Preventing Chargebacks: The Ultimate Guide

Need chargeback protection? Want to avoid chargebacks and the resulting revenue loss?

Of course you do!

But where do you even begin?! Chargeback prevention can be such a stressful, time-consuming process!

If you’re feeling overwhelmed, don’t worry. Kount can help. Check out our valuable insights, step-by-step instructions, essential tools, and helpful tips that will make the task as simple as possible.

- Why Chargebacks Happen

- What You Can and Can’t Prevent

- Chargeback Prevention Tools

- Chargeback Insurance for Protection

- Using Data to Prevent Chargebacks

- Business Updates that Reduce Chargebacks

- Measuring Success

- Integrating Prevention into Your Strategy

Why Chargebacks Happen

Before we talk about preventing chargebacks, let’s look at why chargebacks happen. Understanding the reasons and motives behind chargebacks will help you avoid them in the future.

A chargeback is usually caused by one of three things:

- Merchant error

- Criminal fraud

- ‘Friendly’ fraud

Merchant error happens when you make a mistake while processing a transaction, fulfilling an order, or navigating the customer experience. If you don’t make an effort to fix your mistakes, a customer could request a chargeback.

Criminal fraud happens when someone uses a cardholder’s payment card or account information to initiate an unauthorized transaction. Because the shopper didn’t have permission to make the purchase, a chargeback is the typical outcome.

Friendly fraud happens when a cardholder uses the chargeback process incorrectly, either as an intentional attempt to get something for free or an innocent misunderstanding.

Identifying the underlying reason for a chargeback might seem like an unnecessary step in an already complicated process. But this insight is very valuable. If you know why the chargeback happened, you can fix the issue that caused it. By solving problems at their source, you can create long-lasting protection — instead of a temporary fix.

Visit our detailed guide on chargeback reasons. It provides tips and insights to effectively manage each threat.

What You Can and Can’t Prevent

How many chargebacks can you expect to prevent? Which types of chargebacks are easiest to manage? Are some prevention tools better than others?

Let’s take a look at what goes on behind the scenes of a chargeback prevention strategy.

STEP ONE

Acknowledge Limitations & Set Realistic Expectations

Having a chargeback prevention strategy is important — your business might not survive without it.

It’s also important to have realistic expectations about what your plan can accomplish. And that starts with understanding the limitations of any chargeback prevention strategy.

Unfortunately, it’s impossible to completely eliminate the risk of chargebacks. If you want absolute, fail-safe, 100% chargeback protection, there is only one thing to do: discontinue credit and debit card payments.

Because all credit and debit purchases have built-in protections for cardholders — including the right to dispute transactions. So if cardholders are protected, you can’t be too. Because someone has to accept responsibility — and that someone is usually you.

To learn more about assigning and accepting financial liability, check our detailed guide on chargebacks. Understanding the purpose of chargebacks will help you set reasonable expectations for your prevention strategy.

The realities of chargeback management might initially seem discouraging, but there is good news! Even though you can’t prevent all chargebacks, you can avoid quite a few.

In fact, if you use the tools and technologies mentioned later in this guide, you can stop unauthorized transactions and resolve the majority of disputes from becoming chargebacks. Add in updates to your business practices and policies, and you can prevent even more!

Later in this guide, we’ll go into greater detail on measuring success and improving outcomes. Stick around! There’s lots to learn!

STEP TWO

Understand the Ease & Difficulty of Prevention

Which cases are easiest to avoid? Which types of chargebacks are hardest to prevent?

If we were to measure the difficulty of prevention for the three causes of chargebacks — merchant error, criminal fraud, and friendly fraud — the scale would look something like this:

Why? Why are some causes easier to prevent than others?

Let’s take a look at each reason individually.

MERCHANT ERROR

Chargebacks caused by merchant error are the easiest to manage. Why? Because this chargeback trigger is the only one that is 100% within your control. Unlike criminal fraud and friendly fraud, these chargebacks are influenced by you and you alone.

How do you prevent this type of chargeback? Carefully, objectively, and consistently review your business’s practices, processes, and policies. Then, fix any problems you find. Read on to learn more about business updates that can help reduce chargebacks.

CRIMINAL FRAUD

True criminal fraud has relatively straightforward prevention techniques. The main objective is to detect and block transactions that probably aren’t authorized. If you stop the transaction, you stop the chargeback.

There are several distinctive characteristics of fraudulent activity. There are also trustworthy signals that verify a shopper’s identity. Kount has created tools to detect these attributes and act upon them.

FRIENDLY FRAUD

Compared to merchant error and criminal fraud, friendly fraud is more difficult to prevent.

The other two causes can be traced back to easily-defined activities. For example, criminal fraud is someone stealing his roommate’s card and using it to buy new shoes. And merchant error is shipping a green sweater instead of pink.

But friendly fraud is ambiguous. It’s influenced by factors such as beliefs, opinions, morals, regrets, fear, and confusion. It is nearly impossible to anticipate a customer’s reaction to a situation and incredibly difficult to change that reaction to something less destructive than an illegitimate chargeback.

However, there are things you can do to minimize risk and reduce the impact that these disputes have on your business. Read on for a review of business best practices that reduce the likelihood of friendly fraud.

STEP THREE

Know What Your Biggest Threats Are

We talked about how difficult it is to prevent each of the three types of chargebacks. Now, let’s look at the prevalence of each. What are the most common reasons for chargebacks?

On the surface, it seems like criminal fraud is the biggest threat for most merchants. Data collected in our annual Year in Chargebacks report revealed that over 70% of all chargebacks had a fraud-related reason code.

But what type of fraud is really to blame?

More than 77% of fraud-coded chargebacks were found to be friendly fraud.

This information might, initially, seem discouraging. After all, we just said that friendly fraud is the most difficult kind of chargeback to prevent. And now we are saying the majority of cases are this challenging dispute type.

But the situation isn’t as bad as it seems. Yes, friendly fraud is a significant threat for most merchants. And yes, it can be difficult to prevent. But, friendly fraud chargebacks can be fought. If you can prove the chargeback is invalid — it shouldn’t have happened — you can recover the revenue that was lost.

That means your chargeback management philosophy should be something like this:

| Prevent as many disputes as possible, and then fight what you can't prevent. |

Later in this guide, we’ll explain how to combine the two tasks — preventing and fighting — into a comprehensive strategy.

How to Prevent Chargebacks

This guide has a lot of information on preventing chargebacks. But how do you actually go about stopping disputes from happening? What does a step-by-step plan look like?

The process can be broken down into four action items.

- Check your most common reason codes.

- Analyze your data.

- Update policies and procedures.

- Use the right chargeback prevention tools.

Let’s take a closer look at each individual task.

STEP ONE

Check your most common reason codes.

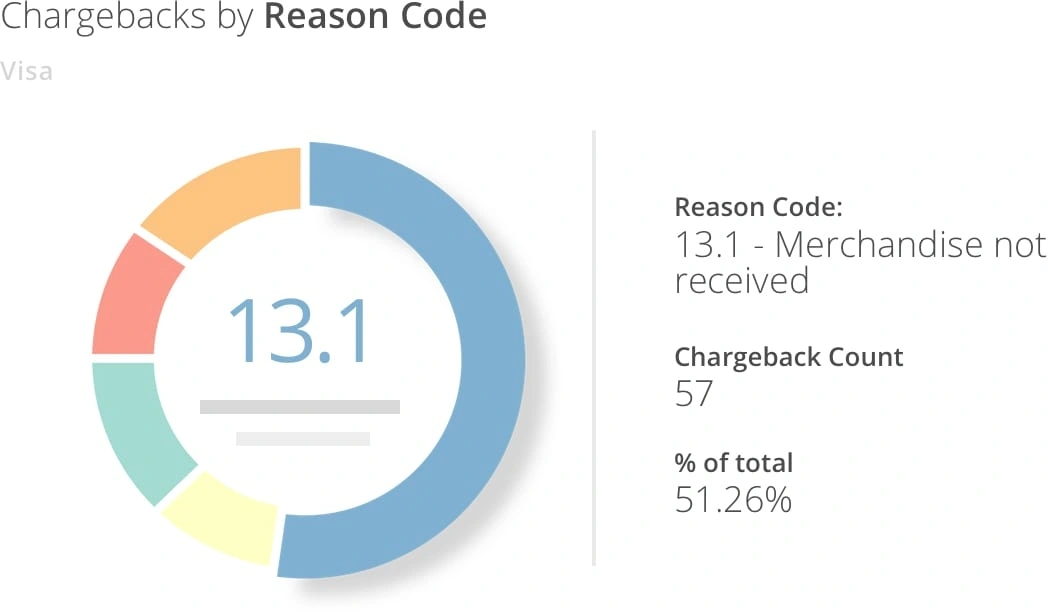

To avoid chargebacks, you need to identify the reasons for disputes and solve the underlying issues. So start with your most common chargeback reason codes.

We have a reason code database where you can look up individual codes.

But sometimes, it is helpful to group codes by category. That way, you can consider the overarching causes. Here are a few examples.

You didn’t follow the rules.

Everyone from processors and card brands to local and federal governments has rules about how payments should be handled. If you break a rule — even if it’s an innocent mistake — you may receive a chargeback.

For example, these reason codes are used when card brand rules are broken.

- No Reply – You were asked to provide transaction information but didn’t acknowledge the request.

- Late Presentation – You were supposed to process the transaction within a set time limit but didn’t meet the deadline.

- Required Authorization was not Obtained – You were required to seek authorization from the issuing bank but didn’t submit the request.

- Incorrect Currency – You were expected to adhere to the cardholder’s currency conversion preferences but didn’t comply with what was asked.

The goods or services you sold weren’t what the customer expected.

For your customers, purchases — especially those made online — require trust and faith despite the unknown. Until they put your merchandise to use or your services are rendered, customers have no idea what the quality will actually be. If you break that trust or don’t meet expectations, the result is usually a chargeback.

There are several quality-related reasons why customers might dispute transactions:

- Goods or Services are not as Described – The cardholder claims to have received goods or services that were different from what was described.

- Goods or Services are Defective – The cardholder claims the quality wasn’t what was expected or the item was defective.

A criminal made an unauthorized purchase.

Criminal (or malicious) fraud happens when a cardholder’s payment card or account information is used without permission. Since transactions are unauthorized, they usually result in chargebacks.

These unauthorized purchases can be made with both card-present and card-not-present transactions. Examples of fraud-related reason codes include the following:

- Card Not Present Fraud – The cardholder claims a mail order, telephone order, or internet order that you processed was not authorized.

- Card Present Fraud (Counterfeit Card) – The cardholder has a chip card, and someone made a counterfeit copy of it. You processed a transaction with the counterfeit card on a terminal that wasn’t EMV-compliant rather than using a chip-reading device that would have detected the fraud. Now, the cardholder claims the purchase was unauthorized.

- Card Present Fraud (No PIN) – The cardholder has a PIN-preferring chip card, but your point-of-sales (POS) terminal doesn’t require a PIN to finalize the transaction. Now, the cardholder claims the purchase was unauthorized.

An order wasn’t fulfilled correctly.

Order fulfillment is an important part of a comprehensive chargeback prevention strategy.

If customers order one thing, but you ship something completely different, they’ll understandably be frustrated. And since today’s consumers are accustomed to instant gratification, you have to move quickly.

There are a few chargeback reason codes that relate to order fulfillment:

- Goods or Services Were Not Received – The customer claims you didn’t provide the goods or services as promised.

- Goods or Services Were Damaged – The cardholder claims to have received goods or services that were damaged.

