INTRODUCTION

About Chargeback Management

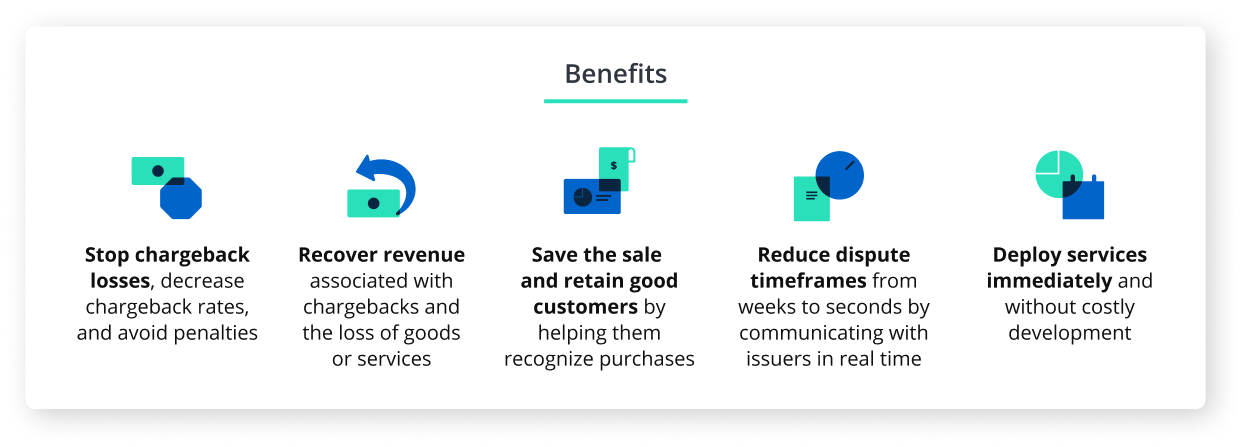

Disputing chargebacks, identifying friendly fraud, and decreasing chargeback rates are among business’s toughest chargeback challenges. Overcoming those challenges requires time and resources. When card issuers and businesses can’t communicate efficiently, they have to engage in the slow and costly chargeback process.

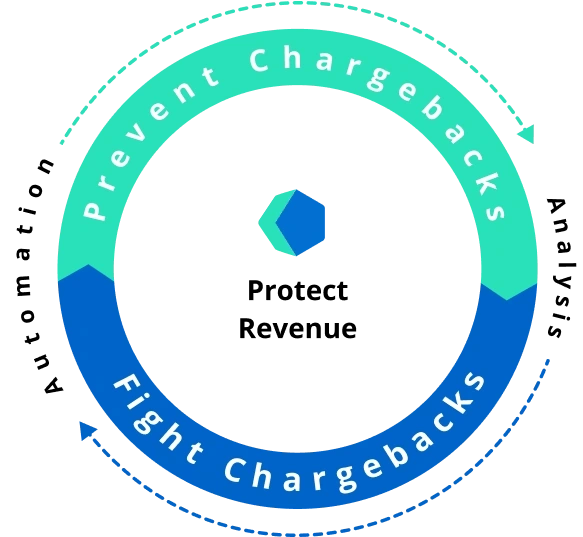

Kount has partnered with industry leaders to combine multiple prevention alert services into one easy-to-use platform. Kount offers a complete solution for chargeback management that provide your business the necessary data and tools to prevent chargebacks and revenue loss from criminal fraud, friendly fraud, and legitimate disputes. Our goal is to protect the maximum amount of revenue in the most efficient and accurate way possible.

