Fighting Chargebacks: Everything You Need to Win

Are chargebacks damaging your business’s bottom line?

There’s good news and bad news.

The good news is you can fight chargebacks and recover revenue that’s been unfairly sacrificed. But the bad news is you only get one chance to plead your case — you had better make it count!

This detailed guide explains how to dispute a chargeback and win. Check out valuable insights, step-by-step instructions, and helpful tips that will make fighting chargebacks as easy and effective as possible.

- The Chargeback Process

- When You Can & Can’t Fight

- Collecting Supporting Documents

- How to Fight

- Measuring Success

- Creating a Complete Strategy

HOW FIGHTING FITS

The Chargeback Process

It’s useful to review how a chargeback moves through the different stages of the dispute process. This can help you determine the best strategy for fighting.

The following is a simplified explanation of the chargeback process.

Within that flow, there are three key stages to note:

- The merchant decides to respond.

- The acquirer forwards the response.

- The chargeback is reversed and the merchant wins the case.

It might seem odd that these processes are included in the dispute workflow. After all, chargebacks are a consumer protection mechanism. They were invented to shield cardholders from fraud and other transaction issues.

Why would a counter argument from the merchant be included in the card brand regulations?

Because not all chargebacks are valid.

There are procedures and technologies in place to help detect and block invalid disputes. However, the review process isn’t perfect, and many invalid chargebacks make it through these filters.

Since you shouldn’t be held responsible for illegitimate or unwarranted disputes, the card brands included a chargeback reversal option in the dispute process.

What is a chargeback reversal?

A chargeback reversal is an attempt to reverse the revenue loss caused by a chargeback. As a merchant, you have the right to challenge chargebacks that shouldn’t have been filed by proving the original transaction was valid. If your reversal is successful, you’ll recover the funds revoked by the chargeback.

The payment industry, as a whole, lacks standardization. There aren’t regulations regarding definitions nor a universal vocabulary. Therefore, it’s common for new phrases to emerge that are actually just alternate terms for legacy processes. For example, all of the following are synonyms for chargeback reversal:

- Chargeback representment

- Chargeback dispute

- Dispute response

- Chargeback response

It doesn’t really matter if you use the phrase chargeback representment instead of chargeback response or reversal. Because ultimately, all the phrases mean the same thing: to fight the chargeback and win back lost revenue.

Now that you know what a chargeback reversal is and how it fits into the overall dispute process, let’s talk about when you can use your response rights.

KNOW YOUR RIGHTS

When You Can & Can't Fight

Before we go any farther in this article, we want to explain something very clearly.

You CAN and SHOULD fight invalid chargebacks. |

If the chargeback is invalid — meaning it shouldn’t have happened — you can respond. You have the right to fight invalid chargebacks. That right extends to all disputes from all card brands and for all reason codes. Nothing is off limits.

Let us repeat: nothing is off limits.

Time and time again, we hear the following:

“Fraud?! I can’t fight a chargeback if the bank says it’s fraud!”

If those thoughts have crossed your mind, you are not alone. Nor are your feelings out of line. The obvious assumption is that a fraud chargeback means the cardholder really is a victim — fighting would just rub salt in the wound. And the card brands would never let that happen.

But the reality is, the cardholder is rarely the victim — more often than not, you are the one coming up short.

