Consumer Insights: The Importance of Customer Lifetime Value (CLV)

To paraphrase Sun Tzu — if you know your customers and know your business, you need not fear the result of a hundred Black Fridays. Consumer insights are critical for building knowledge of who shops with you, want they want, and how you can best serve them.

Few things generate loyalty like getting a deeper understanding of your customers, but where do you even start? Customer lifetime value, or CLV, is a useful metric that can drive your loyalty-building efforts. It’s a tool with the power to simultaneously save money while developing future revenue.

What is customer lifetime value?

Customer lifetime value is the total earnings from a customer over the duration of their relationship with your company. This typically comes in two forms, historical and predictive CLV. Historical CLV lets you determine lifetime value to date. Predictive CLV uses averages to help determine the potential customer lifetime value of the entire relationship. Both are effective tools of measurement that can drive different methods of building loyalty and maximizing returns.

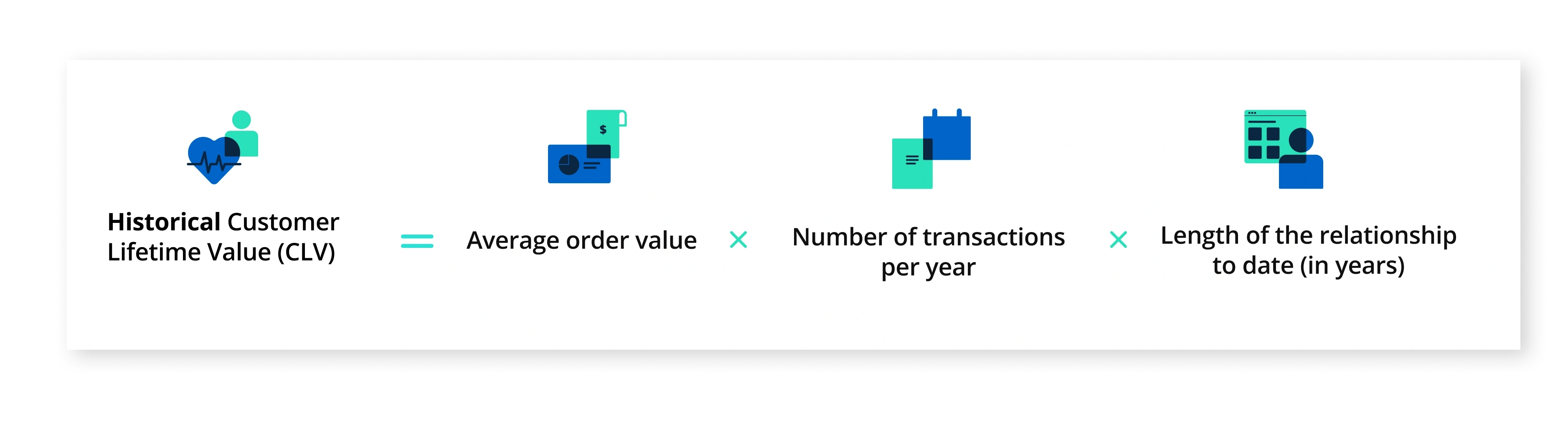

Historical customer lifetime value

The formula for calculating CLV is fairly simple.

For example, a new customer who spends an average $50 each transaction on purchases 20 times over the course of their first year has a historical CLV of $1,000. That tells you where you stand with this customer so far.

