The #1 Choice for Fighting & Winning Bank of America Chargebacks

See why Kount has a 4.7 out of 5 star rating on Capterra.

"The bottom line is Kount works. It does exactly what was advertised for us, which was reducing friendly fraud."

Lee Schmidt

Founder and CEO

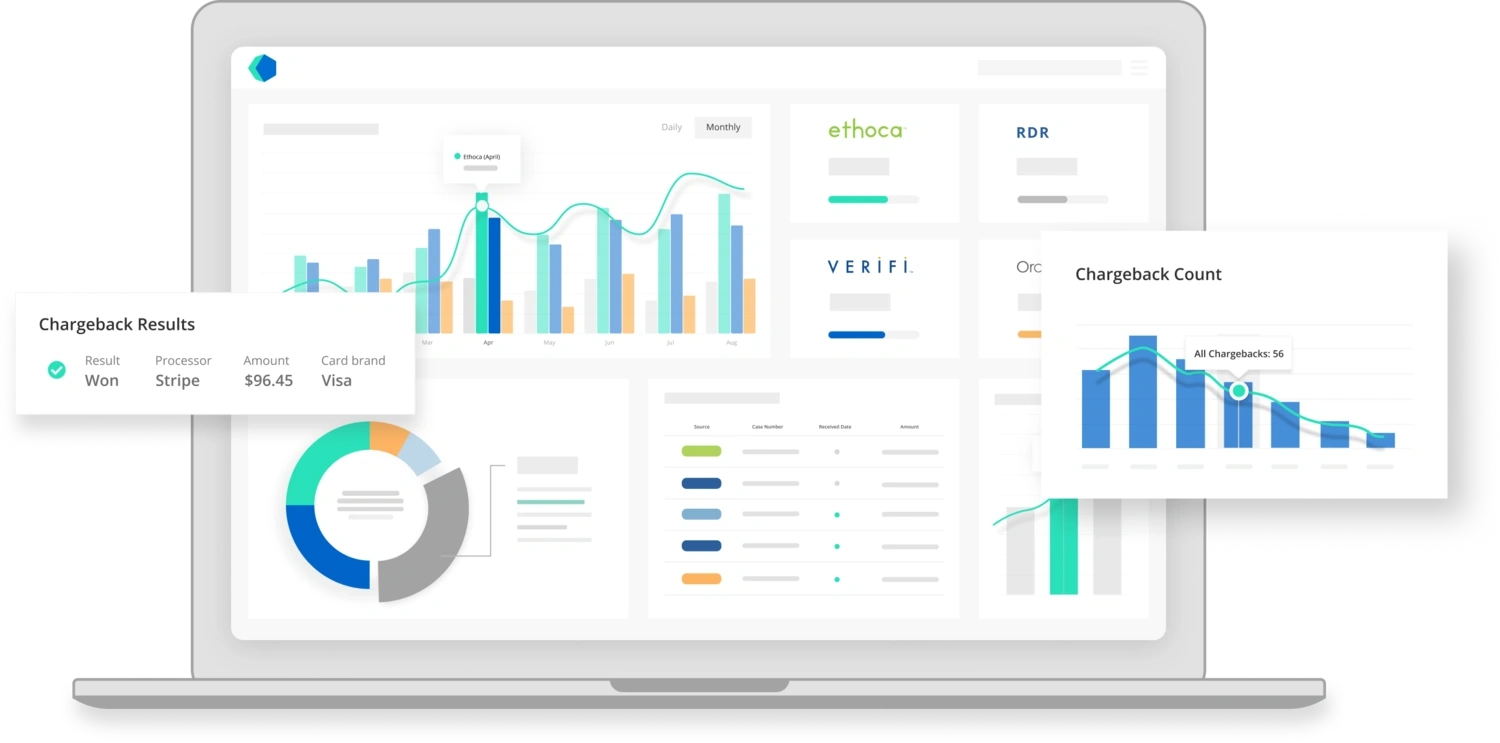

A complete solution for chargebacks

Kount offers a complete strategy for chargeback management — all from a single platform.

