The #1 Choice for a Chargeback Company

See why Kount has a 4.7 out of 5 star rating on Capterra.

"The bottom line is Kount works. It does exactly what was advertised for us, which was reducing friendly fraud."

Lee Schmidt

Founder and CEO

A complete solution for chargebacks

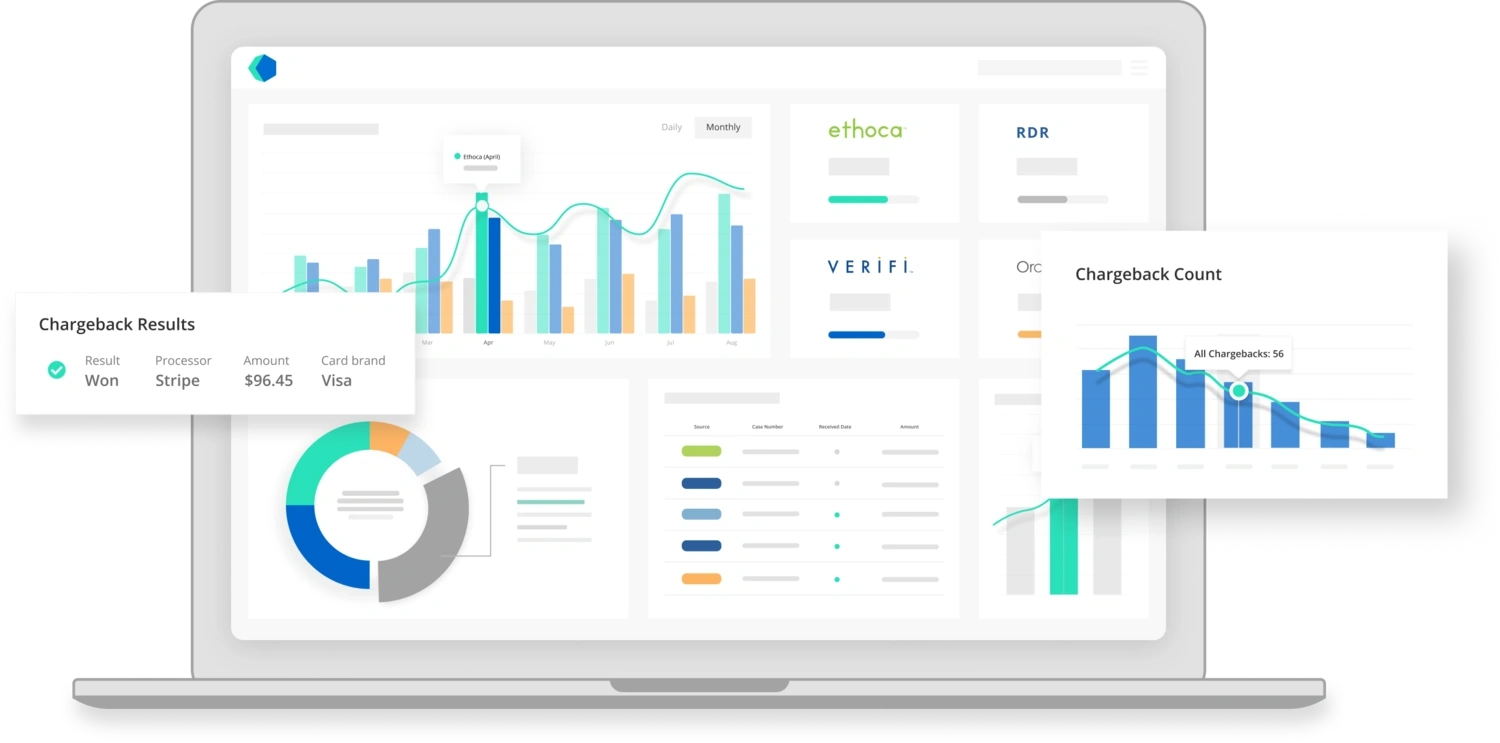

Kount offers a complete strategy for chargeback management — all from a single platform.

