The #1 Choice for Chargeback Software

See why Kount has a 4.7 out of 5 star rating on Capterra.

"The bottom line is Kount works. It does exactly what was advertised for us, which was reducing friendly fraud."

Lee Schmidt

Founder and CEO

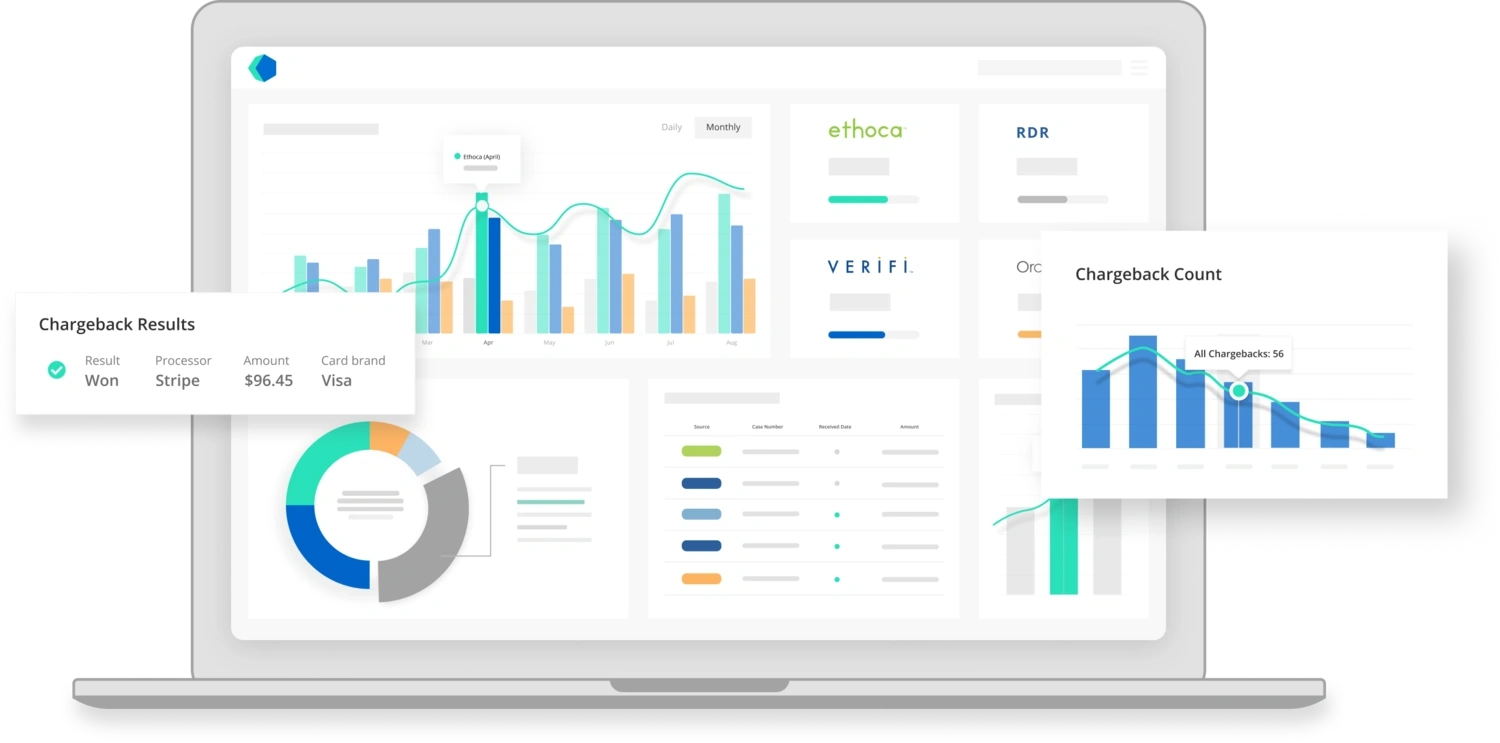

A complete solution for chargebacks

Kount offers a complete strategy for chargeback management — all from a single platform.