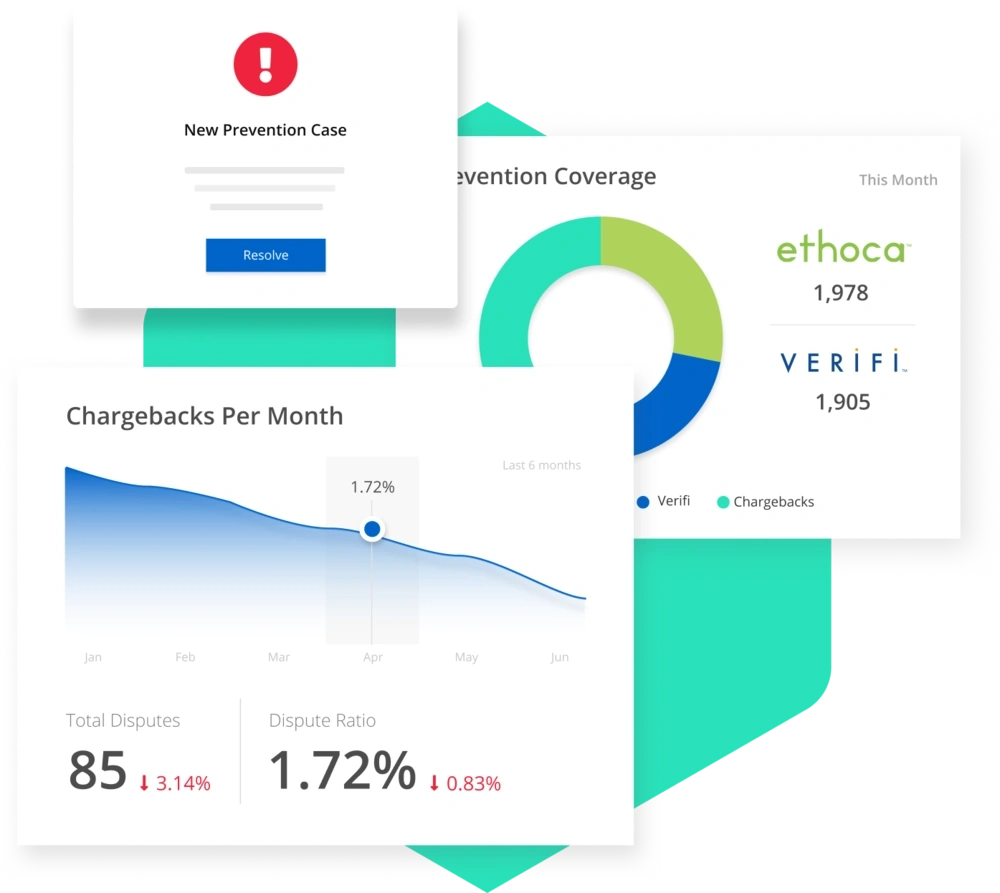

Prevent chargebacks & minimize revenue loss.

The easiest-to-win fight is the one you can avoid. That’s why chargeback prevention is a crucial first step in your management strategy. Kount has everything you need to prevent the preventable.

