Chargeback Arbitration: What It Is and When to Use It

Chargeback arbitration is the final attempt to resolve a dispute. If you and the cardholder aren’t able to reach an agreement in the preceding stages of the chargeback process, the case may be advanced to arbitration. An independent third party — the card brand — will issue a verdict.

The chargeback arbitration process can be expensive and time-consuming. This detailed guide will help you learn when to use chargeback arbitration, when to avoid it, and how to navigate the chargeback arbitration process.

- What Is Chargeback Arbitration?

- The Chargeback Arbitration Process

- Chargeback Arbitration Fees

- When You Should & Shouldn’t Use Arbitration

- Arbitration Chargeback FAQs

Something you should know before we begin…

The phrase ‘arbitration’ tends to strike fear in a lot of people. And rightfully so — if handled incorrectly, arbitration can cost a lot of money.

Concerns about arbitration increased when Visa added the allocation process and changed the notion of pre-arbitration.

If you have arrived at this article because you are worried certain actions will automatically lead to those high-dollar arbitration fees, we want to set the record straight right now!

If you get nothing else out of this article, hear this. You have complete and total control over whether or not a case goes to arbitration — and whether or not you have to pay the associated fees.

There are two different arbitration workflows and neither will automatically be triggered without you knowing.

In one situation, you are the person responsible for filing arbitration. In the other, you have the option to accept liability before the case advances. You can even withdraw the case if you change your mind.

So go ahead and fight reason code 10.4 with confidence. Your response doesn’t advance the case to arbitration.

Have questions about this confusing topic? Contact our team of experts. We are happy to discuss the pros and cons of arbitration in greater detail.

What Is Chargeback Arbitration?

Chargeback arbitration is a process in which disputing parties seek a verdict from an independent third party to settle a transaction dispute. Arbitration is the final resolution attempt, sought after completing the entire chargeback process.

During the chargeback arbitration process, the disputing parties — you and the cardholder — allow the card network to review evidence and make a decision.

The card brand’s decision is final and can’t be appealed, bringing an end to the transaction dispute process.

Rules for initiating chargeback arbitration vary depending on the card brand. Some cases may need to progress through pre-arbitration (or pre-arbitration chargebacks) before chargeback arbitration.

The Chargeback Arbitration Process

Up until 2018, the chargeback process — including arbitration — was basically the same for all card brands (Mastercard®, Visa®, American Express®, and Discover®).

But in 2018, Visa updated their policies to add a second dispute management workflow. Now, the path a dispute takes depends on the specific card brand involved.