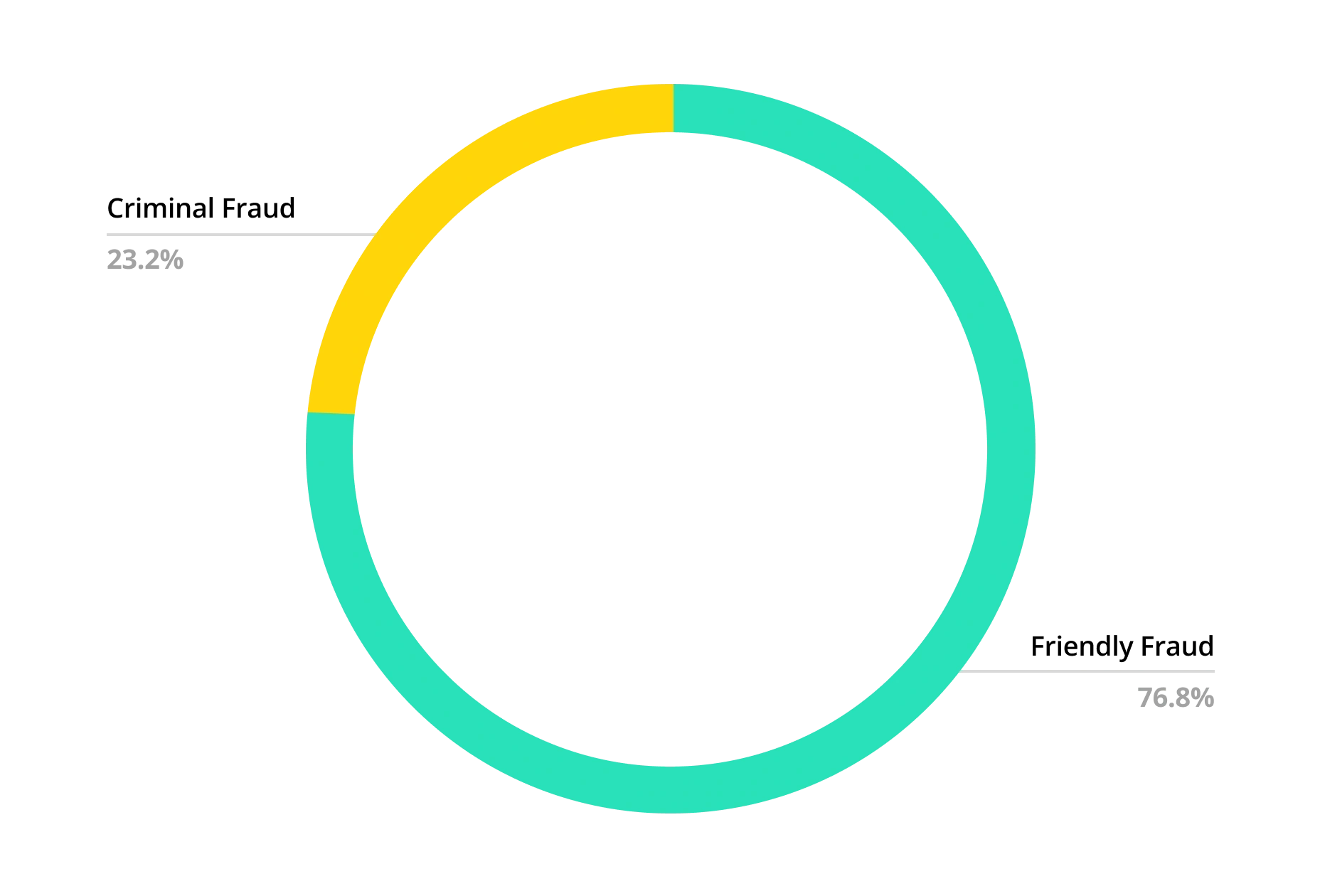

Our Year in Chargebacks report found that the majority of chargebacks are cases of “friendly” fraud rather than the malicious fraud they are pretending to be.

We can’t stress this enough. Just because a chargeback has a fraud-related reason code doesn’t mean it can’t be fought.