The customers thinks you were misleading.

If your business is focused on providing an exemplary customer experience, chargebacks probably won’t be a significant concern. But if customers feel like their desires aren’t important, their rights aren’t respected, or their needs won’t be met, disputes could be abundant.

For example, failure to write and share clear policies will commonly cause the following chargebacks:

- Misrepresentation – The cardholder claims you misrepresented the terms of the sale.

- “No Show” Hotel Charge – You didn’t tell the cardholder about the “no-show” fee before finalizing the hotel reservation.

- Counterfeit Goods – The cardholder claims you promised genuine merchandise, but the merchandise received was counterfeit.

You didn’t handle a customer service issue in the best way possible.

When shoppers aren’t satisfied with their purchases, they usually have one goal in mind: to get their money back. If you can’t easily make that happen, the bank will.

There are several reason codes that relate to refunds and cancellations. For example:

- Canceled Recurring Transaction – The cardholder claims you processed a recurring transaction after a cancellation request was made.

- Canceled Merchandise or Services – The cardholder claims to have returned merchandise or canceled a service, but credit hasn’t been applied to the cardholder’s statement yet.

- Credit Posted Incorrectly – You processed a transaction, but the cardholder claims it should have been a refund.

- Cardholder Dispute for Timeshares – The cardholder claims the timeshare was canceled, but you charged the cardholder anyway.

The more you know about your chargebacks, the better prepared you will be to prevent them.

STEP TWO

Analyze your data.

Sometimes, it might not be immediately obvious why a customer disputes a transaction. The reason code assigned to the chargeback might seem completely irrelevant. That’s because ‘friendly’ fraud — which happens when a cardholder uses the chargeback process incorrectly — can disguise a customer’s true motives.

So if you want to discover the real reason for chargebacks, you’ll need to analyze your data.

Check out the data analysis section later in this guide to learn more.

STEP THREE

Update policies and procedures.

After you’ve reviewed your data, you should have a better understanding of why chargebacks are happening. Once you have those insights, you can start to solve the underlying issues.

The majority of your updates will revolve around enhancing the customer experience. Of course, it’s impossible to please everyone. But that doesn’t mean you shouldn’t try!

Don’t just aim to provide a satisfactory customer experience. Focus on perfecting every single impression the customer has of your business from start to finish. Optimize all of it.

To do that, you’ll need to carefully audit the procedures and practices of each department. Here are some examples of questions to ask.

- Marketing: Are product descriptions detailed and accurate? Are your ads and marketing campaigns honest and realistic? Is someone responding to social media interactions?

- IT: Is the Contact Us form on your website working properly? Are emails being routed to the appropriate teams? Are all your support and policy pages loading correctly?

- Fulfillment: Is merchandise sent with the correct packaging so items don’t break in transit? Are published delivery timelines accurate?

- Customer Service: Are customer queries being answered quickly? Are solutions accurate and complete?

Turn your chargeback prevention efforts into a company-wide initiative. Make sure everyone understands what’s at stake, and encourage team members to look for ways to reduce risk.

We list dozens of other suggestions later in this guide.

STEP FOUR

Use the right chargeback prevention tools.

You reviewed your data, found opportunities for improvement, and created the most customer-centric processes possible. But you are still receiving chargebacks.

You’ve done everything within your power to prevent chargebacks. What else can be done?

It’s time to get help.

There are several tools specifically designed to reduce the risk of chargebacks. Some or all of them might be relevant to your business model.

Chargeback Prevention Tools

Wouldn’t it be nice if there was a silver bullet for chargeback prevention? A single tool that could completely eliminate risk?

Unfortunately, the most complete protection comes from a multi-layer approach — a variety of tools used at various stages of the transaction lifecycle.

While each chargeback prevention strategy is different, some combination of these tools is usually best

NOTE

These tools have different functionality, objectives, and benefits, but they don’t compete with each other — they complement one another. Rather than critique them on an either/or basis, consider a multi-layer strategy that can address different types of threats. Remember, the more comprehensive your approach, the more chargebacks you’ll be able to avoid.

TOOL #1

Fraud Detection & Prevention

Who offers this tool? Various vendors including Kount

What does this tool do? The functionality of this tool depends on the vendor you choose to work with. Some fraud services verify the identity of the shopper. Others specialize in detecting suspicious order details. Kount offers both of these capabilities.

In general, a fraud tool helps you stop transactions that are likely to result in chargebacks.

Why is this tool important? A chargeback is justified if the purchase wasn’t authorized. Theseedisputes can’t be challenged. Since you have no recourse, it is important to identify potentially fraudulent activity and stop unauthorized transactions before they happen.

TOOL #2

Address Verification Service

Who offers this tool? Your processor or gateway

What does this tool do? AVS compares the billing address provided during checkout with the address on file with the card issuer.

A mismatch could indicate the shopper is attempting an unauthorized purchase, as the cardholder would likely provide accurate personal information.

Why is this tool important? This chargeback prevention tool serves two functions.

First, you can decline seemingly high-risk transactions based on AVS results. This means you can stop more bad transactions from being processed — transactions that would ultimately result in chargebacks.

Second, AVS results are used, in part, to determine liability for Visa® allocation disputes. If you don’t use AVS, you may be found liable and receive more disputes than what is warranted. But, if you have a full AVS match and the cardholder is claiming fraud, your chargeback defense will be much stronger.

TOOL #3

Card Security Code Verification

Who offers this tool? Your processor or gateway

What does this tool do? Every card has what’s called a card security code (sometimes referred to as CVV2, CVC2, CID, etc).

If you ask for this code during the checkout process, your processor will relay the information to the card issuer. The card issuer will either confirm or deny the information provided matches what is actually printed on the card.

A mismatch could indicate the shopper doesn’t have the card in-hand — for example, stolen account information is being used by a fraudster.

Why is this tool important? Card security code verification fulfills a very similar function as AVS when it comes to chargeback prevention.

Data can be used to decline transactions with a high likelihood of turning into chargebacks. And, CVV2 results are a determining factor in liability assessment for Visa allocation disputes.

TOOL #4

3D Secure 2.0

Who offers this tool? 3D Secure 2.0 providers (contact us for specific recommendations)

What does this tool do? 3D Secure 2.0 is another identity verification tool.

You can send various transaction details — such as IP address, device name, etc. — to the issuer for verification. In real time, the issuer is able to compare the provided details with what the bank has on file.

Then, the transaction will either be labeled low risk and you can proceed, or it will be identified as high risk and the cardholder needs to take additional verification steps (likely entering a one-time password).

Why is this tool important? Just like AVS and card security code verification, 3D Secure 2.0 is a two-fold chargeback prevention tool.

Results can help identify high-risk transactions — purchases that should be declined. And, Visa Secure (formerly Verified by Visa) results are taken into consideration when liability is assessed for allocation disputes.

TOOL #5

Negative list

Who offers this tool? Your fraud solution provider can help you maintain a negative list.

What does this tool do? A negative list is a dynamic database of customers who have charged back or filed a dispute.

If the list is integrated with your customer relationship management (CRM) or fraud detection platform, the technology can flag orders placed by customers who exist in the database. Then, you can either automate cancellations or you can manually review high-risk orders.

Why is this tool important? If you notice a new order is from someone who has previously disputed a transaction, you have the option to cancel the purchase since it has a high probability of turning into a chargeback. This helps keep chargeback counts low and merchant accounts healthy.

TOOL #6

Order Validation

Who offers this tool? Mastercard Consumer Clarity and Visa Order Insight (collectively referred to as order validation) are offered through certified resellers such as Kount

What does this tool do? Order validation tools enable you to communicate with issuers in real time to validate the cardholder’s purchase. The goal is to equip issuers with the information they need to “talk off” disputes before they occur.

Why is this tool important? Some chargeback prevention tools are able to resolve the dispute and avoid damaging the chargeback-to-transaction ratio. However, revenue is still lost. Order validation tools are unique in that they have the potential to resolve the dispute and prevent revenue loss.

TOOL #7

Prevention Alerts

Who offers this tool? Verifi, Ethoca, and reseller partners such as Kount

What does this tool do? Prevention alerts are another tool that enable you to communicate with issuers in near real time to resolve disputes.

Participating issuers will alert you when a cardholder has disputed a transaction. If you are able to refund the transaction and notify the alert vendor within 24-72 hours, the dispute will be settled — without a threshold-damaging chargeback.

Why is this tool important? Prevention alerts have a track record of almost 10 years of success, and they are consistently improving. Alerts deliver the largest reduction in chargebacks across both brands quickly and effectively.

TOOL #8

Rapid Dispute Resolution

Who offers this tool? Visa and reseller partners such as Kount

What does this tool do? When an issuing bank is ready to process a chargeback, RDR allows your acquirer to automatically issue a credit to your customer instead.

Why is this tool important? If a chargeback-inducing transaction has passed through all your other protective barriers, RDR offers one last chance for chargeback prevention.

PRO TIP

On the surface, it may seem like you’ll need to work with a lot of different service providers and access tons of different management platforms if you want to reduce chargebacks. While you do need multi-layer protection, it isn’t as challenging to create as it may seem.

Kount is an all-in-one solution. We have the tools you need to effectively and efficiently prevent disputes — all from a single platform. Schedule an appointment with our team today and we’ll help you decide which tools are the best fit for your business.

Chargeback Insurance for Protection

Why are you researching chargeback prevention tactics? What is your main objective?

Is your goal to minimize the impact that chargebacks have on your bottom line? If so, you might be considering chargeback insurance.

Chargeback insurance is a service that reimburses you when you receive certain types of chargebacks.

NOTE

On the surface, chargeback insurance might seem like a great deal and something your business needs to have. But the reality is this: chargeback insurance usually increases costs and decreases revenue. Make sure you understand what you are getting into before making any hasty decisions. For nearly all merchants in nearly all industries, fraud detection without insurance has the best ROI.

Who offers chargeback insurance? Various vendors offer this service (sometimes called a chargeback guarantee, a chargeback reimbursement policy, or a chargeback warranty). Chargeback insurance is usually offered in conjunction with fraud detection and prevention services.

What does chargeback insurance do? Fraud vendors that offer insurance add an additional fee to every transaction processed. This fee pays for an extra layer of protection. If an approved transaction ends up being fraudulent, the vendor will reimburse you for what was lost.

What are the drawbacks of chargeback insurance? There are four potential drawbacks to be aware of if you are thinking about adding insurance to your chargeback management strategy.

- If your margins are already tight, the extra per-transaction expense might be more than you can afford.

- In order to minimize the vendor’s potential risk exposure, chargeback insurance policies typically yield a higher rate of false positives (good sales that are incorrectly labeled as fraud and unnecessarily declined).

- Insurance doesn’t stop the chargeback from happening. So your business still suffers all the other negative consequences brought about by a dispute: your customer is unhappy, your chargeback count goes up, your chargeback ratio goes up, your reputation is damaged, and your merchant account is in jeopardy of closure.

- Reimbursement guarantees usually come with restrictions — certain types of chargebacks that aren’t covered and won’t be refunded. So even though you’ve paid the protection fee, you won’t actually have the protection you’d expect.

Using Data to Prevent Chargebacks

This tip is included in every conversation we have about chargeback prevention: analyze your data. Why? Because it is that important. It’s probably the most impactful thing you can do to reduce chargebacks.

Breaking down your dispute data by different variables and analyzing it helps you understand why chargebacks are happening. If you uncover the reason for disputes, you can solve problems at their source. This insight is crucial if you want long-term chargeback protection.

Consider the following prevention strategies.

