FEATURES

Unique features. Complete protection.

Kount offers a complete set of cutting-edge features, creating unparalleled protection. Whether you need account protection, data insights, chargeback management, or help with compliance regulations, Kount has you covered. There are no limits to what we can help you accomplish.

PAYMENTS FRAUD

Complete confidence for payments

Being able to accept payments from your customers is an absolute necessity. But processing transactions can be risky — if you don’t have the right protections in place. Find out how Kount can help your business generate more revenue with less risk.

Fraud detection and prevention

Want to maintain positive revenue growth? And worry less about events that can harm your business? Kount can help. Our fraud prevention and detection software can stop threats and improve business operations so you can focus on increasing revenue.

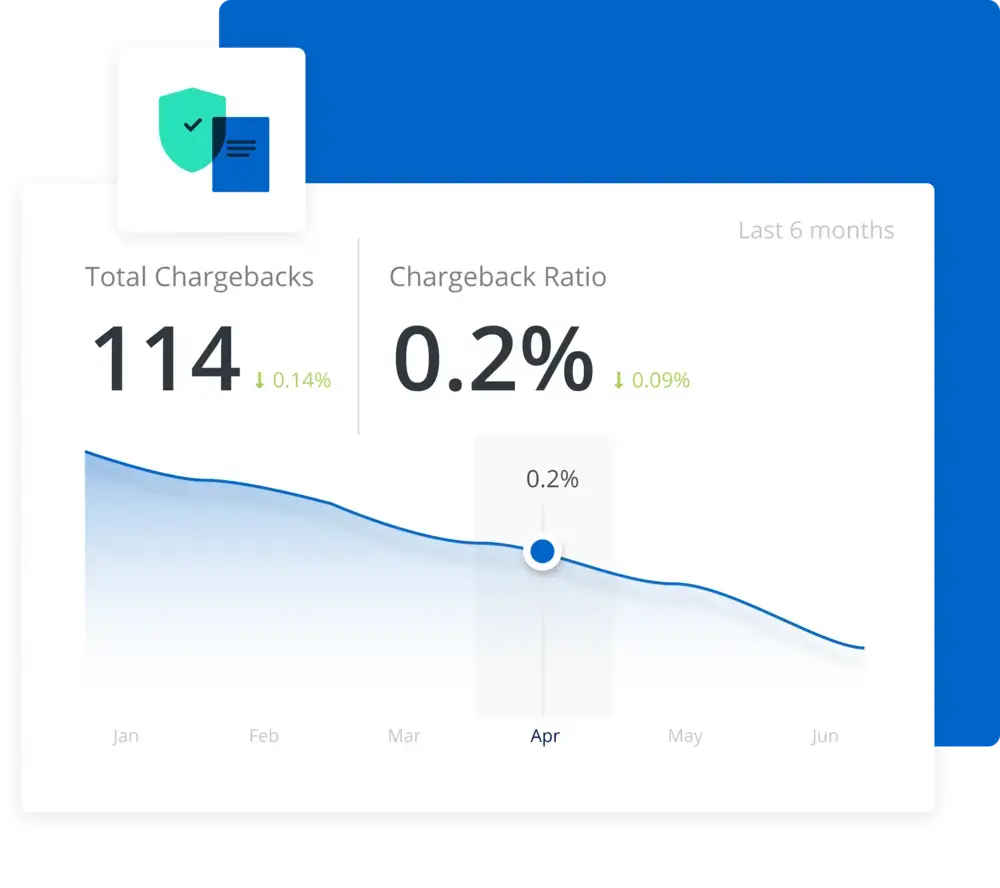

Chargeback management

Chargebacks have damaged your bottom line for long enough. It’s time to protect the revenue that’s rightfully yours — and Kount can help. We offer a complete solution for chargeback management.

Authorization optimization

When customers win, we all win. Reduce the number of false positives — declined legitimate orders — and watch your conversion rates soar.

IDENTITY

Complete confidence for

digital identity

Understand who is interacting with your brand so you can build a better, safer experience to grow revenue.

Consumer Insights

Wondering how to get the right customers in the door? But still manage the risks? Look no further. Kount gives you actionable insights into consumer behavior — risk levels, purchasing decisions, propensity to spend — so you can increase your bottom line while protecting your business.

New account fraud prevention

New accounts can lead to valuable customer relationships — as long as they are created by legitimate customers. Fraudsters and opportunistic customers often open fake accounts that expose your business to unnecessary risks and fraud schemes. That’s why we make sure you let the good customers in and keep the bad ones away.

Account takeover prevention

Account protection technology detects suspicious activity and stops costly account takeover (ATO) fraud. Plus, our technology can give your customers a better, seamless experience across your platforms.

COMPLIANCE

Comply with complete confidence

Laws and regulations are designed to protect your business — but compliance can be a challenge. Fortunately, Kount helps simplify the complex. Our compliance software makes it easy to adhere to rules without sacrificing business growth.

Customer Due Diligence

Looking for a way to improve the efficiency of your customer due diligence workflow? Let Kount help. Take advantage of our industry-leading technology and decades of experience to achieve the best results possible with the least amount of effort.

Global watchlist search

Wondering how to detect and prevent financial crimes? Unsure about how to conduct necessary checks against sanctions lists? Concerned about the technical know-how needed to comply with law enforcement expectations? Don’t worry. Kount offers a complete solution for global watchlist screening with flexible onboarding options.

Regulatory reporting

Don’t let financial crimes jeopardize your business’s growth. Quickly detect threats and accurately protect your business with dependable, ongoing portfolio monitoring.

Schedule your demo

Fill in the form below and we'll get you a personalized demo scheduled as soon as possible.

EXPLORE KOUNT

Want to learn more?

Schedule a conversation with our team to find out how to grow your business with more confidence.