WHITE PAPER

Disputes and Chargebacks: Overcoming the Challenges of 2024

Experts from Kount and Verifi have come together to identify the top chargeback trends impacting businesses in 2024.

New tech means new challenges. It also means new opportunities. Don't overlook the potential impact for your business. Unlock this free white paper now — get immediate, one-of-a-kind insights and actionable advice.

- Anticipate chargeback trends that directly impact your bottom line.

- Maximize both protection and ROI efficiently and effectively.

- Critique the pros and cons of the best available solutions.

Introduction

Chargebacks are an ever-present concern for most established businesses. In fiscal year 2023, Visa processed nearly 100 million disputes.

However, their causes and implications can shift dramatically from year to year.

To ensure success in 2024, our team of experts is sharing three anticipated challenges — and the steps you can take to proactively address them.

CHALLENGE #1

Criminal fraud

Criminal fraud rates will continue their upward climb in 2024 because of several factors.

Artificial intelligence

Innovative technologies can be used in both ethical and unethical ways, and fraudsters have been quick to capitalize on AI’s versatility. The following are just some of the ways we’re seeing fraudsters use AI to make unauthorized purchases with greater efficiency and accuracy.

- Fraudsters are programming bots to make test purchases in quick succession to validate stolen payment details.

- Fraudsters are programming bots to hack into your customer’s online accounts. They use either brute force attacks or information stolen in data breaches (or a combination of both) to gain unauthorized access to an account and everything in it — which often includes stored payment information.

- Fraudsters are using generative AI (like ChatGPT) to improve the quality of their phishing emails — which makes them harder to detect. Unsuspecting consumers hand over sensitive information like payment details, and fraudsters use it before the scam can be detected.

ChatGPT was linked to a 1,265% increase in phishing emails in 2023

85% of cybersecurity leaders say recent bot attacks were powered by AI

Data breaches

Data breaches expose personal information en masse, leading to various opportunities to commit payment fraud.

- If credit or debit card details are included in a leak, unauthorized transactions — and the corresponding chargebacks — will happen at any business the fraudsters choose to target.

- Because consumers often reuse login credentials, exposed account information for another platform could provide fraudsters with access to your online accounts too. And once inside the account, the fraudsters can do serious damage.

In January 2024, a “supermassive Mother of all Breaches” was reported. More than 12 terabytes of information spanning 26 billion records was leaked from some of the world’s most recognized brands.

65% of people reuse passwords across multiple sites

The average person reuses each password as many as 14 times

TIPS & SUGGESTIONS

How to respond

Here are some suggestions on how to address these newly emerging threats.

Add more protection

If you allow customers to create online accounts, you’ll want to protect those accounts at multiple stages:

- Put protections in place for account opening to make sure real people are creating accounts for the right reasons.

- Protect accounts throughout their lifetime to stop fraudsters from taking over.

3D Secure 2.0 is another layer of protection that might be a good fit for your business. 3DS2 can help verify the identity of customers and shift liability for chargebacks. Just make sure you understand what the solution is and isn’t capable of before you add it to your strategy.

Reach out if you’d like to learn more about how to incorporate either 3DS 2.0 or account protection into an end-to-end chargeback management strategy.

Review and update rules regularly

Rules have become a hot topic in the fraud world. But there are a lot of misconceptions out there. Don’t be misled: rules are necessary — and good.

Make sure you are regularly reviewing your rules and making updates to address emerging trends.

NOTE: If you are working with a service provider that makes rule management difficult or is limited to out-of-the-box options, it might be time to make a switch!

Take action sooner rather than later

It’s not a good idea to wait and see if potential threats will become a reality. Just assume fraudsters will hit your business eventually and act proactively.

A Kount client explains it best:

CHALLENGE #2

Friendly fraud

Friendly fraud is an ever-present concern.

And there are several reasons why.

Reckless spending

It’s never been easier to make a purchase. Thanks to mobile devices, online shopping is literally inches away at any given moment. And because the experience is so easy and accessible, consumers are becoming irresponsible.