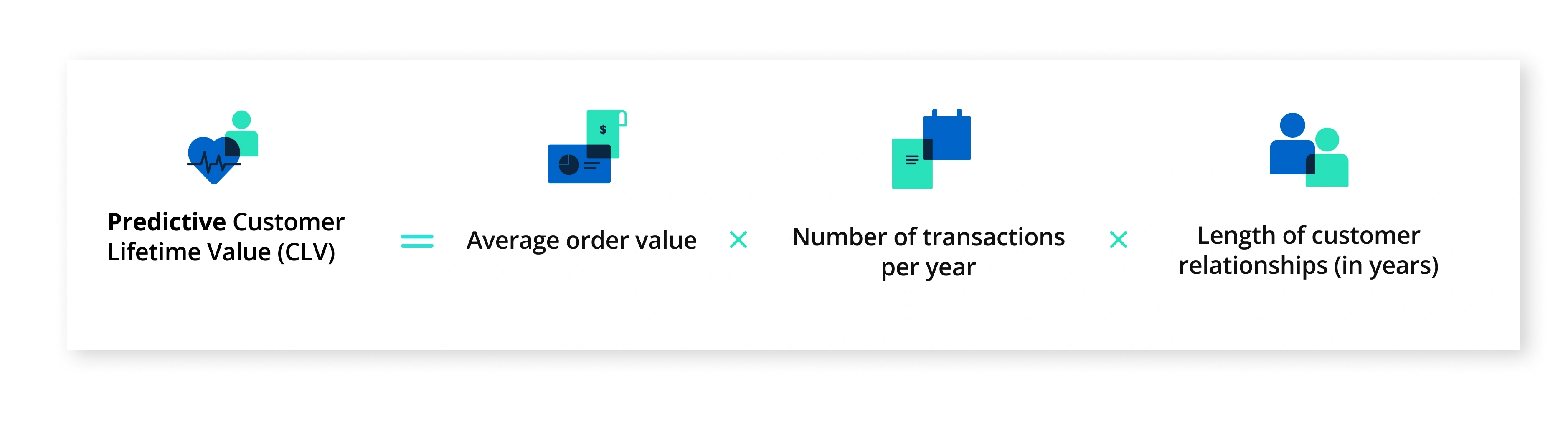

Predictive customer lifetime value

If the average order value across all your customers is the same $50, and they average 20 transactions a year for an average of 5 years, you get a predictive lifetime value of $5,000 per customer. This figure lets you predict what you can expect from customers over time.

How does determining and tracking CLV help your business?

It’s likely you have a standard stable of metrics and key performance indicators you use to evaluate your business. So why add one more? Customer lifetime value gives you a way to quantify customer relationships. You can more easily track who is driving your success and predict future performance. Through determining these relationship values, you can more easily fulfill needs and drive further engagement in a few important ways.

Target the right customers

Use historical CLV to identify your top customers. Examining the profiles of your top patrons helps you learn more about their needs and interactions with your business. The purchase histories of customers with top lifetime values can give insight for future marketing strategies or product deployment ideas. This type of consumer insight shows what needs bring your customers to you and exactly how they’re driving your success.

Focus loyalty-building efforts

The more you know about your shoppers, the better you can tailor your efforts at building loyalty and enhancing retention. Building better relationships with your customers often requires insight that goes beyond transaction histories, but you can use CLV to streamline your efforts. Track loyalty programs for performance and use specific promotional time limitations to help identify which campaigns drive increases in not only sales but also CLV averages.

Identify friction and curb attrition

Predictive CLV can inform your efforts as well. If your average predictive CLV begins to dip noticeably, it likely indicates a problem with your products and services, marketing, or fulfillment. This dip can appear long before shoppers begin to make you aware of any shortcomings, letting you take a proactive approach to any issues causing such a drop in customer satisfaction and loyalty. It typically costs far more to gain new customers than keep old ones. Heading off attrition can lead to big gains over time.

Drive continued success

Similarly, a rise in average predictive CLV indicates that you’re doing something right. Product quality, effective marketing, and efficient fulfillment may deliver such returns. Market conditions could also have shifted. Recognizing these changes gives you a chance to capitalize on them to attract new customers who can become your next set of top relationships.

Combine historical with predictive CLV to maximize your efforts. Similarities in customer profiles for high-CLV relationships provide strong insights for acquisition, letting you build upon proven success.

How to increase customer lifetime value

The benefits of customer lifetime value (CLV) make the metric worth expanding. Increasing CLV means building your relationships with customers and growing the profitability of your business. Even processes seemingly unrelated to marketing or profitability can drive return purchases and enhance CLV. Continual improvement snowballs into stronger relationships for lasting success.

Capture loyalty from the outset. Treat your newest customers with the same level of respect and service you’d give high-CLV relationships. Reduce friction at every stage of the customer journey.

Increase order value through targeted sales. Collect data to build upon existing relationships by using information from previous sales to inform targeted marketing. Try add-on sales, personalized promotions, and bundled packages.

Simplify customer service and return processes. Service is paramount. Ensure customers making returns or requests can do so easily and receive quick responses to issues.

