FREQUENTLY ASKED QUESTIONS

Do chargebacks increase after a holiday or major event?

Unfortunately, a spike in transaction volume is typically followed by a spike in chargeback volume.

Here’s what you need to know about holiday chargebacks and how to respond.

Why do chargebacks increase after the holidays?

There are several reasons why chargebacks might increase after major holidays like Black Friday and Christmas.

- Fraudsters know that businesses typically experience an increase in sales at certain points throughout the year. And they also know it’s a lot easier to hide suspicious activity amongst a flurry of legitimate activity. Plus, if you relax your fraud rules to reduce friction and get more good sales, fraudsters will easily get past your defenses.

- A purchase at your business is likely just one of several that a shopper will make over the course of several months. It’s easy to forget a purchase or get confused about a charge. And it’s possible your customers will accidentally file chargebacks for legitimate purchases.

- A lot of consumers overspend on holiday gifts. If buyer’s remorse sets in, your customers might file chargebacks to get their money back.

- Holiday gifts are often purchased several weeks or even months before they are given. If you don’t extend your return policy, the only option a customer has is to file a chargeback if the gift giving doesn’t go as planned.

- An increase in sales could result in an increase in customer service inquiries. And if your team doesn’t respond quickly or handles those interactions badly, customers might decide to file a chargeback with the bank instead of working with you directly.

- Holiday gifts are typically given with a lot of emotion. And if the gift doesn’t end up being what the gift giver expected, those emotions can quickly turn negative. An unsatisfactory or damaged item can trigger a chargeback out of spite.

NOTE: The holidays aren’t the only time that chargebacks could spike. There could be other causes for seasonal influxes. For example, if you sell bathing suits, sales — and chargebacks — could be higher in the spring or summer. It’s important to understand your customers and their buying trends.

When should I expect chargebacks to hit my merchant account?

Chargebacks usually follow a pretty predictable pattern. But the holidays can throw things off.

Our data has revealed that 56% of chargebacks are filed within 30 days of the transaction. But if a gift is given a month or more after it was purchased, that timeline can change significantly. And it’s not simply a case of replacing “transaction date” with “holiday date” in the calculation.

Here’s what we typically see happen.