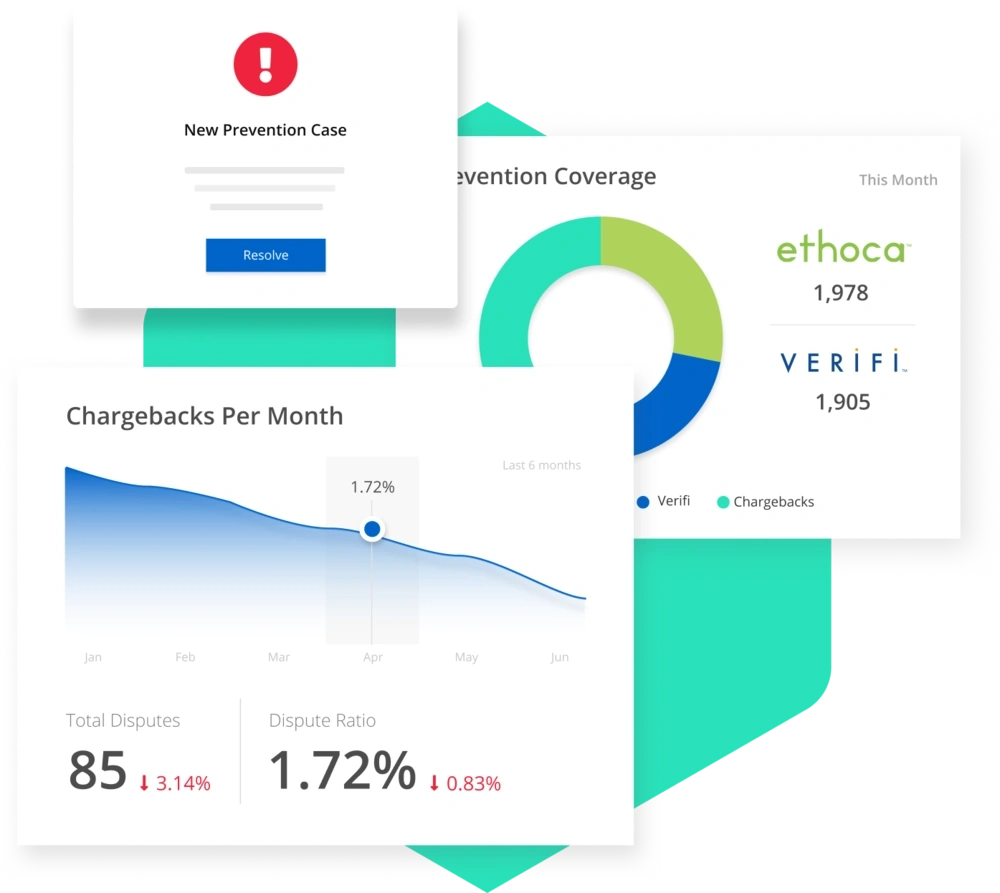

Prevent chargebacks & minimize revenue loss.

The easiest-to-win fight is the one you can avoid. That’s why chargeback prevention is a crucial first step in your management strategy. Kount has everything you need to prevent the preventable.

