TEMPLATE

Chargeback rebuttal letter examples

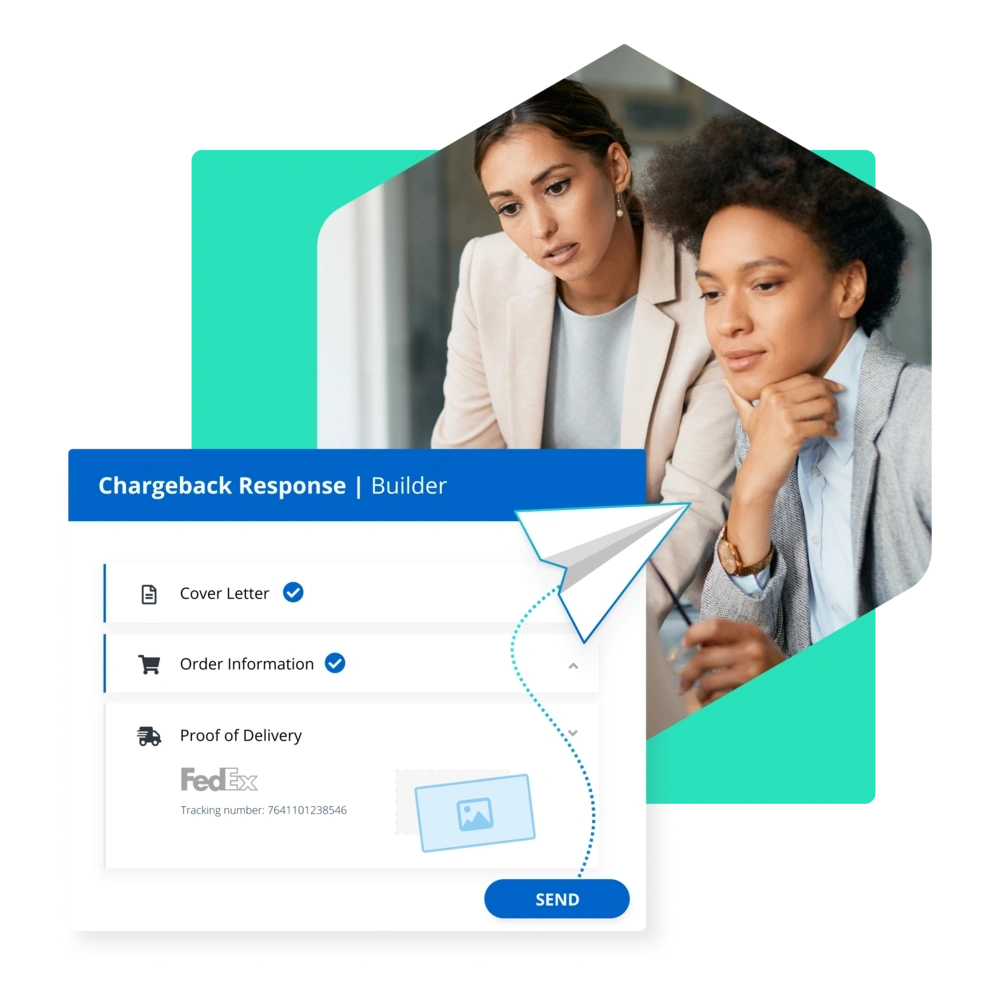

Chargeback rebuttal letters are an important part of your dispute management strategy. But writing a compelling argument isn't the easiest skill to master. Fortunately, Kount can help.

We provide several different chargeback rebuttal letter examples. Simply sign in, copy the example, and add your business details. In no time at all, you'll see a positive impact on your business’s reputation, win rates, and revenue recovery efforts.

Introduction

Getting started

Writing a clear and concise rebuttal letter is an important step to winning any chargeback response.

Kount provides four examples to help you create rebuttal letters that will have a positive impact on your business’s reputation, win rates, and revenue recovery efforts.

Want to know how Kount incorporates rebuttal letters into winning chargeback responses, visit our feature page. Our technology recovers more revenue with less effort.

Example 1

Do you sell tangible merchandise with a subscription billing model? Here's a rebuttal letter for chargebacks with a "merchandise not received" reason code.