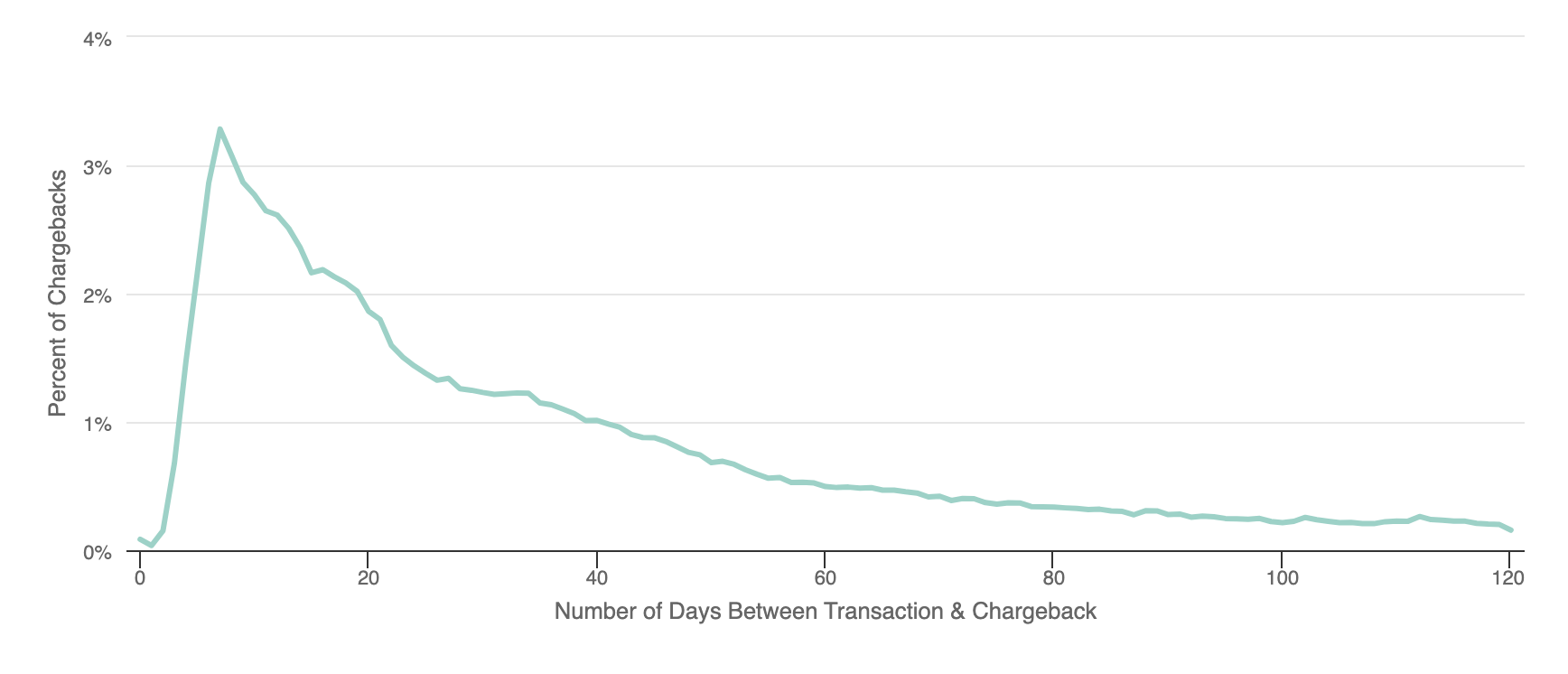

Criminal fraud and friendly fraud

Fraud-coded chargebacks spike on day seven and drop until a small plateau at day 15 and then again at day 26.

The immediate chargebacks are mostly cases of actual criminal fraud. Attentive cardholders detect the unauthorized activity and respond.

These situations shouldn’t be influenced by the holidays. So criminal fraud chargebacks will continue to happen within a week of the original transaction.

The more delayed responses — those coming in after the first week — are more likely to be cases of friendly fraud. And the timing of these chargebacks can fluctuate.

You will still get some friendly fraudsters acting early — for example, if buyer’s remorse is immediate. But you’ll also have cases that hit after the gifts have been opened and the dust settles.

Plan to have some friendly fraud shortly after the initial transaction but the bulk after the first of the year.

