Introduction

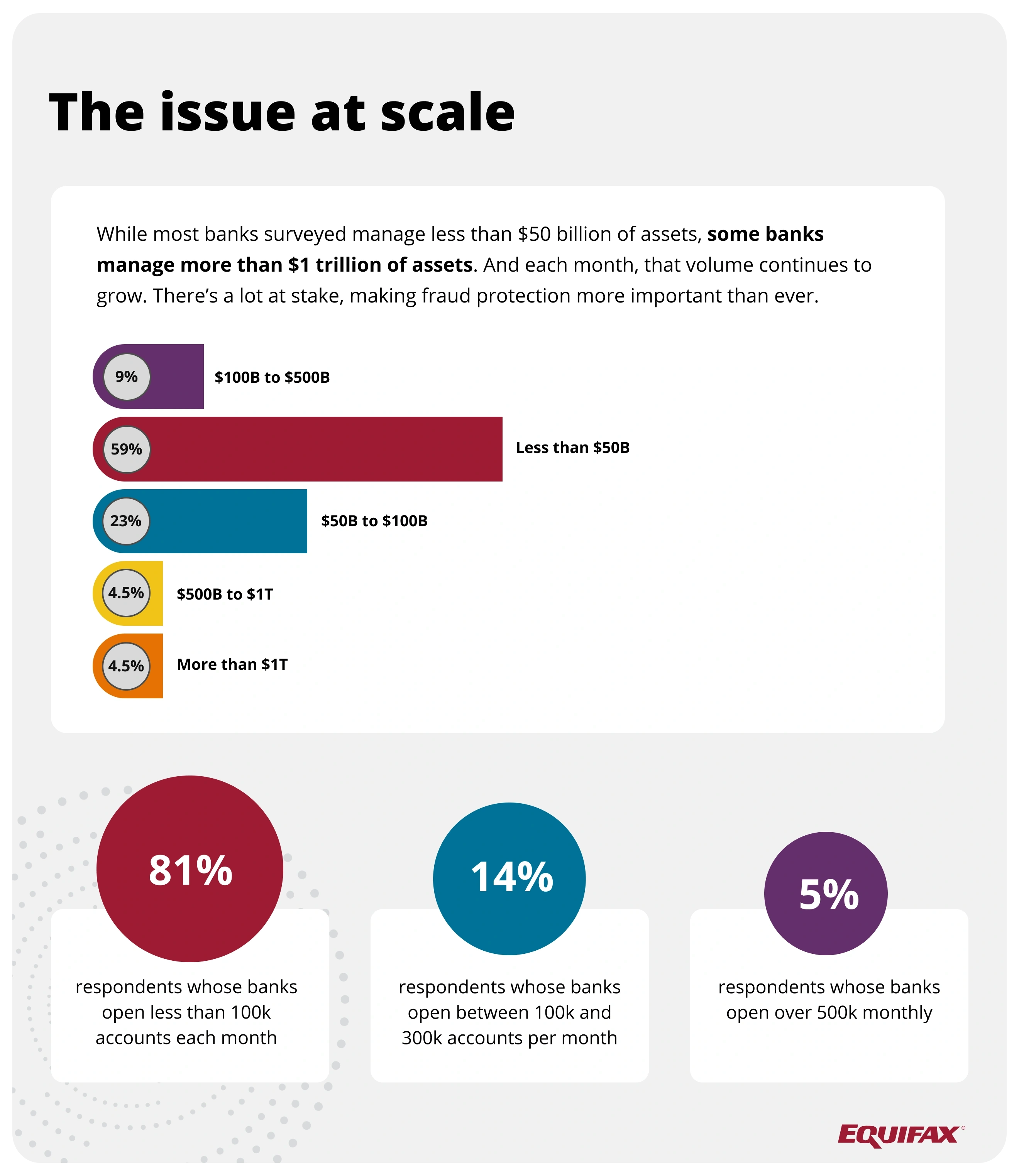

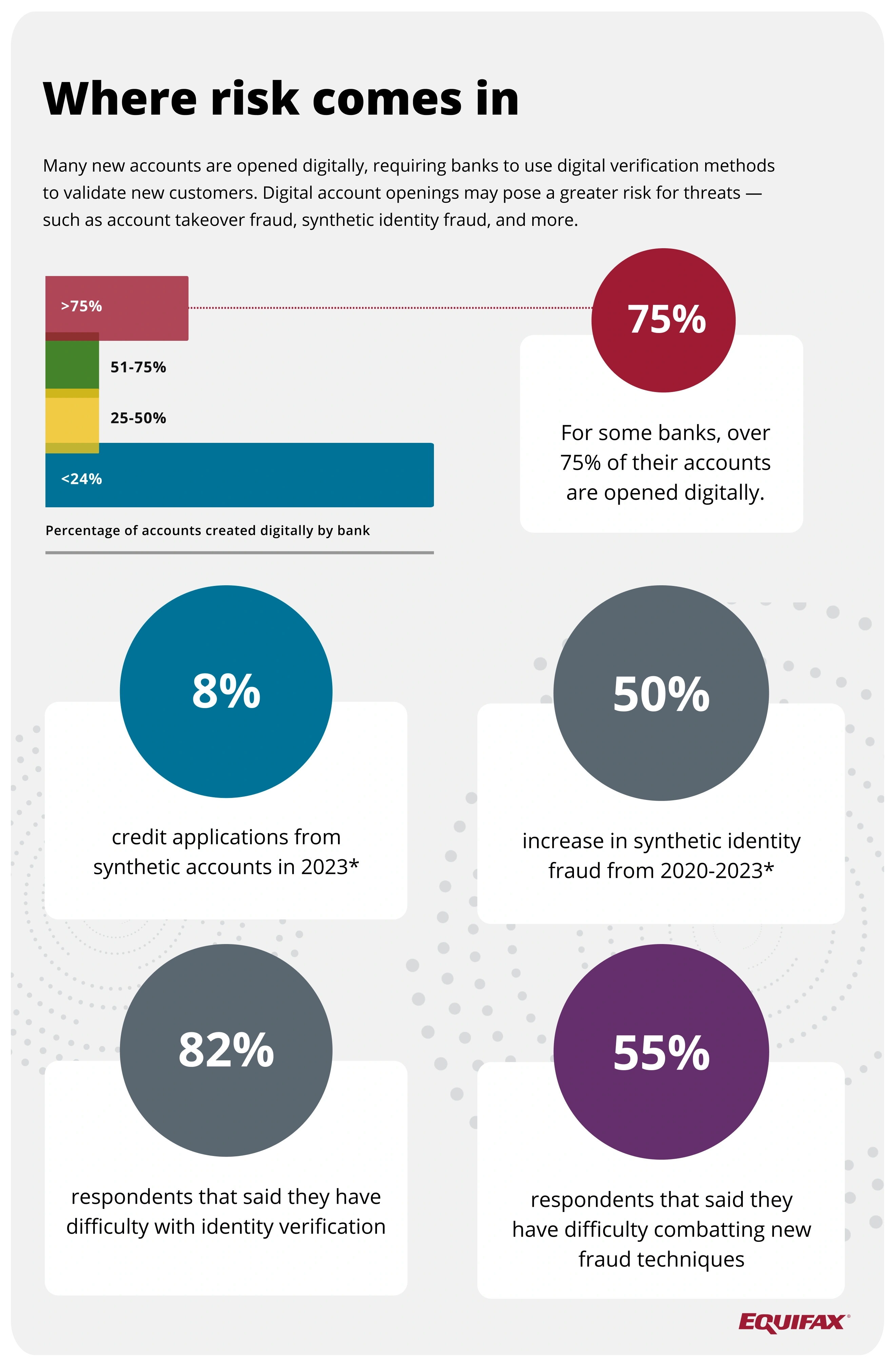

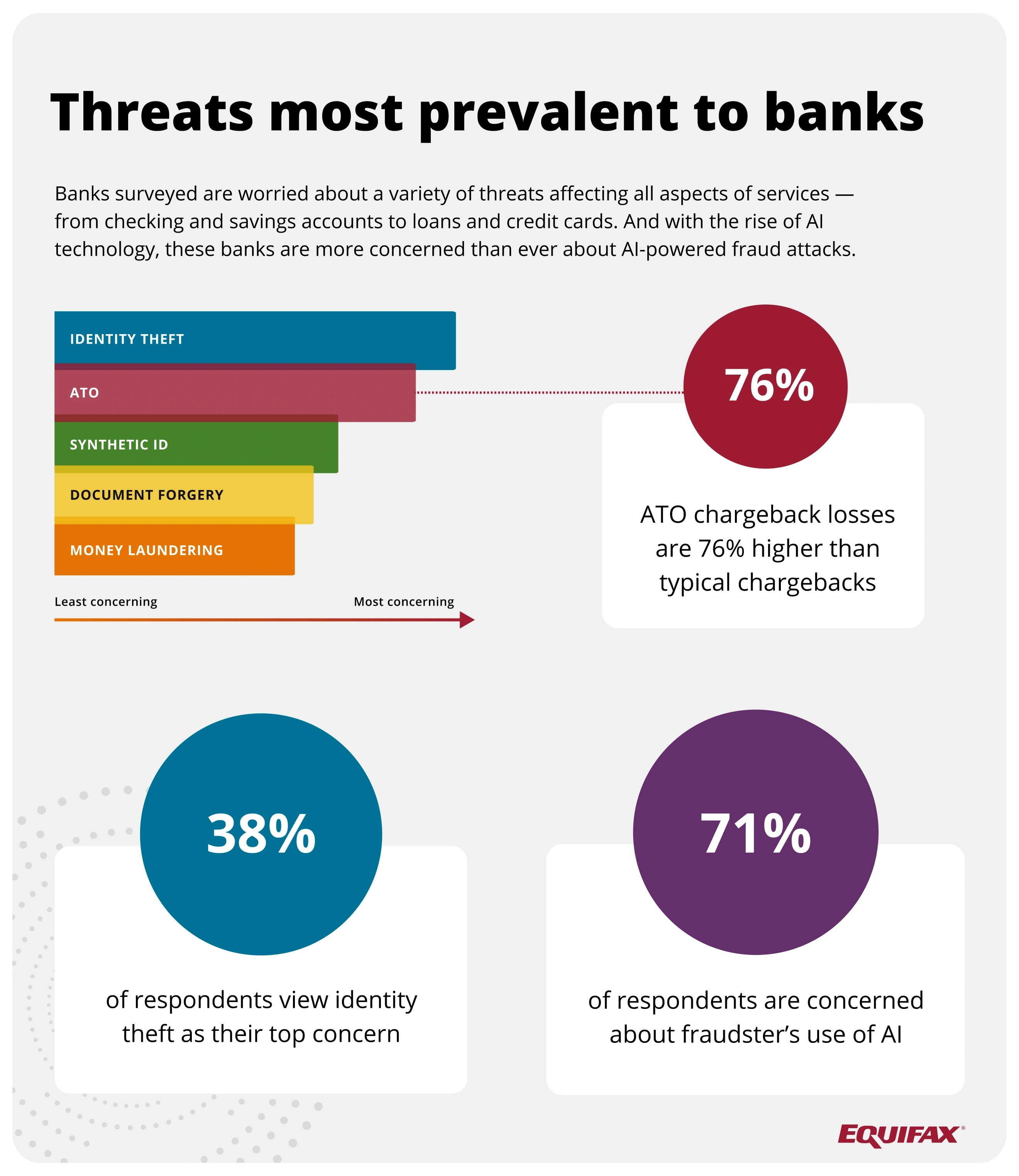

Earlier this year, the Consumer Bankers Association (CBA) surveyed its members to learn how they are handling ongoing challenges to their e-commerce operations due to fraud and chargebacks. Coupled with proprietary data and insights from Equifax, this infographic provides a high-level overview of current fraud trends in the banking industry, banks’ outlook on fraud, and the ways banks are trying to prevent attacks.

Background

The data in this infographic was gathered from a pool of respondents in the banking industry with job titles ranging from fraud risk managers to compliance officers. Additional insights are derived from Equifax data.