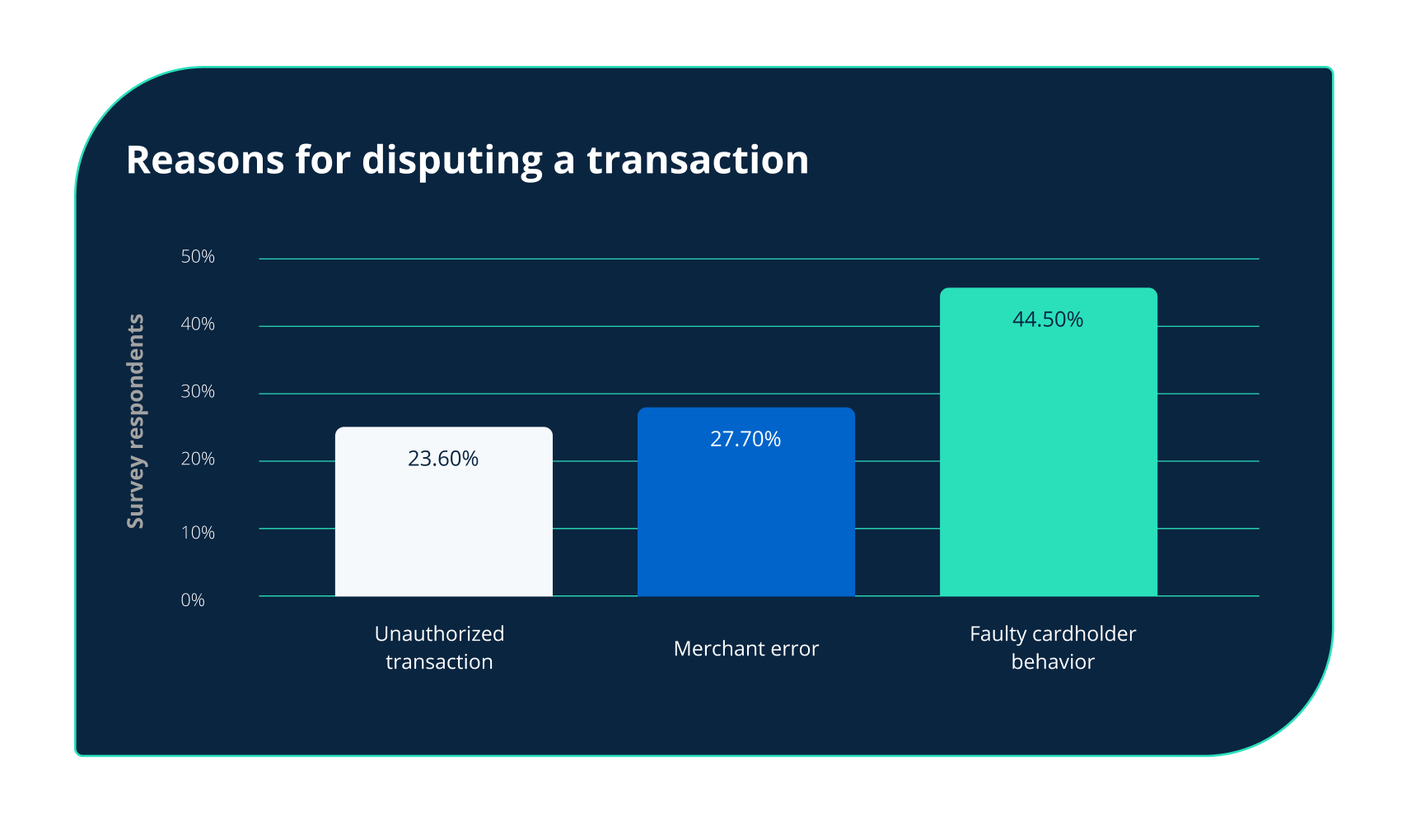

When asked why they filed a dispute, consumers attributed 23.6% of cases to unauthorized transactions. Another 27.7% were caused by merchant error. Some examples that cardholders gave were they didn’t actually receive the items they purchased, the merchant promised a refund but it didn’t happen, or the merchant charged the wrong amount.

Unauthorized transactions and merchant error are valid reasons for initiating chargebacks.