- Start seeing results in as little as 24 hours

- Prevent up to 50% of chargebacks

- Solve issues up to 5 weeks sooner

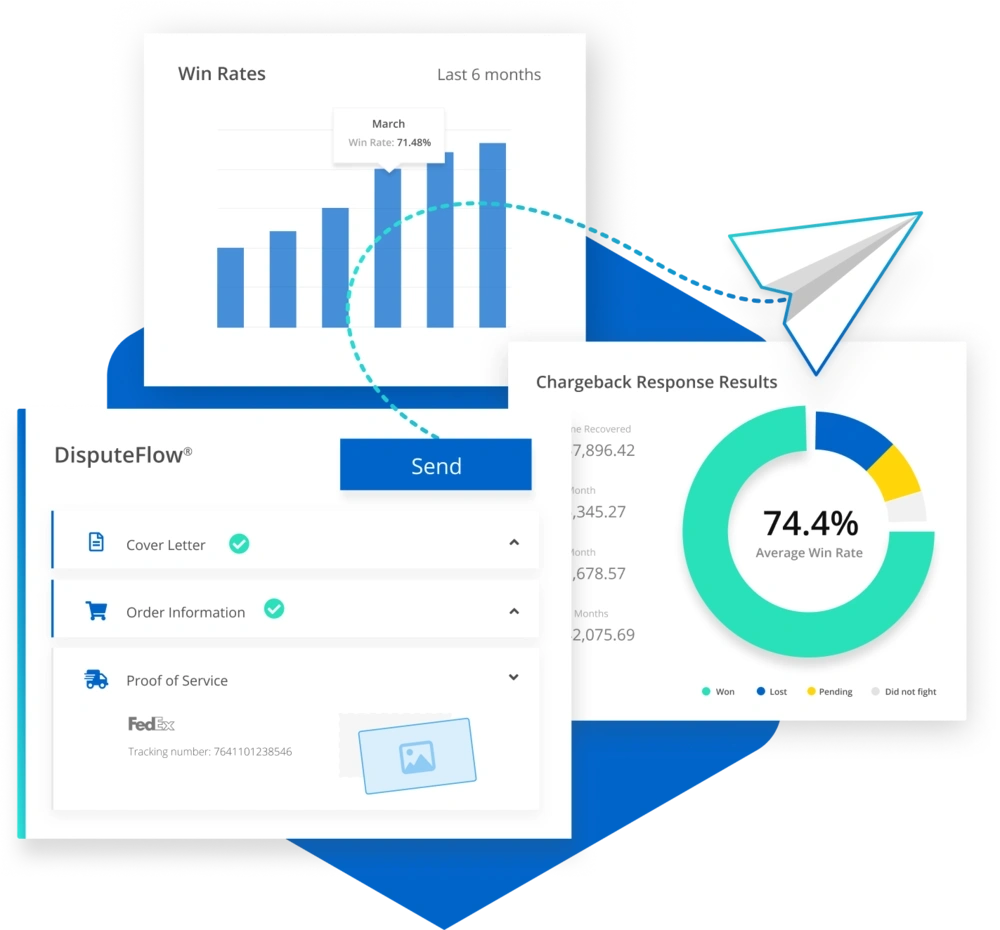

Fight chargebacks & recover more revenue.

When you lose money to chargebacks, Kount gets it back. Our philosophy for revenue recovery is simple: we want you to have the best ROI possible. That means we fight chargebacks with the greatest efficiency and highest probability of success.

- High win rates consistently improve over time

- Intuitive, easy-to-use technology removes guesswork

- Flexible automation replaces time-consuming, error-prone processes

- On-demand support connects you with industry veterans

Chargeback Company

A chargeback, also known as a payment dispute, happens when customers contact their card-issuing bank to reverse a payment made to a merchant. Customers may have queries about the charge when they receive their credit card statement and may initiate a chargeback.

To illustrate chargeback meaning in business, a chargeback scenario occurs when a customer disputes a charge on their account statement. To qualify for a chargeback, a purchase must be made by a customer either online or in-store.

A chargeback can be requested for a variety of reasons. Examples include:

- incorrect transaction amount

- defective merchandise

- unauthorized transaction

Other reasons for chargebacks include point-of-sale processing problems, such as typing in an erroneous account number or charging a customer multiple times.

A customer could make a valid purchase, but is unable to recognize the charge on their bank statement. In some instances, a customer may purposely keep the products without actually paying for them. A chargeback can also occur when fraudsters steal credit card information to purchase goods and services. An authorization hold, or temporarily locking up the payment until the transaction has been settled, is a useful tool for preventing criminal fraud.