Conclusion

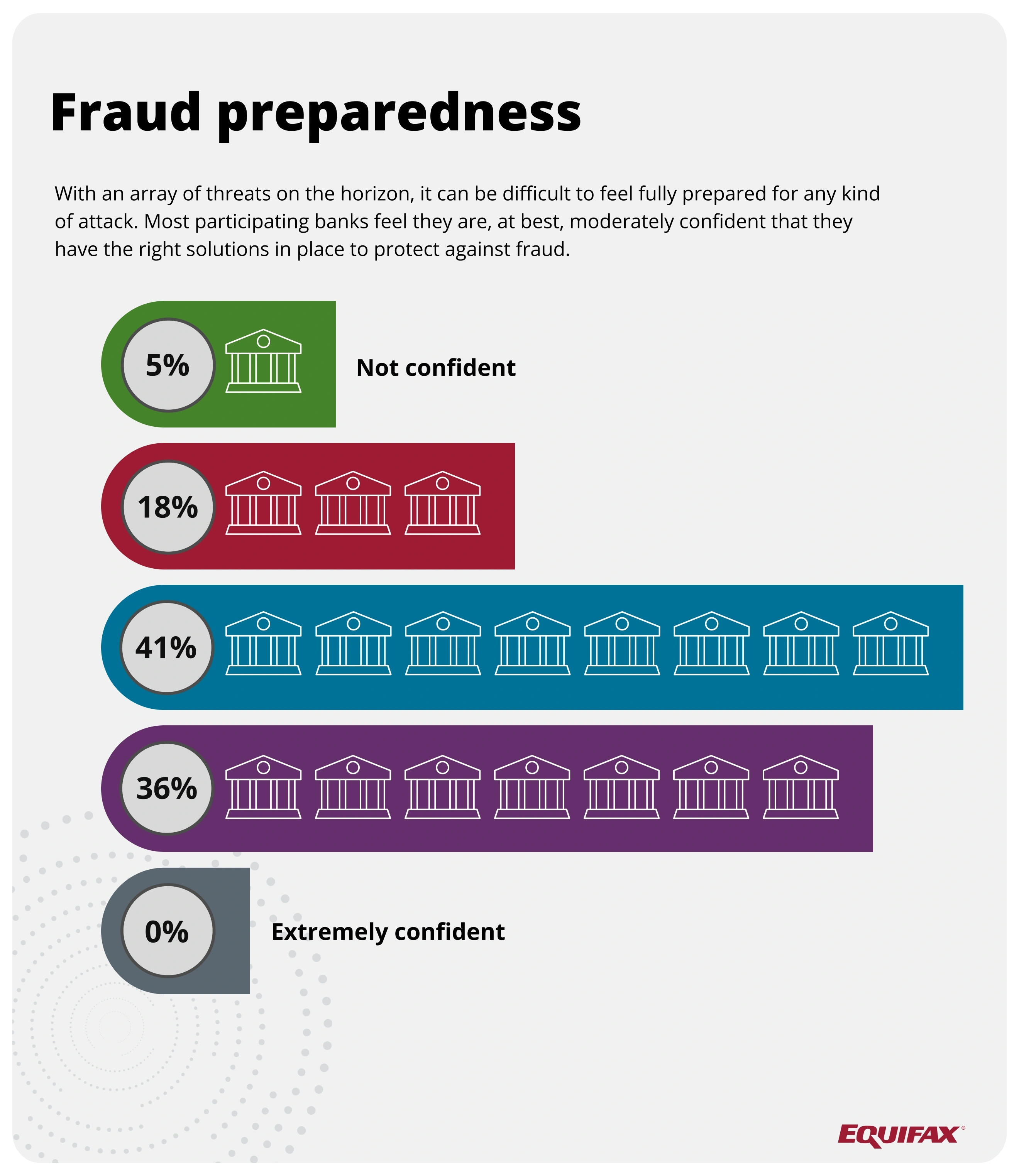

Fraud threats are always evolving — more sophisticated and dangerous ones pop up all the time. And unfortunately, banks are a huge target for fraudsters, given the volume and value of the assets under management. That’s why it’s crucial they have the right protections in place.

Many of the banks surveyed are particularly concerned about the use of AI in fraud, and rightfully so. These threats can cause insurmountable harm. Being prepared is all about taking a holistic approach — implementing several different kinds of authentication tools along with fraud detection software. Too many banks surveyed fail to take advantage of verification tools like facial recognition or behavioral biometrics, but these may be the key to keeping your business protected.

Sources

https://kount.com/resources/data-reports/digital-fraud-trends-2024