However, a staggering 44.5% of chargebacks were filed because the cardholder was inattentive or irresponsible.

Reasons given for requesting a chargeback included:

- They don’t remember making a purchase

- The item wasn’t what they expected

- They didn’t realize the purchase was part of a recurring payment plan

- They ordered the wrong thing

- They meant to cancel but forgot

- They experienced buyer’s remorse

- They intentionally engaged in friendly fraud to get the item for free

“My bank is more efficient at resolving my issue.”

“It just felt like the bank would be more accurate.”

“I had this issue before. The company never complies. Now I just go right to the bank.”

“It’s faster to go through the bank.”

Easy access to dispute process

Cardholders have shown a preference for chargebacks over direct merchant conversations for a long time. But within the last several years, barriers to the chargeback process have gradually faded away.

Back in the day, cardholders had to go through several hoops to initiate a chargeback. Phone calls, mail, and even faxes might have been required to lodge a complaint. But now, the process can be completed with just a few taps in an online banking portal or mobile app.

Mobile banking as the primary method of account access has increased 220% between 2017 and 2023

81% of consumers have used a mobile device to manage their bank account at least once in the past month

TIPS & SUGGESTIONS

How to respond

Here are some suggestions on how to address evolving consumer behaviors.

Enhance your customer service strategy

A chargeback prevention strategy is basically a really intense competition.

Who can provide the fastest and most satisfying resolution for a cardholder’s problems?

You or the bank?

To win that competition, you need to continuously review and enhance your customer service tactics and policies.

Identify the different points throughout the customer journey where issues might pop up and then proactively try to solve them. Be creative and personable with your approach to problem solving.

Use Verifi’s Order Insight + Leverage Visa CE 3.0

Order Insight is a chargeback prevention solution specifically designed to expose and stop friendly fraud in real time. If you are able to send clarifying information to the issuing bank when a transaction is disputed — like product details, delivery information, and purchase history — then the cardholder complaint can usually be talked off.

Of all the chargeback prevention solutions available, Order Insight has the highest ROI and is the easiest to manage.

- ROI - Disputed transactions can be resolved without a refund. This means you can retain more revenue.

- Management - Once integrated, Order Insight is a fully automated solution. All you have to do is review the outcomes.

Plus, Visa recently unveiled a new initiative to further protect merchants against friendly fraud. If you send specific Visa CE 3.0 data elements in your Order Insight response, the fraud dispute will be blocked — guaranteed.

