The #1 Choice for Shopify Chargebacks

See why Kount has a 4.7 out of 5 star rating on Capterra.

"The bottom line is Kount works. It does exactly what was advertised for us, which was reducing friendly fraud."

Lee Schmidt

Founder and CEO

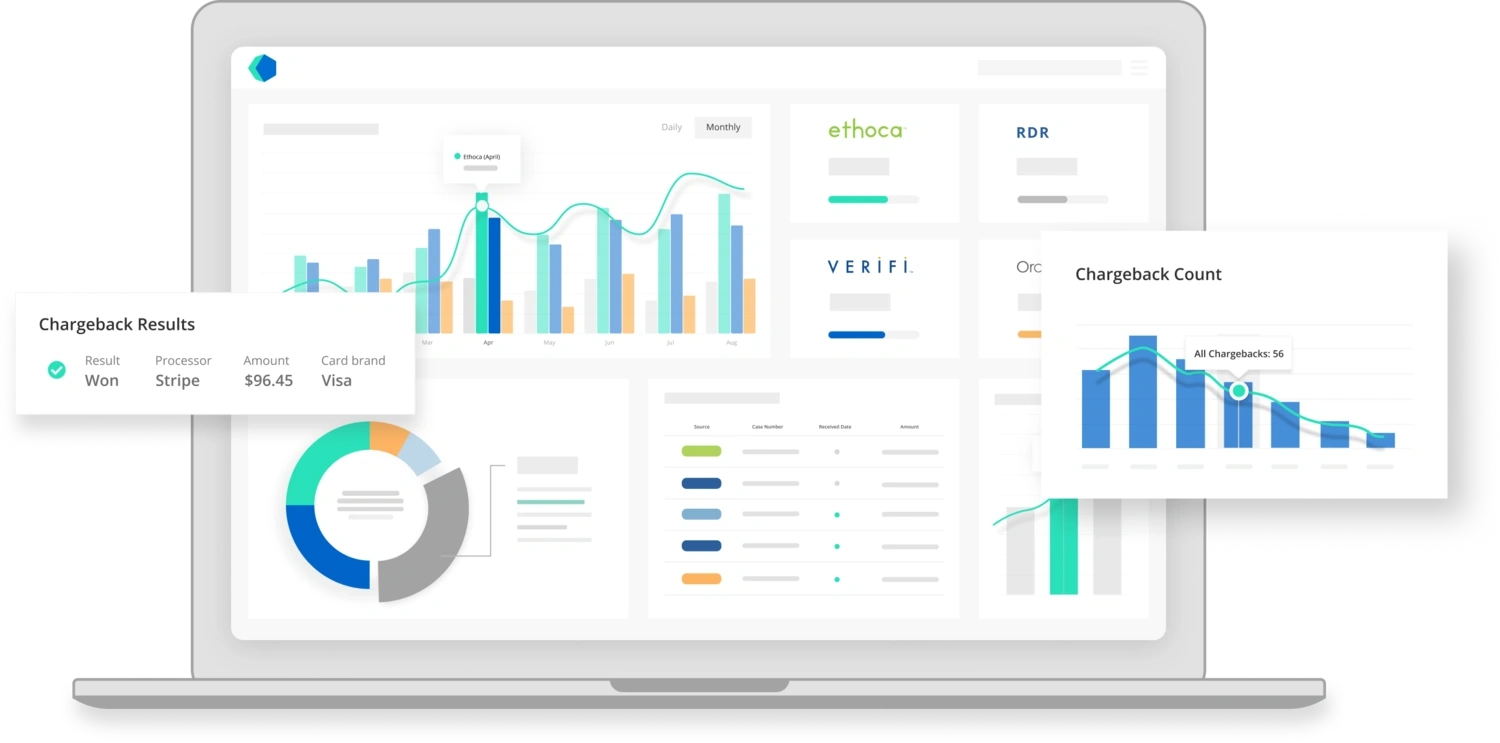

A complete solution for chargebacks

Kount offers a complete strategy for chargeback management — all from a single platform.