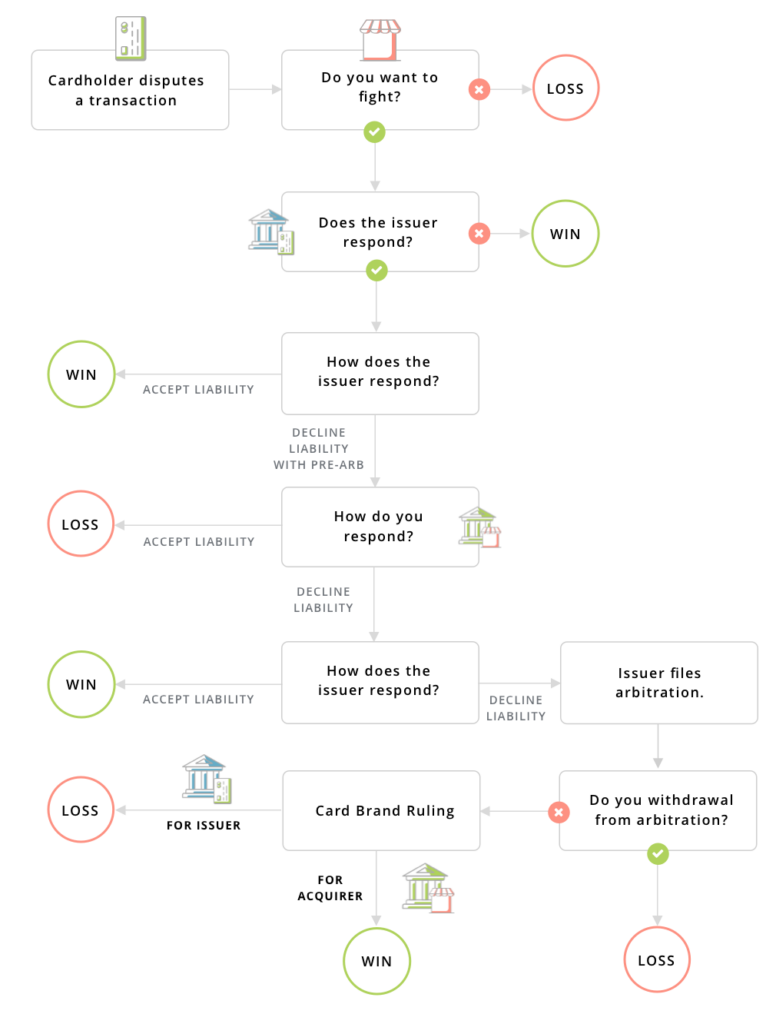

THE LEGACY PROCESS

American Express, Discover, Visa Collaboration, and Mastercard Arbitration Chargeback

The legacy chargeback and arbitration process is used for the vast majority of cases.

- All American Express chargebacks (that had a successful retrieval request response)

- All Discover chargebacks (that had a successful retrieval request response)

- All Mastercard chargebacks (except reason codes 4808, 4870, 4871, and 4834)

- All Visa collaboration disputes (customer disputes and processing errors)

The following is a high-level overview of the process used in these situations.

Step 1

The transaction is processed and settled. Transaction details are sent to the cardholder’s bank (issuing bank). The bank debits (or charges) the cardholder’s account and payment is routed to your account.

(The phrase ‘first presentment’ might be used to describe this stage.)

Step 2

The cardholder contacts the bank to dispute a charge and a chargeback is filed. Funds are withdrawn from your merchant account and returned to the cardholder.

(Other phrases — such as ‘payment dispute,’ ‘transaction dispute,’ or ‘dispute’ — might also be used to describe this stage.)

Step 3

Rather than accept the chargeback and close the case, you challenge the cardholder’s claims with a chargeback response. Your argument is supported with compelling evidence or documentation that validates the original purchase or disproves the chargeback.

(Other phrases may be used to describe this stage, including ‘chargeback representments’, ‘second presentments,’ ‘dispute responses,’ or ‘chargeback disputes.’)

Step 4

Deciding there is reason to continue the fight instead of accept liability, the cardholder responds with a pre-arbitration case filing. Pre-arbitration is used to challenge the completeness of the chargeback response or change the conditions of the initial chargeback.

Step 5

Rather than accept liability and close the case, you decline liability.

Step 6

The cardholder also has a choice: accept liability or decline. If liability is declined, arbitration is filed.

Step 7

Once arbitration is filed, you have the option to withdraw the case or proceed. If you proceed, the card brand issues a verdict. The decision will be final — either in favor of the cardholder or you the merchant.

A visual representation of the process looks like this:

Exceptions

While this workflow is used for the majority of Mastercard, American Express, and Discover cases, there are a few instances where the process might deviate from the norm.

American Express and Discover

American Express and Discover use the retrieval request process to gather additional transaction information with the hopes that greater clarity will eliminate the need for a chargeback. But if you don’t respond to the retrieval request or don’t provide the needed information, the only way the card brand can resolve the dispute is to file a chargeback.

In these cases — if you failed to proactively help avoid the chargeback — you are not allowed to challenge the chargeback. Liability is indisputable. Therefore, the process would stop after step two, never advancing to arbitration.

Mastercard

Mastercard also considers some chargeback reason codes to be indisputable.