Engage in post-purchase follow-up. Drive return sales by reaching out after purchases to recommend related items and emphasize your willingness to provide further service after the sale.

Offer loyalty programs with personalized rewards. Loyalty programs don’t have to be measured in points. Reward high-CLV customers with discounts using targeted marketing. Consider strengthening existing low-CLV relationships with similar offerings.

Develop strong communication and feedback channels. Communication is key. Ensure buyers have a way to reach out to you before they go online for reviews or to post about experiences. Consider using surveys to gauge customer sentiment.

Improve processes based on the feedback provided. Customers are great at helping identify areas of improvement. Ensure you deliver on expectations not met, and thank your shoppers for helping resolve such issues.

Making the most of advanced CLV calculations

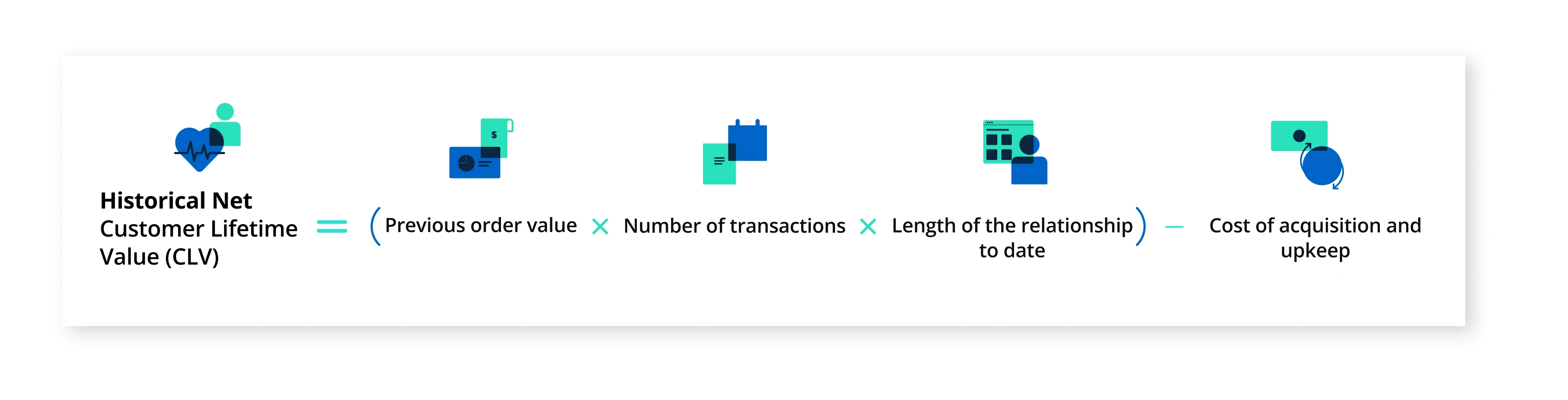

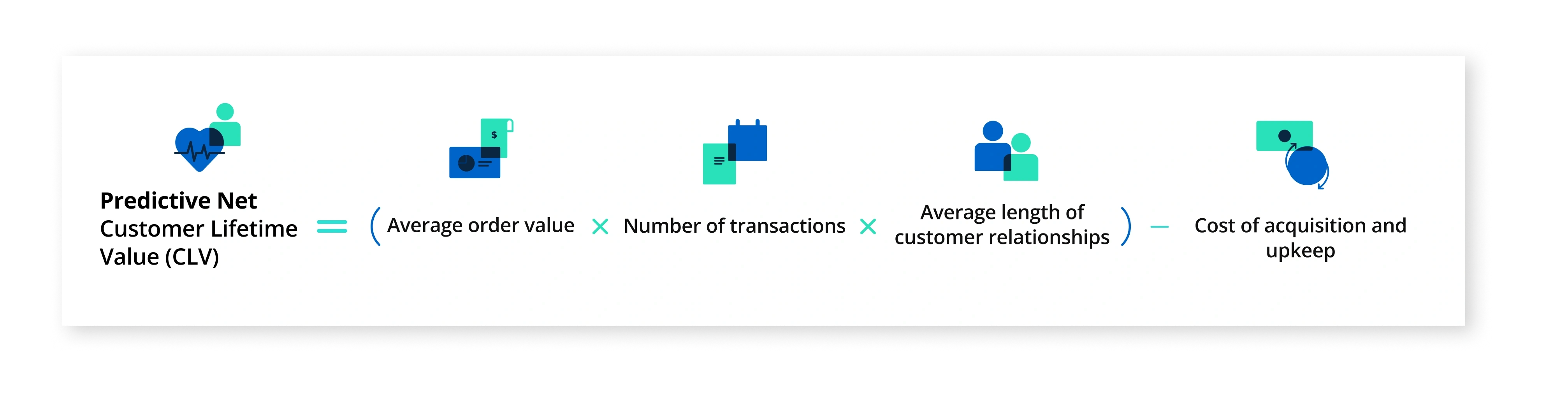

What about the wrong customers? It’s possible you have some customers who cost more to maintain than the value of the relationship. More advanced calculations can help you identify customers who are effectively detracting from your ROI. They can even alert you to chargeback or refund fraud, helping identify those who seek to take advantage of your company.

More advanced calculations require modified formulas. In high-risk industries where acquisition and upkeep may be substantial expenditures, the net versions of these values can be invaluable. Simply deduct those costs from the CLV.

So if you spend an average of $500 each year on acquiring and maintaining the relationship for each new customer, your customer from before with a historical CLV of $1,000 has a net CLV of only $500. Across all customers you can expect a modified lifetime value of $2,500. There are many other considerations you can add to modify these formulas to suit your needs.

Armed with this information, you can now look into what drives these deductions. Is it high acquisition costs, or do you get an abnormal number of returns from these customers? There’s no limit to the modifications you can make to get accurate, actionable insights.

Customer lifetime value and the next generation of shoppers

Boomers (1946-1964) and Gen X (1965-1979) may have informed much of the shopping trends of the past, but Millennials (1980-1994) now have greater buying power than ever before. The newest generation of shoppers continues entering the workforce, bringing new considerations for companies hoping to grow in the new digital age. Here’s a few insights for building CLV with younger shoppers.

Exceptionally strong, but fluid, loyalty

