Request an online demo

Get a personalized online demo of Kount's trust and safety technology at a time and date of your choosing.

RDR FROM KOUNT

How does Rapid Dispute Resolution work?

Rapid Dispute Resolution (RDR) revolves around a simple idea: if a disputed transaction is refunded, a chargeback is no longer necessary. Just decide which disputes you are willing to accept liability for — such as cases with certain reason codes or transactions under a given dollar amount. Then the bank will automatically refund any dispute that meets your chosen criteria.

A transaction is disputed.

The cardholder contacts the bank to dispute a transaction.

RDR is initiated.

The cardholder’s bank activates the RDR workflow.

Filters are applied.

The technology consults your pre-set rules to determine whether or not the transaction should be refunded.

A refund is issued.

The qualifying transaction is automatically refunded on your behalf.

A chargeback is prevented.

The case is closed. A chargeback is no longer necessary.

WHY RDR?

Unique benefits you don’t want to miss

All chargeback prevention solutions come with clear benefits such as keeping chargeback counts low, improving the customer experience, identifying issues quickly, and saving fulfillment costs. But what are the unique qualities that make RDR so useful?

No-chargeback guarantee

RDR is one of only two chargeback prevention tools that comes with a guarantee. If you refund the disputed transaction, Visa guarantees the case won’t advance to a chargeback.

Automated efficiency

RDR automatically refunds cases that fit your criteria. Real-time resolution means you don’t have to worry about expired cases or missed opportunities.

Customizable filters

You have complete control over what is and isn’t refunded. Set rules that yield the best results for your business. Easily adjust filters as your needs and goals change.

WHY USE KOUNT FOR RDR?

Added value achieves better results

If you use Kount to manage RDR, you’ll get a great chargeback prevention solution plus additional benefits you won't find anywhere else.

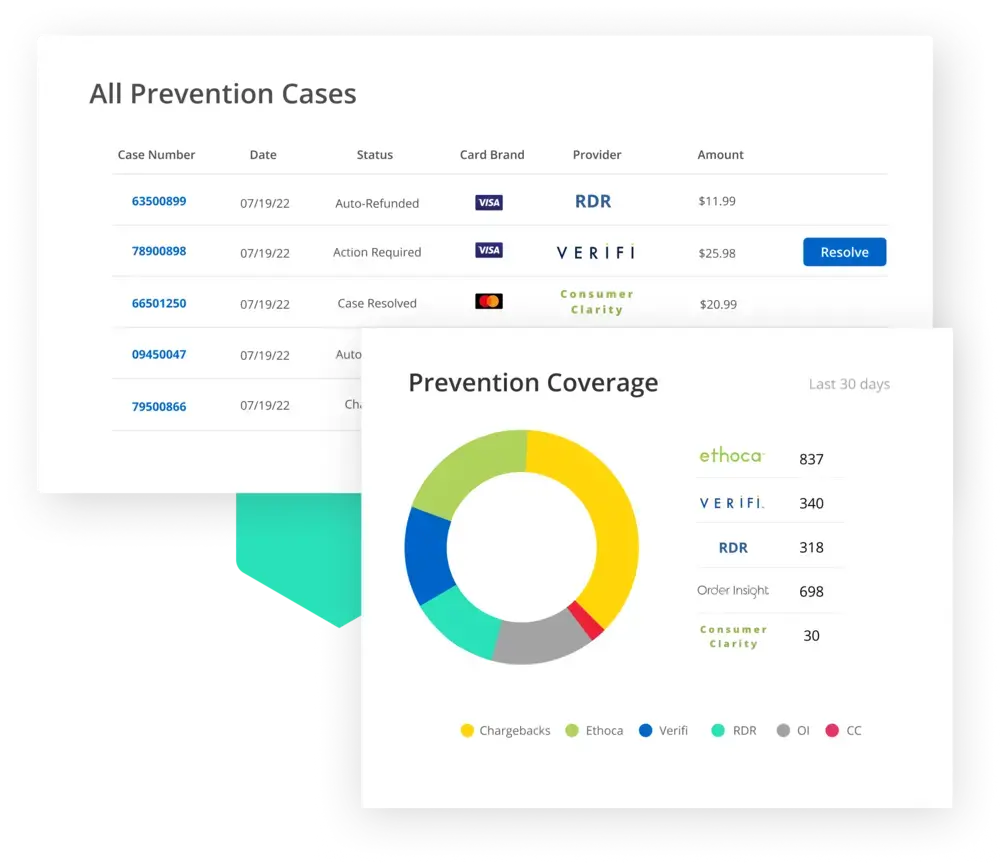

All-in-one platform

The more solutions you use, the greater your protection will be. But keeping track of everything can be a challenge — unless you have all your solutions in one place.