If it were impossible to fight fraud-related chargebacks, the card brands would state that in their rule books. But they don’t! What they do share is more than 25 different types of supporting documents that are considered convincing in the fight against friendly fraud. Consider the following:

HYPOTHETICAL SITUATION | CAN YOU RESPOND? |

| The cardholder really was a victim of criminal activity, and the chargeback is recovering lost funds. | NO |

| You uncovered the fraud and already refunded the transaction. A chargeback would credit the cardholder a second time. | YES |

| Initially, the cardholder requested a chargeback because she didn’t recognize the transaction. A week later, she remembered what the charge was. Rather than contact the bank to cancel the chargeback, the cardholder called you to apologize. | YES |

| You have proof the cardholder is cyber shoplifting and he falsely claimed fraud to get free merchandise. | YES |

For most merchants, friendly fraud is the leading cause of chargebacks — and the biggest portion of cases that are fought. But friendly fraud chargebacks aren’t the only disputes you can challenge.

There is another reason why chargebacks could be invalid: they don’t follow card brand rules.

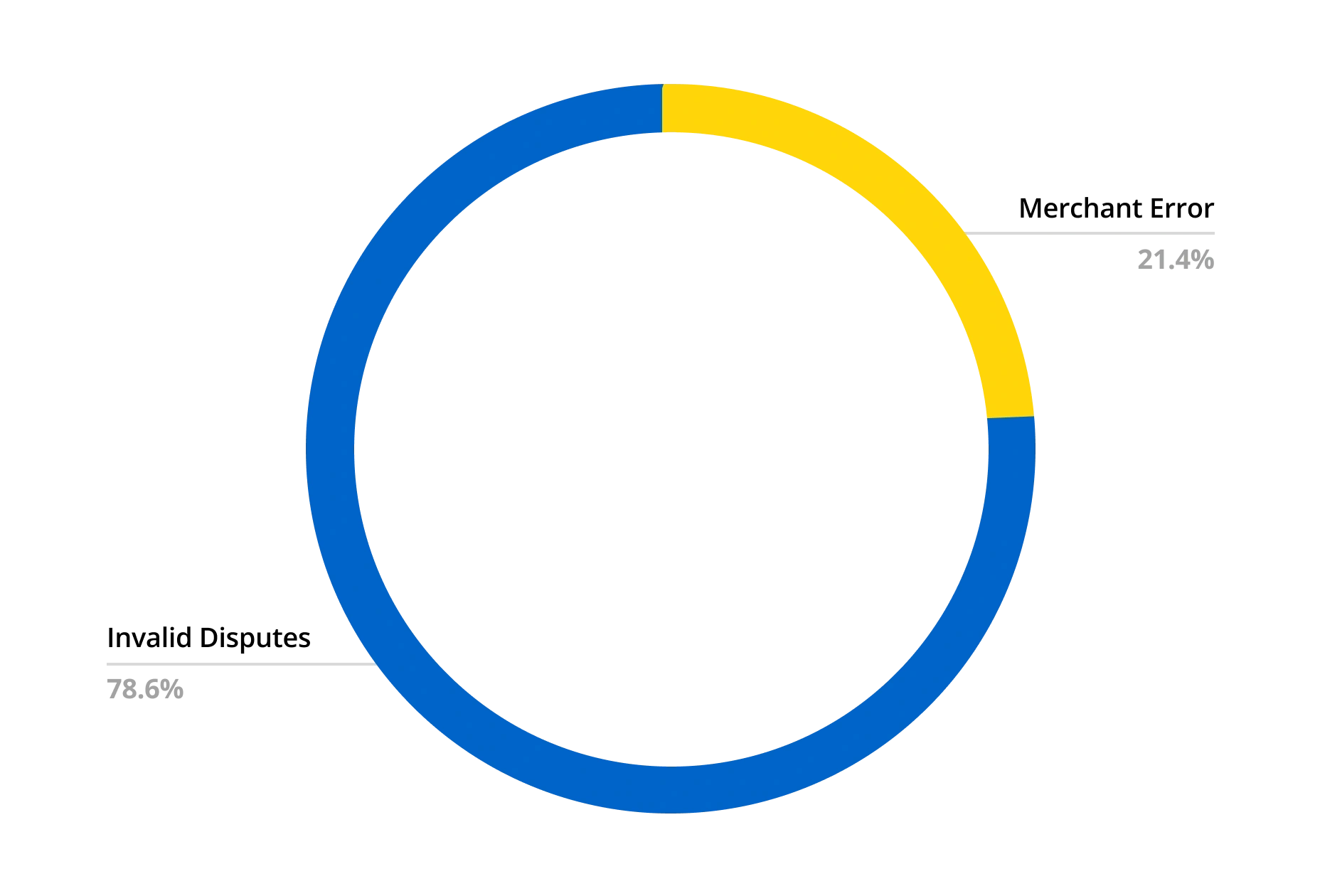

Chargebacks with reason codes in the ‘processing error’ category should be the result of merchant error: agreeing to one amount but processing the transaction for a different amount, charging the card more than once, processing the transaction late, etc.

However, the reality is that merchants are actually only at fault for one out of every four disputes. Three out of four disputes are the result of consumers making false claims or invalid disputes being processed by the issuer.

In these cases, issuers overlook or misunderstand card brand’s regulations. For example:

- Filing a chargeback after the time limit

- Initiating a dispute for an amount that is greater than the original transaction amount

- Not contacting the merchant prior to disputing the transaction

- Initiating a chargeback without attempting to return the merchandise

Ultimately, it doesn’t matter why the chargeback is invalid.

If you can make a credible argument and support your case with proof, you can — and should — fight the chargeback.

SET YOURSELF UP FOR SUCCESS

Collect Supporting Documents

How do you win a chargeback as a merchant or seller?

Success starts long before you attempt a chargeback reversal. In fact, it happens before the transaction is disputed. And in some situations, success starts before the purchase is even made!

Set the stage by doing things that will help you win — such as optimizing the customer experience and using identity verification tools.

Optimize the Customer Experience