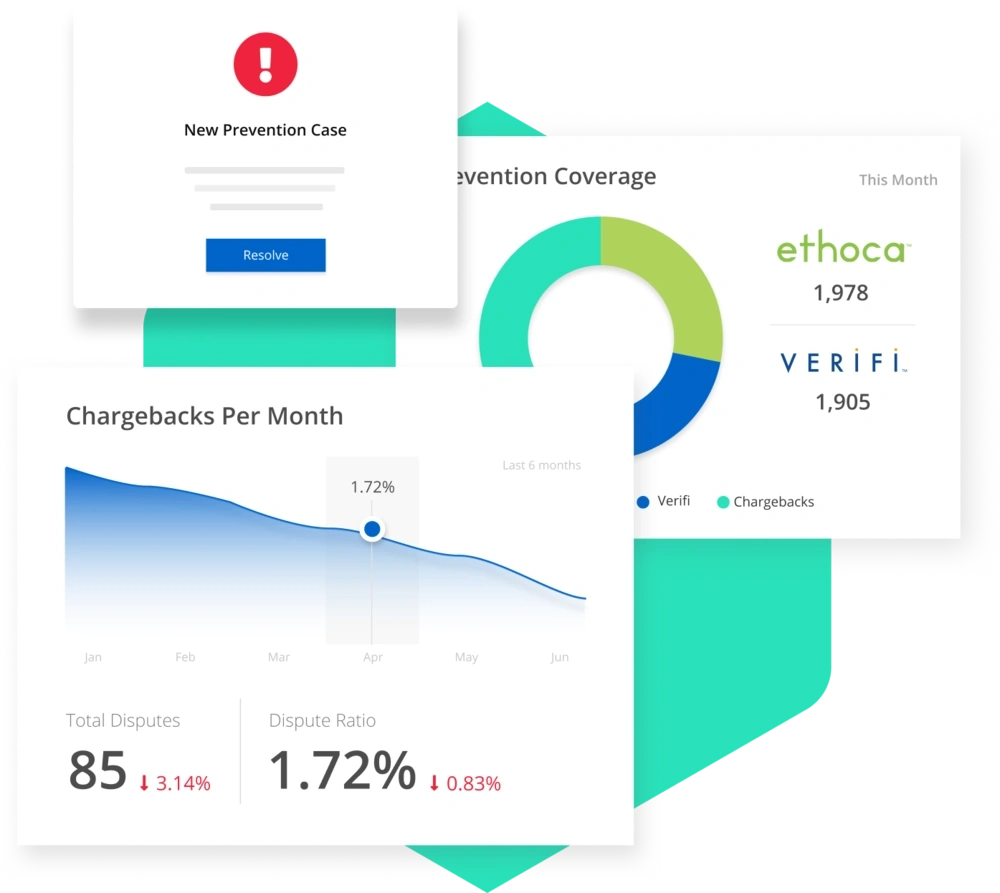

Prevent chargebacks & minimize revenue loss.

The easiest-to-win fight is the one you can avoid. That’s why chargeback prevention is a crucial first step in your management strategy. Kount has everything you need to prevent the preventable.

