How Kount Analytics Help Stop Fraudsters & Prevent Chargebacks

Every time your business grows or changes, you open the doors to new risks and threats. If you don’t recognize and protect against those new dangers, your business could suffer irreparable damage.

But how can you prepare for the unexpected?

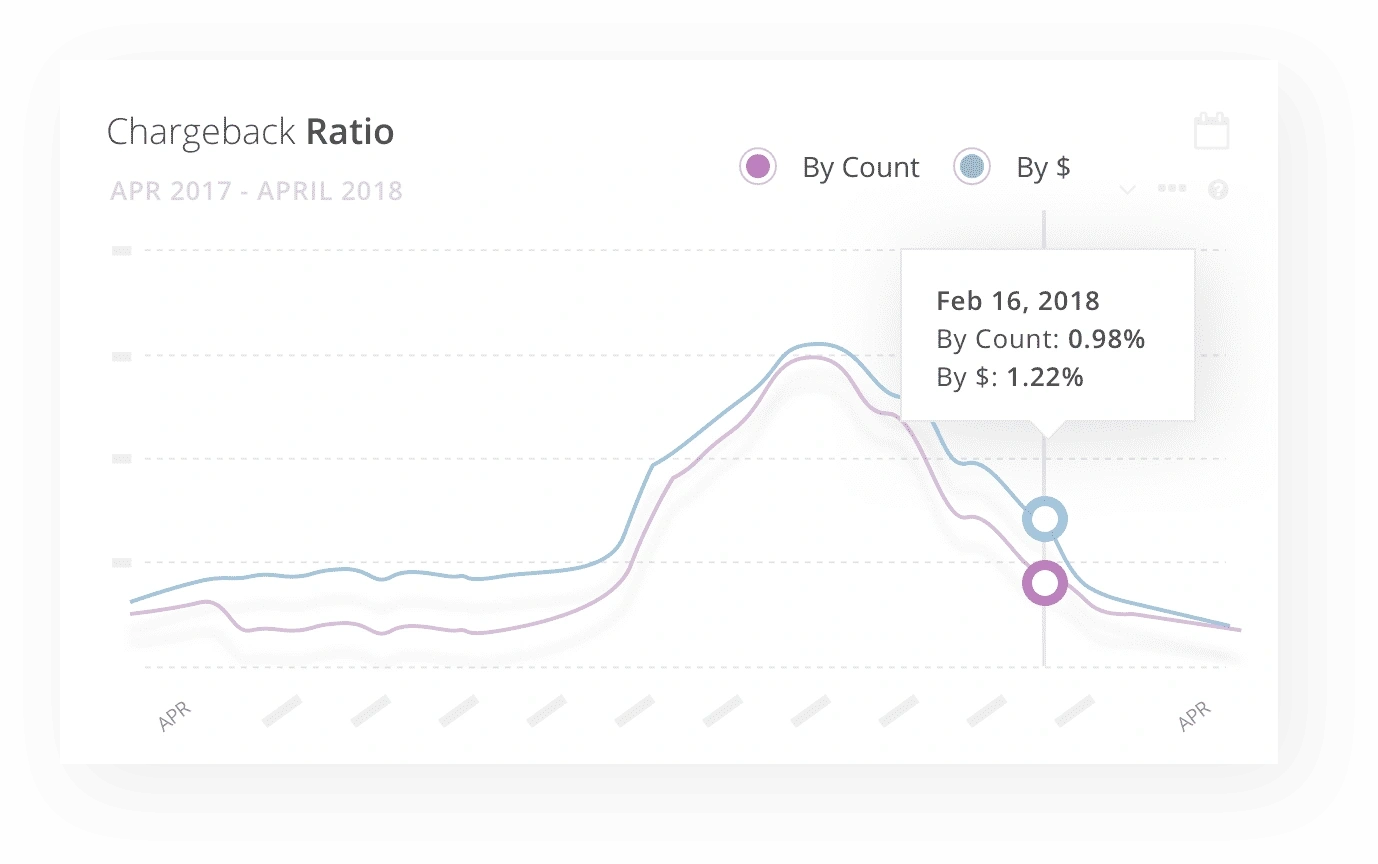

With Kount's real-time data, you know the second risk starts to increase. And our detailed analytics make it easy to discover where the threat is coming from.

The Story of How a Merchant Detected and Stopped Fraudulent Activity to Reduce the Risk of Chargebacks

This is the story of how a merchant used Kount's detailed analytics to block fraud, reduce chargebacks, increase profits, and improve the brand’s reputation.

THE SITUATION

Fiona’s Famous Fashions* is a high-end boutique that sells luxury women’s apparel in-store and online. The company uses Stripe® to process payments.