- Start seeing results in as little as 24 hours

- Prevent up to 50% of chargebacks

- Solve issues up to 5 weeks sooner

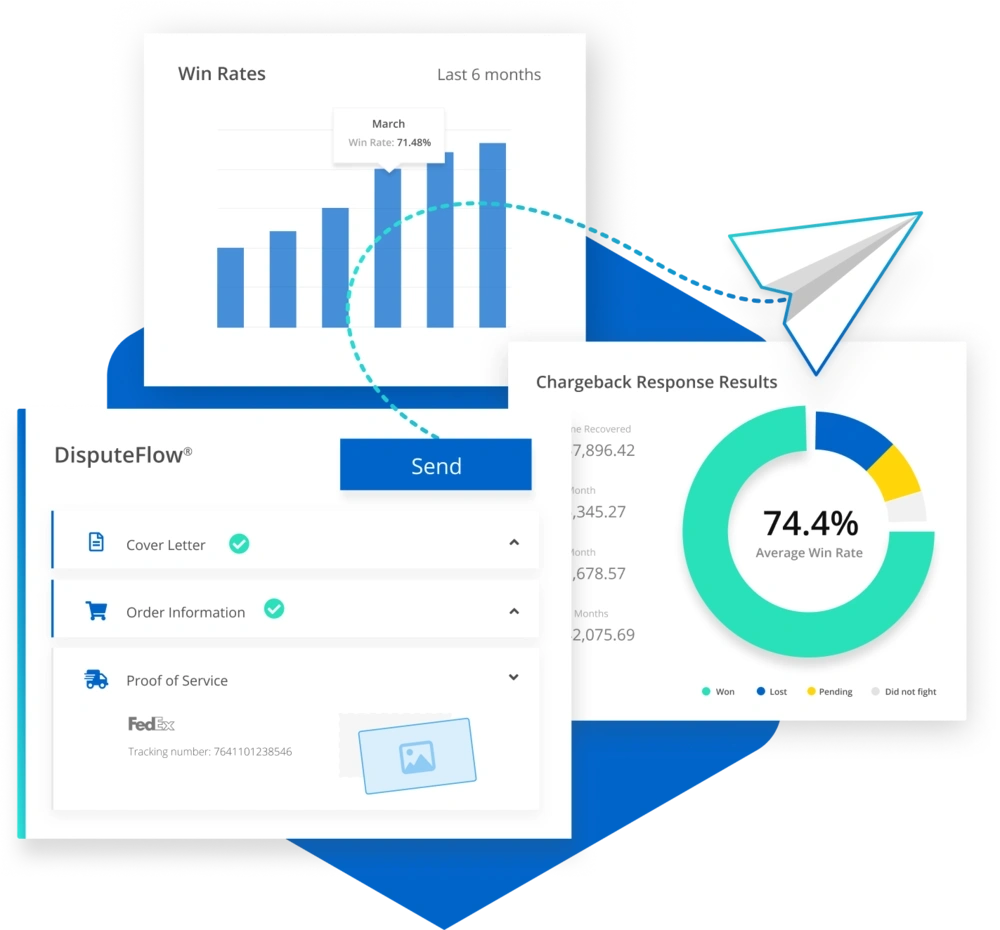

Fight chargebacks & recover more revenue.

When you lose money to chargebacks, Kount gets it back. Our philosophy for revenue recovery is simple: we want you to have the best ROI possible. That means we fight chargebacks with the greatest efficiency and highest probability of success.

- High win rates consistently improve over time

- Intuitive, easy-to-use technology removes guesswork

- Flexible automation replaces time-consuming, error-prone processes

- On-demand support connects you with industry veterans

Bank of America Chargeback

Bank of America chargebacks can represent a serious hurdle for merchants who might face chargeback fees on disputed transactions. Disputed transactions may go through the Bank of America claims department, where customers can dispute a charge. Bank of America recommends that customers call the merchant first, before disputing a transaction, but this may not always happen. In the case of a disputed charge, merchants may see a Bank of America dispute debit charge.

Until a dispute is resolved, the customer, to whom Bank of America is an issuing bank, will see a change in the credit card total due reflecting the dispute. Bank of America will reach out to the merchant via the card brand and acquirer. At that point, a merchant can dispute the legitimacy of a chargeback, but if Bank of America believes it to be a legitimate dispute, the merchant may have funds withdrawn or held from their merchant account and may be responsible for chargeback fees as well.

In most cases, for merchants, it’s preferable not to deal with a chargeback in the first place. For all parties involved, it can be much simpler for customers and merchants to work out a dispute together before involving an issuing bank. If a cardholder submits a dispute on a charge, and Bank of America determines that the charge is legitimate, customers will have their total due readjusted to reflect the charge, but they likely will not be responsible for any fees or interest associated with the disputed charge.

However, if the charge is deemed to be illegitimate, merchants can be held responsible for fees and administrative costs associated with the dispute process. These fees will depend on the merchant agreement. In any case, it’s almost always preferable to avoid chargeback disputes before they happen.

Bank of America Dispute Transaction

Bank of America has a very robust customer service system. Customers who need help and are looking for Bank of America credit card customer service will find that it’s available around the clock. Customers can generally reach Bank of America customer service 24/7, so for merchants, chargeback issues can come in around the clock.

Bank of America recommends that customers with concerns first reach out to the merchant. If they opt not to and to instead call Bank of America customer service, they can do so at virtually any hour of the day. Bank of America, like many other large banks, has a number devoted to customer service specifically. However, the Bank of America customer service number should only be used when the merchant is unwilling to resolve the dispute.

For cardholders, this number is effectively the Bank of America chargeback number, since they encourage customers who believe that there has been unauthorized use of their card to reach out. When cardholders with Bank of America dispute transactions in the case of fraudulent use, it’s the best course of action for them — but sometimes, cardholders might dispute a legitimate charge for an invalid reason. These might include buyer’s remorse or forgetting that they paid for something. This is unethical and an illegitimate use of transaction disputement systems, but it does happen. And it can be a waste of time and money for merchants.

See why we’re #1.

Kount is a true software solution, providing complete, intelligent chargeback management.

