The #1 Chargeback Solution

See why Kount has a 4.7 out of 5 star rating on Capterra.

"The bottom line is Kount works. It does exactly what was advertised for us, which was reducing friendly fraud."

Lee Schmidt

Founder and CEO

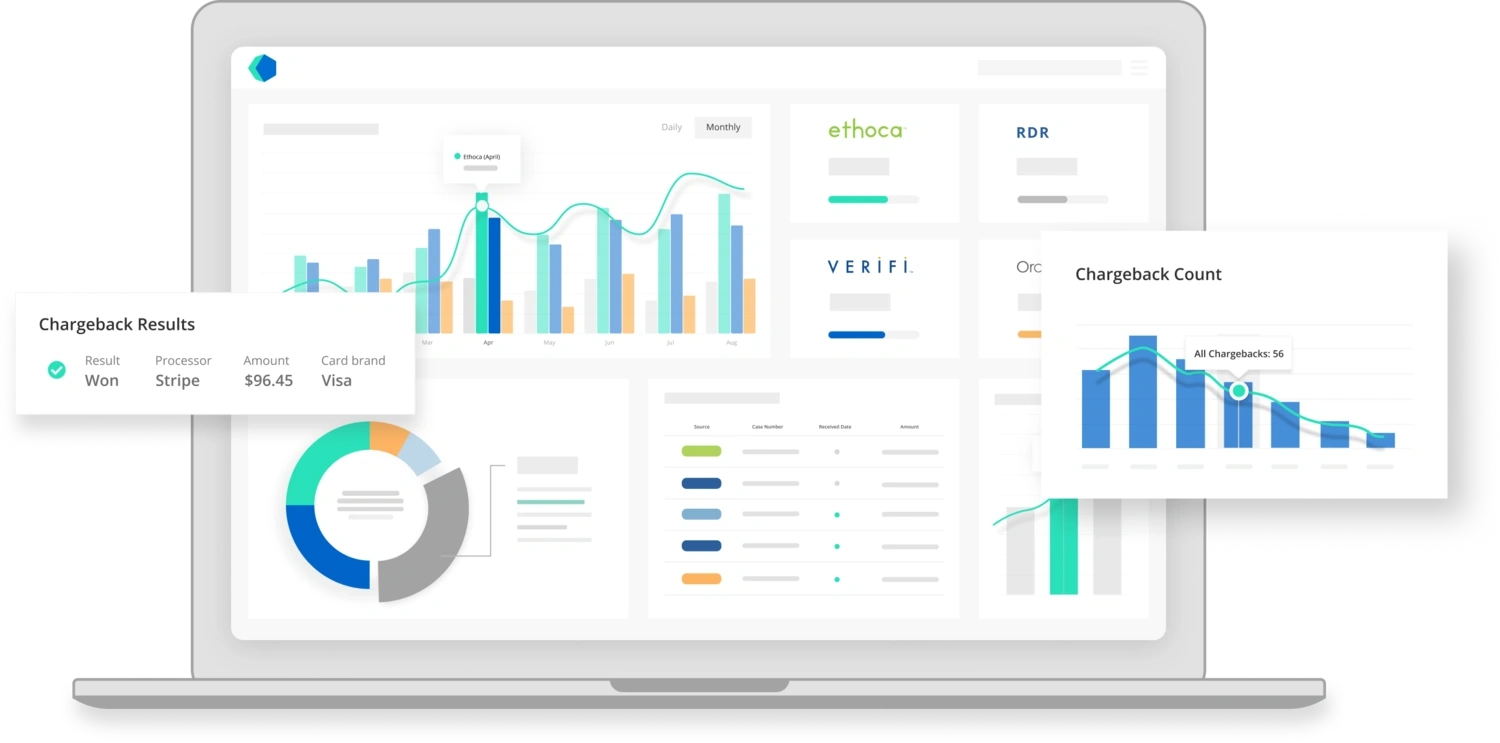

A complete solution for chargebacks

Kount offers a complete strategy for chargeback management — all from a single platform.