Think about the arguments a customer might make when disputing a transaction. What would it take to counter those claims and prove you were in the right?

If you can proactively create that proof in the form of content and conversations, you’ll have the evidence you need to fight chargebacks and win. For example:

CHARGEBACK REASON | EVIDENCE OR ACTIONS TO HELP YOU WIN |

| “The merchandise I received didn’t match the description.” |

|

| “The merchant didn’t issue a refund when I asked." |

|

| “I don’t remember buying anything, and I don’t recognize this charge on my statement.” |

|

Basically, you want to show the bank that you made an effort to satisfy the customer and weren’t trying to be deceptive. If you can do that, you’ll have a better chance of winning the chargeback dispute.

Use Identity Verification Tools

There are many different types of supporting documents that can help you win the chargeback reversal. Some forms of evidence you can provide yourself (like proof of a quality customer experience). But other types will need to be created and provided by a third party (like proof of identity verification).

If a transaction is incorrectly disputed because the cardholder falsely claims it was unauthorized, you’ll need to prove the cardholder actually was the one to make the purchase. This type of convincing evidence comes from tools that verify the shopper’s identity and authorize the purchase.

There are a couple different tools that you may want to consider using.

- Address Verification Service – AVS verifies a cardholder’s identity by comparing the billing address provided at checkout to the cardholder’s address on file with the issuing bank. The assumption is that a cardholder would usually know this personal information but a fraudster might not.

- Card Security Codes – Every debit and credit card has a security code printed on it. Asking for this code during checkout helps ensure the shopper has the card in hand and isn’t using account information that has been stolen.

- 3D Secure 2.0 – 3DS2 allows you to send transaction and contextual information to the issuing bank in real time. The bank compares the information provided to information on file to determine the likelihood of fraud.

Identity verification tools are most commonly associated with chargeback prevention strategies. After all, that’s why these technologies were invented. They were designed to detect and block malicious fraud.

But in recent years, a new use has emerged — exposing friendly fraud.

In 2018, the Visa Claims Resolution initiative changed compelling evidence requirements for reason code 10.4 (Other Fraud – Card Absent Environment). Now, a chargeback response needs to contain evidence that proves the cardholder’s identity was verified. This can be done with positive matches from address verification service and card verification value.