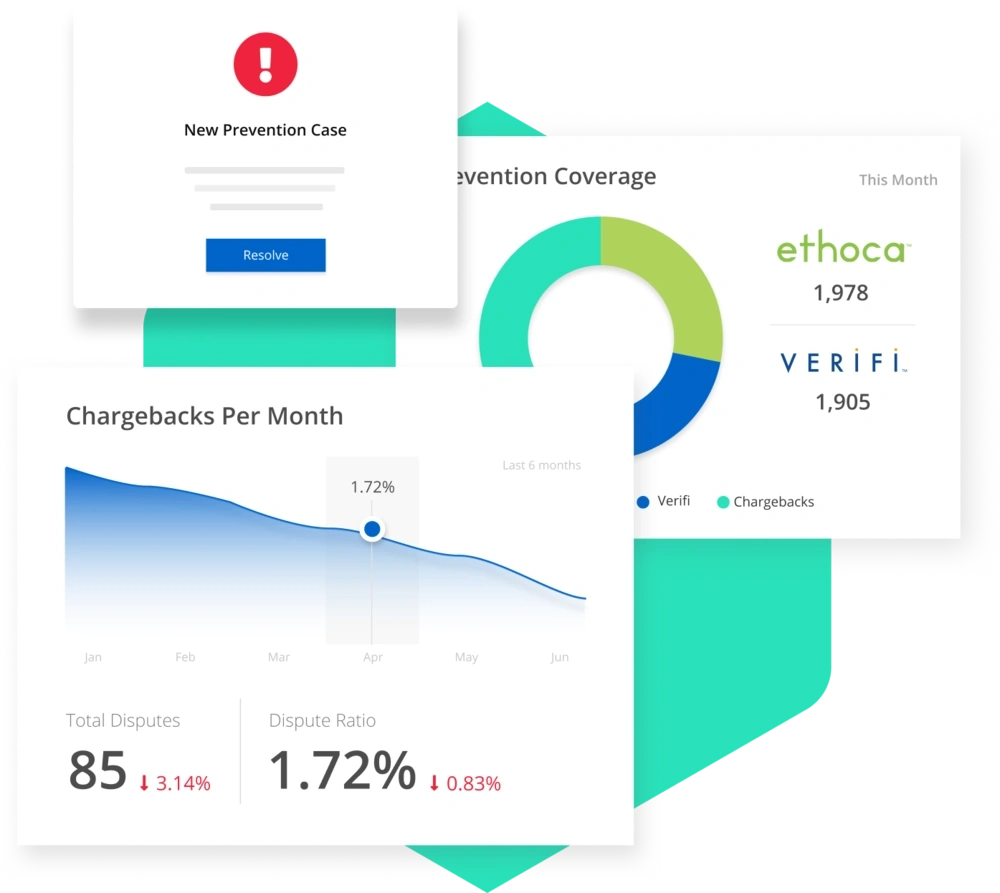

Prevent chargebacks & minimize revenue loss.

The easiest-to-win fight is the one you can avoid. That’s why chargeback prevention is a crucial first step in your management strategy. Kount has everything you need to prevent the preventable.