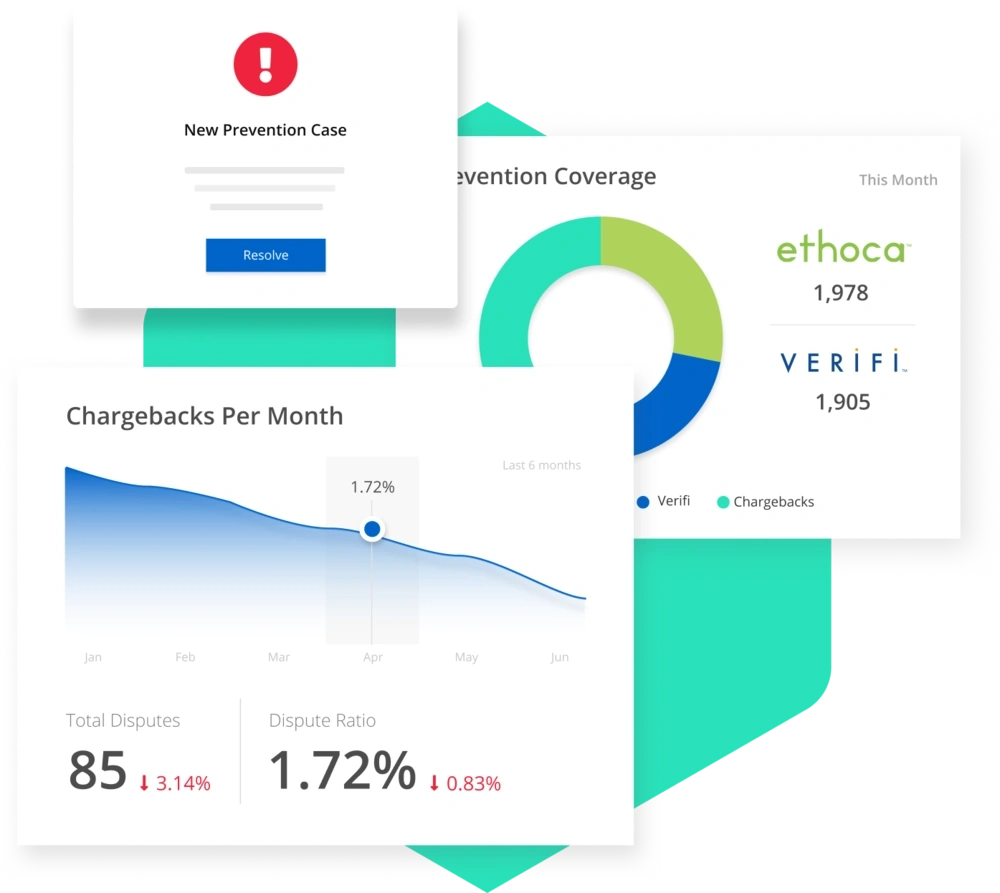

Prevent chargebacks & minimize revenue loss.

The easiest-to-win fight is the one you can avoid. That’s why chargeback prevention is a crucial first step in your management strategy. Kount has everything you need to prevent the preventable.