- Start seeing results in as little as 24 hours

- Prevent up to 50% of chargebacks

- Solve issues up to 5 weeks sooner

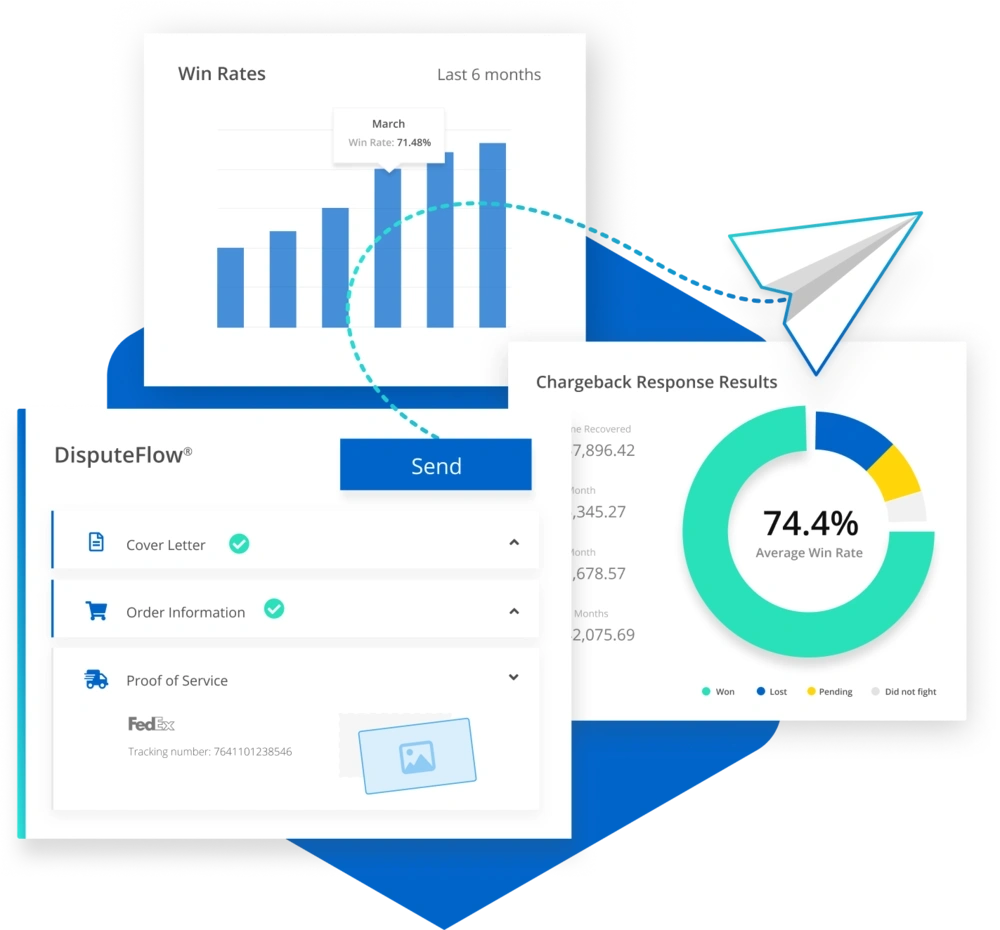

Fight chargebacks & recover more revenue.

When you lose money to chargebacks, Kount gets it back. Our philosophy for revenue recovery is simple: we want you to have the best ROI possible. That means we fight chargebacks with the greatest efficiency and highest probability of success.

- High win rates consistently improve over time

- Intuitive, easy-to-use technology removes guesswork

- Flexible automation replaces time-consuming, error-prone processes

- On-demand support connects you with industry veterans

Chargeback Shopify

Payment disputes are nothing new. It seems very simple: a customer has an issue with a charge and receives a refund. On the retailer’s side, these refunds result in chargebacks. Multiply these transactions by thousands of customers, millions of dollars occurring twenty-four hours a day, seven days a week digitally, and you have data that surpasses manual calculations. In addition, chargeback amounts cost retailers excessive amounts of money and tie up large amounts of cash flow. Companies need a way to manage chargebacks. So what is a chargeback exactly? A chargeback occurs when retailers are required to return funds in response to fraudulent or disputed transactions.

In recent years, a considerable increase in online purchases has resulted in massive amounts of chargebacks. For example, Shopify is an ecommerce platform that allows businesses to build online stores to conduct business. To chargeback Shopify, transactions must be made using a credit or debit card. Most transactions through Shopify are made with these payment cards. Shopify also allows CashApp payments that may not be subject to chargebacks. However, a CashApp chargeback may occur when customers have a credit card linked to their CashApp account.