If you don’t currently use identity verification tools, you may want to reconsider. This one single act will have the biggest impact on your success.

A STEP-BY-STEP GUIDE

How to Fight

When it is time to fight chargebacks, the process will look like this:

- Know when you’ve received a chargeback.

- Check the reason code.

- Check the expiration date.

- Check the ROI.

- Collect compelling evidence.

- Write a great rebuttal letter.

- Submit your response.

Let’s dive into a step-by-step guide of the chargeback dispute process so you can fight with the most effective, efficient techniques available.

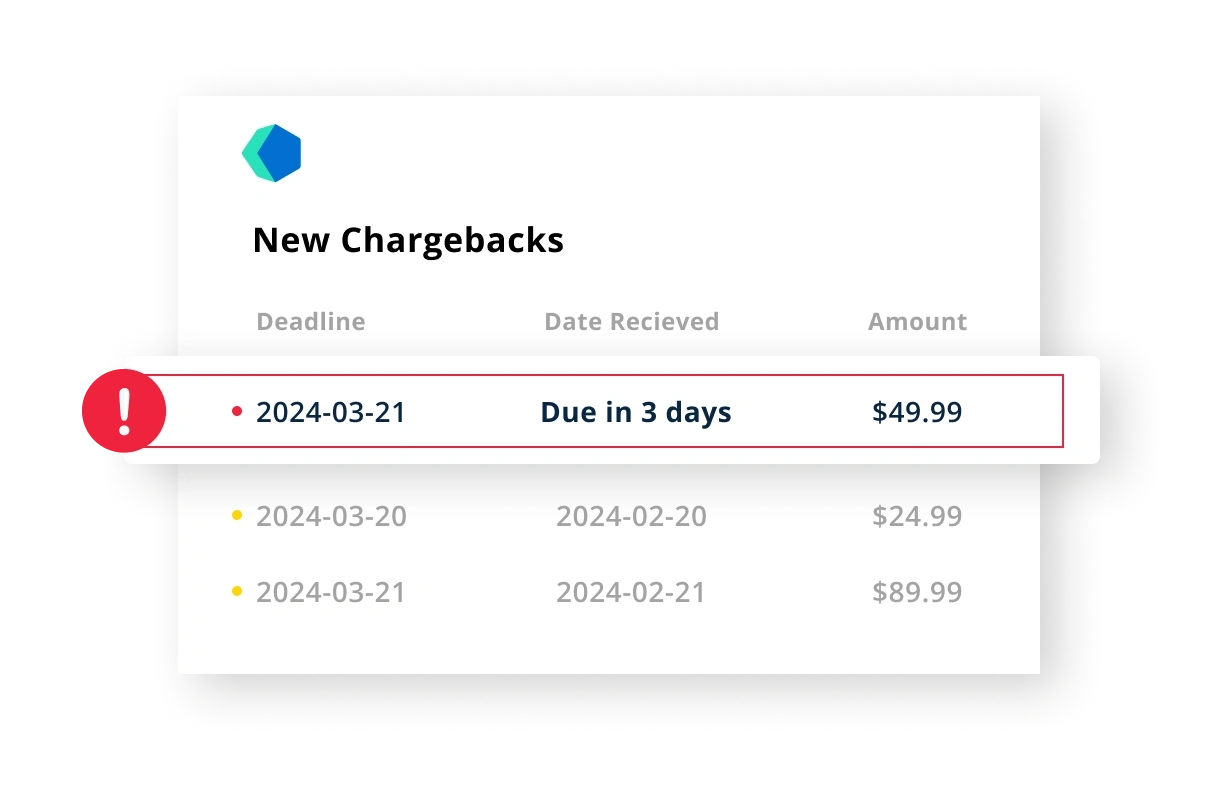

Know when you’ve received a chargeback.