For years, the company limited inventory to name-brand clothing. Wanting to diversify and increase earning potential, Fiona’s decided to add a select assortment of accessories — handbags, sunglasses, and jewelry.

The new products were an instant success. The merchandise attracted a wider audience of buyers, increased the average ticket amount, and boosted customer lifetime value (CLV) by enticing previous shoppers to return to the store.

Fiona’s bottom line had never been better!

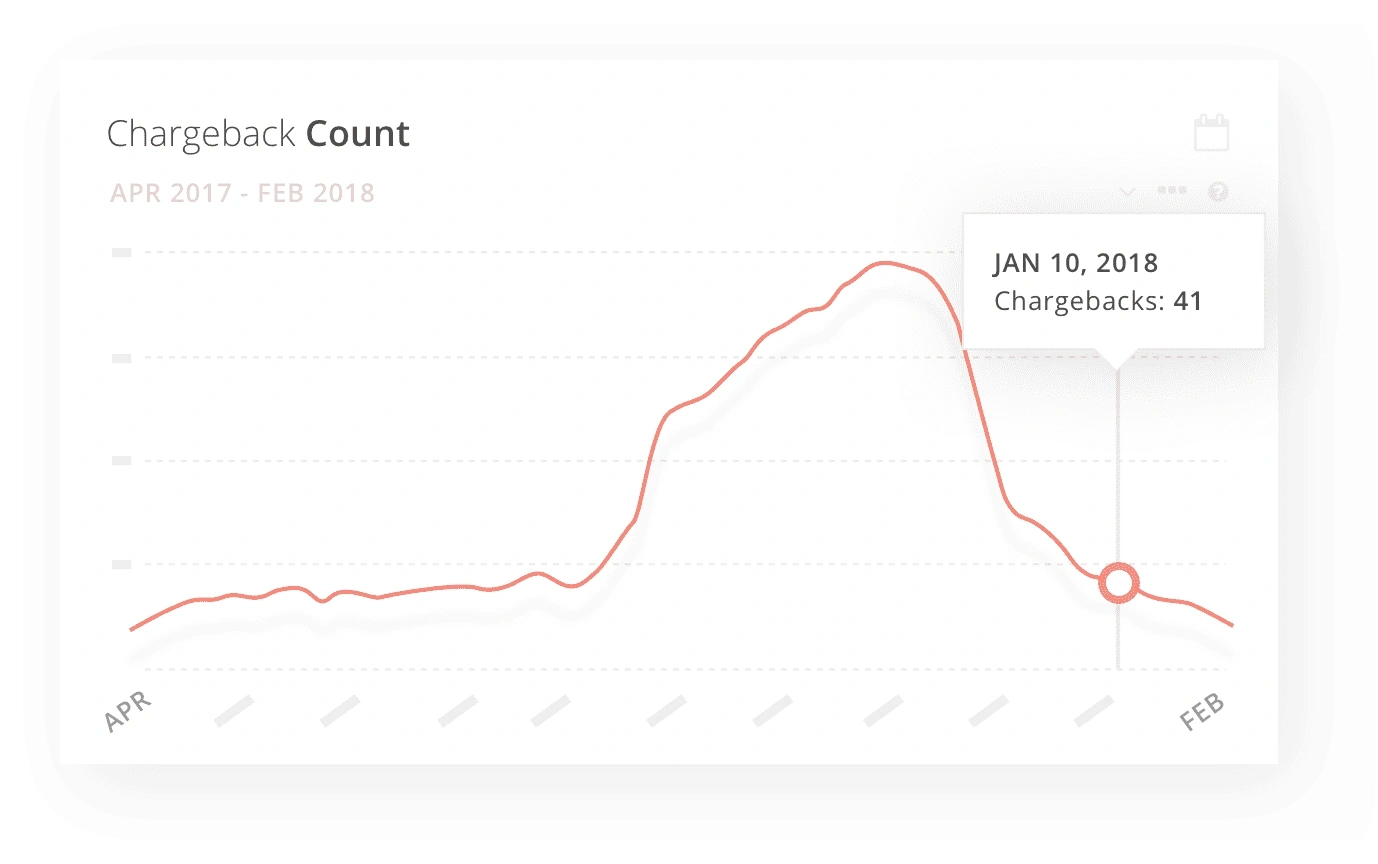

However, the excitement was short lived. About six months after launching the new merchandise, chargebacks spiked drastically.

What happened?!

The obvious conclusion was that the increase in chargebacks was related to the new merchandise. But how?