Most members of Generation Z (1995-2012) feel very strongly about the brands they support. This is not unwavering loyalty, however. They’ll bounce quickly to another brand if they encounter friction during or after a sale. Streamlining onboarding and sales becomes critical. Gaining the loyalty of shoppers reduces disputes and returns with both Millennials and Gen Z; they can be some of your greatest advocates or most vocal detractors.

Living in an increasingly digital world

And those voices matter. Millennials and Gen Z both turn heavily to social media ads, online influencers, and internet searches when making purchasing decisions. Traditional marketing methods may fall short of reaching these audiences if they fail to embrace influencer recommendations or sales through digital apps.

Expand CLV with modern shoppers by offering other ways of purchasing products. Go beyond only buying online or in-store. Try options such as buy online, pick up in store (BOPIS) which appeals to shoppers less interested in physical interaction but can still drive add-on sales. Younger shoppers are also more interested in buy now, pay later options for bigger purchases.

Embracing peer-to-peer (P2P) payments

While expanding your payment options can lead to additional risk, it can also drive sales with newer generations. They’ve proven willing to embrace virtual payments and electronic wallets. Even peer-to-peer payments like Cash App, Venmo and PayPal. Make sure you’re protected against fraudsters when it comes to P2P payments, but consider offering these to improve the customer experience with the digitally-connected generations.

It won’t be that long before the newest generation discovers its spending power. It’s an exciting time with new and emerging opportunities for building relationships across generations. And today’s children will be tomorrow’s shoppers.

Go beyond CLV with the power of consumer insights

Regardless of generation, understanding your customers using consumer insights gives your business an edge. There’s more to consumer consumer behavior than just customer lifetime value. Data analytics from solutions providers like Kount can give you information on:

- Household economics

- Propensity to spend

- Anticipated shopping frequency

- Geographical locations

- Chargeback activity

And more, all without revealing consumers’ personally identifiable information or sensitive merchant data. These insights save money by helping you target marketing efforts and reducing acquisition costs. Insights from Kount can help keep fraudsters at bay as you maximize revenue through additional sales and stronger consumer loyalty. Contact us if you’d like to learn more about consumer insights or how to use key metrics like customer lifetime value to grow your business safely and securely.