It will be impossible to fight and win a chargeback response if you don’t know when a transaction is disputed!

Processors use different techniques for sending chargeback notifications including mail, email, and online portals. Make sure you know which method your processor uses, and then keep an eye out for notifications — whether that’s opening your mail or logging into your portal daily.

NOTE

Since chargebacks require your immediate attention, it’s important to be notified of disputes as soon as possible. But keeping track of chargeback activity isn’t an easy thing to do on your own — especially if you have multiple merchant accounts.

If this step is a challenge for your business, Kount can help. Our technology consolidated all chargeback data into a single platform. And, you can sign up to receive email notifications every time a chargeback is issued. That way, you don’t have to be constantly monitoring your account. Sign up for a demo if you’d like to learn more.

Check the reason code.

All chargebacks have a reason code. Reason codes help you understand why the transaction was disputed. They also help you know what evidence is needed to reverse the chargeback.

Card brands have specific requirements for compelling evidence. Depending on the reason for a chargeback, you will need to include evidence that shows you:

- Processed the transaction correctly

- Verified the identity of the shopper

- Explained the merchandise or service accurately

- Delivered the item as promised

When you receive a chargeback notice, check the reason code. Then, look it up in our reason code database. We’ll tell you what evidence is required for that particular code.

Check the expiration date.

When a chargeback is issued, your processor will send a notice. Included in that notice will probably be a response deadline.

Response timelines vary by processor. We’ve seen a range of 2 to 20 days from the date the chargeback is issued. If you want to fight the chargeback, your case must be submitted by the given deadline.

If you don’t respond on time, your case will not advance — there will be no way to win the chargeback.

At Kount, we suggest merchants err on the side of caution and respond at least three days before the submission deadline. This allows time for the processor to follow up if items are missing or to resubmit if the first attempt didn’t go through.

As Wayne Gretzky said, “You miss 100% of the shots you don’t take.” Don’t forfeit your right to revenue recovery simply because a deadline passed before you had the chance to respond.

But, don’t try to salvage a losing battle either. If you fight the chargeback after it has expired, you will waste resources because your case won’t even be considered.

If you work with a service provider to fight chargebacks, make sure they are responding promptly and aren’t responding to expired cases.

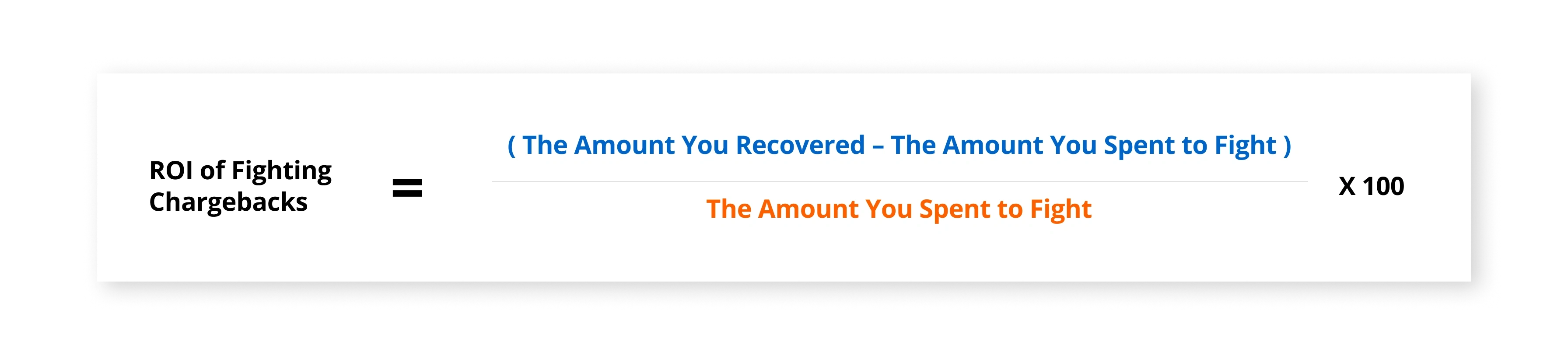

Check the ROI.

