Building a Better Approach to Fraud Prevention

Editor's note: This guest post was written by Jordan McKee. Jordan McKee is research director of the 451 Research Fintech research and consulting practice within S&P Global Market Intelligence. He leads a team of analysts based in North America, Europe and Asia that provide guidance on trends at the intersection of finance and technology.

Well over half (58%) of surveyed merchants have seen a year-over-year increase in fraud volume while just 13% have registered a decrease, according to 451 Research's Voice of the Enterprise Merchant Study. Fraudulent attacks are not only increasing — they’re diversifying. Account takeovers, new account fraud, promotion abuse, friendly fraud and return abuse are just a sampling of the threats that merchants are up against today. In short, every customer touchpoint is becoming a vector for fraud, poor customer experience and losses.

As merchants look to counteract diversifying fraud threats, the customer experience implications begin to proliferate. Friction is no longer created just at the payment stage; it's starting to occur from the initial interaction with a customer or prospect. In fact, our research shows that less than a third of merchants believe they are able to effectively balance their user experience and fraud-prevention priorities. The conclusion we can draw from this is simple: Without the ability to effectively discern good customers from criminals, the end-to-end customer experience — and, therefore, the business — inevitably suffers.

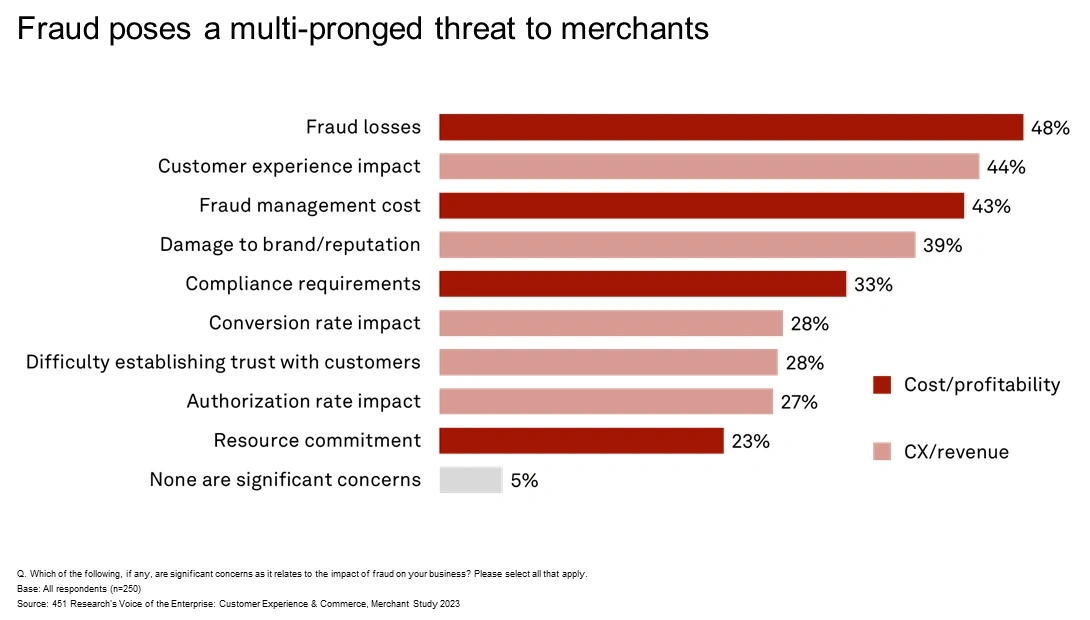

Today, fraud is about much more than the bottom line. It has a multi-pronged impact on merchants that directly impacts the customer experience, top-line revenue growth and operational performance. To address emerging fraud challenges, merchants often find themselves in a dilemma of whether to devote precious time to build internal capabilities or leverage the support of a partner. At its purest form, this is a question of resource allocation and core competencies.

Every merchant has finite resources and a limited number of areas where it can invest its energy. Business leaders must carefully consider where to focus to maximize strengths, better serve customers and drive favorable business outcomes. The majority of merchants are not best placed to deliver solid fraud-prevention results.

Our research consistently shows that most merchants attain the biggest fraud-prevention impacts by aligning with partners that can abstract complexity and reduce operational burden, enabling merchants to do what they do best — serve customers. In particular, merchants should seek out partners that can reduce manual processes and that have large and diverse datasets, as well as dynamic capabilities and an ability to target fraud at multiple points across the customer journey.

Above all, a digital identity strategy is crucial. Merchants can maximize their results by aligning with partners that help them develop an understanding of the identity associated with each customer interaction and, importantly, the extent to which it can be trusted.

Copyright © 2024 S&P Global Market Intelligence.

The content of this artifact is for educational purposes only. S&P Global Market Intelligence does not endorse any companies, technologies, products, services, or solutions. Permission to reprint or distribute any content from this artifact requires the prior written approval of S&P Global Market Intelligence.