- Start seeing results in as little as 24 hours

- Prevent up to 50% of chargebacks

- Solve issues up to 5 weeks sooner

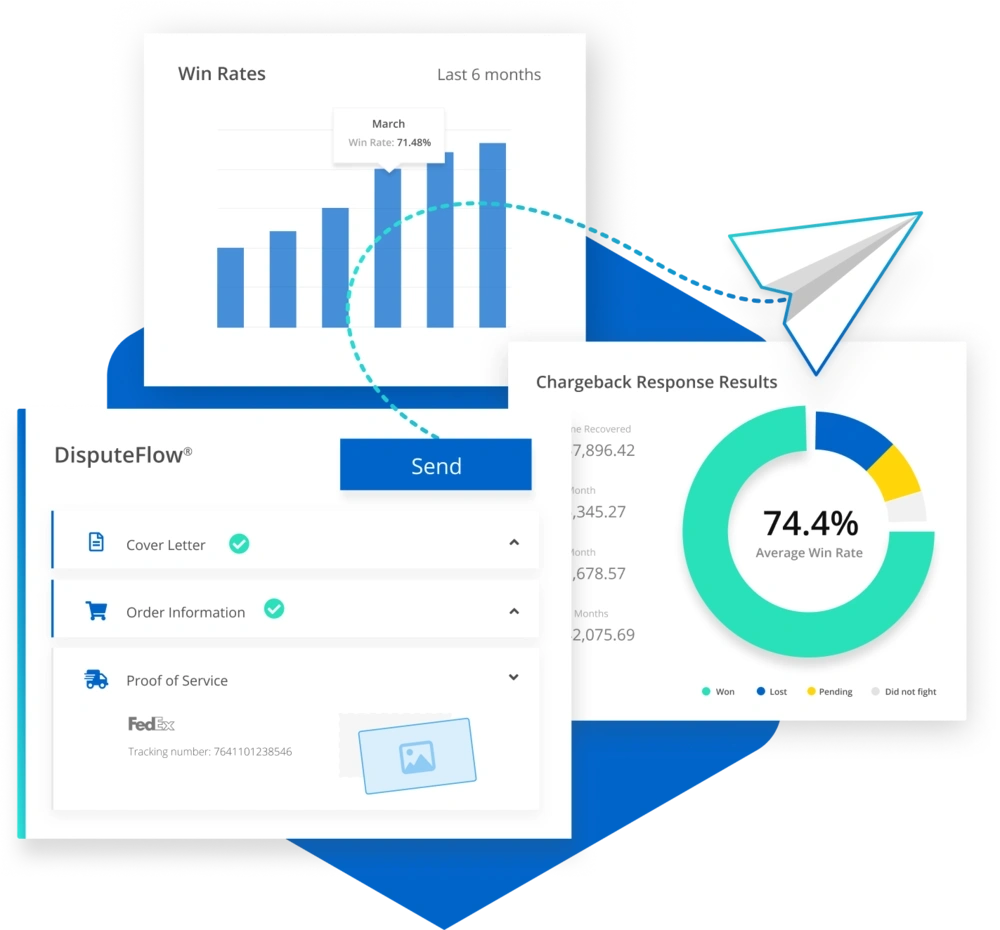

Fight chargebacks & recover more revenue.

When you lose money to chargebacks, Kount gets it back. Our philosophy for revenue recovery is simple: we want you to have the best ROI possible. That means we fight chargebacks with the greatest efficiency and highest probability of success.

- High win rates consistently improve over time

- Intuitive, easy-to-use technology removes guesswork

- Flexible automation replaces time-consuming, error-prone processes

- On-demand support connects you with industry veterans

Chargeback Solutions

As society continues to embrace a more digital world, many businesses are finding themselves migrating their primary interactions with customers to the online marketplace. With this dramatic change comes both benefits and challenges for all businesses, no matter the industry. So while marketing to an online audience may be better for your business and help you to reach a wider audience, there are several challenges that come with that. Some of these challenges may be easily remedied and some may take a bit more time and effort to address. As people continue preferring online shopping to traditional shopping, businesses are creating new and advanced ways to handle the challenges that come up. Additionally, because of these new challenges, others (mainly software as a service SaaS companies) are cropping up to help businesses dealing with ecommerce challenges continue running their stores efficiently.

One of the biggest challenges for businesses that are embracing the ecommerce marketplace is chargebacks. No business owner wants to go through the chargeback dispute process more than they need to — and unfortunately, they need to way more often than they would like. The unfortunate truth about chargebacks, is oftentimes they are preventable, but they need to be caught early on. Because chargebacks pose such an incredibly inconveniencing (and extremely costly) challenge for businesses of all sizes and industries, there are many different chargeback API (application programming interface) options available on the market today.

Kount is one of the many popular chargeback management software platforms that help businesses not only fight chargebacks but learn why they are happening in the first place so they can prevent future chargebacks. Kount's intelligent chargeback management software helps your business to automate dispute responses that help you recover more of your lost revenue as well as provide real-time data about why chargebacks are happening in your business. This software helps businesses of all shapes and sizes to simplify (and take the stress out of) the chargeback management process and offers them a way to easily fight, prevent, and analyze chargebacks all from a single platform.

See why we’re #1.

Kount is a true software solution, providing complete, intelligent chargeback management.

- A team of experts to help you succeed

- Efficient, flexible automation

- Everything you need in one platform

Chargeback Process

As many business owners and ecommerce merchants know, the chargeback process is long, costly, and oftentimes a headache for everyone involved in it. There are often at least four people involved in the entire process and each one has an important role to play in the process. These people (or entities) are:

- the cardholder who requested the chargeback

- the issuer (the cardholder’s bank)

- the merchant who has to deal with the chargeback

- the acquirer (the merchant’s bank).

All of these people must go through the entire chargeback process flow diagram to understand who is in the right — the cardholder or the merchant. If it turns out that the merchant is in the right, then there is a chargeback reversal which gives the merchant back the money that had been withdrawn when the cardholder initiated the chargeback process.

Because (unfortunately) chargebacks are such a large challenge for merchants of all industries, there are plenty of chargeback example situations available for merchants to reference as a general flow of the process. The process as a whole is long with each stage lasting weeks or months, costly, and unpleasant for everyone involved. But, a platform like Kount can help your business to fight, prevent, and analyze any and all chargebacks you are facing all from a single platform so that you can feel confident that you can handle this unpleasant process smoothly and seamlessly and recover as much revenue as possible.