Return on investment (ROI) is an important metric to monitor when fighting chargebacks. It compares the amount you spend on fighting to the amount you are able to recover. This is the equation:

The higher your ROI, the better. To get the best results, you’ll want to recover the most revenue with the fewest costs. And with the right tactics, that is entirely possible.

But with the wrong tactics, the opposite is almost always a given — you’ll create negative ROI by spending more to fight than you are able to recover.

And that’s a worst-case scenario. If you have negative ROI, fighting is doing more harm than good.

Check this guide for a more detailed explanation of how to optimize ROI.

Optimizing ROI needs to be a long-term project. But in the heat of the moment — when the chargeback comes in — you need to know what the threshold is for return on investment.

For example, if you need $20 worth of labor to fight a chargeback, any dispute amount under $20 will have negative ROI — you’ll spend more than you’ll recover.

So what’s that threshold for your business? Find the ROI sweet spot. Then, accept any chargeback below that amount and fight like crazy for anything above it.

As you refine your processes and adopt technology, that threshold will go lower and lower. You’ll have less expenses, making it possible to fight more cases.

Collect compelling evidence.

To win a chargeback dispute as a merchant, you must have evidence that is compelling enough to persuade the cardholder’s bank to reevaluate the case.

Depending on the reason for the chargeback, your evidence needs to prove you:

- verified the identity of the shopper

- processed the transaction correctly

- described the merchandise or service accurately

- delivered the item as promised

Since every customer experience is different, your chargeback response should likewise be unique. This means that you can’t use the exact same pieces of compelling evidence for all disputes and expect to win. Instead, collect evidence that is relevant to the case at hand.

For example, sending proof of identity verification won’t be a very compelling form of evidence if the cardholder claims your merchandise is counterfeit — but a certificate of authenticity from a third party would be.

Customize your evidence based on characteristics such as:

- Item purchased (physical good, digital good, or service)

- Sales method (single sale or recurring purchase)

- Transaction type (card-present or card-not-present)

- Reason code

The following are some examples of how you might start to think about customizing your compelling evidence.

Evidence Examples for Physical Goods

- A screenshot of the product description or a copy of the sales receipt

- A copy of your return policy

- Delivery confirmation and/or shipment tracking information

- An in-store pickup form with the cardholder’s signature

- Photographs or emails that prove the cardholder is in possession of the merchandise

Evidence Examples for Digital Goods

- A written description of the digital goods that were purchased

- Usage logs such as login dates and download activity

- The shopper’s IP address and the device’s geographical location at the date and time of purchase

- Proof your digital platform asks for login credentials after a set period of inactivity

Evidence Examples for Services

- A written description of the services provided

- A contract or work order signed by the cardholder

- Proof a ticket or boarding pass was scanned at the gate

- Proof the cardholder made additional purchases tied to the original transaction (seat upgrade, extra baggage, on-board purchases, room service, etc.)

Once you know what evidence you need, start collecting your documents. Keep in mind, your compelling evidence could be stored in a couple different places.

NOTE

This is an important but overwhelming task. It’s hard to know what will or won’t be persuasive. After all, you aren’t a mind reader! How are you supposed to know what an issuer expects?!

Fortunately, Kount's team of experts has insider knowledge about what should and shouldn’t be included in a chargeback response. We’ve taken that expertise and built automated technology and simplified workflows to make this step as easy and effective as possible. If you’d like to learn more, sign up for a demo and we’ll show you how efficient this process can be.

Write a great rebuttal letter.

The secret to fighting chargebacks and winning is an excellent rebuttal letter.

A rebuttal letter is an introduction to the chargeback response package. It highlights the most important and compelling parts of the reversal.