WITHOUT DATA ANALYSIS

- Based on hunches and guesses

- Capable of producing only short-term results

- Reactive

- Highly susceptible to false positives and unnecessary revenue loss

WITH DATA ANALYSIS

- Based on intelligent, data-driven decisions

- Capable of generating sustainable success

- Preemptive

- Optimized for maximum ROI

Bottom line: Without data, you have no way of knowing what is actually happening, what will be an effective solution, or whether or not you’ve fixed the problem.

The following are examples of how to avoid chargebacks with data analysis.

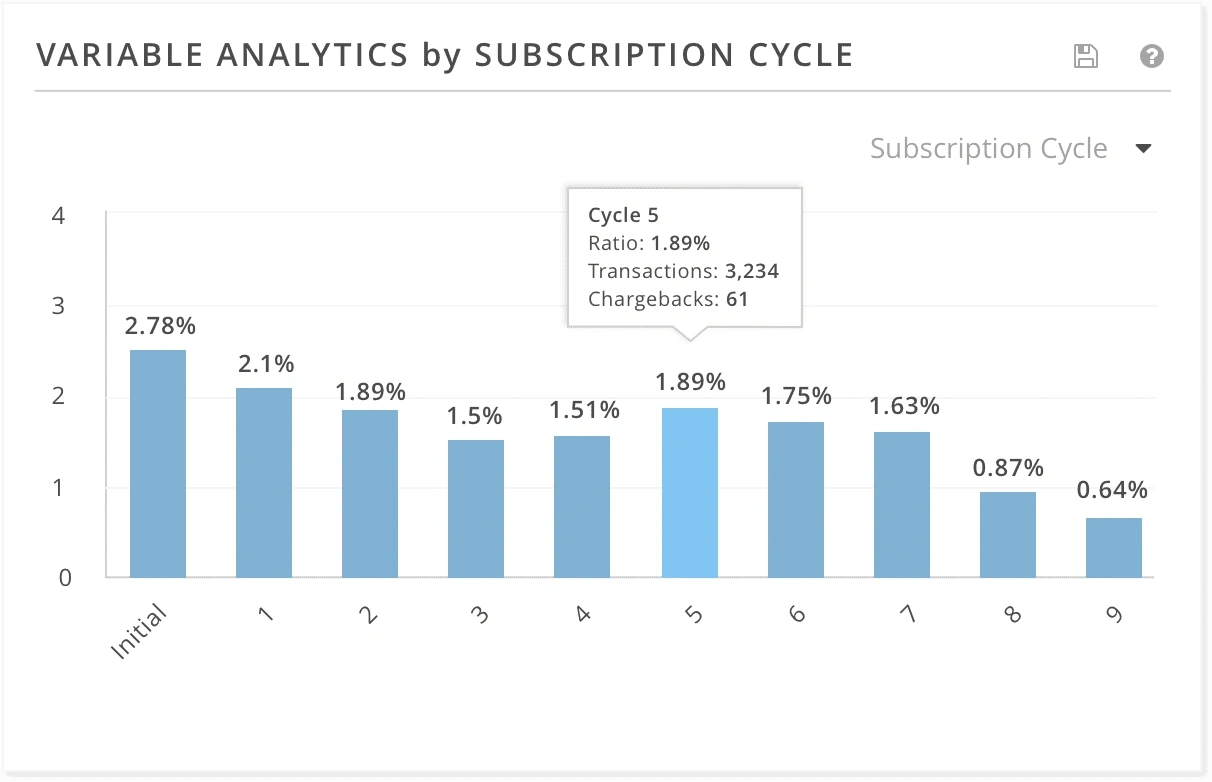

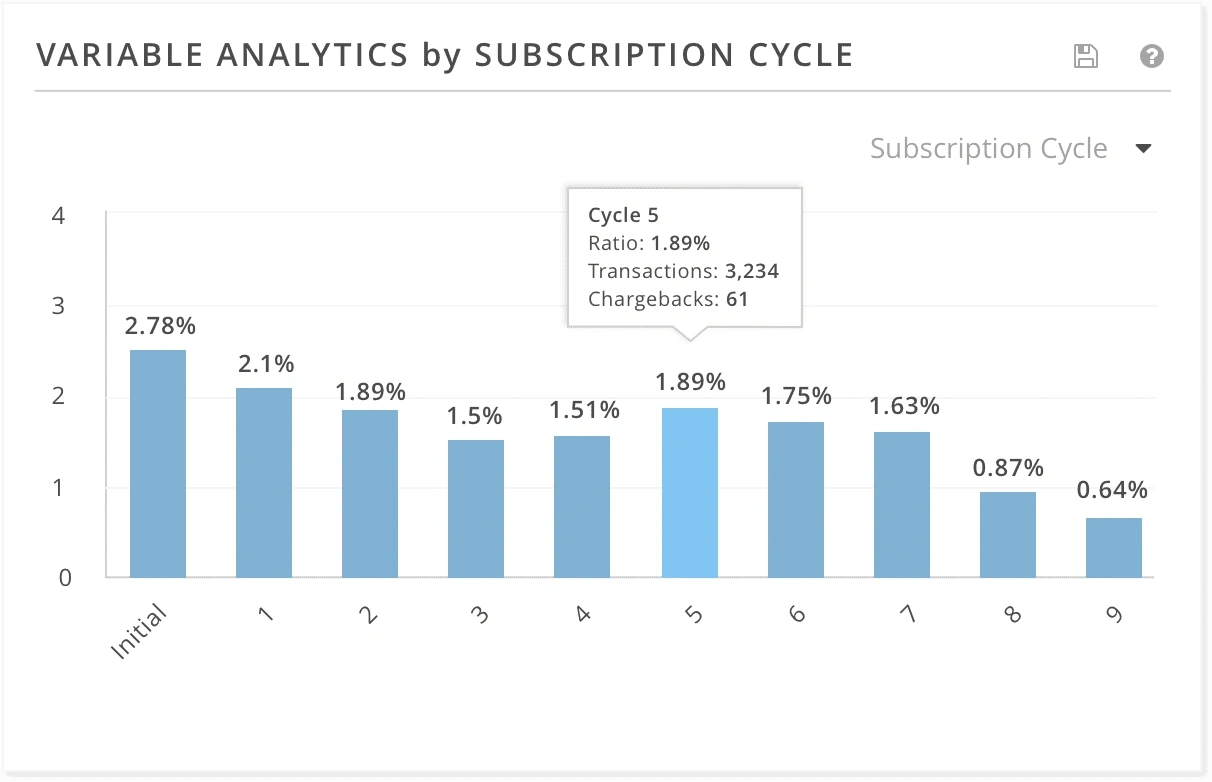

Stan runs a successful subscription business, but chargebacks recently increased. After analyzing his data, Stan found that chargebacks spiked after the fifth subscription billing cycle. He realized that perceived value tapered off the longer customers used his product. Sending a small gift and reminding customers of the cancellation policy helped Stan reduce chargebacks.

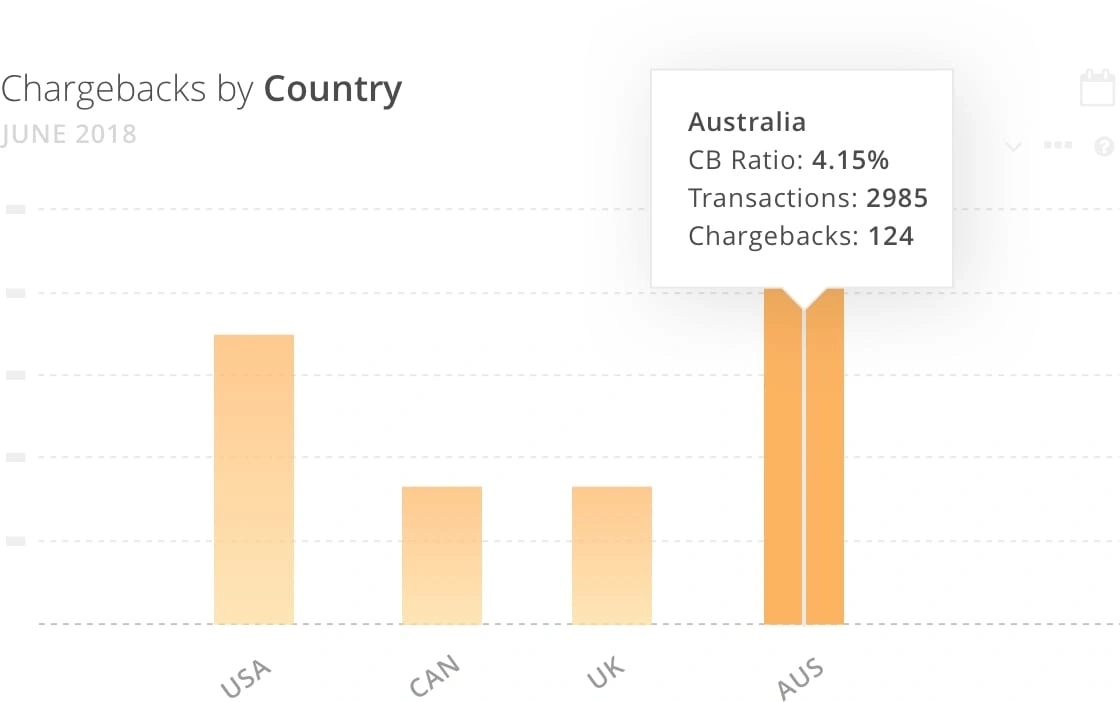

Pete expanded his business to include both domestic and international sales. But chargebacks quickly increased. Data revealed the majority of new chargebacks came from one particular country. Pete suspected that cultural differences made his sales tactics less appealing to certain customers. With A/B testing and more analysis, Pete was able to identify an appropriate sales structure that had a lower chargeback rate.

Walter’s business was doing great. But all of a sudden, chargeback counts went through the roof — and Walter had no idea why! An analysis of reason codes showed that ‘merchandise not received’ claims had gone way up. A quick chat with the warehouse manager revealed an error in the fulfillment process. Orders weren’t being shipped out! Resolving the issue brought an immediate reduction in chargebacks.

As you can see, data analysis is an effective chargeback protection technique. However, the added step of first collecting and organizing the information before analyzing it can be so time-consuming and costly that it negates all potential benefits.

On the other hand, if the data is consolidated for you and laid out in user-friendly reports, it’s easy to detect patterns and trends.

PRO TIP

Collecting and displaying real-time chargeback data is one of Kount’s specialities. Let us provide the in-depth reports. All you have to do is analyze the data. If you’d like to see the interactive analytics and reports for yourself, sign up for a demo.

Read more real-life examples of how merchants used analytics to uncover the hidden reason for chargebacks and solved issues at their source.