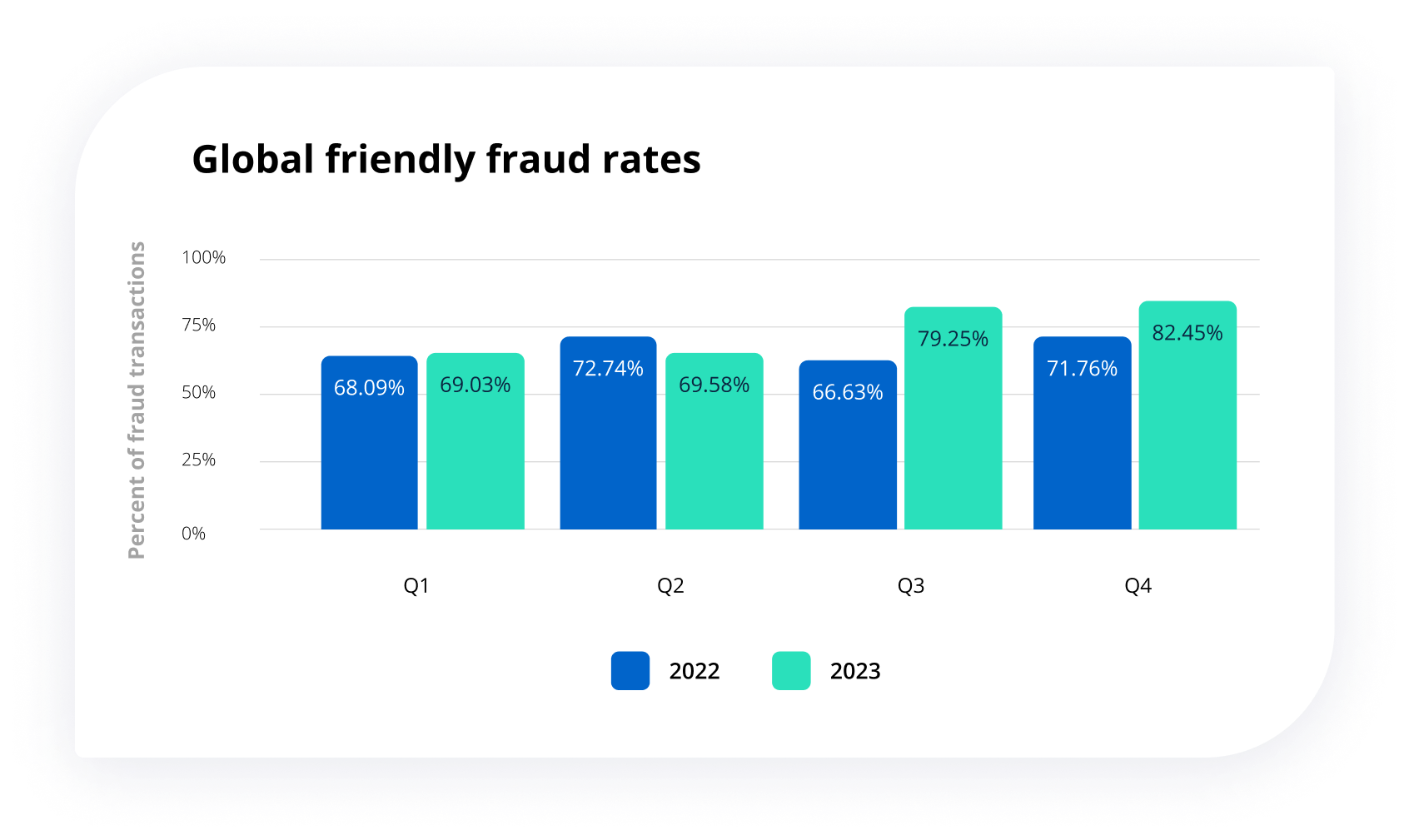

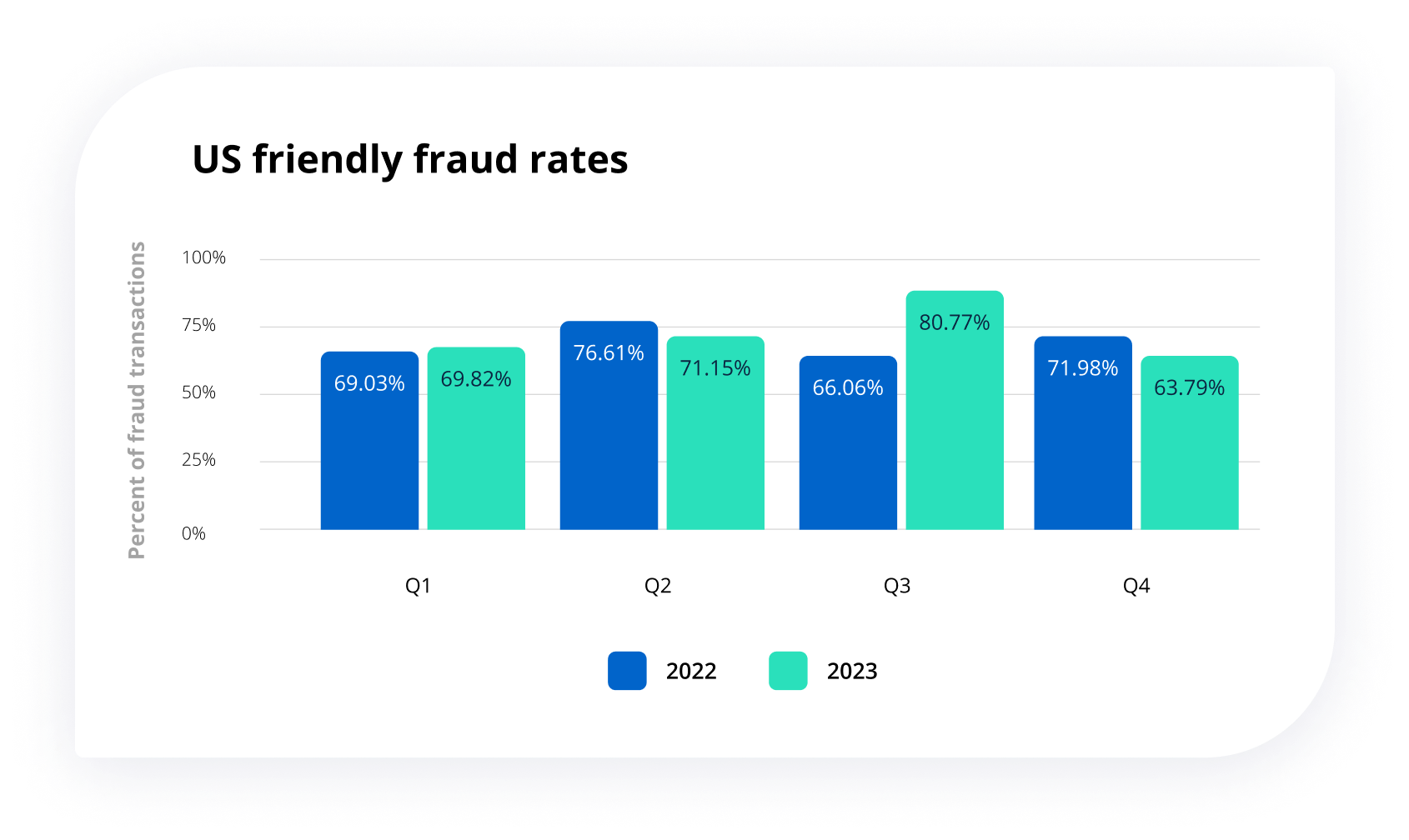

We’ve already seen data trends that indicate Visa CE 3.0 is positively impacting friendly fraud rates. And as adoption increases, outcomes will continue to improve.

In fact, since the launch of the Visa CE3.0 rule update, Order Insight has deflected more than $30 millions dollars — putting money back into merchants’ pockets.

NOTE: Some service providers can offer Order Insight. However, Kount is one of just a few providers able to collect and incorporate Visa CE 3.0 data elements into an Order Insight response. Because of our unique capabilities, Kount is Verifi’s preferred provider for Order Insight.

At Kount, our pricing is based on positive outcomes — you only pay if the chargeback is prevented. So you have absolutely nothing to lose if you use Order Insight through Kount.

Refund disputed transactions

Order Insight is a valuable prevention tool, but that doesn’t mean it’s a good fit for all businesses or situations. Sometimes, it’s best to simply refund a disputed transaction — especially if you have a high chargeback-to-transaction ratio and are in danger of breaching card brand thresholds.

Both Verifi’s Cardholder Dispute Resolution Network (CDRN) and Rapid Dispute Resolution (RDR) solutions enable you to avoid chargebacks by refunding customer disputes. In fiscal year 2023, CDRN and RDR combined have resolved nearly $700 million in pre-disputes.

Use AVS and CVV

Technically, Address Verification Service (AVS) and card verification values (CVV) are identity verification tools used to detect and prevent criminal fraud. However, they also provide vital data needed to fight friendly fraud — especially Visa disputes. If you don’t include AVS and CVV response codes in your chargeback response package, you have a very low probability of winning 10.4 disputes.

Some merchants balk at the idea of adding more friction to the checkout process. However, there are ways to request this information without negatively impacting conversions. For example, you can request AVS and CVV, but not decline transactions with mismatched data.

Respond to friendly fraud and recover revenue

You can and should fight friendly fraud chargebacks.

The recovered revenue will add a massive boost to your bottom line. But fighting chargebacks has additional benefits you might not be aware of.

- Pay less in fees

- Avoid fines and penalties

- Improve your reputation with your payment processor

A lot of merchants try to fight chargebacks on their own and give up because they think there’s not enough ROI. But you’d be amazed by what is possible with the right strategy and technology.