- Reason code 4808 - Authorization-Related Disputes

- Reason code 4870 - Chip Liability Shift

- Reason code 4871 - Chip & PIN Liability Shift

- Reason code 4834 - ATM Dispute

Chargebacks filed with these reason codes are supported by a great deal of back-end data — meaning only valid chargebacks are filed in the first place. Therefore, if you challenge these indisputable cases, you are essentially wasting the brand’s time and resources.

As a result, the issuer has the right to bypass pre-arbitration and directly file arbitration. Or, in other words, the process would jump from step three to step seven.

Timelines

The chargeback arbitration process doesn’t occur overnight. Card brands require merchants, acquiring banks, and issuers to provide responses within specific time frames throughout the process.

| MASTERCARD | VISA | |

|---|---|---|

| Merchant to submit chargeback response | Within 45 days of chargeback | Within 30 days of chargeback |

| Issuer to file pre-arbitration | Within 45 days of chargeback response | Within 30 days of chargeback response |

| Merchant to accept or decline liability | Within 30 days of pre-arbitration | Within 30 days of pre-arbitration |

| Issuer to file arbitration | Within 10 days of decline (or within 10 days of the merchant deadline if no response is given) | Within 10 days of decline (or within 10 days of the merchant deadline if no response is given) |

| Brand to issue a ruling | Usually within 3-6 months | Usually within 1-3 months |

The business operations of American Express and Discover differ from Mastercard and Visa. The primary difference is the card brands’ functionality.

Mastercard and Visa essentially act as a liaison between card issuers and acquirers. American Express and Discover, on the other hand, take a more hands-on approach. They issue cards directly to cardholders and often manage transaction processing themselves.

Therefore, since there are fewer parties involved in AmEx and Discover workflows, their regulations — including timelines — tend to be less structured.

If you are considering arbitration for a dispute involving an American Express or Discover payment card and have questions about the process, feel free to contact our team of experts for guidance.

A WORD OF WARNING

Note that the timelines regulate issuer and acquirer actions. The amount of time allotted for you to review the case, decide on an outcome, and collect necessary documentation will be much less.