- Launch multiple solutions with just one integration

- Manage a complete strategy with a single contract — prevent, fight, analyze, and automate

- Monitor trends across the entire dispute lifecycle

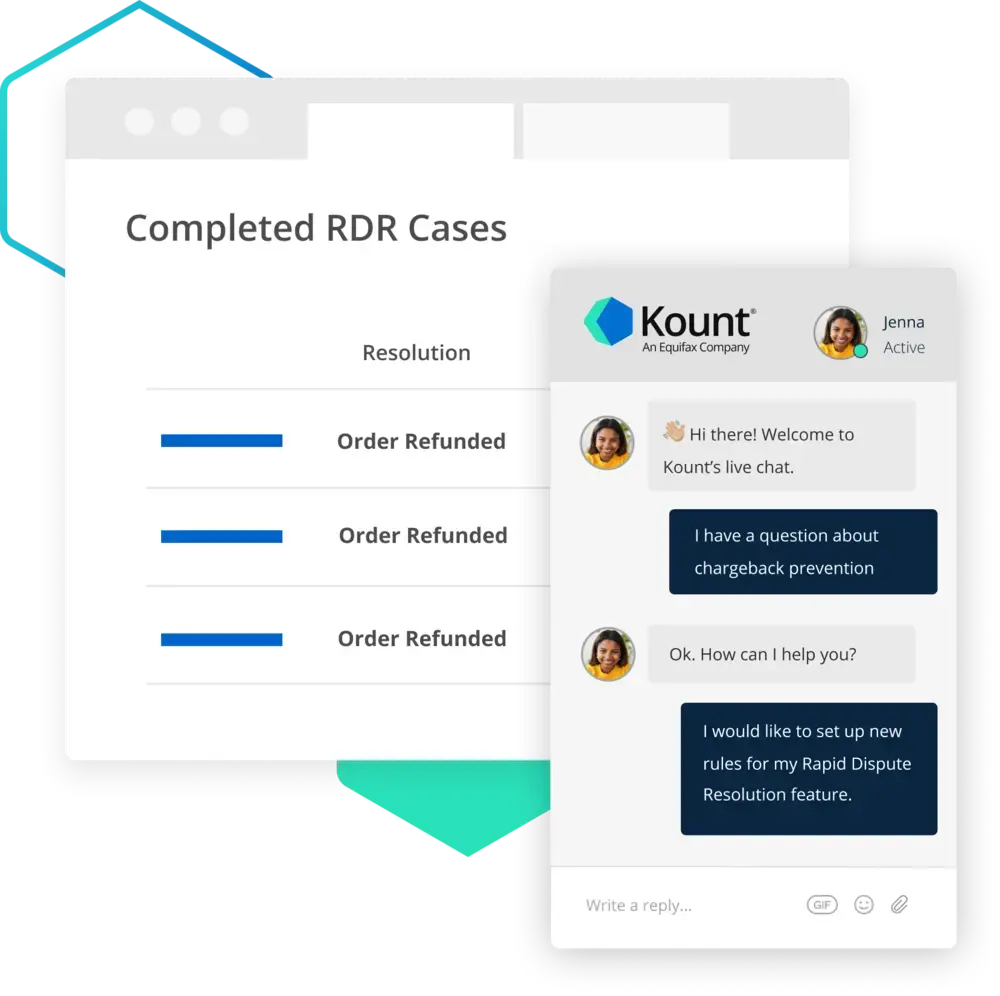

Insights and support

Have questions about new rules and processes? Want advice on improving your strategy? We can help. The Kount team is always willing to share advice and information that will help you achieve better outcomes.