Chargeback Recovery

Since people are continuing to pursue more digital manners of shopping and generally interacting with the world, many businesses are going to need to do the same. To stay relevant and maintain a customer base, businesses are needing to implement more forms of digital marketing, online stores, and even social media presence just to stay in the eye of the public. However, even with all of these changes, businesses must be wary of the event of a chargeback on something they have sold. It is very easy in today’s society for a person to use (or abuse) the chargeback system to their advantage and a business needs to make sure that they have a process for the chargeback cycle that helps them address these issues immediately and recover as much revenue as possible from each chargeback.

While chargebacks are annoying for businesses and can cause a great deal of damage, it is important that you know how to win a chargeback and this is where a little chargeback help can come in handy. The best way to “win” a chargeback is to stop the problem before it becomes a chargeback. If you can stop the problem from becoming a chargeback and instead turn it into a return or exchange, you have won. However, this is not always possible. To better your chances of winning and solving a dispute before it becomes a full-blow chargeback as well as lessen the damage you are taking when a chargeback does happen you can use a software solution such as Kount.

Chargeback Company

So, what is a chargeback in business? Essentially it is a payment that is returned to a customer when they dispute the purchase. Because chargebacks pose such a real and extreme challenge for businesses pursuing the online marketplace, there are several chargeback management companies that offer solutions to help your business combat chargebacks and prevent them from happening in the future. One of these solutions is called chargeback insurance. Unlike a chargeback management software solution, like Kount, chargeback insurance actually reimburses you for the cost of chargebacks in specific situations in exchange for paying an insurer a monthly amount or portion of the transactions you process. Kount, on the other hand, helps you to create a complete chargeback protection system that helps you not only fight and analyze chargebacks but also prevent them.

One of the main reasons that chargebacks are so problematic for businesses is that on top of having to reimburse the person issuing the chargeback, there is often a chargeback fee (or even multiple) that comes along with the process. So businesses end up losing extra money during the exchange. Since this problem is quite common in society today, it is not difficult to find a chargeback example situation to help better understand the process or reasons why chargebacks can happen.

Chargeback Software

Because chargebacks can pose such an incredible inconvenience for businesses of all sizes and industries, there has been a growing number of chargeback solutions available on the market today, for example, credit card chargeback software. These solutions help businesses and other organizations to effectively manage chargebacks and fight against (and in some solutions, prevent) chargebacks. Oftentimes chargeback systems used in organizations will offer features that help that business or organization not only fight chargebacks but also automate their chargeback management process to help improve their overall efficiency and effectiveness in lessening the number of chargebacks coming in.

Having an effective dispute management system is absolutely essential in helping your business to better handle chargebacks. This is where a software solution, like Kount, can be helpful. Kount offers businesses the ability to prevent, fight, and analyze chargebacks so that you understand where they are coming from in the first place and how you can better avoid them in the future. This software solution also helps you create automated dispute resolution processes such as automated prevention alerts and automated dispute responses. These automated tasks can help you to stop disputes before they turn into chargebacks and save you a lot of time, money, and stress.

Chargeback Alerts

It can be difficult to decide on what chargeback management solution you want to use for your business — especially with all of the options available today. But, there are definitely some solutions that may be better for your business than others. For example, you will probably want a solution that not only helps you fight disputes and chargebacks but also helps you implement methods of preventing chargebacks from happening. After all, if you prevent chargebacks from happening, then you are able to avoid all of the stress that comes with dealing with chargebacks.

One example of a good chargeback management software is Kount. Kount offers features such as chargeback alerts and automated chargeback responses. These features help to ensure that you are able to resolve any disputes before they even become chargeback questions or requests. A good (and prompt) chargeback response example can make the difference between having to deal with a full-blown chargeback process or simply a return or exchange that is handled between you and your customer. This is why Kount's automated chargeback prevention alerts can be essential to preventing unnecessary chargebacks from becoming bigger problems.

Chargeback Dispute

No business enjoys dealing with chargebacks — and to be honest no customer does either. A customer can dispute a transaction for several different chargeback reasons — for example, if the purchase was fraudulent — but in the end, once a chargeback dispute has been started it can take a long time and a lot of money to become fully resolved.

The process for handling a chargeback dispute is long and costly and it can be extremely frustrating for all parties involved. But what is a chargeback dispute exactly? A chargeback is a bank-initiated version of a refund. In other words, it is a bank-initiated reversal of a translation that withdraws the funds deposited into your bank account and returns them to the customer’s bank account. Basically, it is a refund, but rather than your business and the customer resolving the issue and you returning the money to the customer, a bank does it. This is the biggest difference concerning chargebacks vs refunds. For a business, there is no doubt that in the chargeback vs refund battle which one is better. A refund will always be easier for both a business and the customer and it also does not reflect poorly on the business whereas a chargeback does.

RELATED READING