Mastercard Chargeback & Dispute Resolution Guide

Each card brand handles chargebacks and disputes differently — everything from the terminology to workflows. It’s important to understand Mastercard chargebacks and the rules that govern them. If you don’t, your bottom line will suffer. Unfortunately, card brand rules are constantly changing, and it can be difficult to stay current and compliant.

To make transitions easier, Kount created this Mastercard chargeback guide.

HOW DISPUTES ARE MANAGED

Mastercard Chargeback Process

Before digging into the rules, it may be helpful for you to review the Mastercard chargeback process.

Here’s how Mastercard defines and manages transaction disputes.

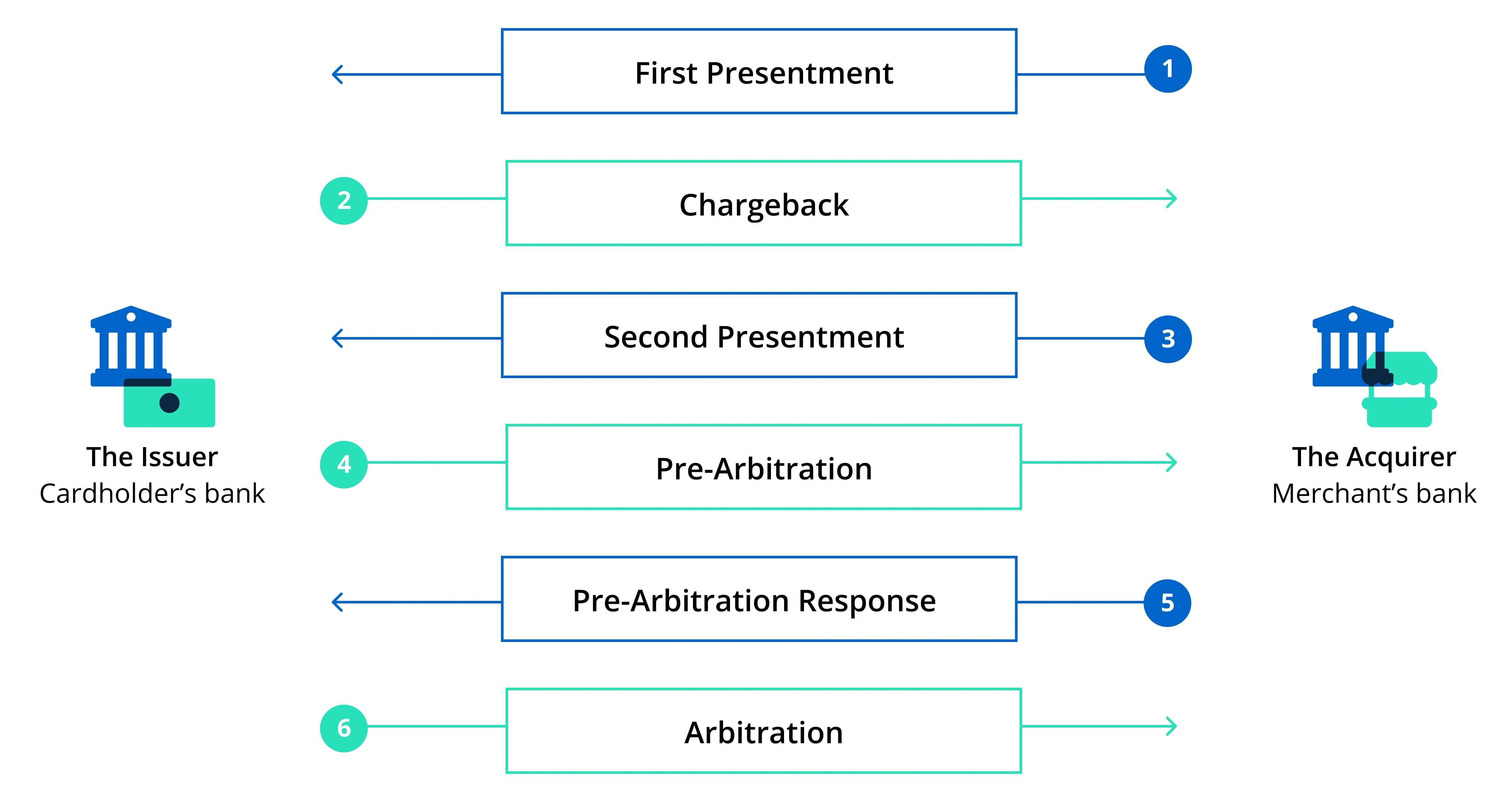

1. First Presentment

The merchant’s transaction data is submitted to the cardholder’s bank. The bank charges the cardholder’s account.