For example, at Kount, our clients have been able to reduce labor costs by 45%, improve win rates by 116%, and increase ROI by 914%.

Use a pre-transaction fraud solution

One of the biggest challenges of chargeback management is differentiating between criminal fraud and friendly fraud. Data and technology can help improve the efficiency and accuracy of that task — and a pre-transaction fraud solution offers both.

A fraud solution provides the evidence you need to expose friendly fraud — whether that’s through Order Insight or chargeback responses. And the technology can help block known fraudsters from attacking your business again in the future.

Reach out to Kount if you’d like to learn more.

CHALLENGE #3

Roadblocks to effective management

Chargeback management is a challenging task for a variety of reasons. But at the root of all the frustration, there are essentially just three main triggers.

Segmented data and processes

New fraud and chargeback threats emerge every day. And new solutions regularly pop up to solve those challenges. However, more solutions often mean more platforms. More platforms mean additional segmentation for data and processes. And segmentation leads to serious issues.

- Requirements to learn multiple platforms and functionality

- Reduced transparency and difficulty identifying threats

- Increased demand on IT and data security teams to manage platforms

- Additional costs from integration fees, platform minimums, and redundancies

Some chargeback management teams have been able to consolidate solutions.

“We use one platform to manage payment fraud and chargebacks.”

“We currently use 1 solution through our payment processor.”

But the majority of surveyed individuals rely on multiple platforms to be successful.

“We use many — our own homegrown platforms, Excel, third-party providers. I’m aware of 3 third-party providers. But my team is only one aspect of fraud. There are multiple fraud teams, and they could be using tools or providers I’m not aware of.”

“We're in the process of switching between some providers, so the number is a bit higher than typical temporarily. In addition to internal tooling and tools to help us organize and analyze info we collect, we're using 5-10 services.”

“We have reports that come from about 10 different places. Homogenizing those reports into one dashboard is something we're trying to build internally. … Hopefully in the future we're going to massage 5+ systems into one.”