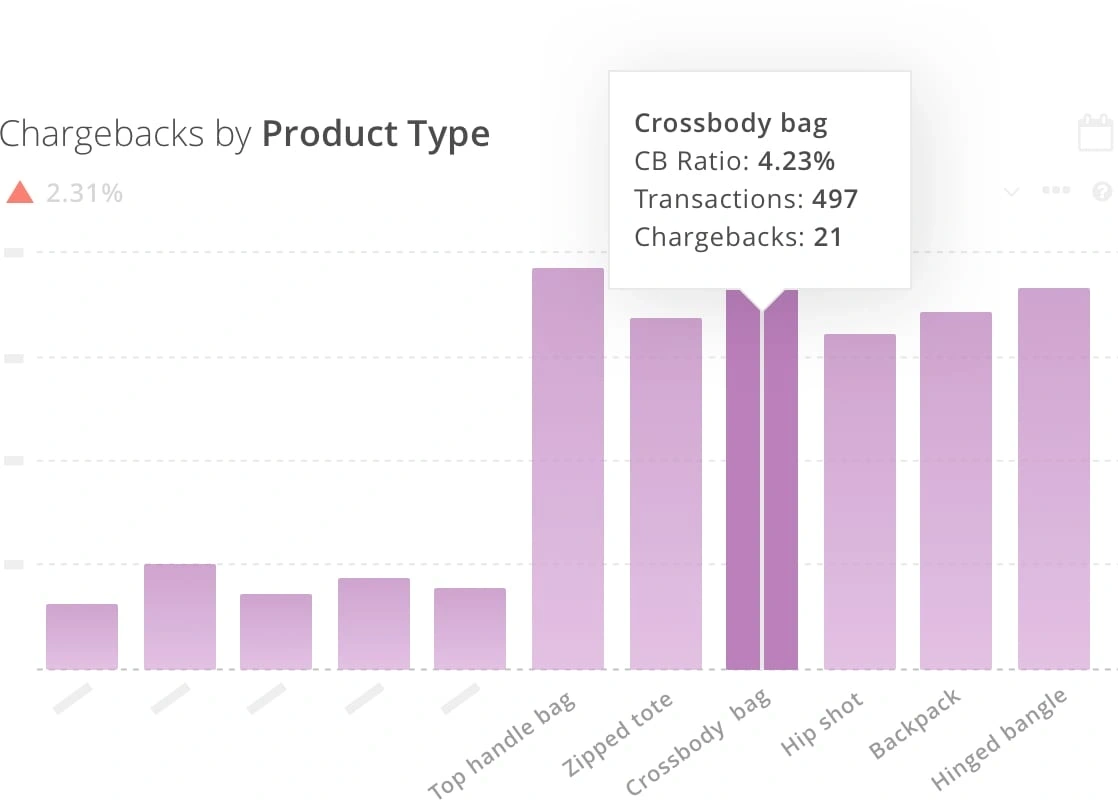

Fiona’s CFO, Felicity, turned to Kount's analytics for help and found the answer in the Chargebacks by Product chart.

THE TAKEAWAY

Fiona’s Famous Fashions had introduced 27 new products as part of their expansion from apparel to accessories. Were all 27 products bad? Or were there only a couple that were causing problems?

Felicity looked at the chargeback-to-transaction ratio for each new product. Six products had a higher-than-expected ratio — five handbags and one bracelet.

Nearly all (91%) of the chargebacks for those high-ratio products had fraud-related reason codes.

Felicity realized that adding new merchandise introduced new risks. Previously, Fiona’s Famous Fashions didn’t have much of a fraud problem. Consumer disputes, like merchandise not received, were a bigger concern than unauthorized transactions.

However, the new designer handbags were enticing fraudsters in a way that apparel hadn’t. Fraudsters were using stolen payment card information to buy handbags because the high-quality, one-size-fits-all merchandise would be easy to resell.

And, the inexpensive bracelet was making it even easier for fraudsters to get what they wanted.

