CASE STUDY

BlueSnap uses Kount to Increase Business by 50% and Protect Merchants

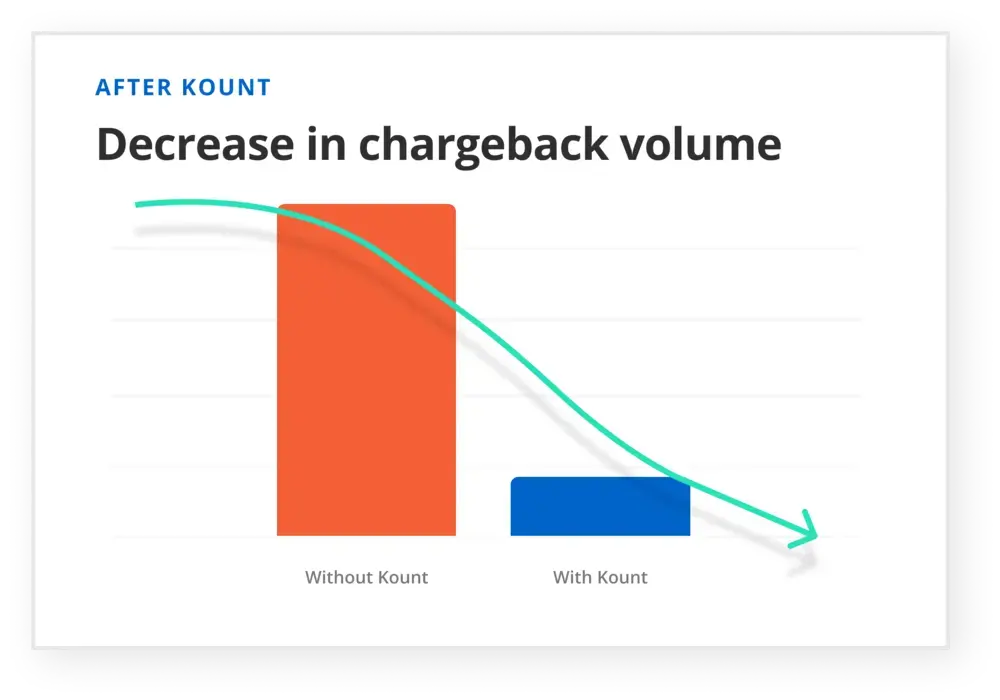

5X

chargeback rate reduction for merchants

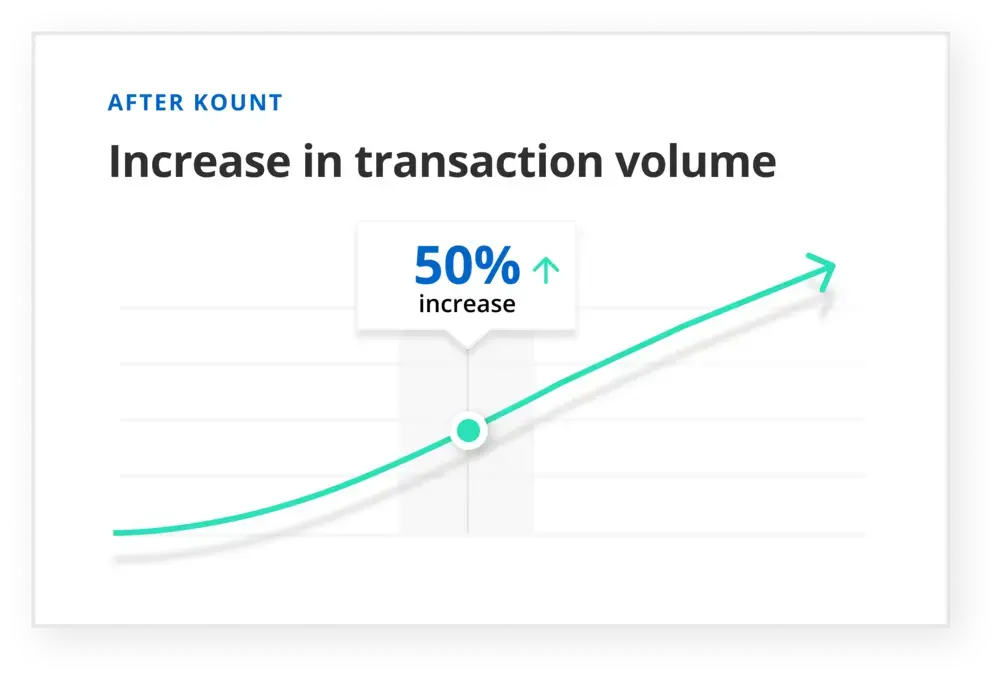

50%

increase in transaction volume

100s

of daily manual reviews eliminated

BlueSnap is a global payments company that helps businesses accept payments, increase revenue, and reduce costs. Their comprehensive back-end solutions simplify the complexity of payments so merchants can easily customize their payment workflows.

THE PROBLEM

Inefficient processes. Too many manual reviews.

Prior to implementing Kount, BlueSnap had a labor-intensive fraud detection process. Their internal fraud system often flagged more orders than necessary — which created a heavy workload and slowed down the approval process. Customer service representatives spent each day manually reviewing hundreds of suspicious transactions. But despite reviewing so many orders, fraud rates were still higher than they should have been.

At the same time, the company continued to add more accounts to their existing merchant base — increasing the amount of labor for the team. BlueSnap needed a fraud solution that could automate fraud prevention for their entire customer portfolio — reducing manual reviews — while enhancing the screening process.

THE SOLUTION

Customizable, accurate, and efficient protection.

With Kount, BlueSnap can provide a baseline level of fraud prevention across their entire merchant portfolio while enabling varying degrees of customization for mid-level and top-tier merchants. The company also can respond quickly and accurately to emerging threats simply by modifying business policies.

Additionally, BlueSnap has eliminated their manual review process thanks to Kount’s automation capabilities. The customer service reps who were reviewing transactions for fraud have shifted their focus to helping merchants build their sales.

THE RESULTS

More business. Less fraud.

After implementing Kount, BlueSnap has won more business from competitors than ever before. Their base level of fraud prevention – coupled with their ability to offer merchants custom anti-fraud configuration – has allowed the company to differentiate their offering from other processors.

And overall, BlueSnap has been able to help merchants reduce chargeback rates down to .02% while doubling their business — all without increasing risk.

Our ability to offer the baseline level of Kount fraud protection at no extra cost helps us win business from competitors. Merchants see it as a big benefit. And being able to offer additional, configurable options of Kount makes that offering that much stronger.

John Johansen, Fraud Manager, BlueSnap

GET STARTED TODAY

Give your merchants the gift of simple fraud management

Want to provide an easy-to-use, simple but effective fraud detection solution to merchants? Look no further. Partner with Kount and we'll help set you up for success.