- A team of experts to help you succeed

- Efficient, flexible automation

- Everything you need in one platform

Bank of America Dispute Process

The Bank of America dispute process is very well documented, and they have it outlined on their website for applicable parties to consult. As a merchant, if Bank of America is your acquiring bank, you can consult your merchant agreement to find more information about potential administrative costs and fees associated with chargebacks.

When it comes to Bank of America chargeback, PayPal which many sellers use, is not immune. Using PayPal for payment processing won’t really change the bank dispute process. With PayPal as your processor, you’ll still get chargebacks from Bank of America cardholders. If cardholders with Bank of America dispute a charge, phone numbers can be found on their website, but the primary one to use is their customer service line.

As with other banking entities, sellers using PayPal will generally find that many disputes are better handled if customers reach out directly to their merchant. The exception would be in the cases of identity theft and fraud, in which case cardholders may not even be aware that that’s possible or have a way to easily contact the merchant since they won’t have a receipt or familiarity with the merchant.

Bank of America Chargeback Fee

Bank of America chargeback fees, and chargeback fees from many banks, can be a serious hurdle for sellers and merchants. The best case scenario is that merchants can avoid them in the first place. With Kount, you can accomplish just that. With Kount, the majority of chargebacks can be avoided. Kount works with the bank dispute process and helps avert chargebacks.

Through Kount, you’ll be notified of the dispute. Then, you’ll have the opportunity to avert the chargeback by issuing a refund to the customer. This stops the dispute from going to a chargeback where you might face chargeback fees or additional administrative costs. Since the Bank of America claim department works around the clock, having Kount, which works with the Bank of America claims department hours, can save you a lot of hassle and help you avoid costly chargebacks.

As a seller or merchant, ideally, you’ll never face disputes, but unfortunately they happen. They can be legitimate or illegitimate, but either way, avoiding chargebacks whenever possible is ideal. By using Kount, you’ll be able to resolve charge disputes and keep customers happy before they ever turn into chargebacks.

Bank Of America Dispute Chargeback

The Bank of America claim department has a well documented process for credit disputes, and there are several steps to it. The process goes through the Bank of America claim department.

- A customer initiates a dispute.

- Bank of America will change their total due to reflect that a charge has been disputed.

- Bank of America will try to determine if the charge is legitimate or illegitimate.

- If they determine that the dispute has merit and the charge is illegitimate, then it will go to chargeback.

Dealing with chargebacks can be bad business for merchants who can face chargeback fees and have money withdrawn or withheld.

Some merchants dealing with a cardholder with Bank of America dispute chargebacks. Bank of America will investigate and, after a period of time, make a determination. There are many reasons that cardholders with Bank of America dispute charges and their determination may be based on what the reason for the dispute is. Even if you dispute a chargeback, it’s generally ideal to avoid them in the first place. They can be costly and they’re a drain on time and resources.

Bank of America Customer Service

Bank of America customer service is available around the clock which is great news for cardholders and customers. It’s great for cardholders to have Bank of America customer service 24/7. Cardholders with a Bank of America credit card can initiate a dispute at strange hours as a result. Customers can easily find the Bank of America customer service phone number online. They can also access online banking, and even ask for a Bank of America fax number.

As a merchant, though, this can mean you might see disputes on charges initiated at any time of the day and try to keep up with Bank of America claims department hours. It can be difficult to keep up with them. Kount features chargeback automation so you no longer need to worry about this. With Kount, you can set automated chargeback responses and automate the response process. Once a bank has issued an alert that there’s been a dispute, Kount can automatically begin to respond, enabling you to avoid chargebacks and respond to them in real time whether or not you’re even awake.

Bank of America Claim Status

Once a dispute has been initiated with Bank of America, knowing the claim status is essential for the customer and merchant side. Generally Bank of America claim processing time is up to around 60 days, but they can go much faster or slower depending on the situation. The Bank of America claim process varies from case to case. But as a merchant facing possible chargeback fees and administrative costs, it’s always important to know what’s going on.

That’s why Kount provides real time reporting. As Kount receives response outcomes, you’ll receive reports in real time on the status of a claim. As a merchant, keeping up with claims in real time is an invaluable asset, since chargebacks can be costly and time consuming. But with Kount, you’ll always be up-to-date on the status of a claim, and know exactly what’s going on. Kount's automated claim responses and around the clock real time updates allow you to rest easy without worrying about the status of a dispute claim or losing out on revenue to chargebacks that could have been avoided or successfully disputed.

RELATED READING