Other commonly used terms: transaction settlement, transaction clearing

2. Chargeback

The cardholder’s bank disputes the transaction. Funds are withdrawn from the merchant’s bank account.

Other commonly used terms: payment dispute, transaction dispute, dispute

3. Second Presentment

The merchant challenges the chargeback by providing evidence that validates the original purchase or disproves the chargeback.

Other commonly used terms: representment, chargeback dispute, chargeback response, dispute response

4. Pre-Arbitration Case Filing

The chargeback process has ended, yet the cardholder’s bank wishes to address information provided in the second presentment.

Other commonly used terms: second chargeback

5. Pre-Arbitration Response

The merchant’s bank reviews the pre-arbitration case and does one of two things:

Accepts liability. The merchant’s bank accepts liability, and the case is closed.

Denies liability and rebuts the case. The merchant’s bank uploads supporting documents and adds a short memo to explain why the case is being rebutted. This gives the cardholder’s bank a choice: accept liability or advance the case to arbitration.

6. Arbitration Case Filing

The cardholder’s bank does not want to accept liability and seeks to challenge the merchant’s pre-arbitration response. The bank requests that Mastercard review the case, issue a verdict, and assign responsibility. The losing party must pay all fees.

CHANGES COMING

New Mastercard Chargeback Rules

Payment industry rules and processes evolve as consumer behaviors and expectations change. It is important to carefully monitor regulation updates and understand the impact these changes could have on your business.

Kount has compiled a list of the most relevant and impactful Mastercard chargeback rule updates. We’ll add new information as it becomes available.