- How Analytics Help Merchants Sell in More Countries with Less Risk

- How Analytics Help Stop Fraudsters

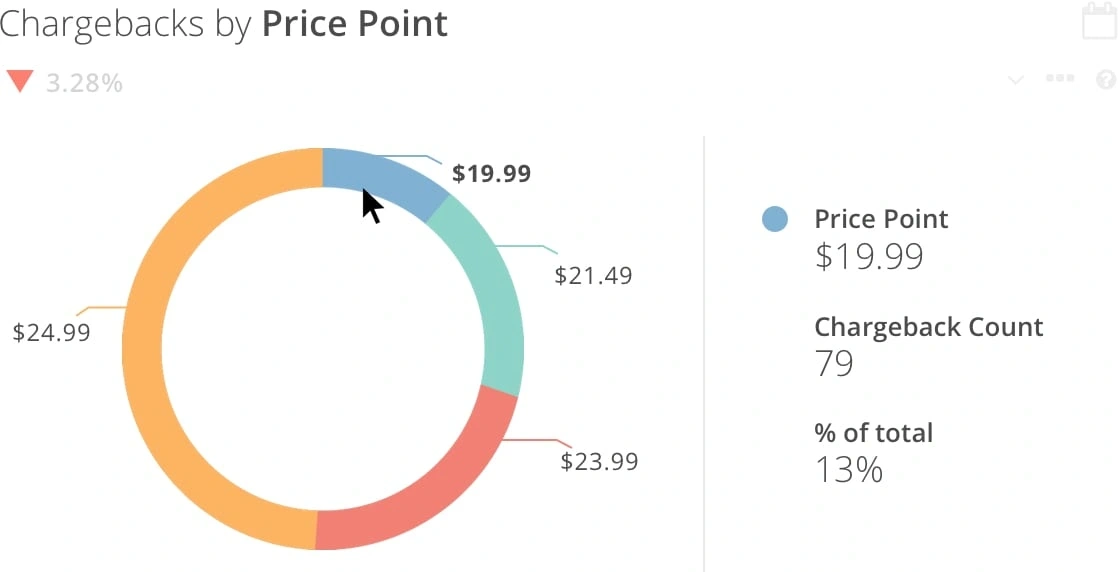

- How Analytics Help Determine the Perfect Price Point

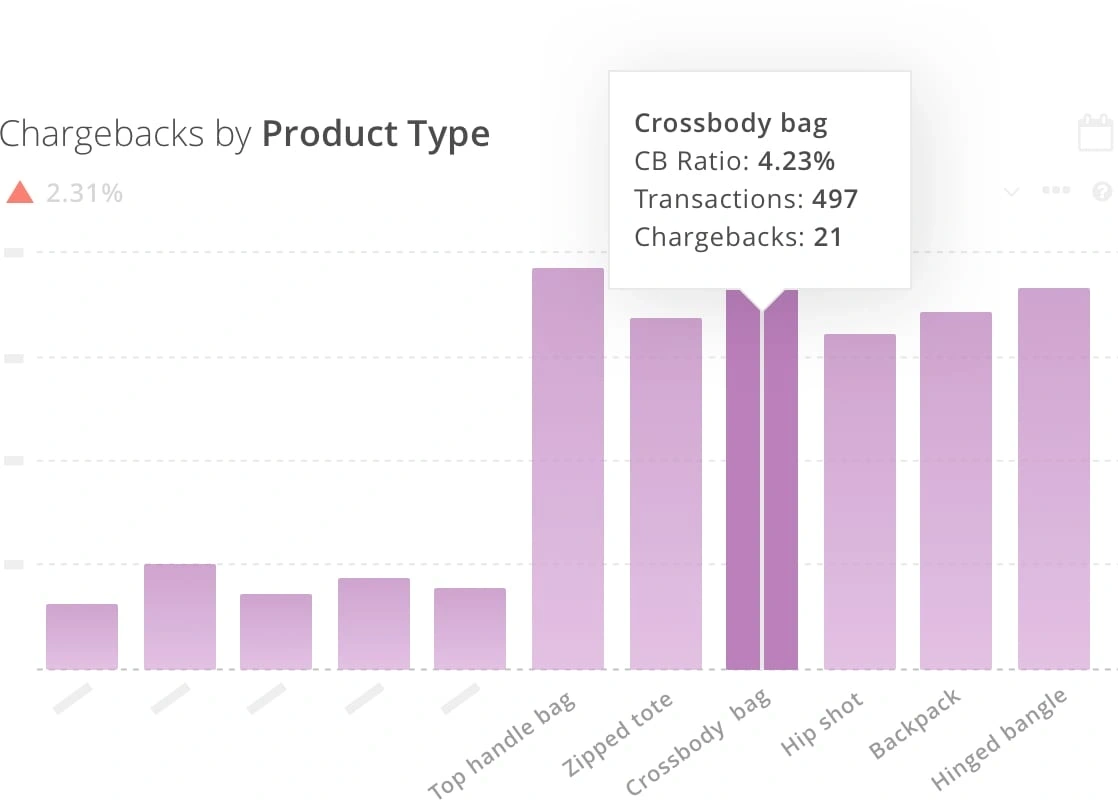

- How Analytics Help Uncover Merchant Errors

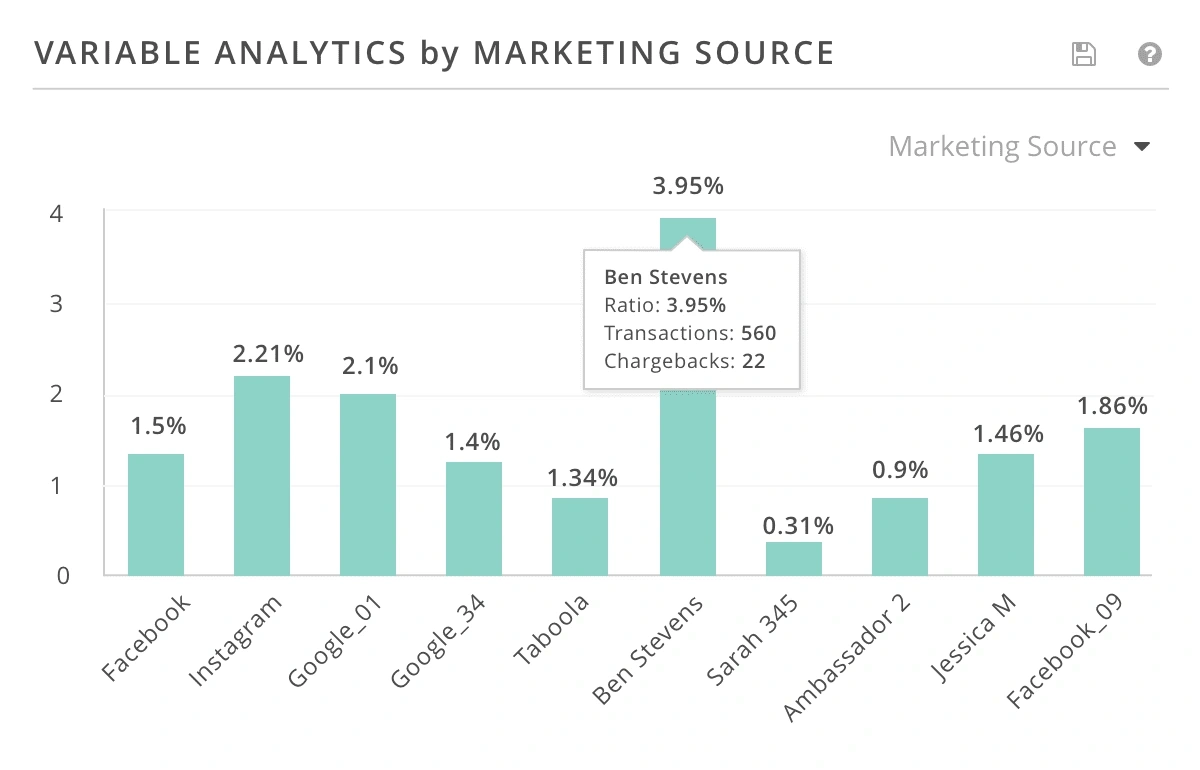

- How Analytics Help Expose High-Risk Marketing Sources

- How Analytics Help Expose High-Risk Issuing Banks

- How Analytics Help Prevent Subscription Billing Chargebacks

Business Updates that Reduce Chargebacks

Many disputes come from customers who are unhappy with their experiences or don’t find sufficient value in what was offered. With a little effort and attention to detail, it’s possible to avoid these chargebacks.

Turn your chargeback protection efforts into a company-wide initiative. Make sure everyone understands what’s at stake. Then carefully audit the procedures and practices of each department and touchpoint throughout the customer journey. Identify ways to become more customer-friendly and work to continuously optimize the experience.

Here are some specific things you can do to reduce the risk of chargebacks.

Update your product or service offerings.

If you want to reduce chargebacks, start with the very foundation of your business — the products you sell.

Sell high-quality items. Low-quality and counterfeit merchandise are easy targets for ‘not as described’ and ‘defective merchandise’ chargebacks.

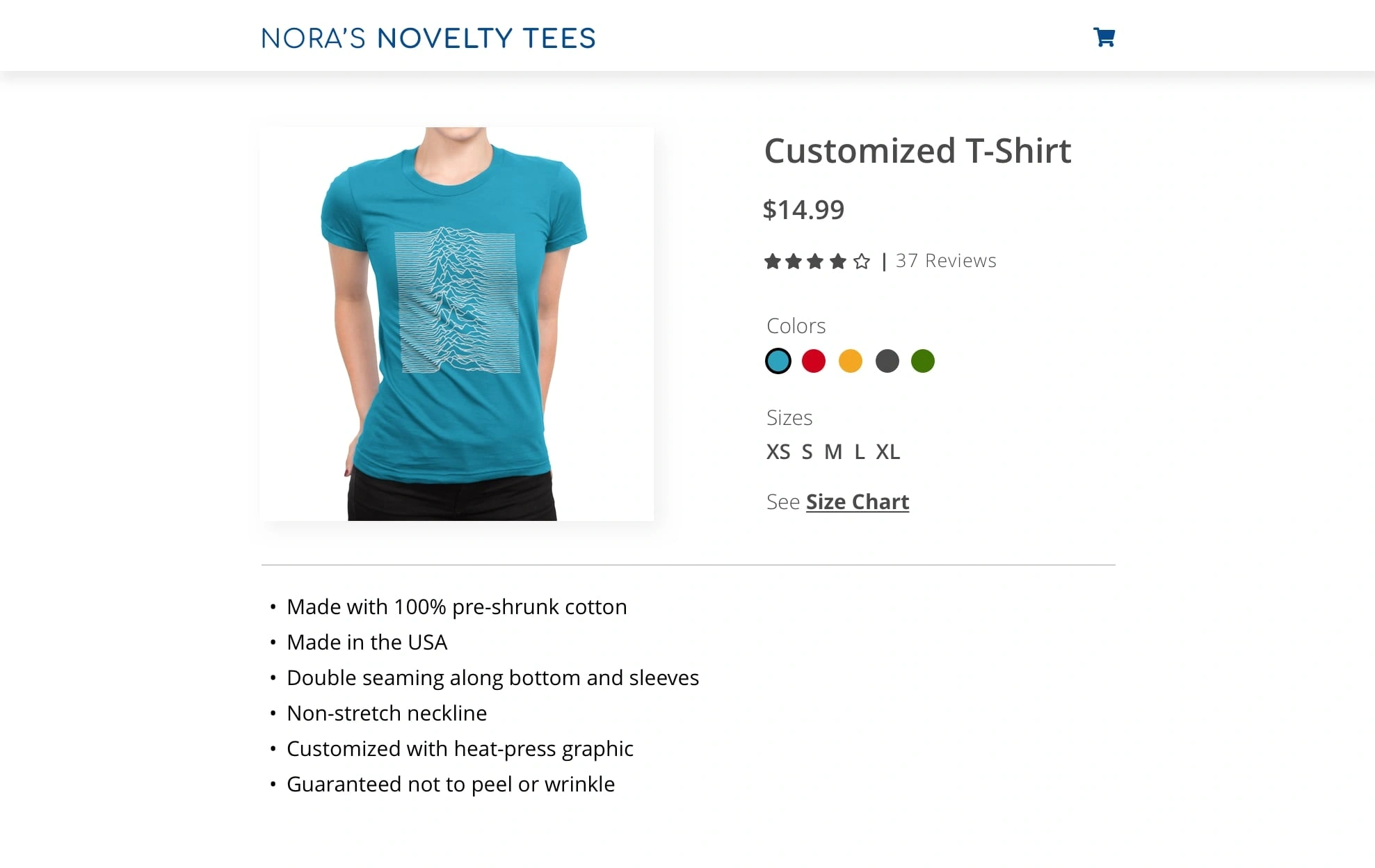

Clearly set expectations. Let customers know exactly what they are getting. Include every detail you can, including size, materials, colors, quantity, etc.

