Account Creation Score: A Revolutionary Upgrade in Fraud Technology

Fraudulent account openings happen all the time. It’s one of the fastest growing threats facing the digital commerce industry today. Most account creation fraud solutions address the threat by evaluating risk signals like location and device signals to make a decision. However, this approach needs refinement to better address the problem.

Recently, we launched a new scoring feature that specifically addresses the challenges in fighting account creation fraud. Instead of relying on limited risk signals, our score goes further — looking at risk, authenticity, and behavior associated with individual identities to create a complete and more detailed view of the activity happening on your site.

New Account Opening Fraud: What’s the Problem?

New account fraud is a type of fraud that occurs at the point of new account opening. Typically, a person will use fake or stolen information or a combination of both to open a new online account. In many cases, when fraudsters open these accounts, they intend to use them nefariously. For example, they may create multiple fake accounts to abuse sign-up promotions.

Account creation fraud can be incredibly damaging to your bottom line. Each year, US businesses lose $300M to $600M USD from promo abuse — also known as multi-accounting fraud. And the problem is only growing more rapidly as advancements in generative AI become more easily accessible and difficult to identify. In 2023 alone, 13.5% of transactions associated with online account creation were flagged as fraudulent.

But this widespread issue is only one part of the larger problem. Balancing fraud prevention with good customer experiences is incredibly challenging. The protections that many businesses use to stop account creation fraud can cause extra friction for their good customers — leading to onboarding abandonment and poor user experiences. Just in the ecommerce industry, user abandonment rates are as high as 21%.

Can you imagine losing 21% of your customer base because their onboarding experience was too slow or required too many identity verification checks?

The Solution: A Risk Score for New Account Openings

Many fraud solutions on the market address the problem of new account fraud. But as fraudsters develop new techniques to pull off the scheme, fraud tools also need to advance. That’s why we developed technology specifically for this complex and dangerous fraud threat.

Risk Scores: what are they?

A major component of fraud prevention technology is scoring — which involves evaluating interactions to produce a number or “score.” This score essentially tells you how risky the interaction is. Almost every fraud solution provider uses scoring to help with fraud decisioning, but what goes into those scores differs greatly. Most solution providers do not build scores specifically for account creation, nor do they have the identity-level insights that are essential for the scores to be the most effective.

What is the Account Creation Score?

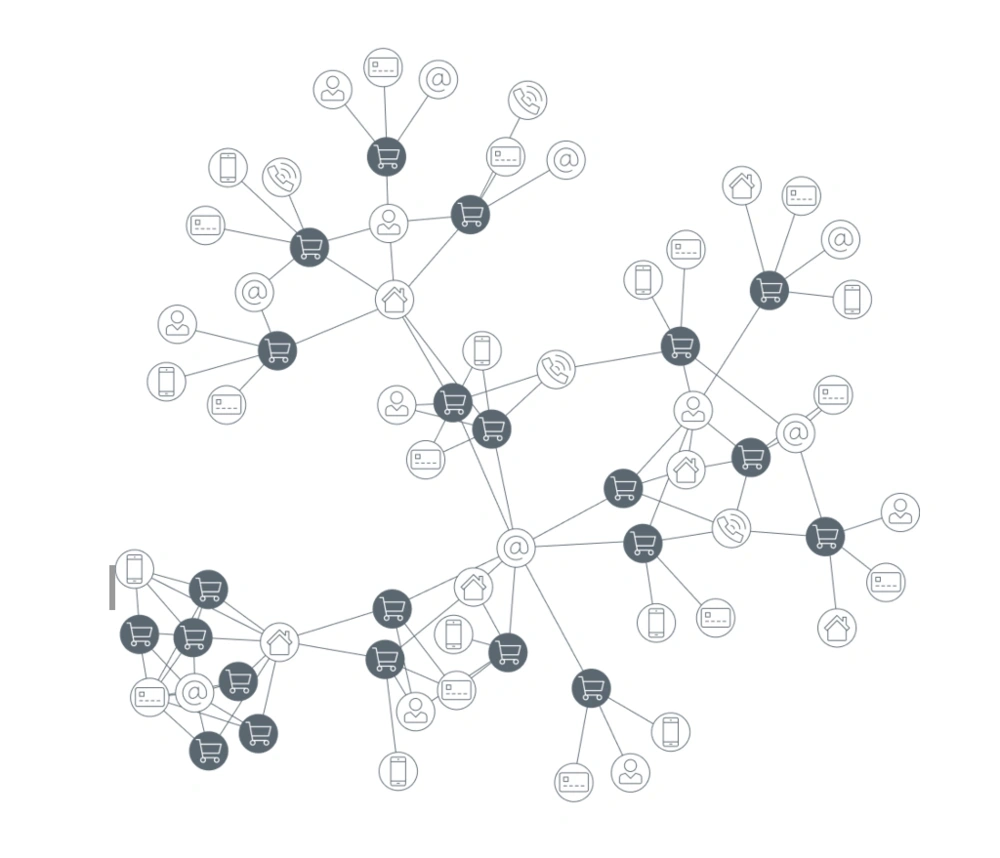

Our Account Creation Score (ACS) is an AI score that assesses the risk of new account onboarding in milliseconds. It is powered by our supervised and unsupervised machine learning models and built with a variety of data points around identity — such as physical addresses, device and IP information, email, phone, and customer data.