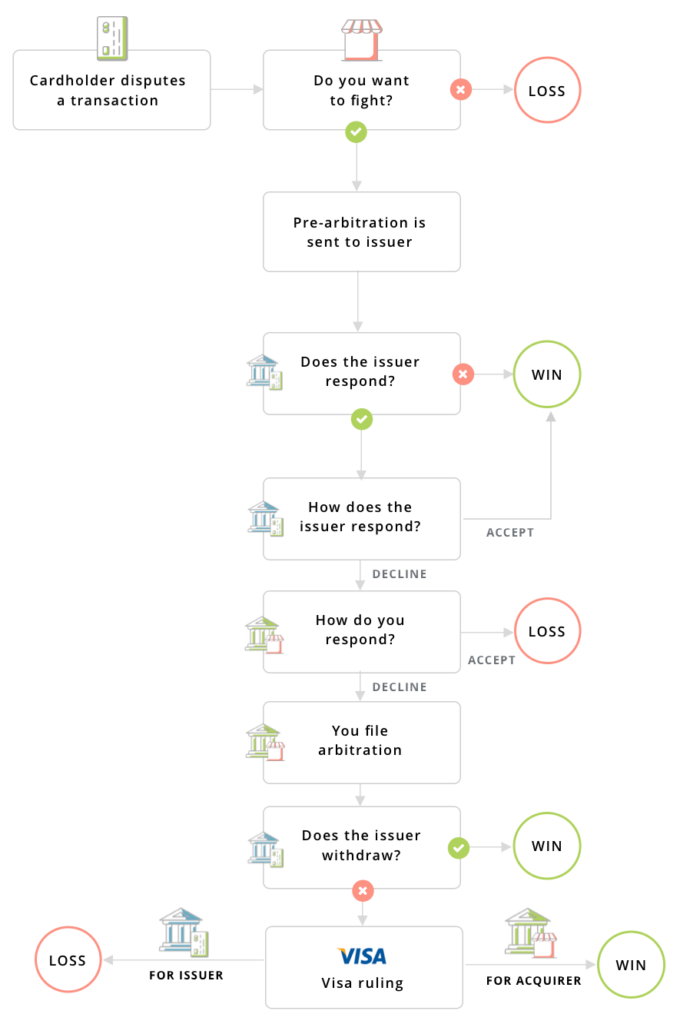

THE NEW PROCESS

Visa Arbitration for Allocation Disputes

While Visa’s collaboration initiative follows the legacy process for dispute resolution, allocation is a unique workflow.

Allocation occurs when Visa uses its internal data to automatically assign liability. If liability is assigned to the issuer, the case is closed. If liability is assigned to you, you can choose whether to accept responsibility or submit a response.

However, because liability has already been assessed, your response is technically considered pre-arbitration.

The following is a high-level overview of the Visa arbitration process for allocation disputes.

STEP 1

The transaction is processed and settled. Transaction details are sent to the cardholder’s bank (issuer). The bank debits (or charges) the cardholder’s account and payment is routed to your account.

STEP 2

The cardholder has an issue with the transaction and a dispute is filed. Funds are withdrawn from your merchant account and returned to the cardholder.

(Note: Visa has replaced the phrase ‘chargeback’ with ‘dispute’. Despite the name change, the concept remains the same.)

STEP 3

Rather than accept liability and close the case, you challenge the cardholder’s claims by filing pre-arbitration. Your argument is supported with documentation that validates the original purchase or disproves the chargeback.

(Note: In the legacy process, this step is the dispute response. However, for Visa allocation disputes, the chargeback response step is removed and the case advances to pre-arbitration instead.)

STEP 4

Rather than accept liability and close the case, the cardholder declines.

STEP 5

If the cardholder declines your pre-arbitration, you have a decision to make: accept liability or file arbitration.

(Note: In the legacy process, the cardholder is the party that opts for arbitration. But with the allocation process, you are responsible for filing arbitration.)

STEP 6

Once arbitration has been filed, the cardholder has the option to withdraw the case or proceed. If the case proceeds to arbitration, Visa will issue a verdict.

A visual representation of the process looks like this:

Timeline

The timeframe for arbitrating a dispute in the Visa allocation workflow differs from its legacy process.

- A merchant responds to a chargeback (which is considered pre-arbitration) within 30 days of receiving the chargeback.

- The issuer accepts or declines liability within 30 days of the pre-arbitration date.

- The merchant can choose to advance to arbitration within 10 days of receiving the issuer’s response (or within 10 days of the deadline if a response isn’t given).

- Visa issues a ruling, usually within 1-3 months.

A WORD OF WARNING

Note that the timelines regulate issuer and acquirer actions. The amount of time allotted for you to review the case, decide on an outcome, and collect necessary documentation will be much less.

Chargeback Arbitration Fees

Chargeback arbitration fees can be costly, on top of your labor costs for managing the transaction dispute.

Card brands assess fees at different stages of the arbitration process and can include filing fees, administrative fees, and withdrawal fees. Fee costs vary between card brands and geographical regions, but typically fall within the range of $100 to $250 per action.

If an arbitration case isn’t withdrawn before a ruling is issued, the losing party is responsible for paying the entirety of accumulated fees. As a result, chargeback arbitration can result in a total cost of at least $650 USD.

When You Should & Shouldn’t Use Arbitration

Chargeback arbitration is an effective strategy for fighting some transaction disputes, but it should be practiced sparingly — and only when it makes financial sense for your business.

Typically, advancing a dispute to arbitration makes sense if both of the following are true:

- You have a reasonable belief that you will win the case and won’t be responsible for the associated fees

- You would recoup a significant amount of revenue

Situations in which it makes sense to advance to arbitration include:

When There is a Compliance Issue

It may be worth seeking arbitration if the case itself is invalid and not in compliance with card brand rules.