Be cautious of custom orders. It’s easy to disappoint customers with personalized orders. Maybe the customer forgot to share certain desires or didn’t realize how the final product would really look. And, unique, one-of-a-kind items usually come with a no return policy since the merchandise can’t be resold. These two things combined can lead to an influx of ‘not as described’ chargebacks.

Find the “sweet spot” for product prices. Run A/B tests to determine which price points are most likely to initiate chargebacks. Pick prices that provide sufficient revenue, but reduce chargebacks.

Drop products that generate more risk than revenue. Determine which products are receiving the most chargebacks. You can do this by analyzing chargeback data by product type. You can also survey your cusomters. Ask about perceived value and quality.

Check your marketing strategies.

Merchants often overlook marketing tactics when they build a strategy to reduce chargebacks. But if you want comprehensive protection, you can’t leave anything out!

Comply with marketing best practices. Check to make sure your marketing efforts aren’t unknowingly causing chargebacks. Don’t engage in bait-and-switch tactics. Don’t hide important details in the fine print. Don’t overpromise. For a complete listing of dos and don’ts, check with the FTC.

Replace high-risk marketing sources with target-rich sources. Learn which marketing sources are generating the most and least chargebacks. Focus your marketing dollars on the sources that have the highest profitability, and eliminate the sources that have high chargeback ratios.

Follow card brand rules.

Everyone — from processors and card brands to local and federal governments — has rules about how payments should be handled. If you break a rule, even if it’s an innocent mistake, you may receive a chargeback.

Respond to retrieval requests. Retrieval requests are pretty rare — they are primarily used by American Express® and Discover®. But if you do receive one, reply as soon as you can. You could receive a ‘no reply’ chargeback if you don’t.

Request all necessary information. Make sure you have all the information necessary to process the transaction — specifically the card expiration date. Some chargebacks are only valid if the card has expired. Declining transactions on expired cards can help you avoid chargebacks.

Settle transactions within the specified time limit. Domestic transactions usually have to be settled within 7 - 14 business days. International transactions might have up to 30 business days. But the sooner you finalize the transaction, the less likely you are to receive a ‘late presentment’ chargeback.

Request authorization. Technically, there are some transactions that don’t need to be authorized by the issuer. However, it’s safest to always request authorization — no matter the amount or type of transaction. That way, you can avoid any authorization-related chargebacks.

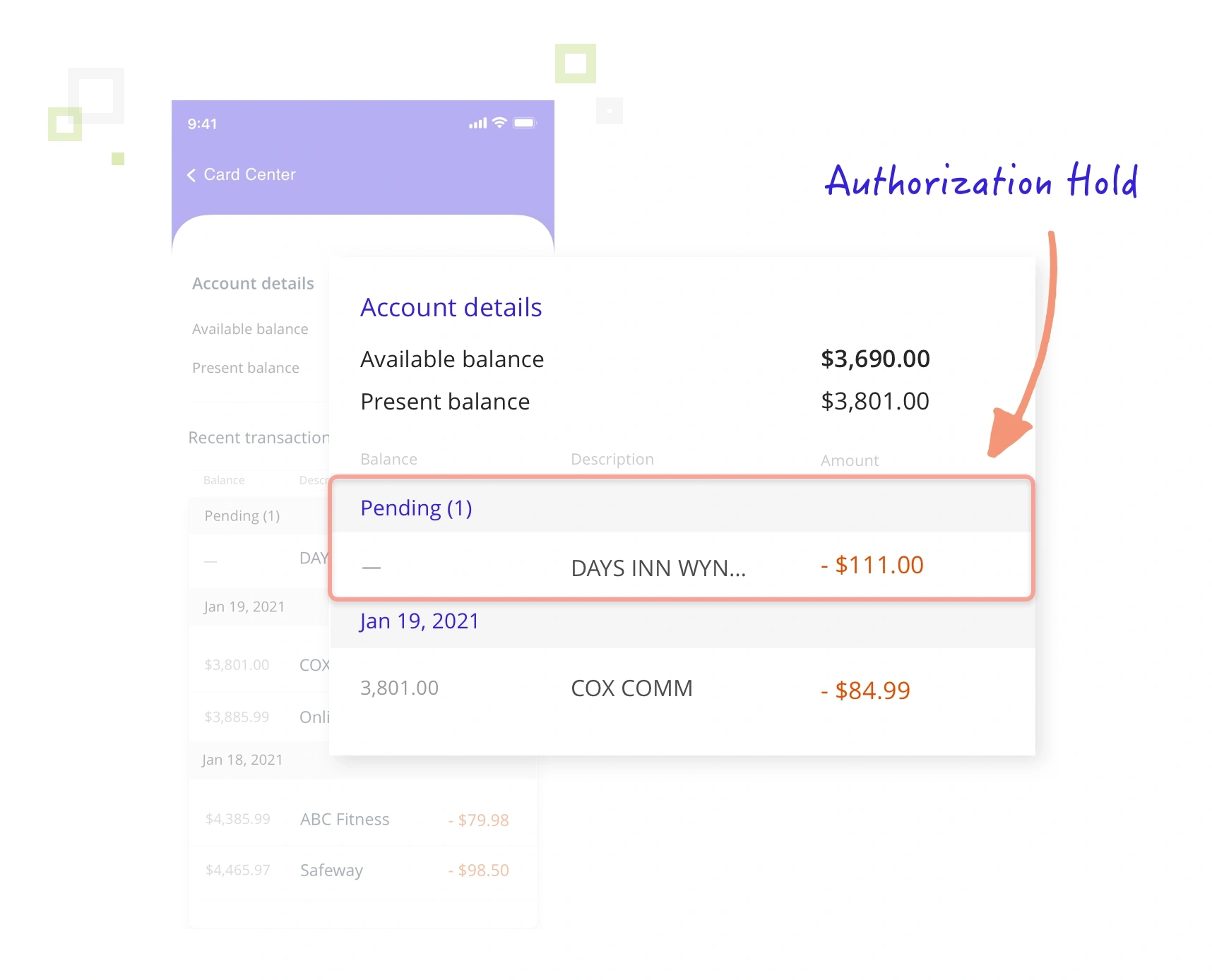

Know how to use authorization holds. Authorization holds are a double-edged sword. They can help you prevent chargebacks if you know how to use them — but they can cause chargebacks if you don’t.

Apply tips and surcharges correctly. Certain types of transactions — for example, bar tabs — can be authorized for an amount that’s greater than the actual purchase. Make sure you know what the allowed markup is. Otherwise, you open the door to ’transaction amount differs’ chargebacks.

Void any duplicate transactions. Don’t process a transaction more than once. If you do, you could get a ‘duplicate transaction’ or ‘paid by other means’ chargeback.

Make sure you process a credit, not a debit. This seems like an obvious hint, but make sure refunds don’t accidentally turn into a charge on the cardholder’s account. ‘Credit processed as a charge’ disputes are real!

Only quote realistic amounts. If you give your customers a quote before performing a service or providing merchandise, make sure you share accurate, realistic numbers. Otherwise, you could get an ’unreasonable amount’ chargeback.

Comply with region-specific regulations.

If you sell to a global marketplace, your efforts to prevent chargebacks will need to be more extensive than if you have a domestic-only sales structure.

Don’t automatically process transactions with Dynamic Currency Conversion (DCC). All transactions must be processed in the local (merchant’s) currency unless the cardholder specifically chooses to use Dynamic Currency Conversion. DCC gives cardholders the option to process a transaction in the issuing bank’s currency instead of the merchant’s currency. However, DCC usually comes with additional fees for the cardholder. If you use DCC without giving the cardholder the option to pay in the local currency, you could receive ‘incorrect currency’ chargebacks.

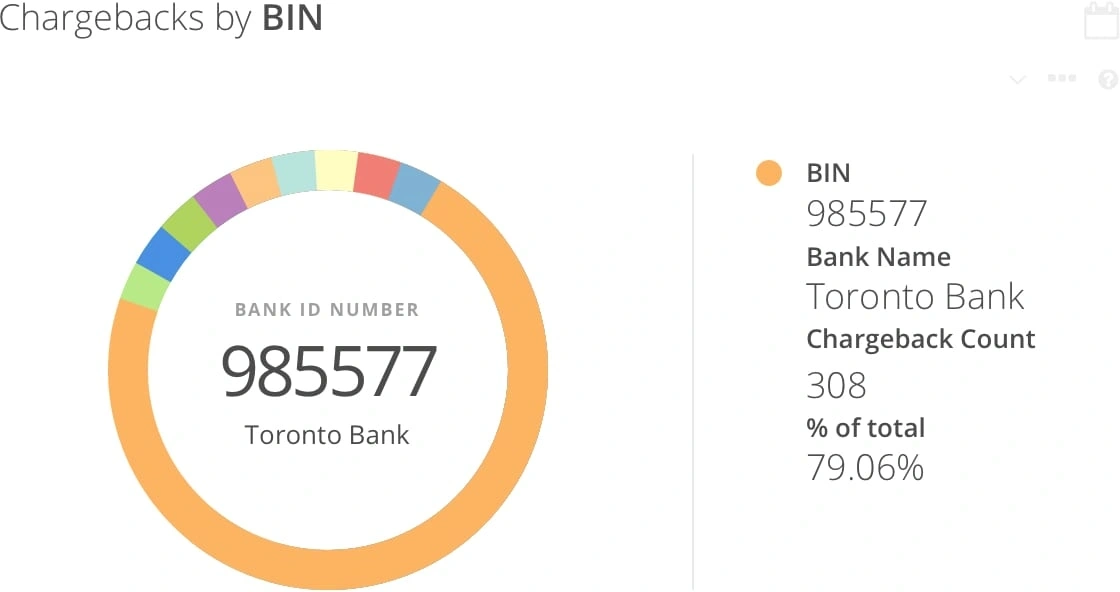

Determine which issuing banks are generating the most chargebacks. You can do this by analyzing chargeback data by bank identification number (BIN). Funnel this information into pre-sale transaction scrubbing and chargeback response fight rules.