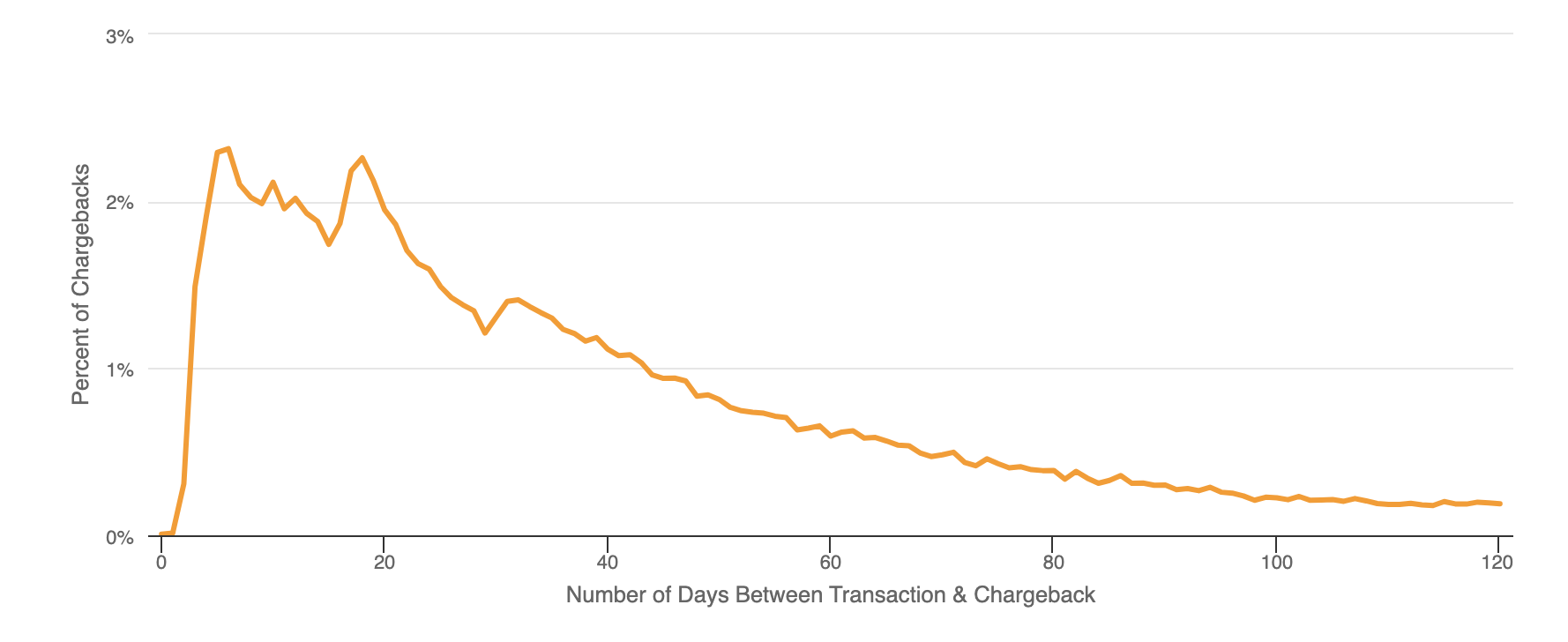

Cardholder disputes

Cardholder disputes spike on day five, drop for a few days, and then spike again on day 18 and day 31.

Cardholder disputes are nearly everything other than fraud. Here are some examples:

- Credit was not issued

- Merchandise wasn’t received

- Merchandise is defective

- Subscription wasn’t canceled

Like fraud, some cardholder disputes will continue to follow the normal pattern — but others won’t.

For example, if an item arrives damaged, the shopper might notice the defect immediately. Or, the shopper might not know about the issue until the gift is actually given.

The key to managing these cardholder disputes is communication. If you can proactively resolve potential problems, you can reduce the risk of chargebacks.

Reach out to your shoppers after the purchase and again after the holidays. Check satisfaction levels and answer any questions that might arise.

BOTTOM LINE: There are no universal timelines for chargebacks around the holidays. We suggest you review your own business data and try to find a norm for your situation.

How do I deal with the potential influx in chargebacks?

Worried about upcoming chargebacks? Here are some things you can do to prepare.

Pre-holiday tips

Here are some things you can do before or during the holiday shopping frenzy.

- Check your billing descriptors. Billing descriptors are the short explanation of a transaction that appear on card statements. Make sure yours is easy to recognize — for example, your “doing business as” name instead of your legal business name. If possible, add a website or phone number for customer support.

- Audit your refund, return, or cancellation policy. Make sure it is easy to find and understand. Consider extending deadlines. The more user friendly, the better the chargeback protection.

- Review your fraud detection strategy — everything from your third-party vendors to your AVS and CVV response policies. Aim for the perfect blend of flexibility for good customers and friction for suspicious customers. If you have questions, ask a professional for advice.

- Audit your inventory. If you have merchandise or services that pose a higher risk for chargebacks, consider temporarily removing them from your inventory. Or at the very least, scrutinize those purchases more carefully.

- Make sure all internal teams are on the same page. Know what the marketing team is promising. Check if fulfillment timelines are realistic. See how the customer support team is fairing.

- Sign up for chargeback prevention tools like alerts, order validation, and RDR.

Post-holiday tips

After the excitement has died down, take the time to do these things.

- Hire or reallocate staff. Make sure your customer support team can handle all incoming calls and emails. Get a team ready and trained to fight illegitimate chargebacks. Prepare for an influx in refunds — and refund fraud.

- Communicate with customers. Proactively reach out to resolve potential issues. Check to see how the purchasing and gift-giving experiences unfolded.

- Build a strategy to fight chargebacks. Know what you should and shouldn’t fight. Organize your evidence. And build templates to streamline the process and increase accuracy. Consider working with a third-party vendor — such as Kount — to ensure the best results possible.

- Readjust your fraud strategy. If you temporarily made changes to optimize ROI during the holidays, make sure you reset your strategy to account for day-to-day activities.

Can Kount help me manage these chargebacks?

Yes! Kount provides the industry’s best solutions for fraud and chargebacks.

If you are already using Kount for one piece of the puzzle — fraud or chargebacks — reach out to your customer support manager to learn about add-ons that could increase protection.

If you aren’t using Kount, now is the perfect time to check out our technology.

We provide a complete solution for chargeback management. Whatever threats you’re dealing with, we can help. Sign up for a demo today to learn more.