When a customer disputes a charge, the issuer takes the money from the retailer while the charge is investigated. A common occurrence, the Shopify chargeback percentage can be quite high. The question for retailers becomes how to dispute a charge. Shopify API (application programming interface) may be needed to dispute chargebacks. Shopify API documentation allows automated access to data using a set of functions or processes, transforming the data into actionable information for follow-up. Some free API is included with a Shopify account. However, Shopify API pricing is tiered and includes better tools with different account levels. A software tool like Mitigator integrates with Shopify to help prevent and dispute chargebacks.

See why we’re #1.

Kount is a true software solution, providing complete, intelligent chargeback management.

- A team of experts to help you succeed

- Efficient, flexible automation

- Everything you need in one platform

Shopify Chargeback Protection

Protecting yourself from Shopify chargebacks may involve an extensive understanding of Shopify chargeback API. Shopify chargeback protection usually goes beyond the built-in fraud-based protection offered by Shopify. Shopify chargeback protection from the Shopify platform states they will cover all chargeback costs for fraud-based chargeback disputes. However, there are many different types of chargeback Shopify does not consider fraudulent. A fraudulent chargeback includes transactions the customer did not authorize. Other chargebacks include unrecognized charges, duplicate charges, canceled subscriptions, product issues, and return credits not processed. A chargeback results in a merchant account debit in the transaction amount plus a chargeback fee Shopify applies. When disputes are resolved, money may be credited back to the merchant, depending on the results of the dispute.

Shopify chargeback protections are a necessary business practice dependent on Shopify chargeback API. A software like Kount can aid with Shopify chargeback protection by integrating chargeback solutions. One way to implement Shopify chargeback protection is to quickly respond to customer disputes and resolve issues before they turn into chargebacks. In addition, Mitigator helps merchants rapidly resolve disputes by analyzing and optimizing Shopify data. A consolidated platform using an integration tool increases efficient responsiveness to disputes.

How To Win Chargebacks Shopify

Dealing with chargebacks is an inevitable part of conducting business online. Most merchants need to know how to win chargebacks Shopify charges to merchant accounts. First, merchants must understand Shopify chargeback policy. Dealing with chargebacks and challenging them will include gathering proof of delivery date, evidence of receipt of the products, copies of invoices or product orders, and delivery confirmation, such as a signature. Digital products present another layer of complexity for dealing with chargebacks. For example, they require technical data to present sufficient evidence for chargeback disputes. Shopify may need the recipient’s geographic location, IP address, name, and accessed email addresses used during the transaction. In addition, the customer profile information and dates associated with the profile are pertinent to a chargeback dispute. Evidence that someone accessed the digital merchandise after delivery is also beneficial.

You can see the massive amounts of data needed to win a chargeback dispute. Technology such as Kount can make it easier to fight chargebacks yourself or even handle the process for you from start to finish. For example, the minute Shopify chargeback notifications occur, Kount can go to work for you, helping you win chargebacks. In addition, Kount has advanced dispute management technology that easily integrates with Shopify, offering intelligent dispute responses using real-time account reporting.

Shopify Chargeback Insurance

Shopify chargeback insurance is chargeback protection. This chargeback protection is a form of a chargeback reimbursement or warranty offering to reimburse you for protected fraudulent transactions. Shopify chargeback insurance is called Fraud Protect. It analyzes and identifies fraudulent orders, classifying them as protected or not protected. As you can see, this highly specific category of protected chargebacks may be challenging to apply when there is a long list of potential chargeback categories and may result in a large number of unprotected chargebacks. How many chargebacks are you allowed Shopify will disable payment processing if you have too many? The number is not specified, but it is important to avoid a “high number” as specified on their website, to avoid a disabled payment.