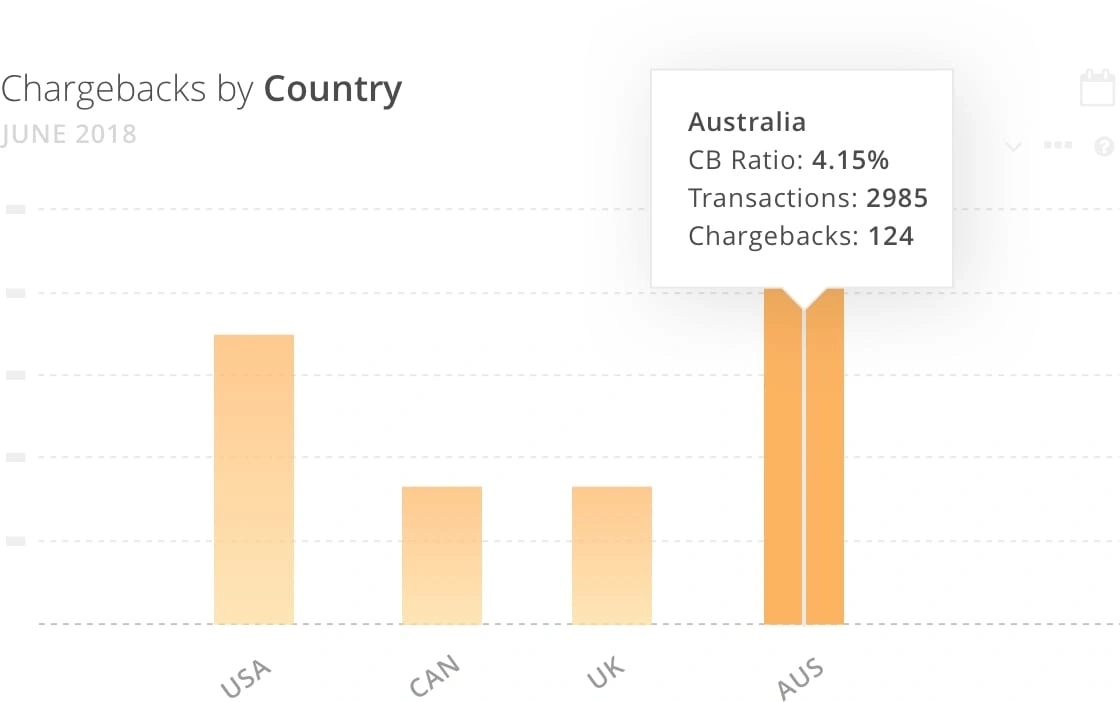

Evaluate risk vs. revenue on a country-by-country basis. Monitor the risks associated with each country as you add new markets. You can do this by analyzing chargeback data by country.

Use billing best practices.

There are steps you can take before and after processing a payment to reduce chargebacks.

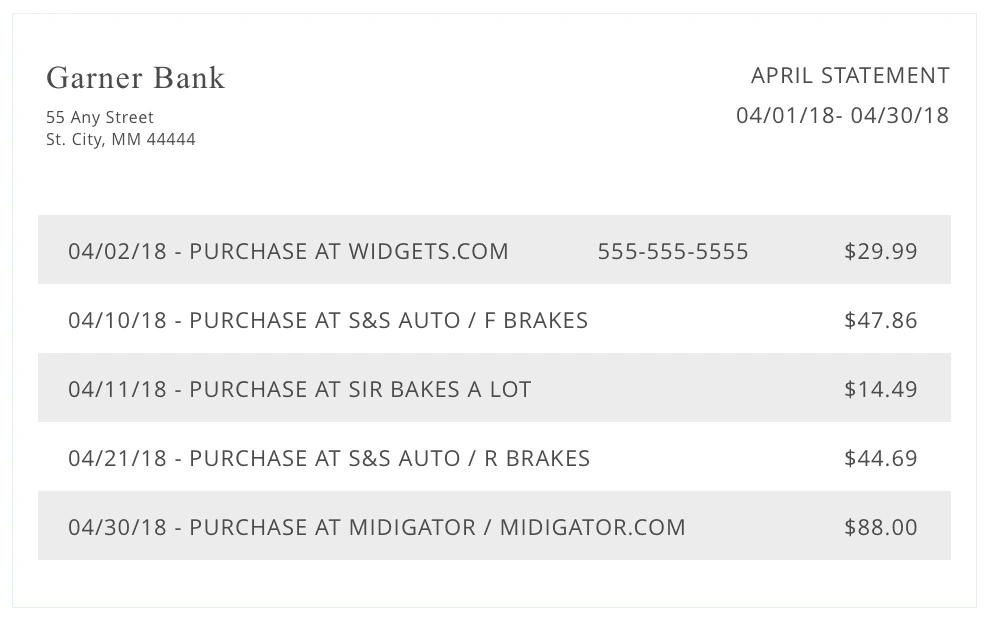

Test your billing descriptors. A billing descriptor is the short explanation of the transaction that appears on the cardholder’s statement. Descriptors play an important role in your effort to reduce chargebacks. If cardholders don’t recognize your descriptor, they might suspect fraud. Run several test purchases using different card types (Mastercard, Visa, debit, credit) to check how your descriptor displays. Consider these things while you are testing:

- For most processors, the default setting for your descriptor is your legal business name. If your legal name is different from your “doing business name,” ask your processor to replace your legal name with something your customers are familiar with.

- The length of the descriptor will depend on the issuing bank. Some issuers will truncate the descriptor so the full message won’t be displayed. This can cause confusion. Descriptors can be anywhere from 20-25 letters. If those last couple of letters are important, try abbreviations so more of your message will be conveyed.

- Depending on the length of your business name, your descriptor could also include your business phone number. This helps increase the odds the customer will contact you with issues instead of the bank. Make sure the phone number you have listed is operational and someone answers 24/7.

- Ask your processor if dynamic descriptors are an option. A dynamic descriptor will include your standard descriptor, followed by additional, transaction-specific information. For example, a descriptor would be “S&S Auto”. A dynamic descriptor would be “S&S Auto/FordTransmission”.

- Descriptors are set on a per-MID basis. Each merchant account will have its own descriptor. If you need to make changes, contact your processor and have your merchant account identification number ready.

Don’t charge the card until you are ready to ship the merchandise. The greater the amount of time between payment and receipt of merchandise, the greater the risk of a chargeback.

Update card-on-file information. If you allow merchants to store card information or if you use a recurring billing model, you’ll want to make sure account information is up-to-date before charging the card again. Otherwise, there is a chance transactions can clear with invalid account numbers — which would become chargebacks.

Remind customers of recurring payments before charging the card. If you charge customers on a quarterly or annual billing cycle, they may forget about the upcoming payment. Or, they might not recognize it on their statement. Notifying customers before charging the card could reduce chargebacks and doesn’t necessarily mean you’ll lose the sale.

Fulfill refund requests promptly. If you take too long to issue a refund, the cardholder could get impatient and request a chargeback. Send an email after the refund or cancelation has been issued. Let your customers know you've acted upon their requests and estimate when they can expect to see the money returned to their account.

Use fallback options — like manually entering transaction data — as a last resort. If you do perform a key-entered transaction, make an imprint of the card.

Only use EMV-compliant terminals. If applicable, upgrade to a PIN-preferring POS for the highest level of protection.

Act preemptively. If you use a recurring billing model, analyze chargeback data by billing cycle. Figure out which cycle is most likely to trigger chargebacks. Then, act preemptively. Reach out and inquire about satisfaction. Send a free gift. Do whatever you can to get the customer excited about your products or services again.

Conduct manual fraud reviews.

Manual reviews are a labor-intensive process, but with the right insight you can make data-driven decisions that will help you avoid chargebacks. Check this article for warning signs of fraud.

Follow up on irregular orders placed by regular customers. Suppose a regular customer has ordered two packs of diapers every month for a year. But all of a sudden, you get an order for 10 packs of diapers. Your customer might just be stocking up — or it could be a mistake. Follow up to reduce the risk of a chargeback.

Follow up on repeat orders or multiple purchases of the same item. Criminals will often buy items in bulk for easier resale, or they’ll make a second purchase if the first goes undetected. Or, a cardholder’s kid might buy 100 lives in their favorite online game. Regardless of who you think the potential fraudster is, you should check up on anything that seems suspicious. If you want to automate this task, see if your fraud detection tool or processor conducts velocity checks.

Keep a close eye on low-dollar merchandise. Criminals often “run” a card — they make small purchases that will hopefully go unnoticed so they can determine if a card is still valid. These test purchases will result in chargebacks.

Set fulfillment expectations.

Processing good orders is only half the battle. To reduce chargebacks, you have to make sure fulfillment goes smoothly too.

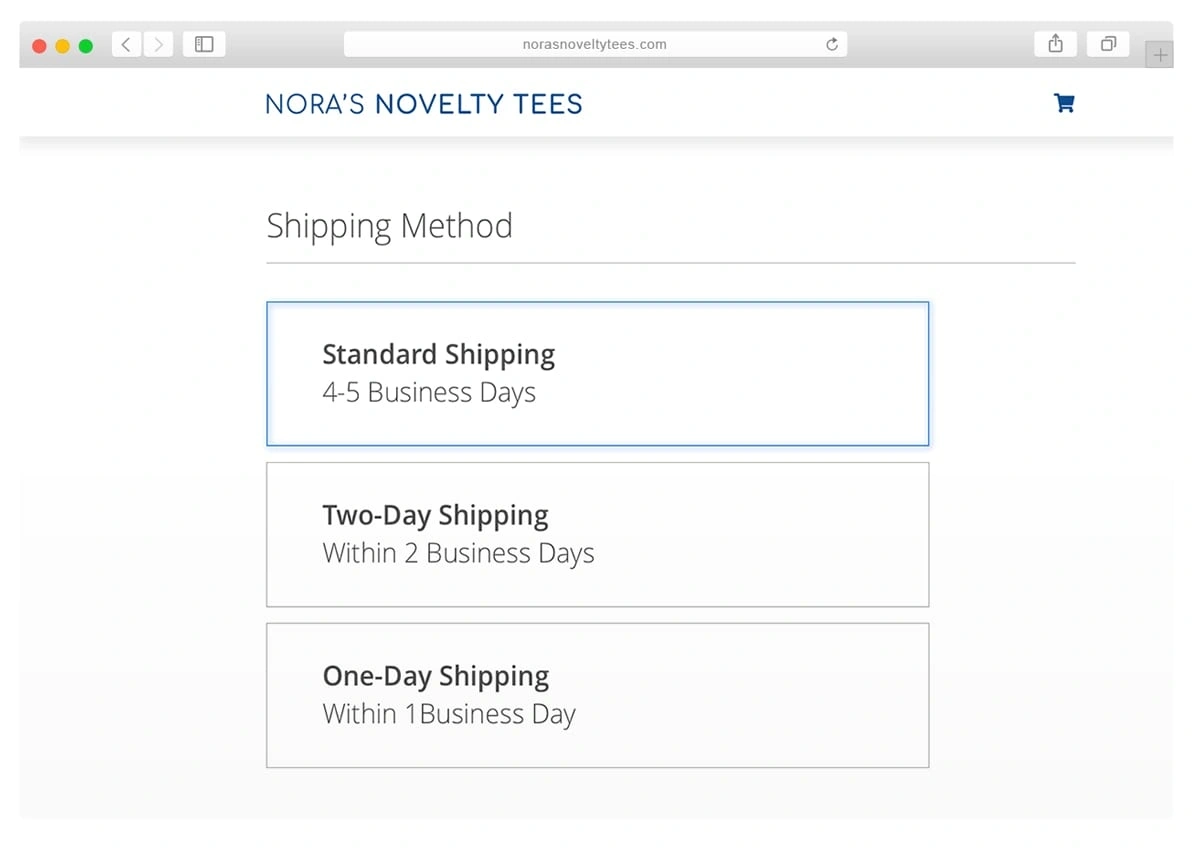

Offer a variety of shipping prices and speeds. Some customers will be happy to receive your merchandise whenever it arrives. But if other customers are going to demand exceptionally fast service and file chargebacks if they don’t get it, you’ll want to do your best to meet their high expectations.

Make sure your delivery estimates are accurate. Be honest with yourself about how long it will take to fulfill and ship orders. Chargebacks are warranted if you aren’t living up to your promises.