Business: The Flower Co. | MID: 987-6543 | Chargeback Case: #1234 | ARN: 9911

To whom it may concern:

The Flower Co. is an urban farm providing locally-grown flowers to New York City residents.

We serve customers through a website where they can browse products at various price points. Flowers are sold with a subscription billing model; a bouquet of flowers is delivered to the customer every month and the customer’s card is charged for the purchase amount.

Subscriptions can be canceled anytime for any reason with just a few clicks. And our 100% satisfaction guarantee is designed to ensure every customer is happy with our flowers. We will refund or replace any order for any reason.

Despite our customer-centric policies, cardholder Meredith Grey decided to initiate a chargeback.

On May 2, 2019, Meredith Grey signed up for our “Colorful Mix” bouquet subscription for $19.99 per month. We delivered her bouquets and charged her card on May 4, June 4, and July 5, 2019.

On July 26, 2019, Meredith disputed the July 5 charge claiming the merchandise was never received. We are disputing this claim and request that the chargeback be reversed.

Because case number 12345678 was categorized as reason code 13.1 Merchandise/Services Not Received, we have included the following details. The attached evidence explains why we are challenging this dispute.

- The Flower Co. has a clearly defined billing structure and cancellation policy. Meredith Grey clicked the “I have read and agreed to the terms” box before completing the initial transaction.

- Meredith signed delivery confirmation receipts for each of the three purchased bouquets.

- A customer satisfaction survey was sent to Meredith Grey on July 15. On July 16, Meredith completed the survey and said she was “very happy” with her most recent delivery.

As our policies clearly state, The Flower Co. would have been happy to resolve any issues with Meredith directly. However, Meredith did not give us the opportunity. Moreover, the attached evidence proves the claims made in the dispute lack authenticity. For these reasons, we request the disputed funds be reversed.

Please contact our team if you have any questions about this case.

Sincerely,

The Flower Co. customer service team

Example 2

Do you sell digital goods with a free trial subscription? Here's a template you can use fight chargebacks with an "unauthorized transaction" reason code.

Business Name: Perfect Match | MID: 12-34-56789 | Dispute ID: 88223377

Dear Sir or Madam,

Perfect Match, which launched in 1999, helped pioneer the online dating industry. We now serve 24 countries and display our website in 15 different languages.

We offer customers a free trial for their first month, and then we charge $29.99 for each month thereafter. We send an email reminder seven days before the card is charged. To cancel a subscription, customers can visit the Change/Cancel Membership page under the Account Settings option in the site’s main navigation. Cancellation requests must be made by midnight on the day before the monthly charge.

At Perfect Match, we pride ourselves in creating a safe, secure environment for our customers to interact. That’s why it is disappointing to discover that customer Michael Scott claims we charged his card without permission.

Michael Scott created a “Basic Membership” account on February 16, 2020. His card was charged $29.99 on March 16, 2020. On March 17, 2020, Michael disputed the transaction by claiming fraud. We are challenging Michael’s claim with proof the chargeback is invalid.

Since dispute #88223377 was classified with reason code 4837 No Cardholder Authorization, we have included the following details. The attached evidence explains why we are challenging this dispute.

- The transaction returned a positive AVS match code of Y.

- The transaction returned a positive CVC2 match code of M.

- Strong consumer authentication (SCA) was used to verify Michael’s identity.

- Usage logs show Michael Scott logged into his account 47 times.

- The IP address associated with the account creation matches the geographical region of the billing address.

- Perfect Match has a clearly defined billing structure and cancellation policy. Michael Scott agreed to the terms and conditions before creating his account.

- A billing reminder was sent to michael.scott@email.com seven days before the card was charged. The email was opened and viewed on two separate occasions.

Perfect Match completed this transaction in full compliance with not only our own policies, but also in accordance with Mastercard’s free trial regulations. Despite the fact that Michael agreed to use our service in exchange for a monthly fee, he chose not to fulfill his obligations. Therefore, we are requesting that the chargeback be overturned and the full transaction amount be returned to Perfect Match.

Please contact us at billing@pm.com with any questions or additional information requests.