A chargeback dispute can be resolved either in the favor of the cardholder or the merchant. Merchants may ask, “What happens if you lose a chargeback?” A customer’s claim may be contested by a merchant. If the consumer’s claim is confirmed to be valid following an inquiry, the merchant’s revenue loss will be finalized and irreversible.

Because dealing with chargebacks can be complicated, businesses may benefit from partnering with a chargeback company such as Kount that can assist them in resolving payment issues. Kount can help prevent chargebacks and recover lost revenue, as well as automate the chargeback process. Businesses may also use a chargeback app to handle disputed transactions at every stage.

A leading chargeback reporting and management platform, Kount can help eliminate the complexity of payment disputes using intelligent chargeback management software. Kount can monitor merchant accounts in real time, with analytics that enable businesses to take proactive measures to prevent chargebacks. Kount can help ensure that merchant accounts remain sound and in good shape.

How Does a Chargeback Work?

One commonly asked question is: What is a chargeback in business? In business, a chargeback happens when a customer disputes a purchase, and the payment amount is refunded to a credit or debit card.

So, how does a chargeback work? In a nutshell, a chargeback is a transaction reversal initiated by a customer to secure a refund. The purpose of a chargeback is to protect consumers from potentially fraudulent activity.

Another question that might come up is, “What is a chargeback in banking?” Sometimes, the bank will file a chargeback before the cardholder even knows there is a problem. As with a cardholder-initiated chargeback, the process is the same. The customer’s bank contacts the merchant’s bank to provide a refund after a chargeback has been initiated, or request proof to refute the chargeback claim.

Different fraud tools can be used by merchants searching for ecommerce chargeback protection to detect fraudsters and prohibit transactions that are likely to result in chargebacks. However, not all software solutions are made equal, and there’s no one-size-fits-all solution that will totally eradicate chargeback risk.

Kount's multi-layer protection may benefit businesses looking to boost their bottom line. With Kount, companies can access all of the tools they need from a single platform to prevent and combat chargebacks. Merchants can employ a pre-sale fraud tool, and Kount can assist with chargeback management and prevention after the sale has been completed.

See why we’re #1.

Kount is a true software solution, providing complete, intelligent chargeback management.

- A team of experts to help you succeed

- Efficient, flexible automation

- Everything you need in one platform

Chargeback vs Refund

To further simplify the chargeback definition, a chargeback happens when a customer’s bank conducts payment reversal, in which the transaction payment is returned to the cardholder’s bank.

Regarding the difference between a chargeback vs refund, both terms may be used interchangeably due to their similarities. In both instances, customers may file a complaint and receive their money back if they are not satisfied with a particular transaction.

As for their difference, a chargeback is issued by the bank when a customer disputes a charge, while a refund allows a merchant to avoid a chargeback fee when returning the amount of transaction back to the customer.

What is a chargeback fee? A chargeback fee is a fee paid to acquiring banks to compensate for the administrative costs of processing chargebacks. Chargeback fees depend on how the payment was processed and the chargeback amount.

As for chargeback vs dispute, there are two ways to answer this question. Some consider the terms dispute and chargeback to be interchangeable. Others think of the terms as different stops on a timeline: if you can resolve the dispute, you can avoid the chargeback.

To assist merchants, Kount has created a technology platform designed to not only automate the dispute response process, but also provide real-time data as to why chargebacks occur in the first place.

Chargeback Example

As for chargeback meaning in banking, bank chargeback happens when the bank automatically initiates the chargeback without a request from the cardholder. This commonly happens when the bank detects fraud.

One chargeback example is when a customer does not recognize a purchase that appears in their credit card statement and decides to initiate a chargeback by going directly to the issuing bank to reverse the transaction.