- Start seeing results in as little as 24 hours

- Prevent up to 50% of chargebacks

- Solve issues up to 5 weeks sooner

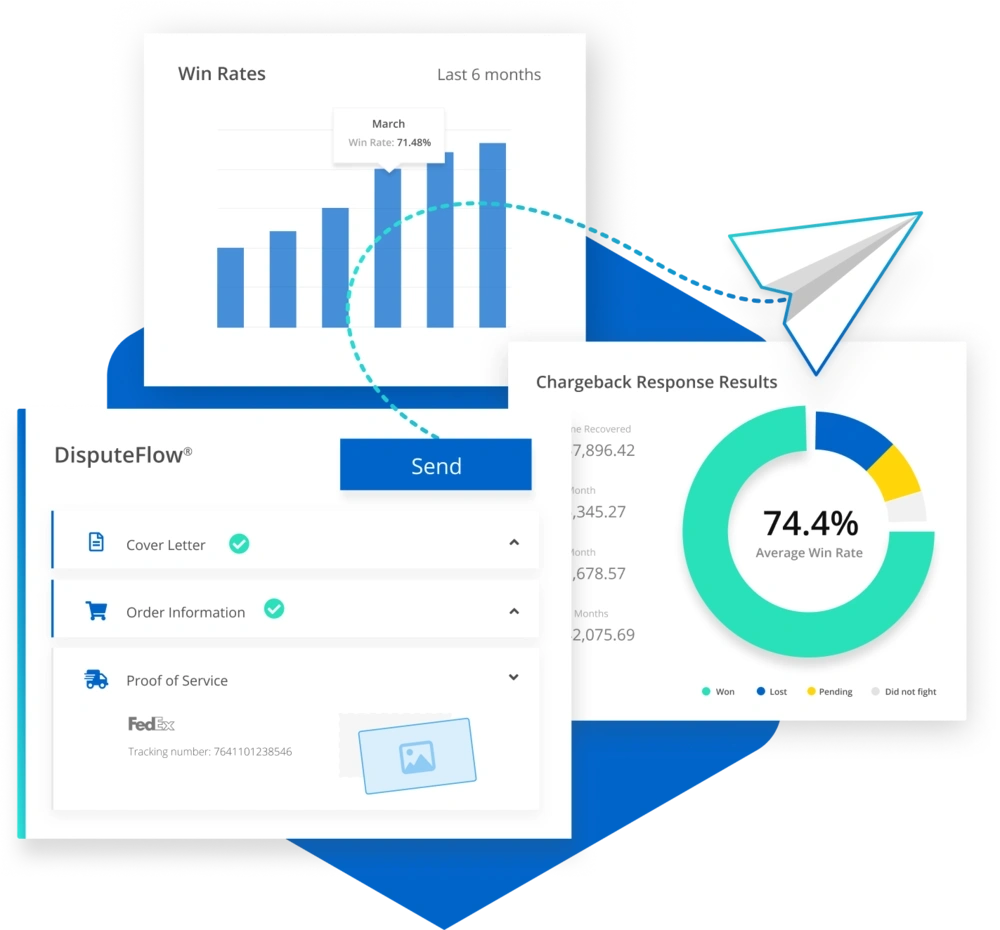

Fight chargebacks & recover more revenue.

When you lose money to chargebacks, Kount gets it back. Our philosophy for revenue recovery is simple: we want you to have the best ROI possible. That means we fight chargebacks with the greatest efficiency and highest probability of success.

- High win rates consistently improve over time

- Intuitive, easy-to-use technology removes guesswork

- Flexible automation replaces time-consuming, error-prone processes

- On-demand support connects you with industry veterans

Chargeback Software

Chargeback software is a type of software that can help business owners protect themselves against payment disputes. Chargeback software can decrease the amount of time that is required to manage chargebacks, including helping business owners fight chargebacks when they do happen and recover any revenue that was lost as a result. Chargeback software can also provide the tools that are needed to analyze chargebacks and prevent them from happening again in the future.

Chargebacks are sometimes confused with refunds, but chargeback meaning in banking differs in a few ways from the way refund is defined. A refund is a voluntary repayment to a customer directly from a business. On the other hand, a chargeback is when a transaction is reversed by the customer’s bank, resulting in the money being taken out of the business’s bank account and put back into the customer’s bank account. From the business’s perspective, the main difference between chargeback vs refund is that a refund is under the business’s control, while a chargeback bypasses the business entirely. Since chargebacks remove the business’s agency in the transaction, it can be helpful for businesses to protect themselves against chargebacks by using chargeback software.

While the obvious factor that makes a chargeback worse than a refund is that a chargeback removes money from a business’s bank account while also happening totally outside the business’s control, there are other downsides to chargebacks as well. There are valuable insights that can be learned from refunds that are not possible with chargebacks. For example, when a customer asks for a refund, they usually must tell the business why they want the refund, and the business can work to solve the problem that is causing the customer to want a refund. If a chargeback occurs, the business may miss the chance to communicate with the customer and understand the problem. This could force the business to make blind adjustments based on guesses instead of concrete customer interactions.

Chargeback Management Software

Chargeback management software could be a worthwhile investment for businesses that need a way to protect themselves against the risks presented by chargebacks. Chargeback management can sometimes be complex, and it can cause some people to wonder: “what is chargeback management?” or “what is chargeback in cloud computing?” Chargeback management software can help businesses prevent chargebacks, learn from them, and dispute them to recover lost revenue.

Users of chargeback management software can receive alerts from the software as soon as a dispute is detected so the issue can be addressed quickly. Prevention alerts can be an effective way of detecting transaction disputes and communicating with the customer before the situation escalates into a chargeback. Even if the customer must be refunded, the business can still gain something from the ability to resolve the dispute directly with the customer. A chargeback is almost always the worse outcome because it results in lost revenue and a missed opportunity for improvement and customer engagement. Chargeback management software can help prevent this outcome by alerting users whenever a dispute is detected so that it can be handled before it progresses to a chargeback.

See why we’re #1.

Kount is a true software solution, providing complete, intelligent chargeback management.

- A team of experts to help you succeed

- Efficient, flexible automation

- Everything you need in one platform

Best Chargeback Companies

A chargeback company is a company that can offer chargeback management software that could help detect chargebacks before they happen, prevent them if possible, and fight them when they are unavoidable. Businesses can use chargeback management software to reduce the risk of losing revenue as a result of chargebacks. The best chargeback companies can offer chargeback management software that can significantly reduce the negative impact of chargebacks on a business.