A complete strategy for chargeback management

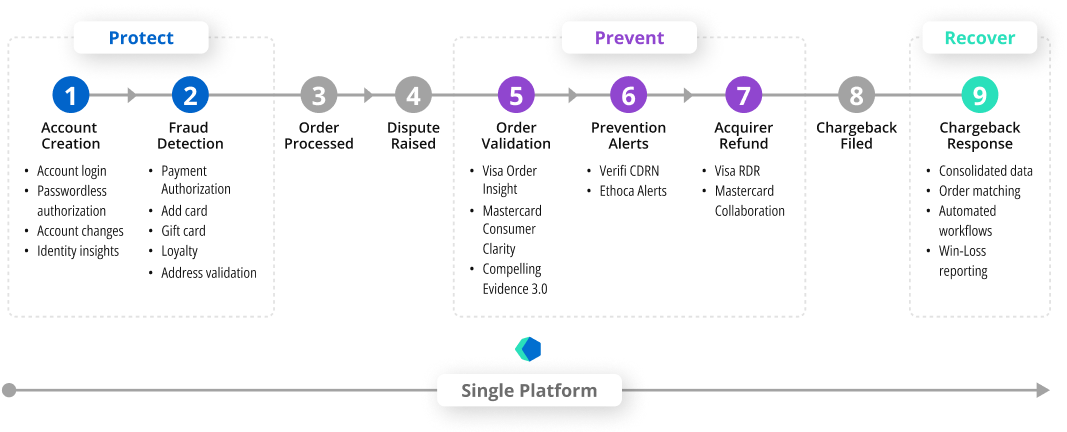

Stop friendly fraud chargebacks with Order Validation

Turn the cardholder’s bank into your ally against friendly fraud. Share business, transaction and device fingerprinting information in real-time when requested — such as your return policy or a description of what was purchased. Empower banks to work on your behalf to resolve the customer complaint and avoid payment disputes. Kount’s order validation capabilities support:

- Ethoca Consumer Clarity

- Verifi Order Insight

- Visa CE 3.0

Intercept disputes to preempt chargebacks with Prevention Alerts

Resolve pre-dispute cases by receiving alerts from participating issuers quickly and easily within 72 hours. These alerts enable the initiation of a refund, to avoid any chance of the pre-dispute escalating to a formal dispute. Prevention alerts are essential to help your business avoid monitoring programs and costly chargeback fees. Kount’s prevention alerts support:

- Verifi Cardholder Dispute Resolution Network (CDRN)

- Ethoca Alerts

Prevent future chargebacks with Notices and Inform Reporting

Receive data for all confirmed fraud (TC-40) and chargeback notifications in real time. INFORM provides a single source for key data points that can improve link analysis, fraud analytics, and modeling, to enhance fraud detection and improve manual reviews. Businesses can analyze this data to track and improve fraud rates, gain customer purchase insights, and identify chargeback patterns. The results can then be used to improve rules and further optimize chargeback prevention.

Automate credits to reduce manual reviews with Rapid Dispute Resolution

Apply auto-decisioning to resolve both fraud and non-fraud Visa disputes to avoid a chargeback. Sellers can use a robust decision engine that includes seller-defined rules to optimize their refund policies. Automated credits improve customer experiences through quick resolutions, save manual review time and cost, and prevent dispute filing errors to reduce chargeback liability.

Recover revenue with Chargeback Responses

A chargeback response allows you to challenge illegitimate transaction disputes. If you successfully overturn the chargeback, you’ll recover revenue that’s been lost. With Kount’s advanced technology, you no longer need to be burdened by time-consuming, labor-intensive, error-prone processes.

