Disputes-to-Sales Transaction Count Ratio

The disputes-to-sales ratio analyzes how many of a merchant’s transactions turn into disputes.

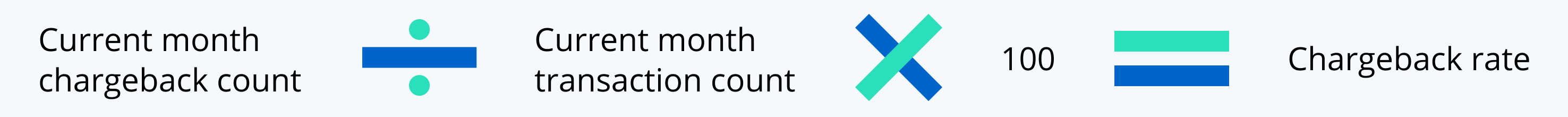

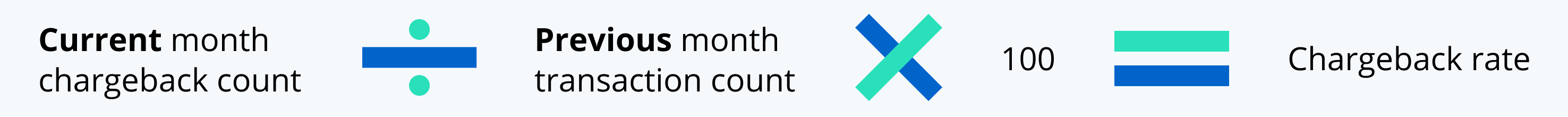

The metric, which is usually expressed as a percent, is calculated by comparing the number of disputes to the number of transactions.

Number of chargebacks ÷ Number of transactions X 100 = CTR

NOTE: Card brands often use different terms to express the same concept. Instead of disputes-to-sales ratio, the phrase chargeback-to-transaction ratio may be used instead.

Brand-Specific Calculations

While the disputes-to-sales equation is the same for all card brands, the data source used in the formula varies slightly.

Visa®, American Express®, and Discover® compare dispute counts for the current month to transaction counts for the current month.

Mastercard® compares dispute counts for the current month to transaction counts from the previous month.

How the Disputes-to-Sales Ratio is Used to Manage Risk

The card brands expect acquirers (banks) to monitor the risk associated with each merchant that processes payment card transactions. There are several different risk metrics that the acquirer must monitor, and the monthly disputes-to-sales ratio is one of them.

The brands have set thresholds, or limits, that merchants need to abide by. In most situations, the acceptable limit for the disputes-to-sales ratio is about 1%.

If the disputes-to-sales ratio is above the acceptable limit, the merchant could be placed in a monitoring program with even greater scrutiny. Merchants enrolled in a dispute monitoring program may pay additional fees. Penalties can include losing payment processing privileges.

RELATED READING

Help! I Breached the Chargeback Thresholds! Now What?!

Protect your revenue with chargeback management