Talk to an Expert

GUIDE

7 Features to Look For When Buying Fraud Detection Technology for Restaurants

Talk to an Expert

Your content has been unlocked!

Please enjoy your unlocked content below!

Developing a fraud strategy can feel like a major hassle. But fraud detection software can make the process easier and more effective.

It’s important to find a technology solution that can solve all the problems you’re experiencing from a provider that truly understands the challenges facing restaurants today.

Here are the seven features you need to achieve the results you’re looking for.

1. Dynamic, Real-Time Data

Data is the foundation of a fraud detection and prevention strategy. And with that data, you can do so much.

Without fraud technology, all your customers look the same. For example, you might collect and store the standard details for everyone who dines with you — like email address and payment details. But those details don’t provide insights. You don’t know anything about your customers or the risk they pose to your business.

Fraud technology goes beyond the basics to collect and analyze real data that has value and meaning. For example, fraud technology can take the email address you collected and check to see how many devices it’s associated with, if that email has already been used for a promotion, if the account created with that email is trying to be accessed by someone else — and so much more.

To stop fraud, you need to be informed of the potential risks of each customer you interact with. And data makes that possible.

What Makes Data Effective?

You don’t need just any data. You need the right data.

- Network of Data: Having access to a network of data collected from other businesses gives you insights outside your own customer database so you can make better assessments. Look for technology that will not only analyze your own data but will compare it to anonymized data across an entire network.

- High Quality Data: The more data you have, the more accurate your decisions will be. Look for technology that has years of data collected globally from multiple industries.

- Up-to-Date Technology: Data can only be as effective as the technology it comes with. As new fraud threats arise, you will need more robust data and stronger controls. Look for technology that is constantly upgraded and can adapt to new trends.

- Real-Time Insights: Fraudsters are quick and agile. You need real-time insights that let you stay one step ahead of risks.

- Industry-Specific Features: QSRs usually have unique reporting needs. For example, maybe you want channel or franchisee-level reporting so you can monitor individual and overall trends. Make sure the data provided can be sorted and filtered in a way that’s relevant to your business.

2. Advanced AI and Machine Learning

Having the right data is the first part of effective fraud technology. The second part is artificial intelligence (AI) and machine learning that can use the data to make decisions.

Make sure the technology you implement has the right kind of machine learning so that it can solve a variety of problems accurately.

What is Machine Learning?

Machine learning is a form of applied AI. It is the science of getting machines to act intelligently without being programmed. Using machine learning, fraud prevention solutions can learn on their own and continually improve results without human intervention. That way, you can automate decisions while still getting the most accurate risk assessments possible.

Some fraud technologies in the industry today incorporate supervised machine learning — which is the most basic capability.

Supervised machine learning looks at the customer’s past actions such as chargeback activity and refund requests.

But the best protection comes from combining multiple machine learning models. This allows for greater insights and more accurate decisions. At Kount, we use both supervised and unsupervised machine learning.

Unsupervised machine learning looks at the customer’s attributes such as number of email addresses and types of devices.

Both models evaluate the data associated with a given interaction and compare it to data in the network. Then, it generates a transaction safety rating. From there, transactions can be automatically declined, approved, or held for manual review based on established policies. So all you have to do is set up policies and risk thresholds that align with your business goals, and the technology will go to work.

Below is a visual of how Kount's technology incorporates machine learning.

3. Mobile Fraud Screening Technologies

Mobile apps can increase earning potential for QSRs, but they pose a major fraud risk if left unprotected. If your restaurant has a mobile app, you’ll want to secure it with fraud technology. Here are a couple of fraud screening features to look for when considering your options.

- Mobile Device ID: Device information helps quantify the risk of a mobile transaction. The ability to detect the type of device — and dozens of other characteristics such as IP address, operating system, region, country, language, etc. — is essential to detecting fraud. For example, if a returning customer places an order using the same device but from a different location, the order may be fraudulent.

- Mobile Geo-Location: Mobile devices often use proxy IP addresses or connect through carrier network IPs, which can distort the actual location of the device. By pinpointing the true location, you can quickly detect fraud. For example, if an order to pick up a meal at a quick service restaurant drive-thru window in Dallas originates from a device in Vietnam, it’s likely fraudulent.