There are several critical pieces of information that must be included and formatted in a specific way. Check out this detailed guide that tells you everything you need to know about the letter writing process. It even includes examples that you can customize for your own letter.

Submit your response.

Once you have collected all the compelling information and written a winning rebuttal letter, it is time for you to submit your chargeback response.

On the surface, this seems like a pretty straightforward task. But in reality, it’s fairly complex. That’s because each response goes through a stringent review process.

The issuer (cardholder’s bank) is responsible for determining the winner and loser, but your processor inspects the case first. Only certain cases are forwarded on to the issuer for decisioning. If your chargeback response doesn’t advance, you can’t win.

It is essential that you make it easy for the processor to review your response and forward it to the issuer. Here’s how to increase your odds of acceptance.

- Make it easy to scan your rebuttal letter and identify the most compelling pieces of information.

- Include all required documents and evidence.

- Optimize the package for your processor’s preferences (such as page order).

- Format the documents into a compliant file type (.doc, .pdf, .jpeg, etc.).

- Deliver the package via your processor’s preferred method (fax, email, etc.)

NOTE

This step isn’t very well-known, and it might not be something you’ve ever thought of before. That’s probably because each processor has different preferences, and it’s difficult for merchants to find out what those preferences are.

But the Kount team has well-established industry partnerships and has been able to determine the best practices for submitting chargeback reversals. By customizing each case, our reversal packages exceed processor expectations and have the highest possible chance of winning.

If you’d like to take advantage of our insider intelligence, sign up for a demo today. We’ll show you how Kount makes this step easy and effective.

IMPROVING RESULTS

Measuring Success

Win-loss results can be hard to come by. There are no official reporting requirements or standards. Each processor has different policies for sharing outcomes. And, it usually takes several months for results to be decided and recorded.

While it is challenging to obtain this information, it is important to try.

Chargeback regulations and consumer behaviors are constantly changing. A chargeback reversal strategy that works now might not still be effective in a few months.

That means you’ll want to constantly analyze and refine your processes. Adjusting your workflow based on what you discover can help achieve better results in the future.

Here’s how.

Monitor your results, and analyze your data.

Each chargeback you receive contains a wealth of valuable information. Analyzing this data, along with your results, can give you a clearer picture of performance.

Track how many chargeback reversals you won, lost, and didn’t fight. Then break down those outcomes by metrics such as:

- Reason Code – Do you have a higher win rate for certain reason codes?

- Bank Identification Number (BIN) – Do some issuers deny reversals more often than others?

- Product or Service – Do win rates fluctuate based on the item sold?

- Employee – Does one team member write more compelling cases than the others?

- Available Compelling Evidence – Do things like AVS responses or customer services notes impact winnability?

Review your processes and workflows.

After you’ve collected your data and analyzed it, think about what it means in relation to your business workflows and processes.

First, identify the tactics that are working well. Keep what you can. Not only will this help you maintain a high win rate, but it will also ensure your processes are as efficient as possible.

Next, identify the strategies that aren’t achieving desired results. What needs to change? How can you improve your efforts?

Adjust and test again.

Once you have identified your strengths and weaknesses, start adjusting your processes. Be sure to monitor your results and retest your outcomes. If you’ve overcompensated, adjust again.

Keep repeating these steps so your results will constantly improve over time.

INCORPORATE FIGHTING

Creating a Complete Strategy

Hopefully, the tips we’ve shared here have been useful to you and your team.

But it’s time to face reality.

Chargeback management is complicated. There are tons of detailed, time-consuming, error-prone tasks involved.

We know you are a highly skilled professional. An expert. No one can do your job quite like you. But you can’t be a master of everything — and no one expects you to!

That’s where chargeback technology can help. Free up your team’s valuable resources by streamlining workflows, automating redundancies, and optimizing efficiencies.

If you’d like to learn more, contact Kount today. We’ll help you pick a strategy that is just right for your business so you can fight chargebacks with the best win rates, the maximum amount of revenue, and the least amount of effort.