What makes this score different from other scoring systems is the fact that it looks at all these data elements and evaluates individual identities, not just the PII elements. In essence, it takes the segmented data points and connects them together to build complete user profiles.

The score specifically looks at three key aspects of the identity:

- Legitimacy: Determines if the input information is real and primary for the individual.

- Affiliation: Combines the information with unsupervised graph techniques to determine how likely the input data belongs to the same individual or household.

- Behavior: Views past history for the individual and checks for fraudulent behavior.

How the ACS works

The ACS is embedded into our Account Creation Abuse product, so customers using this will be able to use this score to inform onboarding decisions. The score is available within our Account Creation Abuse product, which leverages the Kount 360 platform policy manager. Businesses can customize how they use the score, along with other existing data points on device, location, email, velocities, and more. The Account Creation decisioning happens in real-time, and the response is delivered seamlessly, without affecting the customer experience.

Here’s how it would work in an example scenario. Let’s say a customer is trying to create an online account with a retailer.

Step 1: The customer fills out the account opening form online, inputting personal information such as name, email, phone, physical address, etc.

Step 2: All of the customer’s information is analyzed by machine learning models against our network of data — taking into account all elements of the identity.

Step 3: Once evaluations are complete, a score is produced on a scale from 0 to 100.

Step 4: AI consults the policies set up by the retailer and determines if the score falls within acceptable risk thresholds. Additional policies can also be set up using other data points such as device, email, velocities etc.

Step 5: Depending on the risk score, the customer’s application is approved, declined, or held for review.

It’s important to note that we provide complete transparency into what these scores mean and offer guidelines on how to use them. Scores shouldn’t be confusing. So we’ve made our ACS as user-friendly and easy-to-understand as possible. You won’t need to rely on an expert to figure out what the score ranges mean and how to incorporate them into your fraud strategy.

Use cases for ACS

Our Account Creation Score was developed to provide better protection against a variety of sophisticated threats and schemes.

Fake account creation

Prevent fraudsters from creating accounts using fake identities for fraudulent activity such as payment fraud or promotional abuse.

High-risk accounts

Identify accounts created by individuals who have a history of risky behavior — such as excessive refunds, criminal fraud, and more.

3rd party criminal fraud

Block fraudsters attempting to open new accounts using stolen personal information.

Pioneering AI Advancement in Fraud Prevention Technology

Our Account Creation Score is truly a revolutionary development in the world of fraud technology. And here’s why we feel compelled to call it that.

1. Our score is built on identity-level intelligence.

We own the most robust collection of data on the market. And we have built an Identity Network that uses advanced AI to feed this data into an identity-graph that spans globally. Our identity network allows us to connect key identity elements such as device, IP, email, phone, and address with an individual. This provides us with the identity-level intelligence that drives the account creation score.

Most scoring systems only evaluate personal identifiable information (PII) elements separately for risk. For example, they look at device risk or email risk. However, our Account Creation Score goes further and evaluates the individual identity — thus providing a more accurate, complete way of analyzing the risk of a customer.

2. Our score is powered by multiple machine learning models.

Our technology consists of both supervised and unsupervised machine learning (ML) models — which allows us to not only predict behavior based on historical data but also evaluate attributes that uncover trends and patterns in data.

Using multiple ML models, we’re able to gather all our global consumer data, analyze it, and build connections between data elements to better predict consumer behavior and determine risk. Then we’re able to quantify all that information into a single score.

3. Our score works with minimal input.

Many scoring systems are only as effective as the amount of data that runs through them. However, our ACS is different. Because it is powered by such a robust data network, it only needs to be fed minimal information — such as an email address or phone number — to generate an accurate score. This allows a wide range of businesses that are only capturing email or phone in the account creation process to use this score.

4. Our score was built specifically for account creation fraud.

Most fraud providers use one scoring system for all of their solutions. Seems simple, but in reality, that scoring system may not be equally effective for all types of fraud. And when it comes to more sophisticated threats — like new account creation or synthetic identity fraud — you need a scoring system that looks at multiple aspects of an identity, not just risk signals.

Let’s take a realistic-looking fake identity as an example. A fraudster creates a digital identity using their own device or a stolen device and real identity elements such as an email and a phone number. The identity appears legitimate because both email and phone are real. However, those pieces of information - device, phone and email, don’t actually belong to the same person. Most scoring systems aren’t built with AI that can identify those connections. However, our new score can.

Benefits of the ACS

This score is not only helpful for preventing various types of account fraud but can help with other aspects of your business as well.

Stop Fraud at the Front Door

The Account Creation Score detects fraud during the account creation process to prevent new account fraud, as well as downstream fraud such as payment fraud and promotional abuse.

Increase approval rates

The accuracy and specificity of the risk score leads to better fraud decisioning and less friction during account opening events. As a result, legit customers won’t be turned away due to false positives or bad experiences.

Protect against new threats

Because the risk score uses multiple types of machine learning models and is continually fed new, real-time data, it never stops learning and never falls behind. In turn, it adapts to new threats, ensuring that screening remains effective over time.

Want to See Our Account Creation Score in Action?

Our newest development in fraud technology is pretty incredible. But we don’t want you to just take our word for it. We want you to see and experience the difference for yourself. Get in touch with our team, and we’ll walk you through a demo of our technology.