These elements combined assign a risk score to every transaction. From there, businesses can customize policies to approve high-trust interactions and decline high-risk interactions automatically.

Kount’s chargeback experts expect other major card brands to follow Visa’s lead on compelling evidence. So businesses that implement fraud prevention tools now can save themselves precious time and resources when new changes come.

3. Implement a post-authorization friendly fraud solution that combines pre-authorization and Order Insight data

To prevent disputes on both sides of the equation, pair data from a digital fraud tool with Order Insight and manage it all from a dispute and chargeback management solution. Bringing these tools together allows merchants to send additional transaction data and more compelling evidence to customers and issuers.

“Pairing Order Insight with Kount Command allows merchants to take a hands-off approach to their dispute and chargeback strategy,” said TJ Roberts, Kount’s Director of Product Marketing. “As a result, they can stay ahead of the curve, protect their revenue, and significantly increase their chances at dispute success.”