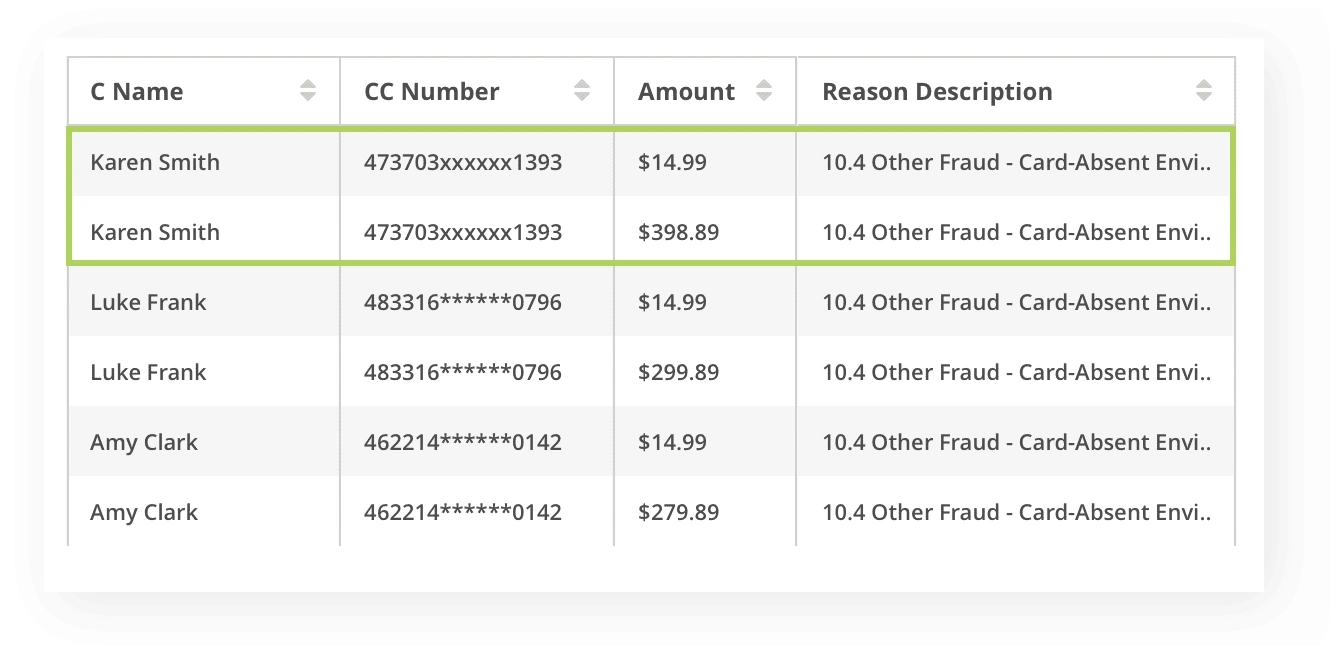

Felicity found that several victimized cardholders were filing two chargebacks — one disputed purchase was for a bracelet, the other was for a handbag.

Fraudsters were “running” stolen cards by making small, seemingly low-risk purchases to see if the accounts were still in good standing. If so, the fraudsters would then make bigger purchases, hoping those unauthorized transactions would likewise go undetected.

As a result of what Kount's analytics revealed, Fiona’s Famous Fashions did three things:

- Fiona’s removed the bracelet and a few other low-dollar items from their inventory.

- The company enhanced their pre-sale fraud detection strategy: strengthened their firewall to block malicious traffic, added address verification service (AVS) and card security codes to the checkout process, and tightened approval requirements for their fraud monitoring tool.

- The company added chargeback prevention alerts to their other Kount services.

THE OUTCOME

Within three months, Fiona’s chargeback rate had returned to a manageable level. The changes the company made yielded positive results.

Chargebacks decreased by 60.8%.

By removing low-dollar merchandise, Fiona’s Famous Fashions completely eliminated the chargebacks that were associated with fraudsters running cards. And enhancing pre-sale fraud detection efforts meant fewer criminals were able to get their hands on the coveted resale merchandise.

The brand’s reputation improved.

It was unfortunate that the first impression a consumer had of Fiona’s Famous Fashions was an unauthorized transaction. But with the help of chargeback prevention alerts, Fiona’s was able to refund those transactions so the cardholder could at least have a quick and easy resolution.

Revenue loss decreased by 15.7%.

Because chargeback prevention alerts notified Fiona’s of fraud much sooner than the chargeback process did, the company was often able to stop shipment for disputed purchases and retain fulfillment, shipping, and product costs.

The company cut gross revenue by 9.4%, yet net profit stayed the same.

Limiting merchandise reduced revenue. However, the loss of revenue generated through good sales was still less than the financial damage that would have come from chargebacks.

Fiona’s Famous Fashions learned that scaling their business introduced new and unexpected risks. As the company continues to grow and develop, Kount's analytics will become more and more essential.

Kount's detailed analytics make it easy to discover why chargebacks are happening so Fiona’s can quickly and effectively solve problems at their source.

*Our client requested their actual name remain anonymous.

Do You Want Access to Chargeback-Preventing Data Too?

At Kount, we believe the challenge of running a business should be delivering great products or services, not managing payment risk. Kount has helped Fiona’s Famous Fashions and countless other businesses remove the complexity of payment disputes so they could get back to business.

If you would like a simplified approach to preventing chargebacks and stopping unnecessary revenue loss, Kount can help you too. Sign up for a demo today.