UPDATE

July 2020

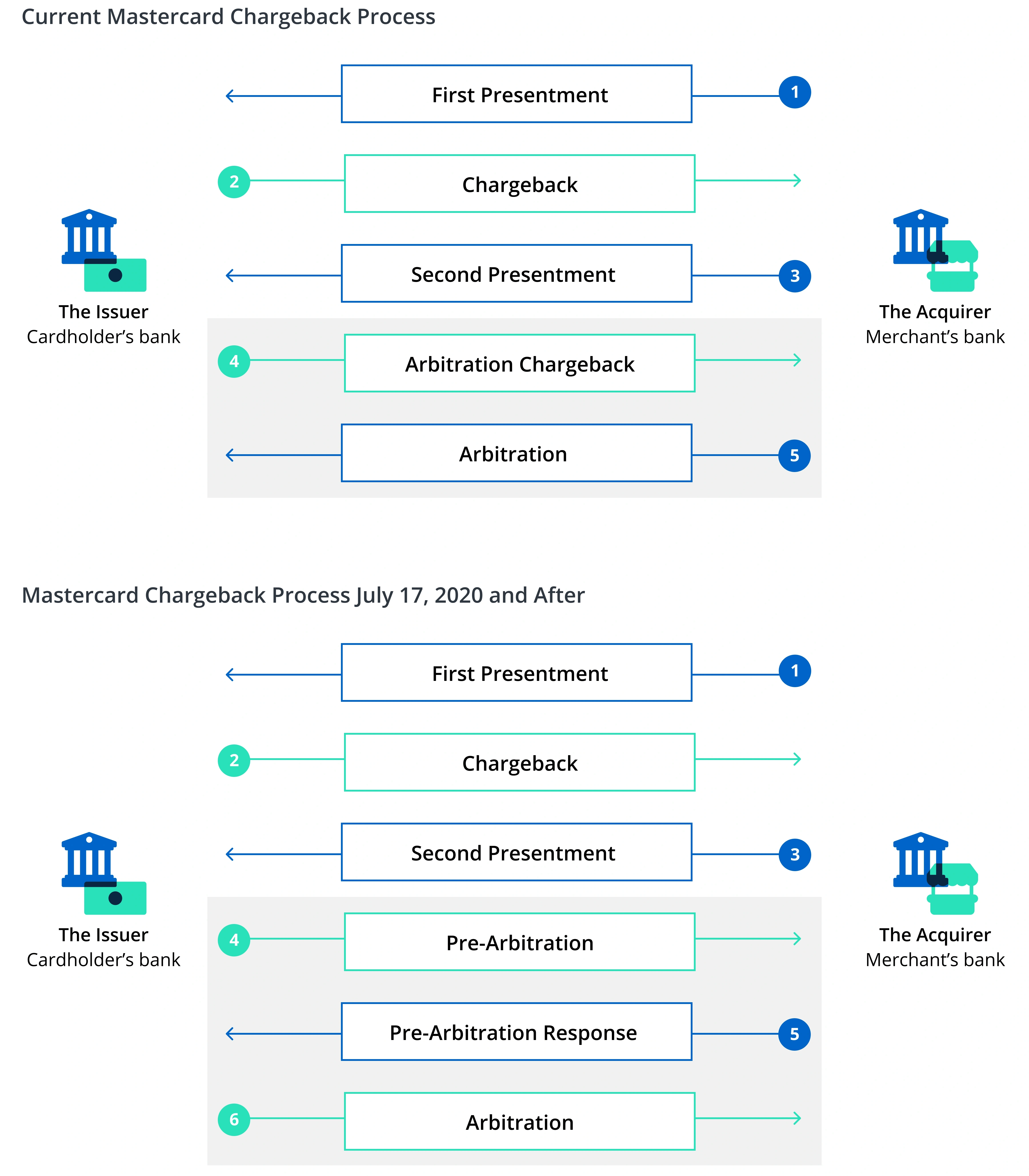

In July 2020, there will be a significant update to the Mastercard chargeback rules. The workflow used to manage disputes is changing.

| Update | The arbitration chargeback cycle is being discontinued and pre-arbitration case filing is being added. |

This update will remove one cycle from the dispute resolution workflow and introduce another. The initiative removes the arbitration chargeback cycle and adds pre-arbitration.

| Impact | You technically have an additional opportunity to argue your case, but you probably don’t want to use it. |

The arbitration chargeback cycle and pre-arbitration case filing are similar, yet different. One difference is available response options.

| ARBITRATION CHARGEBACK RESPONSES Accept Liability OR Advance the case to arbitration | PRE-ARBITRATION CASE FILING RESPONSES Accept Liability OR Submit new compelling evidence |

In the majority of pre-arbitration cases, it’s best to accept liability. Click here to learn more about pre-arbitration.

| Action | Think carefully about what your pre-arbitration response strategy will be. |

If you submit a pre-arbitration response, the case will likely advance to arbitration. Once an arbitration verdict is issued, the losing party will forfeit the original transaction amount and pay hundreds of dollars in arbitration fees.

Therefore, it is only advisable to respond to Mastercard pre-arbitration if you have an abundance of relevant and compelling evidence.

UPDATE

April 2020

Mastercard quickly made changes to the brand’s rules due to the COVID-19 pandemic.

| Update | Fraud and chargeback monitoring programs will be temporarily suspended for certain merchants. |

Mastercard understands that the influx in online shopping may be difficult for some merchants to manage. As a result, the brand will temporarily suspend certain rules relating to their monitoring programs.

| Impact | You may not be penalized if you breach thresholds. |

Depending on your industry, you may not be fined if you go over the chargeback-to-transaction ratio or the fraud-to-sales ratio limits.

| Action | Continue to monitor your ratios carefully. |

It’s important to note these rule suspensions are only temporary. Eventually, program enrollments — and penalties — will return to normal.

Continue to monitor your ratios. If it doesn’t seem like your counts will be within the limits by the time the suspension is lifted, get help. If fraud is a problem, work on fine-tuning your acceptance rules. If chargebacks are a problem, check out the prevention tools that Kount has available.

UPDATES

July 2019 - October 2019

An additional update will happen in the second half of 2019. It is part of a broader initiative to introduce merchant-cardholder collaboration and improve data transparency.

| Update | Reason code 4863 (cardholder does not recognize) is being discontinued. |

Issuers will no longer be able to file chargebacks with reason code 4863. However, new collaboration initiatives might be introduced instead.

| Impact | There is potential for a reduction in chargebacks, but as of now, very little is expected to change. |

For many merchants, reason code 4863 is one of the most commonly used classifications for disputes. Since it is such a popular reason code, a logical assumption would be that eliminating it would have a significant impact on the ecosystem.

But in reality, there won’t be a major impact for merchants.