- Decades of experience means we understand industry expectations

- Official partnership with Visa® offers a direct line of communication

- On-demand support provides direct access to our team of experts

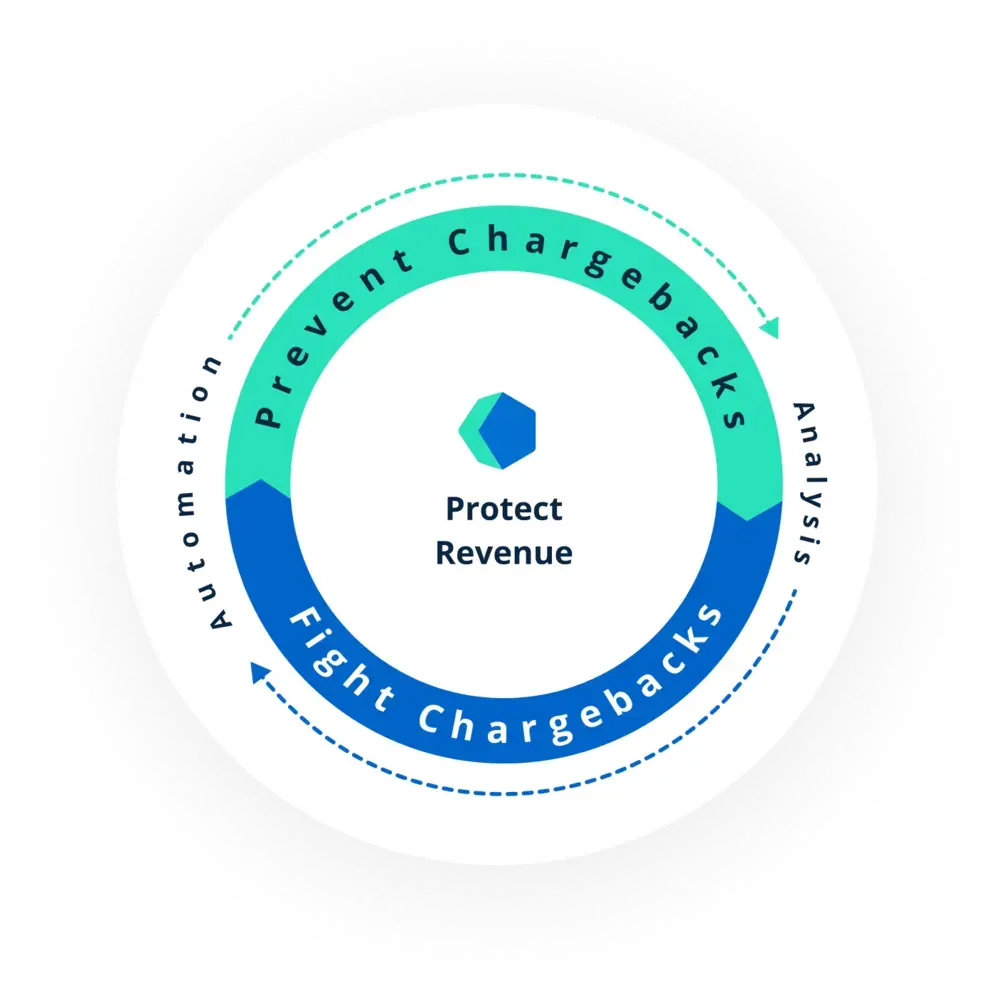

MAXIMUM PROTECTION

Incorporating RDR into a complete strategy

Rapid Dispute Resolution is a useful chargeback prevention solution, but its real value is realized when the solution is incorporated into a broader management strategy. The more complete your strategy, the greater revenue protection you’ll have.

Kount offers a complete chargeback management strategy so you can achieve the best results with the greatest efficiency possible.

ANSWERS & INSIGHTS

Frequently asked questions about RDR

When you enroll in RDR, you’ll set filters (or rules) for refunds. For example, maybe you want to refund all cases with reason code 10.4. Or maybe you only want to issue a refund if the dispute amount is below $20.

RDR cases that do not fall within the defined ruleset will continue through the standard chargeback process. From there, you can decide whether or not you want to fight the chargeback.

Yes! You can change your RDR rules at any time. However, updates might not be immediate. It can take a week or so for the new rules to be adopted.

RDR has a very high adoption rate amongst global issuers. Visa estimates that issuer adoption covers 97% of U.S. disputes and 83% of global disputes.

Pricing for all prevention tools is decided by the vendor that created them. In the case of RDR, pricing is set by Verifi.

Fees are assessed on a per-case basis, regardless of whether or not a refund was issued.

The fee amount varies by pricing tier. The three pricing tiers for RDR are set by merchant category code (MCC). Your business’s MCC will dictate how much you pay per RDR case.

When you sign up for a demo of RDR, our sales representative will calculate more specific pricing for your business.

We estimate that RDR is able to stop about 90% of Visa chargebacks. So there are about 10% of cases that are susceptible to chargebacks. And there are three main reasons why.

- It can take 2-5 weeks for a chargeback notice to reach you. So when you signed up for RDR, there were chargeback cases already in flight but you didn’t know about them yet. The full effect of RDR will be realized about a month after you sign up.

- Globally, RDR has a very high adoption rate. However, there are still some banks that haven’t opted into the process. You’ll still receive chargebacks from banks that aren’t using RDR.

- Most merchants set up filters (or rules) for RDR that dictate whether or not a chase should be refunded. Because sometimes, it is better to let a case advance to a chargeback so it can be fought — for example, if you have strong compelling evidence or the dispute amount is very high. Unless you’ve set your rules to refund every single case, you’ll still receive some chargebacks.

If you think your RDR coverage isn’t as good as it should be, our support team can investigate and help troubleshoot.

Schedule a demo

GET STARTED TODAY

Prevent chargebacks. Guaranteed.

Companies all over the world use Kount to prevent chargebacks with RDR. Will you be next? Sign up for a demo today, and see how our technology delivers confidence in every interaction.