Thank you for your time,

Perfect Match dispute team

Example 3

Do you provide services, typically sold as one-time transactions? Here's a template you can use to fight chargebacks with an "incorrect amount" reason code.

HomePhoneFix - MID 11223-34566 | Chargeback Case #66778899

To whom it may concern:

HomePhoneFix is a cell phone repair service that travels to the customer at any location and at any time to repair damaged devices on the spot. Our services include screen repair, battery replacement, camera replacement, charging port cleaning, button replacement, and water damage restoration.

Services are explained and appointments are booked online, but transactions are processed in person at the time of service. Prices vary based on the services provided and the time of the appointment. Once the scope of work has been determined and a price set, a contract is created for the customer to sign.

On August 2, 2020 at 9:47pm, customer Frasier Crane requested assistance from HomePhoneFix to replace a cracked screen. A technician arrived at Frasier’s home at 10:11pm. Due to the late hour of the appointment and the extent of the phone’s damage, HomePhoneFix quoted a price of $350. A contract was printed, Frasier signed it, and work began.

On August 10, 2020, Frasier Crane disputed the transaction because he claims the amount charged was more than what our company quoted. We are disputing this claim and request that the chargeback be reversed.

Because chargeback case #66778899 is reason code 12.5 Incorrect Amount, we have included the following details. The attached evidence explains why we are fighting this chargeback.

- Frasier Crane signed a contract that clearly listed the transaction amount.

- The contracted amount matches the amount charged to Frasier Crane’s card.

- Frasier Crane presented a photo ID that matched the name on the card.

Our policies clearly state that service amounts are determined by the on-site technician on a case-by-case basis. Frasier Crane agreed to this stipulation before he booked the appointment. As the signed contract indicates, he also agreed to pay the amount that was quoted for services. Therefore, the claims made with this chargeback are invalid. As such, the transaction amount should be reversed to HomePhoneFix.

Questions about this case can be sent to invoice@homephonefix.com.

Sincerely,

The billing department at HomePhoneFix

Example 4

Do you sell tangible merchandise with one-time purchases? Here's a template you can use to fight chargebacks with a "not as described" reason code.

MID: 12345-123-45 | Dispute ID: 91827364 | Business Name: Fiona’s Fashions | ARN: 1122334455

Dear Sir or Madam,

Fiona’s Fashions is a high-end boutique that sells luxury women’s apparel and accessories online.

On March 28, 2020, first-time customer Rose Nylund purchased one of our most popular handbags. On the same day, the merchandise was shipped and Rose’s card was charged $389.74. On April 1, 2020, Rose received the handbag and signed for delivery.

Because most of the merchandise at Fiona’s Fashions costs more than the average clothing purchase, we take great care to provide exceptional customer service before and after the transaction. Our product descriptions are extremely detailed, we follow up with customers after each purchase to ensure satisfaction, and our refund policy allows product returns for any reason.

But despite our best efforts, Rose Nylund disputed the transaction on May 19, 2020, claiming that the product is counterfeit. We are disputing this claim with evidence that validates the quality of our merchandise.

Because dispute #91827364 was submitted with reason code 13.4 Counterfeit Merchandise, we are providing the attached compelling evidence. The following is an overview of what those documents contain:

- Before completing the purchase, Rose Nylund agreed to our terms and conditions which clearly state that customers can return merchandise if they are dissatisfied.

- Our customer service department exchanged emails with Rose seven days after she received the merchandise. Rose confirmed that the handbag was what she expected.

- Fiona’s Fashions has a certificate of authenticity from an independent, third-party expert for the item that Rose Nylund purchased.

As our policies clearly state, Fiona’s Fashions would have been happy to resolve any issues with Rose directly. However, she did not give us the opportunity. Moreover, the attached evidence proves the claims made in the dispute are not valid. For these reasons, we request the disputed funds be reversed.

Please contact our team if you have any questions about this case.

Sincerely,

The customer service team at Fiona’s Fashions

WANT HELP?

Check out Kount's chargeback response strategy

Tired of fighting chargebacks yourself? Wish there was an easier way to recover revenue? Check out Kount's chargeback management solutions. Schedule a demo today to see the technology in action.