It is imperative that you understand and know how to dispute chargebacks promptly. A Shopify chargeback template can help you quickly file dispute letters and evidence. Creating a Shopify chargeback template for a rebuttal letter can help you repurpose generic information that remains the same every time and fill in customized information for each dispute. A template will help you maintain professionalism and help you remember all the steps and information you need to include with your rebuttal.

Shopify chargeback insurance is a service for which any merchant may apply. Not all merchants qualify for the insurance. In addition, those that qualify will not have all chargebacks covered. Therefore, having a rebuttal plan for chargebacks is essential for every Shopify merchant.

Chargeback Protection Shopify

Fraudulent chargebacks are costly and time-consuming. The chargeback protection Shopify offers through Shopify Protect is offered to qualifying merchants. Shopify Protect only applies to chargebacks categorized as “protected” under Shopify characterization of the disputed charge. While this does apply to some chargebacks, there are many chargeback Shopify Protect does not cover. Therefore, merchants must have effective ways to implement chargeback protection. For example, finding a software tool like Kount that integrates with Shopify can offer chargeback protection through tools like prevention alerts and RDR.

Chargeback protection and Shopify consumer protection are different but related. Some chargebacks occur due to consumers requesting refunds. Merchants must understand and comply with Shopify consumer protection requirements involving refunds to dispute some refund-related chargebacks properly. Merchants must provide public-facing, accurate, up-to-date, easily accessible information about their refund policies on the online store. This information must contain time frames, addresses for returns, shipping costs, and payment requirements. In addition, refund policy information must clearly state time frames for refunds and merchant contact information. If a refund is requested and a chargeback is in the process, sending a chargeback email to the customer may help resolve the issue. Kount chargeback protection services help you avoid potential chargebacks by rapidly alerting you to refund requests.

How To Find Chargebacks On Shopify

Knowing how to find chargebacks on Shopify is critical for merchants. In order to dispute, manage, and reduce chargebacks, you must be able to find them among all the transactions and data collected on Shopify. Chargebacks on Shopify may be accessed directly through Shopify Admin. Payments made with Shopify Payments that result in a Shopify dispute have a Shopify chargeback email response drafted to send to the issuer. As a merchant, you will have an opportunity to add evidence to the Shopify chargeback email. In order to manage this through Shopify, you need to monitor your account activity. It is helpful to use an integrated tool to assist with data analysis, send you real-time Shopify chargeback notifications, and alert you to potential fraud.

Kount is a chargeback solution for Shopify helping merchants gather data and manage and resolve Shopify disputes. Many chargebacks are invalid, but merchants are overwhelmed with data analysis and the complexities of finding and resolving disputes. As a merchant who wants to focus on products and customer service, using software that seamlessly integrates with Shopify to help with chargeback solutions will quickly show its worth by potentially saving time and money through automated chargeback management.

Shopify Chargeback Lost

Merchants do not win every Shopify dispute. Several things happen when a merchant loses a chargeback dispute or takes a Shopify chargeback lost due to opting not to contest the chargeback. The merchant loses the money from the sale, including the actual product, plus the merchant is responsible for any fees incurred due to the chargeback. For example, a Shopify chargeback fee can be incurred for every Shopify chargeback lost.

Merchants wonder if a customer can cancel a chargeback, and the answer is yes. One way to prevent chargebacks Shopify is by contacting the customer. Communicating with your customer may help you resolve the problem before the chargeback is entirely through the process. After communicating and finding a resolution, if a customer decides to cancel their Shopify dispute, they can contact their bank and request the cancellation of the dispute. At this point, a Shopify chargeback email may have been sent from Shopify. Communication is key between all parties when managing any Shopify dispute.

Prevent chargebacks early in the process by using a tool like Kount. An integrative software that works seamlessly with Shopify to provide real-time data analysis. Kount works to help you prevent chargebacks Shopify receives requests daily by using intelligent data collection and alerting you to potential issues early, allowing you to manage and resolve Shopify disputes.

RELATED READING