- Account Takeover Prevention: Many mobile apps store customer payment information and loyalty points. And fraudsters will go to great lengths to get that information. So account takeover attacks are a major risk. If the mobile app for your QSR stores information that’s appealing to fraudsters, make sure the fraud technology you choose has robust account protection capabilities.

4. Mobile Software Development Kit

It’s important to use mobile fraud screening tools to detect fraud. And it’s ideal to embed those fraud prevention capabilities into the development of your mobile app. A software development kit (SDK) provides an easy, smooth integration of fraud technology for mobile devices. Plus, it allows you to create a frictionless — yet secure — mobile app experience across all mobile platforms.

What Are The Main Benefits of SDKs?

These are the two key benefits of using a mobile software development kit to manage fraud:

Stronger Fraud Protection:

- An SDK gives you superior device identification. You’ll have the most complete and accurate insights about who you are interacting with.

- More layers of protective technology means multiple points for detecting anomalous behavior and transactions.

Improved Customer Mobile Experience:

- Customers can have zero friction during mobile login.

- Customers will have a faster checkout and smoother process.

5. Customizable Business Policies

Some fraud prevention solutions make approval decisions based solely on their machine-generated algorithms. That means the technology assumes it knows what’s best for your business. But what you actually need is a way to make decisions based on your business’s unique fraud risks and business goals.

For example, maybe you want to adjust your policies to correspond with promotions or big events. If you sell chicken wings and pizza, your restaurant is probably popular during the Super Bowl. If you operate a cafe, you could see an influx in activity on National Coffee Day. At busy times, you might want to relax your fraud rules. Letting in a few more fraudsters could be preferable to accidentally turning away good customers that would otherwise be loyal, repeat diners.

Customizable business policies enable the flexibility you need to be efficient but also increase revenue as much as possible.

How Do Business Policies Work?

No one knows your business better than you, which is why you should determine the way your business responds to different risk factors.

- Policy Management: You should be able to customize policies within the solution, giving you complete control to approve, decline or review transactions based on your business goals. For example, different franchises might need a different set of fraud controls to cater to unique challenges. You get to decide the risk thresholds that make sense for different scenarios.

- Automated Decisions: Setting risk thresholds allows you to accurately automate a higher percent of decisions. Fraud experts can manually review any anomalies. Then, those anomalies can be incorporated into your business policies so that you can reduce manual reviews over time.