Manual processes

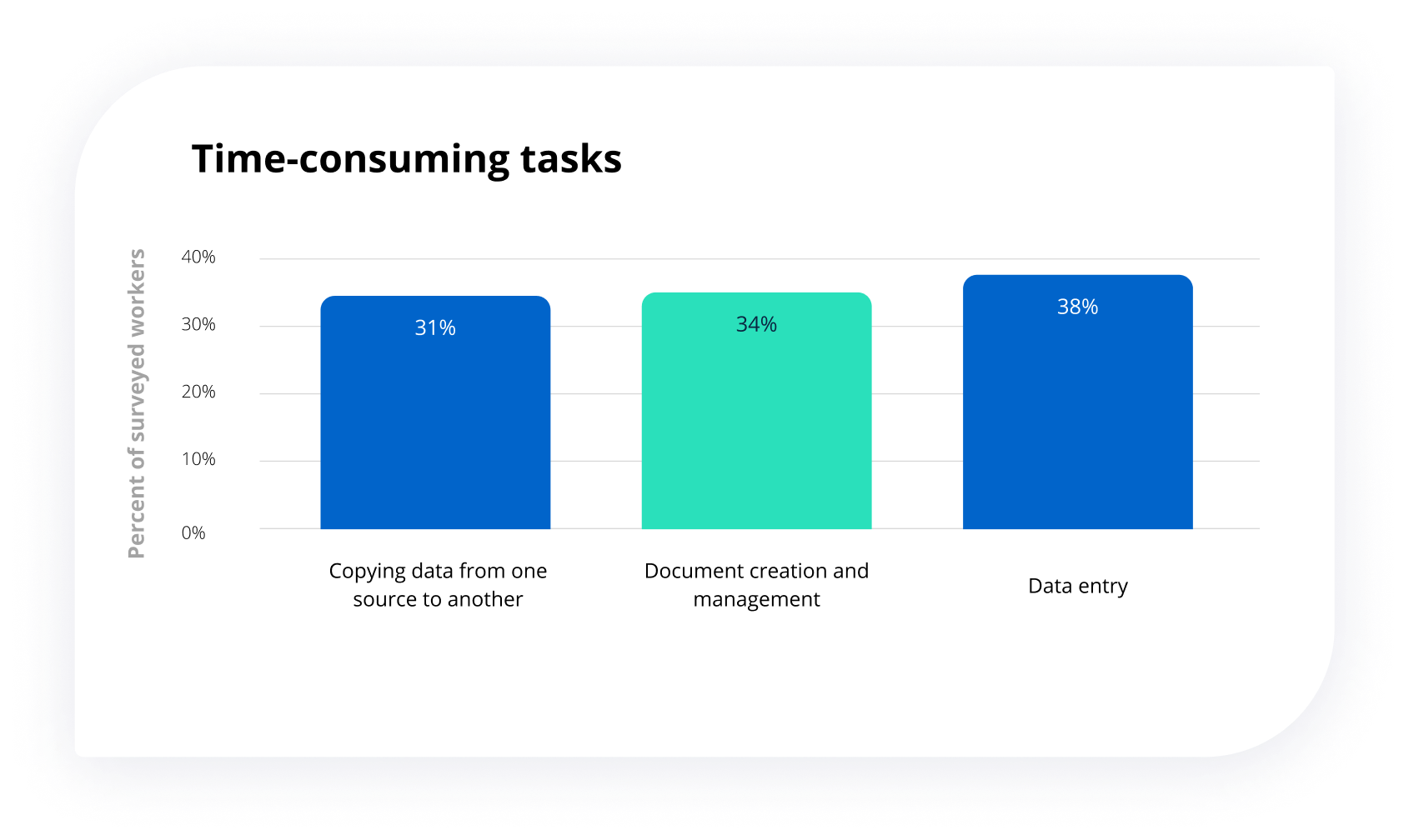

Nearly all businesses struggle to create efficient ways to manage labor-intensive, manual processes. When asked what time-consuming tasks they are burdened with, surveyed knowledge workers shared the following.

And risk management teams are no exception.

Chargeback management is a notoriously time-consuming, labor-intensive, error-prone process. From unearthing the cause of chargebacks and refunding disputed transactions to calculating losses and responding to chargebacks, the process is incredibly laborious. And laborious tasks cost money.

94% of surveyed knowledge workers perform repetitive, time-consuming tasks

44% of surveyed knowledge workers are not highly efficient or productive in their day-to-day work

Confusing rules and processes

A typical chargeback management strategy is built on two things:

- Confusing rules

- Complex processes

Card brand regulations are detailed and often difficult to understand. And rules can change significantly without much warning.

The processes you build to comply with those rules are usually just as complex. Yet there isn’t always enough transparency to know if those processes are generating the results you expect.

You probably ask yourself questions like:d

- What do these rules really mean for me and my business? Will brand updates help or hinder my current processes and results? What do I need to change to be compliant with expectations?

- What are the underlying reasons for disputes? Is it criminal fraud or friendly fraud? Intentional friendly fraud or accidental friendly fraud? What about merchant error? How can I solve issues to stop chargebacks at their source?

- Are the tools I’m using effective? What’s the ROI? Can I reduce costs? Increase revenue?

TIPS & SUGGESTIONS

How to respond

Here are our top suggestions on how to make your chargeback management strategy more efficient, effective, and transparent.

Combine solutions when possible

Look for ways to break down silos and consolidate your data.

Can one platform replace the functionality of another? Or could you switch to one new platform to eliminate two old platforms?

This suggestion might seem like a daunting, expensive task. But the long-term cost savings and efficiency will be well worth the short-term effort.

Increase automation

Automating repetitive, error-prone tasks has many obvious productivity benefits.

For example, 67% of surveyed knowledge workers report that automation makes them more productive. And 58% admit that automation helps them save time on projects.

But automation also offers quality of life enhancements too.

Two out of three employees say they are satisfied with their role because of automation. Sixty five percent of survey respondents say automation at work makes them less stressed.

And 52% of surveyed workers said they would rather sit in traffic for two extra hours every day than give up the automation tools that make their lives easier.

When applied to chargeback management, automation has the same notable benefits. For example, automation can reduce the time spent fighting chargebacks by 84%.