What is a chargeback in accounting? To get an accurate picture of how chargebacks affect a company’s bottom line, chargebacks must be recorded properly and correctly in a ledger.

Chargeback Process

A chargeback dispute process typically consists of five phases.

- The first phase is the chargeback, in which a customer initiates the dispute. The case could be closed if the merchant accepts responsibility.

- The second phase, or chargeback response, happens when the merchant responds and challenges the claim made by the customer.

- The third phase, or pre-arbitration, means that a customer continues to dispute the purchase after a chargeback has been won by the merchant.

- The fourth phase, or pre-arbitration response, is when the merchant declines to accept liability and rebuts the case.

Lastly, the arbitration process occurs when the card network examines the evidence and makes the final decision on the dispute.

Merchants may use prevention alerts, in which merchants receive an alert to notify them of pending disputes before the disputes turn into chargebacks. Merchants may also benefit from using automated chargeback solutions which can automate the dispute response process.

To distinguish between chargeback vs refund vs reversal, a chargeback happens when a payment amount is returned to the customer following a dispute; a refund comes directly from the merchant; and a reversal is an attempt to recover the cash value caused by a chargeback.

One of the key features of Kount includes chargeback prevention alerts, which allow merchants to automatically respond to customer disputes before they become chargebacks. Kount can also automate the dispute response process and provide real-time data that shows why chargebacks occur.

Best Chargeback Companies

For merchants looking for chargeback software from the best chargeback companies, there are different options available. However, it is important to note that not all chargeback solutions are created equal.

Kount, a chargeback management company, can help remove the complexities of payment disputes. Kount was developed by merchants with the aim to solve the many challenges that merchants may be facing.

As a chargeback management platform, Kount can assist in preventing chargebacks by resolving issues to reduce the incidence of chargebacks. Kount can help merchants lower chargeback-to-transaction ratios, boost their account health, and increase customer satisfaction, among other things. In addition, Kount can also be used to dispute chargebacks by responding to illegitimate chargebacks, and allow merchants to recoup lost revenue. Furthermore, Kount can eliminate chargeback errors and reduce manual work associated with the chargeback process.

What Is A Chargeback Dispute?

Just because a customer approaches them with a dispute does not necessarily mean that they will succeed with a chargeback. Before a dispute evolves into a chargeback, the merchant may have the opportunity to resolve the issue and directly issue a refund. Beyond this, the merchant can also craft a response to the chargeback.

When a chargeback occurs, merchants lose not only the amount of the transaction, but also have to pay additional chargeback fees. These expenses may include the cost of settling the dispute, a non-refundable transaction commission, and any other chargeback fees that may apply based on the payment provider’s contract terms. In addition, when a customer files a cashback claim, it may have an impact on a merchant’s brand image and customer connection. This is why understanding the chargeback dispute process is essential.

First, it could be helpful to understand: what is a chargeback dispute? When a customer disputes a charge with their bank, you will be notified of this. At that point, you might draft a response that shows why the original transaction was legitimate and recover any money that was lost in the process. Of course, to do this, you must provide the customer’s information and include compelling evidence that the chargeback is not warranted. That can be challenging to do when you have to access many different platforms to retrieve essential customer information. Fortunately, Kount's streamlined platform makes it easy to pull customer information from your CRM and access any essential data whenever you need it. These features can help ensure chargeback protection for merchants.

Of course, merchants may benefit from adopting a dispute management system to reduce the occurrence of chargebacks, as well as resolve cashback disputes and recover lost revenue. Ideally, dispute management software would be used in conjunction with tech that identifies fraudulent charges before they even occur.

Kount is an industry-leading software platform that can prevent, analyze, and manage credit card chargebacks, resulting in increased merchant income and decreased costs. Some of the key features of Kount include automated chargeback prevention alerts, intelligent chargeback representations with industry benchmark win rates, and real-time data analytics and reporting.

RELATED READING