Package merchandise correctly. Use the correct size boxes and sufficient packing material so items don’t break in transit.

Send the correct merchandise. This seems obvious, but you’ll need to make sure your fulfillment department is familiar with your merchandise, has a complete understanding of what has been purchased, and knows what to ship.

Monitor inventory. Make sure your fulfillment department has a way to report low inventory. You don’t want to find out after an order has been placed that you can’t fulfill it — that’s a chargeback waiting to happen.

Check digital products. Confirm that the correct items are being delivered. Make sure the actual file type and size match what you've promised. Look for downloading errors or other technical glitches.

Follow through with services. If you've promised to perform a service, do it! And do it the way you've said you would. Don't cut corners, show up late, or cheapen the experience.

Check your policies.

Fair and easy-to-understand policies help reduce chargebacks. Check this article for more details and insights on writing policies that prevent chargebacks.

Write user-friendly return and cancellation policies. The more customer-centric your policies, the more chargebacks you can avoid. Be as lenient and flexible as possible. And, make sure your policies are dynamic. For example, does your return time limit need to change from 30 days to 90 days after the holidays?

Make sure your policies are easy to understand. Use concise, straightforward wording. The customer needs to know exactly what is expected — both on the customer end and how you’ll respond.

Add customer reviews to your policy page. Ask satisfied customers to explain how easy your return process is and how helpful your customer service team is. Other shoppers may be enticed to give it a try instead of a chargeback.

Make your policies easy to find. Your policies need to be easily accessible at three different stages. First, customers should know what they are getting themselves into before completing the purchase. Include a link to your policy page in the product description and on the checkout page. Second, customers might want to reference the information after the purchase has been made. Include a link to the policy page in the order confirmation email. And third, customers will need access to policy information if they want a refund or cancellation. Make navigation to your policies clear and simple from the homepage.

Ask customers to read and agree to policies before making a purchase. Consider adding an “I have read the return policy” box to the checkout page.

Provide outstanding customer service.

Only a small percentage of customers contact the merchant before initiating a dispute, so it’s important that every interaction is optimized to its fullest potential to reduce chargebacks.

Consider offering live chat. Live chats could potentially help you “talk off” disputes in real time. Having someone answer even the simplest questions like, “Where can I find your return policy?” or, “When will my package arrive?” could resolve problems before the issue escalates to a chargeback.

Answer emails promptly. Numerous studies have found customers expect a response to email inquiries within one to six hours. If you fail to meet their expectations, they might file a chargeback out of spite.

Respond to emails with personalized solutions. An autoresponder can be used to acknowledge a customer complaint, but it usually needs to be followed by a personalized message that addresses the customer's unique situation.

Monitor social media. Businesses use social media for marketing. Consumers use it for communication. Be prepared to field grievances there, just like you would with any other communication channel.

Check call wait times. If you use a call center, ask for detailed analytics regarding call wait times. Many call centers will report the average wait time, but you need to check the longest wait time. Long wait times result in more chargebacks.

Share your contact information. Publish your contact information in as many places as possible — your website, email signatures, social media, etc. Eliminate the risk of chargebacks happening simply because customers don’t know how to reach you.

Check online review sites. If your customers are unhappy about something, you need to know about it! However, studies show you’ll only hear from 4% of dissatisfied customers. Online review sites could give you a better understanding of your customers’ true feelings and might reveal issues you didn’t know about.

PRO TIP

Does this step seem overwhelming? Are you unsure of where to begin and what to look for? Sign up for prevention services from Kount, and your account manager will become your trusted advisors as you build an effective chargeback prevention strategy.

Regular consultations will ensure you stay current on topics like new prevention tools and techniques, industry trends, emerging threats, best practices, and much more.

Measuring Success

How do you know if your chargeback prevention strategy is working? Are your results as good as they should be?

Let’s take a look at which metrics you should monitor, what your targets should be for each one, and how you can improve your outcomes.

How the Card Brands Evaluate Your Chargeback Management Skills

The card brands (Mastercard, Visa, etc.) are very interested in your ability — or inability — to prevent chargebacks. Because your risky business decisions could impact everyone else in the ecosystem — the brands, their banks, and their cardholders.

The brands use two metrics to evaluate how well you are preventing chargebacks:

- Chargeback count

- Chargeback-to-transaction ratio

Chargeback count is how many chargebacks you receive in a month. Chargeback-to-transaction ratio is the percent of monthly transactions that turn into chargebacks.

| Number of chargebacks ÷ Number of transactions x 100 = CTR |

Visa, American Express, and Discover base the calculation on the number of transactions processed in the current month. Mastercard uses the number of transactions processed in the previous month.

The card brands have set thresholds for both of these metrics and monitor them on a month-by-month basis. There are a few exceptions to the rule, but most merchants are expected to stay below these thresholds:

Chargeback count less than 100 and a ratio less than 1% for the month.

Chargeback count less than 100 and a ratio less than 0.9% for the month.

What Happens if You Don’t Prevent Chargebacks

So what if you don’t do a good job preventing chargebacks? What will happen if you go over the card brands’ chargeback thresholds?

A couple things might occur.

- You may be enrolled in a chargeback monitoring program. If your chargeback activity is over the limit for several consecutive months, you’ll be eligible for one or more monitoring programs.

- You may pay additional fees. The longer you are in a chargeback monitoring program, the more you’ll have to pay.

Beyond that, there isn’t a hard-and-fast rule for what comes next. From a merchant’s perspective, there are a lot of unknowns.

There are rules for how a card brand responds to excessive chargebacks — there are established penalties that will get doled out to your bank. But then your bank decides how much of those penalties to pass along to you — and there’s no telling what that decision will be.

Your bank’s reaction could be lenient or strict — it all depends on the circumstances. Since each situation is unique — a unique combination of chargeback activity, merchant initiative, business type, banking preference, and more — every response is different.

Here are some of the most common disciplinary actions that are taken:

- You may pay even more in fees. In addition to the monitoring program fees assigned by the card brands, your bank may apply other fines.

- You may be asked to create a chargeback reduction plan. A chargeback reduction plan, sometimes referred to as a dispute remediation plan, is a formal document that outlines the steps you’ll take to get your chargeback activity under control. This plan will help the bank gauge your ability to solve your current chargeback problem and stop it from happening again in the future.

- You may lose the ability to process payments. Account closure is one of the most severe consequences. After a certain amount of time in a chargeback monitoring program, the card brand will demand that the bank revoke your payment processing privileges. But the reality is, your bank will probably cut ties much sooner than the card brand requirement.

Chargeback prevention is a very important task. Make it a priority, and your business will flourish. But overlook its value, and your business could suffer irreparable damage.

PRO TIP

Recognize the importance of chargeback prevention but overwhelmed by the process? Let Kount help. We provide an all-in-one solution to prevent chargebacks with the best results, fewest costs, and least effort. Sign up for a demo to learn more.

How to Measure Your Own Success

We’ve covered how the card brands and the bank critique your abilities. But what metrics should you use to measure the effectiveness of your chargeback prevention strategy?

The following are some of the key performance indicators (KPIs) that you may want to consider.

METRIC #1

Chargeback Count

Of all the KPIs that we recommend, this metric should be the least significant.

Why? Because there isn’t any context.

For example, should you freak out if your monthly chargeback count is 25% more than your average? Not if sales increased by 70%. On the other hand, should you keep a marketing campaign just because the chargeback count is 25% less than other campaigns? Not if sales from that campaign are 70% less than the others.

So why do we suggest you monitor this metric? Because the card brands do. You need to have the same information they do. And you need to keep your activity within their set restrictions.

Monitor the count for your entire portfolio, each individual merchant account, and each individual brand.