Collaborate with industry members

Don’t let chargeback management become an isolated task. It’s easy to feel overwhelmed, confused, and frustrated, but you don’t have to face those struggles alone.

Look for opportunities to collaborate with other professionals. Bounce ideas and suggestions off each other. Learn from other people’s mistakes.

But be selective of who you talk to. There are lots of individuals out there willing to give their advice on all sorts of things. Make sure you are consulting with an actual professional.

Here are some people and places to consider.

- Your payment processor: Your processor acts as a gatekeeper at various stages throughout the chargeback process. There are certain preferences and expectations — like how to order and format a chargeback response — that you’ll want to know. And processors have a close working relationship with acquirers who connect directly with the card brands. If you reach out to your processor with questions or requests, you’ll likely get insider information you wouldn’t find anywhere else.

- Your solution provider: If you work with a third-party solution provider for chargeback management, you should have access to an account manager or customer support team. Reach out and see if you can get advice on how to improve the accuracy and efficiency of your strategy. Some providers might charge for consulting sessions. But the team should be willing to provide basic advice as part of your contract. If not, it might be time to look for a new provider!

- Online forums: There are various ways to virtually connect with industry professionals. For example, MRC manages a Slack channel. Kount offers an online community for clients. Midigator created an Ask the Chargeback Expert group on LinkedIn. Look for opportunities to get connected.

- The card brands: When possible, go directly to the source. The card brands will have the most accurate information on regulations and updates. Dig into their published guides, look for representatives at trade shows, and read thought leadership content — like this white paper!

If you ever have questions about chargebacks, you are always welcome to reach out to the teams at Kount and Verifi. We’re happy to help!

IN CONCLUSION

Looking ahead in 2024

This year holds great potential — potential for both growth and challenges. But with a proactive risk management strategy, you can get ahead of emerging trends before they become a liability.

If you have additional questions about the year ahead or the best strategy moving forward, feel free to reach out to the experts at Kount and Verifi.

About Kount

Kount, an Equifax Company, is leading trust and safety technology that helps businesses grow with complete confidence. The platform includes solutions for fraud detection and prevention, identity verification, chargeback management, and regulatory compliance. Kount’s flexible, award-winning AI and machine learning are what empower businesses to make safe, accurate decisions that best fit their needs.

Kount works with thousands of brands worldwide — top brands like GNC, PetMeds, AMC, and more — and holds over 30 patents in fraud prevention. Founded in 2007, Kount is headquartered in Boise, Idaho. In 2021, the company was acquired by Equifax, expanding Kount’s robust data portfolio and global reach. View our chargeback management solutions to learn more.

About Verifi

Verifi, A Visa Solution is a leading provider of next generation post-purchase solutions, that streamline the dispute process and improve the customer experience. Available for all major card brands, Verifi solutions help merchants globally to prevent and resolve disputes by sharing compelling evidence, data transparency and merchant-initiated or rules-based refunding. Verifi equips merchants, issuers and acquirers to reduce financial loss, create operational efficiencies, and remove unnecessary fraud and first-party misuse disputes from the payment ecosystem. Visit: verifi.com.

- VisaNet Data - October 2023

- https://www.infosecurity-magazine.com/news/chatgpt-linked-rise-phishing/

- https://www.cfo.com/news/cybersecurity-attacks-generative-ai-security-ransom/692176/

- Kount internal data, January 2023 - December 2023

- https://www.enzoic.com/blog/8-stats-on-password-reuse/

- https://cybernews.com/security/billions-passwords-credentials-leaked-mother-of-all-breaches/

- https://www.superoffice.com/blog/response-times/

- Kount internal data, January 2022 - December 2023

- https://www.bankrate.com/banking/digital-banking-trends-and-statistics/

- https://midigator.com/the-consumer-confessional-2019/

- Verifi internal reporting, June 2023 - February 2024

- Verifi internal reporting, October 2023

- Kount internal data, January 2021 - December 2021

- Individual merchant interviews conducted on LinkedIn, March 2024

- https://zapier.com/blog/state-of-business-automation-2021/