6. Chargeback Management

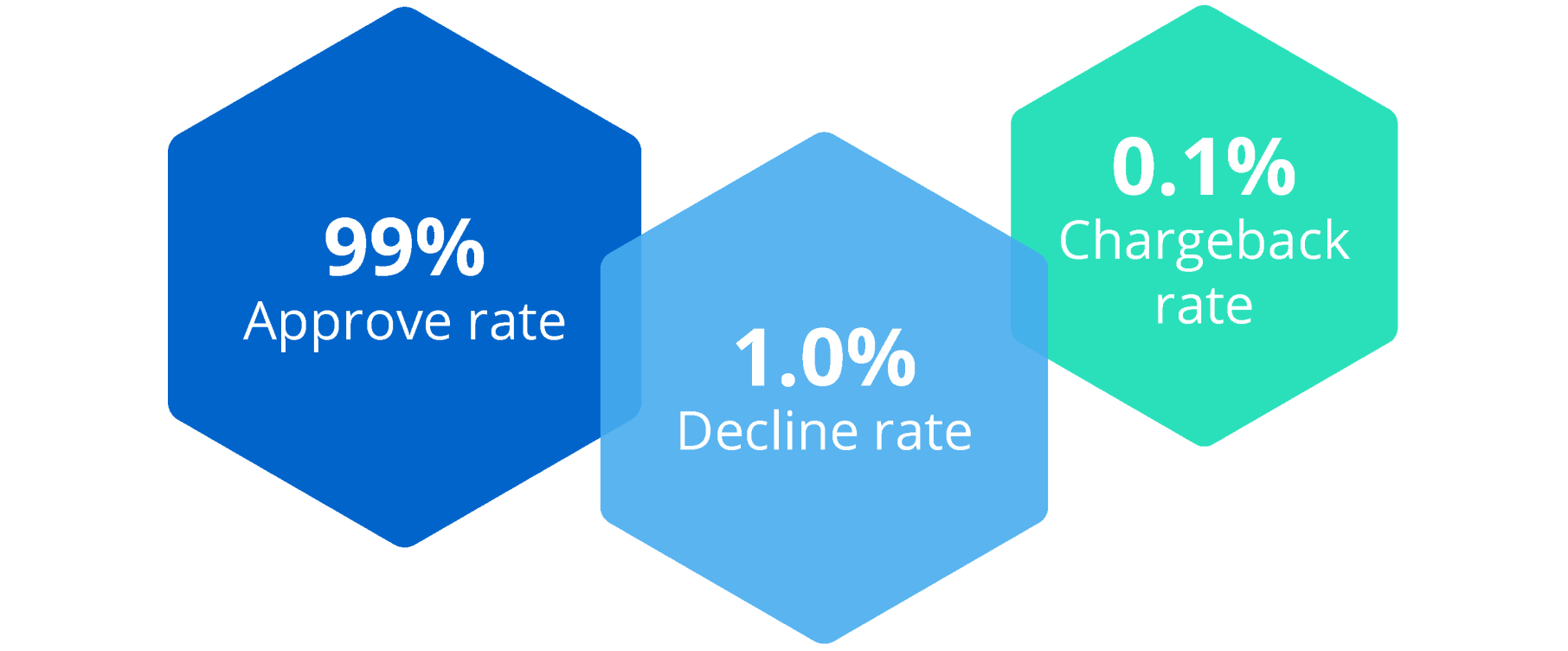

Chargebacks happen when customers contact their bank to dispute purchases they’ve made with your restaurant. Managing chargebacks can be confusing, labor-intensive, and costly — if you don’t use technology. A quality fraud management platform will incorporate chargeback solutions into the technology.

How Does Fraud Technology Manage Chargebacks?

- Preventing Chargebacks: Technology can implement various strategies to reduce the risk of chargebacks. It’s often possible to resolve customer complaints before a dispute advances to a chargeback. This helps protect your business’s reputation and revenue.

- Responding to Chargebacks: Not all chargebacks can be prevented. When chargebacks do happen, you have options on how to respond. Sometimes, if the chargeback is invalid, you can challenge the customer’s claims and recover revenue that’s been lost. Technology makes the response process more accurate and efficient.

7. Experienced Human Intelligence

Fraud is not your core competency — and that’s okay. The right fraud technology platform comes with experts that can help you set risk thresholds and business policies to maximize your profits.

Benefits of Having Fraud Experts on Your Team

- Respond to Strategic, Adaptable Fraudsters. Criminals are organized and strategic. It takes a team of industry experts to help identify new fraud trends as they emerge. And those experts can help you adjust the technology or suggest additional tools to help you counter emerging schemes.

- Reduce Costs. Managing fraud on your own can be expensive and difficult. Luckily, fraud experts are an extension of the fraud prevention platform you purchase. They have the resources and expertise to help you manage fraud threats without increasing costs.

- Focus on Your Core Business. When you allow fraud experts to help manage fraud, you free up time to focus on what really matters — serving your customers. Fraud experts can also help you improve business operations and efficiencies, save time on fraud maintenance, and lower your upfront and recurring costs so you can spend more time on integral business processes.

RESULTS

Protect Your Business and Save Revenue

In today’s digital world, fraud management is a necessity. And on your own, it’s incredibly difficult and expensive to do right.

That’s where fraud technology comes in.

But not just any technology. You need a solution specifically designed to tackle the unique threats facing restaurants. And Kount can help. Kount works with dozens of restaurants like yours to reduce risk and increase revenue — with the highest ROI possible. And we can help you too.

We understand the challenges unique to your business. And we can help you solve them. Plus, our fraud experts will be there to guide you every step of the way.