Issuers will likely feel the effects of the update because it was easy for them to file 4863 disputes without much thought, effort, or proof from the cardholder. However, issuers aren’t going to simply ignore cardholders when there is confusion about a purchase. They’ll likely just shift those “cardholder doesn’t recognize” disputes to a different reason code.

Here’s where the potential for significant change might happen: Mastercard has said that this update will be accompanied by “the implementation of a collaboration layer and process within the new Mastercard Claims Manager.”

It’s uncertain what the effectiveness of this collaboration layer will be, as it is dependent on issuer adoption. But similar to Visa Merchant Purchase Inquiry, it seems promising. Given some recent acquisition activity by Mastercard (learn more here), a significant portion of consumer disputes could be resolved before they become chargebacks.

| NEW! Mastercard is using Consumer Clarity to enable issuer-merchant collaboration. Read more about it here. |

| Action | Be proactive. |

If you do nothing at all, your chargeback count won’t increase or decrease — you’ll just see a difference in chargeback reason codes. But, if you make a few simple changes, you could see a reduction in disputes.

First, update your billing descriptor. Make it as easy as possible for cardholders to recognize and understand what they purchased.

Second, consider using the new Consumer Clarity tool. Consumer Clarity can resolve disputes before they progress to chargebacks. If you’d like to learn more about how this tool fits into a chargeback prevention strategy, contact our team of experts.

UPDATE

April 2019

More rule changes associated with Mastercard Dispute Resolution Initiative will take effect on April 12, 2019.

| Update | The timeline for reason code 4834 (point-of-interaction error) is being decreased. |

Issuers will need to file disputes with a point-of-interaction error reason code within 90 days of the transactions (instead of 120).

| Impact | If you made a mistake, you’ll know about it 30 days sooner. |

One of the biggest shortcomings of the chargeback process is that it takes so long for information to travel back and forth between parties.

By the time a chargeback reaches you and you learn about the problem, you’ve probably processed several additional transactions with the same error — all of which could likewise result in chargebacks.

But if you learn of the issue sooner, you can solve the problem sooner.

| Action | Monitor dispute data. |

Get a system in place to accurately monitor disputes in real time. That way, you can take full advantage of this new Mastercard rule update.

Kount provides real-time reporting and detailed analytics. These features help you discover the underlying reason for your disputes and solve problems at their source. If you’d like to learn more or see the technology in action, sign up for a demo of the platform.

UPDATE

October 2018

The following updates will go into effect on October 12, 2018. They are the first phase of changes associated with what Mastercard is calling the Dispute Resolution Initiative.

| Update | A condition of reason code 4837 (no cardholder authorization) will be discontinued. |

Acquirers will no longer be able to overturn disputes caused by a mismatch in authorization and clearing information.

| Impact | You could lose revenue if your merchant account hasn’t been set up properly. |

The 4837 reason code allowed acquirers to provide alternate information when the originally-submitted payment information was incorrect.

If there was a mismatch between authorization and clearing, the acquirer could respond to the chargeback with the correct merchant name, location and/or date. This information would successfully overturn the chargeback and the merchant’s revenue would be safe.

After this update goes into effect, acquirers will no longer have this capability.

| Action | Double check your account settings. |

To avoid unnecessary revenue loss, check with your processor and make sure your merchant account has been configured correctly. The same business information you use during authorization must also be used for clearing.

| Update | Issuers will need to ask cardholders for supporting documentation. |

If cardholders want to dispute certain types of transactions, they will need to provide issuers with documents that help justify their cases.

Supporting documentation will be required for the following chargebacks:

- Disputes with reason code 4863 – Cardholder Does Not Recognize until it is discontinued

- Disputes with reason code 4834 – Point of Interaction Error and the Transaction Amount Differs subcategory

- Disputes involving digital goods

- Disputes involving recurring transactions

| Impact | You might experience less friendly fraud. |

Friendly fraud, whether intentional or accidental, can often be avoided if issuers have access to more information. Without insight as to what happened or what will happen, issuers may be forced to side with the cardholder and initiate a chargeback.

Asking for supporting documentation may help clear up any confusion about what was purchased and deter customers trying to file illegitimate chargebacks.

| Action | Review and optimize the customer experience. |

Use this as an opportunity to perfect all your customer-facing communications:

- Product descriptions

- Order Confirmation emails

- Return policy

- Terms and conditions

- Customer support interactions (email, phone, social media, etc.)

Make sure all information is clear, concise, and accurate. Not only do you need cardholders to understand what’s expected, you need banks to understand as well.