METRIC #2

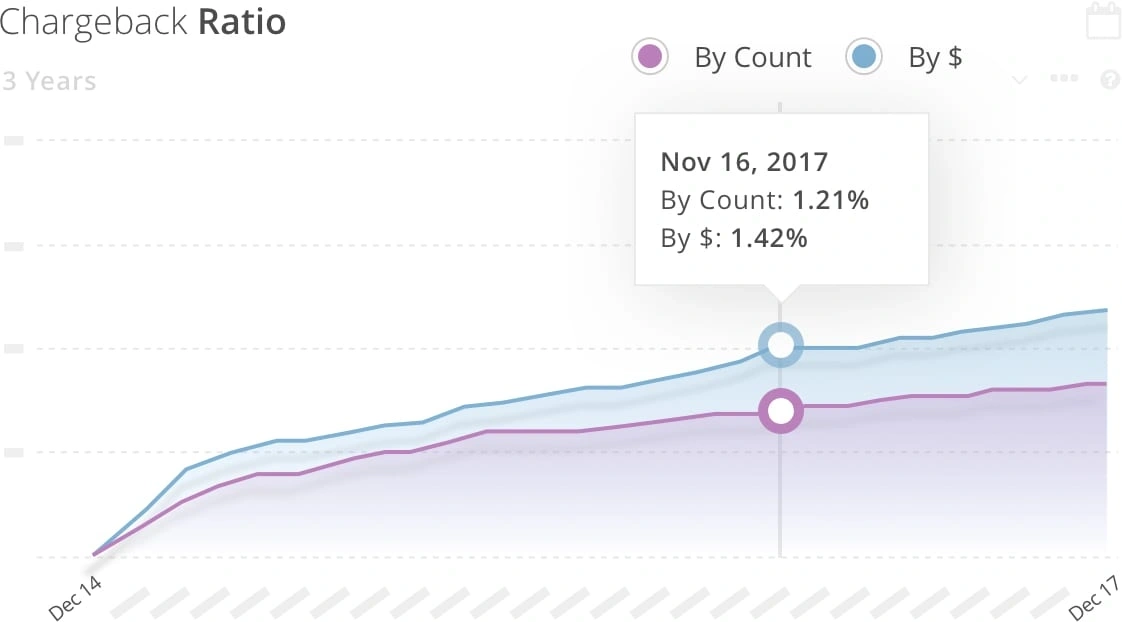

Chargeback-to-Transaction Ratio

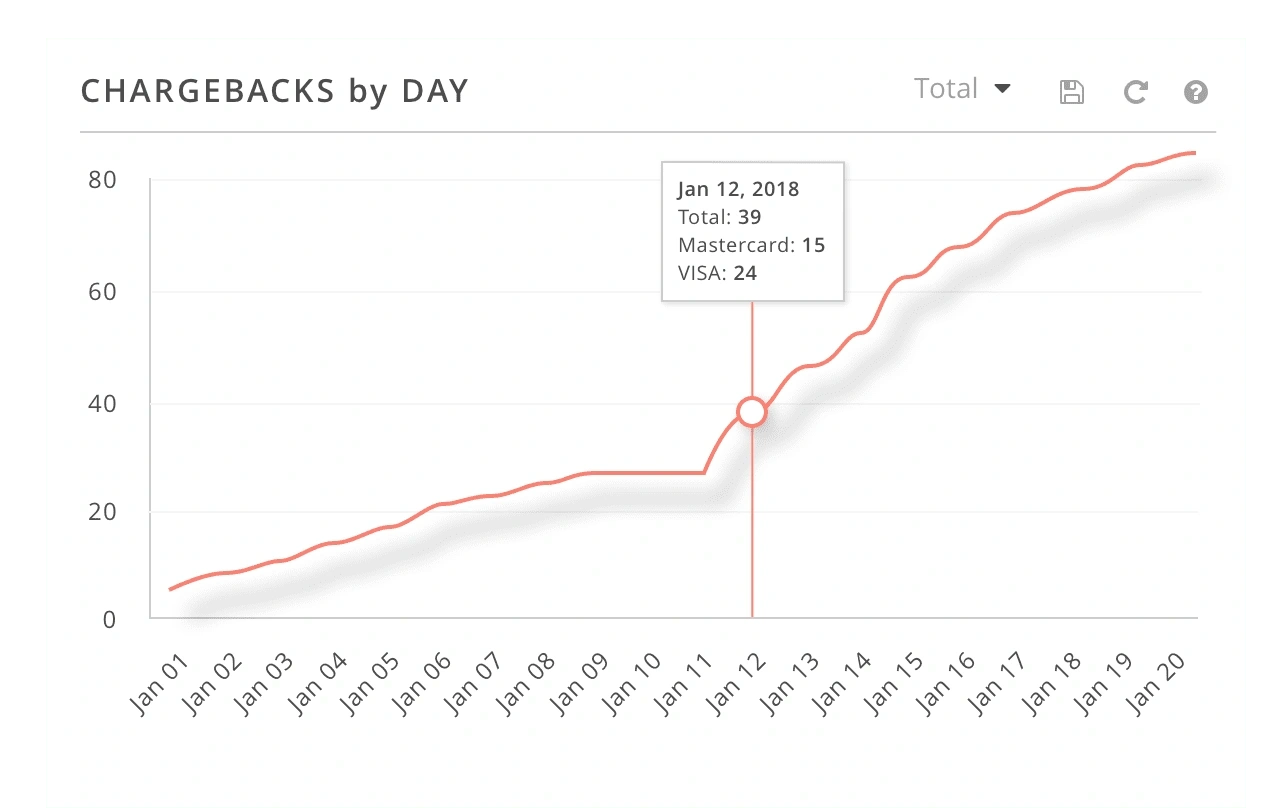

This is another metric that the card brands monitor — so you should too. Monitor activity on a daily basis. Look for unexpected spikes in activity that could cause potential threshold breaches.

Monitor the ratio for your entire portfolio, each individual merchant account, and each individual brand.

As you analyze your data, check the percent of increase or decrease in your chargeback-to-transaction ratio every month. If your ratio is escalating, take a critical look at what you are doing and why. Maybe you need more layers of protection. Or maybe you need to fine-tune your acceptance rules.

What can you do to keep risk in check?

METRIC #3

Percent of Chargebacks Prevented

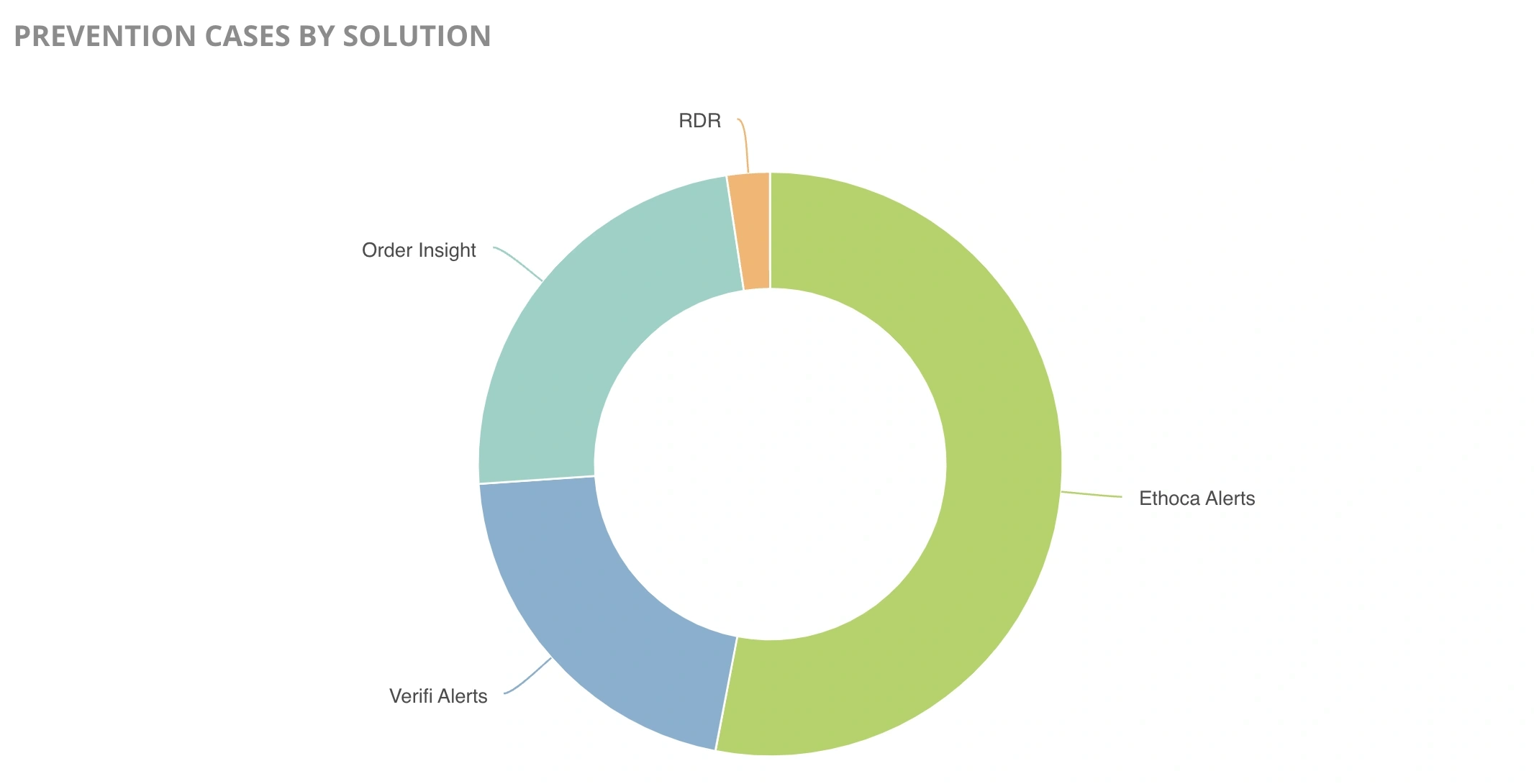

If you use tools like order validation and prevention alerts, you’ll want to monitor the percent of chargebacks that are successfully blocked.

Calculate the percentage for each individual tool. For example:

| Alerts ÷ (Alerts + Chargebacks) x 100 = Percent Prevented |

You’ll also want to determine the effectiveness of your strategy as a whole. That equation could look something like this:

| (Alerts + RDR + OI) ÷ (Alerts + RDR + OI + Chargebacks) x 100 = Percent Prevented |

Remember, the more tools you use, the greater your protection will be. If you use both Ethoca and Verifi alerts, you’ll probably prevent about 30-40% of your chargebacks. Order validation will add another 10% or so. RDR usually stops up to 90% of Visa disputes.

If your results aren’t what you expected, take a look at how you are using the different tools.

For example, are you only sending static information through order validation? Would dynamic responses increase your success rate? If you are managing alerts manually, could you automate the process and reduce the risk of expired cases?

METRIC #4

Percent of Overlap

In a perfect world, your chargeback prevention strategy would work exactly as you planned. But unfortunately, things don’t always turn out the way you want them to!

Using multiple prevention tools means you have the greatest protection possible. But it also means there is a chance of overlap between the technologies.

For example, you could receive a prevention alert from both Ethoca and Verifi. Or you may receive a chargeback after using order validation.

These occurrences are usually very minimal for most merchants. And even though there is a risk of overlap, we still recommend you create these multi-layer strategies. You just have to carefully monitor the situation.

If you are seeing an unusually high amount of overlap, investigate. Are there any hidden errors causing the issue? If you can’t find a logical reason for the overlap, reach out to your account manager for help.

PRO TIP

Worried about the risk associated with complete chargeback prevention? Let Kount help.

Our team of experts can help you determine which prevention tools will be most relevant and valuable to your business. Then, you can easily manage and monitor all your tools from a single dashboard. The transparency of Kount’s all-in-one technology ensures the best revenue protection possible with the least risk, effort, and costs. Sign up for a demo today to learn more.

METRIC #5

Productivity

If your team is manually responding to prevention alerts, you’ll want to carefully monitor productivity.

Prevention alerts have strict response deadlines — they usually need to be addressed within 24 hours or less. If an alert expires, it will probably turn into a chargeback.

If you are regularly missing deadlines, check in with your team. What can you do to increase efficiency and improve accuracy?

PRO TIP

Want to eliminate the risk of expired alerts? Automate the response process! Contact Kount if you’d like to replace error-prone manual processes with efficient technology.

How to Improve Results

Once you know which KPIs to monitor and how to calculate those metrics, you’ll want to work on enhancing your outcomes. After all, there’s always room for improvement!

Here are some things to consider.

- Be open minded. We’ve shared a lot of tips and information in this guide. Some of our suggestions might seem a bit unorthodox or irrelevant to your business. But don’t just brush them off. Our team has decades of experience. We’ve read the rule books, conducted the research, and tested different strategies. We’ve done the hard work for you. All you have to do is trust us!

- Try to be objective. We know that change can be hard. And criticism — even constructive criticism — isn’t always well received. Focus on the big picture and what it takes to meet your goals.

- Get help. Chargebacks are complicated. And, if we are honest, they’re unfair too. Rules are complex. And they change regularly. Unspoken expectations make you feel like you have to be a mind reader. How do you know if your results are as good as they could be or what would make them better? Let the professionals help. Insider insights, proven-effective strategies, and efficient technology will make all the difference.

A WORD OF WARNING

There is nothing good about a chargeback but a whole lot that is bad. It’s completely natural to want to minimize all those terrible things as much as possible.

But don’t go overboard.

Your chargeback protection efforts need to balance risk with reward. With the wrong strategies and focus, you’ll reduce revenue as you reduce risk. You’ll stop chargebacks, but you’ll also stop good sales.

Look at the big picture. Focus on a comprehensive plan with multiple layers of protection rather than using one or two tools with rigid and restrictive rules. Constantly analyze your outcomes and make adjustments to find the perfect balance.

Integrating Prevention into Your Strategy

You probably came to this article because you were looking for actionable advice on how to reduce chargebacks. We can certainly help you with that — but we want to offer a word of warning.

Don’t focus exclusively on preventing chargebacks. |

It might seem like chargeback prevention is the most pressing need right now, and it should be the top priority. That’s fine — but don’t make it the only priority.

Remember, it’s impossible to eliminate the risk of chargebacks — no matter how hard you try.

You can definitely work on minimizing chargebacks, but fit those tasks within the bigger, broader initiative of minimizing the overall impact that chargebacks have on your business.

Think of your chargeback management strategy like this:

As you create a comprehensive chargeback management strategy, keep these things in mind:

- Technology is key. Manual processes — whether you are doing them yourself or you’ve outsourced responsibility to someone else — are costly, labor-intensive, and error-prone. Intelligent technology with flexible, customizable automation will be the key to your success.

- Make data-driven decisions. Don’t base your strategy on hunches, guesses, or assumptions. Use data to make well-informed decisions that can be tested and analyzed.

- Get started now. The longer you wait, the harder it will be. Start with small, attainable goals and ease yourself into bigger, more detailed projects.

Want help managing chargebacks?

Are you ready to create a comprehensive chargeback management strategy? Let Kount help. We have everything you need.

- Flexible automation fits your needs, processes, and abilities.

- User-friendly, easy-to-use, intuitive features eliminate confusion.

- Efficient technology costs less than manual processes.

- Real-time reporting means you know exactly what is happening at any given moment.