Some examples of non-compliant cases include chargebacks filed after the time limit or cases that don’t contain required supporting documents.

When You Have a Strong Case

If you respond to certain chargebacks (such as those resulting from card-not-present fraud or merchandise not received), certain actions must be taken by the issuer and cardholder before the case can be advanced to arbitration. To continue the case, the cardholder must certify that your supporting documents were reviewed and that his/her claim is still valid despite your argument.

If these two things haven’t happened, the case is not compliant with card brand regulations. Therefore, if you advance the case to arbitration, there is a strong probability of winning.

In general, if you feel your supporting documents are more convincing than those provided by the issuer, you may want to proceed to arbitration. Your processor should be able to help you evaluate the likely success of your case.

A WORD OF WARNING

There is no guarantee a card brand will rule for or against you during arbitration. Arbitration is highly dependent on many factors, all of which the card brand will consider during its investigation and ruling.

When There is a Significant Financial Incentive

It may be worth arbitrating a chargeback if the dispute is over a product or service with a high dollar amount. If there’s a possibility you could win more than you would lose — bearing in mind the significant fees you may incur — it may make sense for your business to use chargeback arbitration.

Compare the potential fees and additional labor costs to the total chargeback amount you may be able to recoup. If there is a significant difference between the two, and you possess sufficient evidence to argue your claim, filing for chargeback arbitration can be an effective response.

A WORD OF WARNING

Because chargeback arbitration is so costly and time-consuming, it should be avoided when possible. Rather than relying on arbitration to recoup lost revenue, use effective chargeback prevention strategies and intelligent chargeback management software like Kount to reduce your risk.

Arbitration Chargeback FAQs

Chargeback arbitration is a challenging subject to understand. The following are questions we commonly receive from merchants.

If you have a question that’s not answered here, contact our team of experts. We’re always happy to help. Because the better you understand the arbitration process, the easier it will be to navigate.

Can I add more evidence to my case if it goes to arbitration?

Typically, the evidence a card brand reviews during chargeback arbitration will be the same documentation submitted in your chargeback response. New evidence submitted at the arbitration stage will be ignored, unless it’s in response to the card brand requesting more information.

That’s why it is important to submit all your documents the first time around. Some chargeback management ‘experts’ might advise you to save some evidence for arbitration. However, that isn’t actually a good idea.

Does fighting Visa 10.4 chargebacks automatically initiate the arbitration process?

No. Though Visa considers a response to a 10.4 chargeback as “pre-arbitration,” you still maintain the option to accept liability and close the case before the case advances to arbitration.

Is there ever a situation where the issuer would skip pre-arbitration?

Yes. Some Mastercard reason codes (4808, 4870, 4871, and 4834) allow issuers to skip pre-arbitration and proceed immediately to arbitration. In other words, if you dispute the chargeback, the case may proceed directly to arbitration.

How long does it take to reach a verdict?

The total length of time it takes a card brand to reach a verdict for a chargeback arbitration case can vary.

In some cases, Visa’s chargeback arbitration process can take as little as three months to complete, whereas Mastercard’s review may require up to six months.

Avoid Arbitration With Effective Chargeback Management

The best defense against arbitration — and all its fees and costs — is a proactive strategy that helps prevent chargebacks in the first place. With the right tools and processes, you can improve customer satisfaction and resolve disputes before they escalate.

Learn more about how prevention solutions can help avoid arbitration.

When you inevitably receive a chargeback, how you respond can go a long way toward avoiding arbitration. A highly-detailed, relevant, and accurate chargeback response can help reduce the risk of costly and lengthy arbitration.

Here are some resources to help you create a compelling case.

If you want the best protection possible, consider using Kount. Kount offers complete chargeback management that can both prevent and fight chargebacks. Not only will our intelligent technology help you avoid arbitration, it will also protect more revenue with greater efficiency and less effort.

Contact Kount today to learn more.