Kount is an example of a chargeback company that can provide businesses with chargeback management software. One of Kount's functions is the ability to prevent chargebacks by tracking and analyzing chargeback trends. Kount's chargeback software could help businesses leverage real time data in order to improve the business’s understanding of what is causing chargebacks and how they can be prevented. Businesses could use Kount's chargeback trends analytics features to resolve issues as much as five weeks sooner as well as minimize revenue loss.

Some of the top chargeback companies can provide chargeback management software that is capable of making the transaction dispute process much more efficient so that customers can be refunded before their dispute triggers a chargeback. The transaction dispute process for a company that uses Kount for chargeback prevention would look something like this:

- When a customer contacts their bank to dispute a transaction, the bank will usually take note of the customer’s information and then send the details of the dispute through a prevention alert network to be received by the business’s chargeback management software.

- Once this alert is received, the software will alert the business that a transaction dispute has occurred.

- This gives the business time to refund the customer and resolve the issue favorably before it turns into a chargeback.

Chargeback Systems Used In Organizations

Chargeback management software can benefit all kinds of businesses that sell products to customers. One chargeback example is chargeback systems used in organizations. By using chargeback software, organizations could reduce the time spent fighting chargebacks and may be able to reduce the number of chargebacks that occur. Chargeback software can send alerts whenever it detects a transaction dispute that could escalate to a chargeback in order to make it possible for businesses to react quickly. When a business tries to address a dispute without using chargeback software, they might not be alerted as quickly and could waste precious time.

In some cases, poorly timed dispute management could result in a refund after chargeback, which can happen when the business processes a refund after a chargeback has already been initiated. A refund after chargeback scenario can result in the money being withdrawn from the business’s bank account twice. By using chargeback management software, businesses may be able to react to disputes almost immediately so they can be resolved in plenty of time before a chargeback is initiated by the bank.

The chargeback process can sometimes be complicated and difficult to understand. Some people might wonder: “what is a chargeback check?” Sometimes it might be helpful to use a chargeback model example to learn more about chargebacks.

Chargeback Solutions

Chargebacks can be a major risk for businesses, because it can cause them to lose a significant amount of revenue. Businesses are also not in control of the chargeback process, which is handled by the bank, making them even more harmful to the business than refunds are. Thankfully, there are some potentially effective chargeback solutions available. One of these solutions is chargeback management software. Providers like Kount can supply businesses with chargeback management software that could help them fight chargebacks and recover lost revenue.

Chargeback management software can also provide the tools businesses need to track chargeback trends and analyze them, which could make it easier to avoid chargebacks in the future. A chargeback model template could be used to give businesses a starting point for a chargeback model. By using chargeback management software, businesses could gain access to one of the most effective types of chargeback solutions.

Dispute Management System

A chargeback dispute management system can be a very valuable tool for a business to have at its disposal. When a chargeback dispute happens, a company without a chargeback management system might have a difficult time fighting the chargeback and would possibly lose money. By using a chargeback management system, the dispute management process can be made much easier and the business may be able to recover their lost revenue.

How often do merchants win chargeback disputes? Without chargeback management software, it can sometimes be quite difficult for a merchant to recover any revenue that is lost to chargebacks. Thankfully, business owners don’t need to wonder how to dispute a chargeback as a merchant. A credit card dispute management system can help protect merchants against the risk of chargebacks by making them easier to prevent and increasing the chances of winning a chargeback dispute.

Without understanding how chargebacks work, it can be difficult to fight them. So what is a chargeback dispute? Chargebacks can be very complex and difficult to understand. When a chargeback is initiated due to a transaction dispute, the bank withdraws money from the business’s bank account and deposits it back in the customer’s bank account. However, merchants can use chargeback software to help them respond to chargebacks and fight back against them.

Chargeback Process

Businesses that use chargeback software for internal chargeback management could find that it makes the chargeback process much faster and easier. A chargeback fee can be a significant problem for a business. When a customer disputes a transaction and the dispute becomes a chargeback, the business is now susceptible to lost revenue. Since chargeback policy and procedure can sometimes be complicated, it can be useful to use a chargeback management solution like chargeback software to simplify the chargeback process.

Even though the chargeback process is often complicated, simple tools like a chargeback process flow diagram can make it easier to understand. By using tools like chargeback management software, businesses can protect themselves against chargebacks and may be able to prevent them from happening in the first place.

RELATED READING