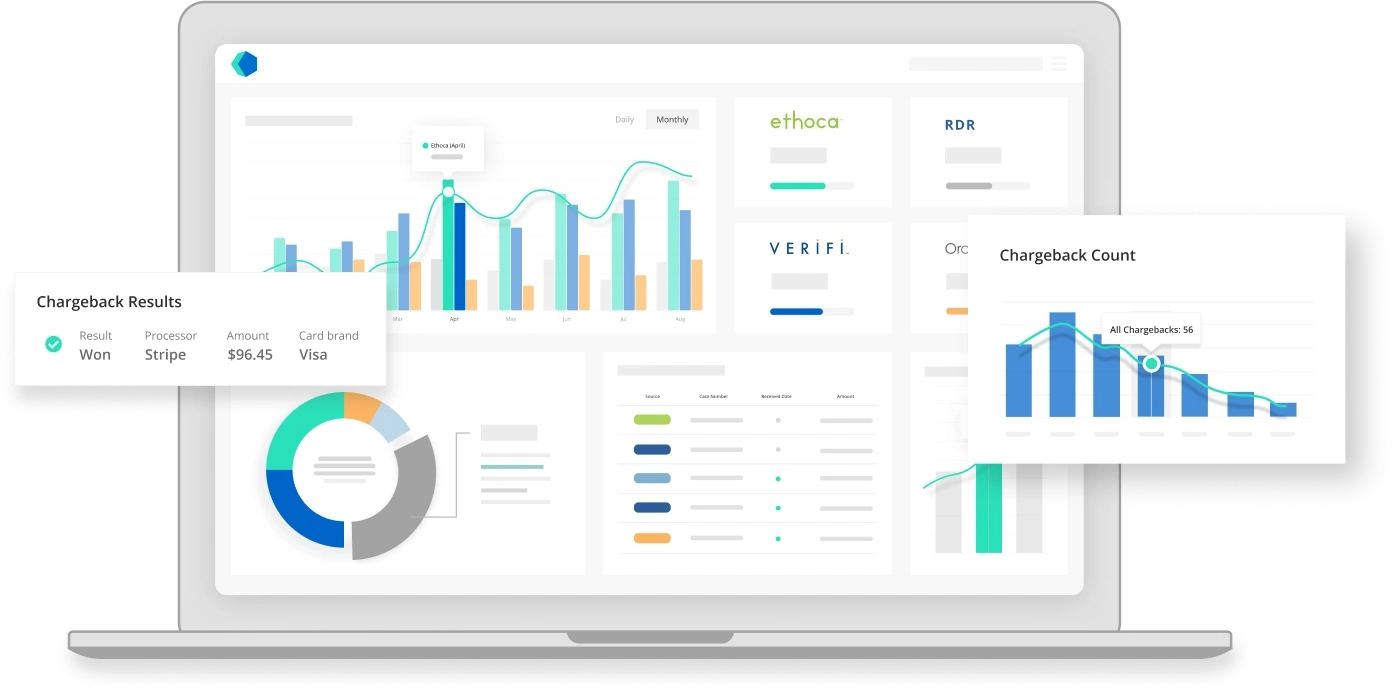

Business oriented Scalable Automation

Kount enables you to prevent chargebacks with a choice between advanced or basic automation. Our advanced automation technology will do everything necessary to stop chargebacks from happening. All actions are recorded so you know exactly what’s being done. Alternatively, our basic automation offers guided workflows, ensuring you won’t miss a step or waste any effort. Detailed reporting makes it easy to evaluate the effectiveness of your strategy.

Complete End-to-End Chargeback Solution

Chargebacks have damaged your bottom line for long enough. It’s time to protect the revenue that’s rightfully yours. Kount is here to help by offering a complete end-to-end solution for chargeback management that will help protect your business and grow revenue.

Kount offers advanced solutions that prevent chargebacks from happening. Our advanced data transfer technology spans every touchpoint across the customer journey, from an account being created to a chargeback being filed, and is fed into our artificial intelligence (AI) and machine learning (ML) models to help identify fraud patterns. This enables fraud analysts to make rapid data oriented decisions on whether or not they should add a customer to a decline list and also facilitates the adjustment of policies according to your business goals. Kount’s unique data transparency provides the information you need to save a sale, prevent a chargeback, and grow your business efficiently.

We’re here to help

Contact your Kount representative or visit Kount Support for a tutorial on chargebacks and dispute flow.

Download the Chargeback Management brochure

For more information on Equifax Fraud Solutions powered by Kount, please contact your Account Manager.