We’re talking about REAL results!

225%

average increase in win rates

1000%

average increase in ROI

84%

average reduction in time spent fighting chargebacks

How to win chargebacks in 5 easy steps

Are you tired of losing revenue? Ready to fight and win chargebacks?

Don’t let chargebacks be a cost of doing business any longer. Use these 5 tips to easily win chargebacks and recover lost revenue.

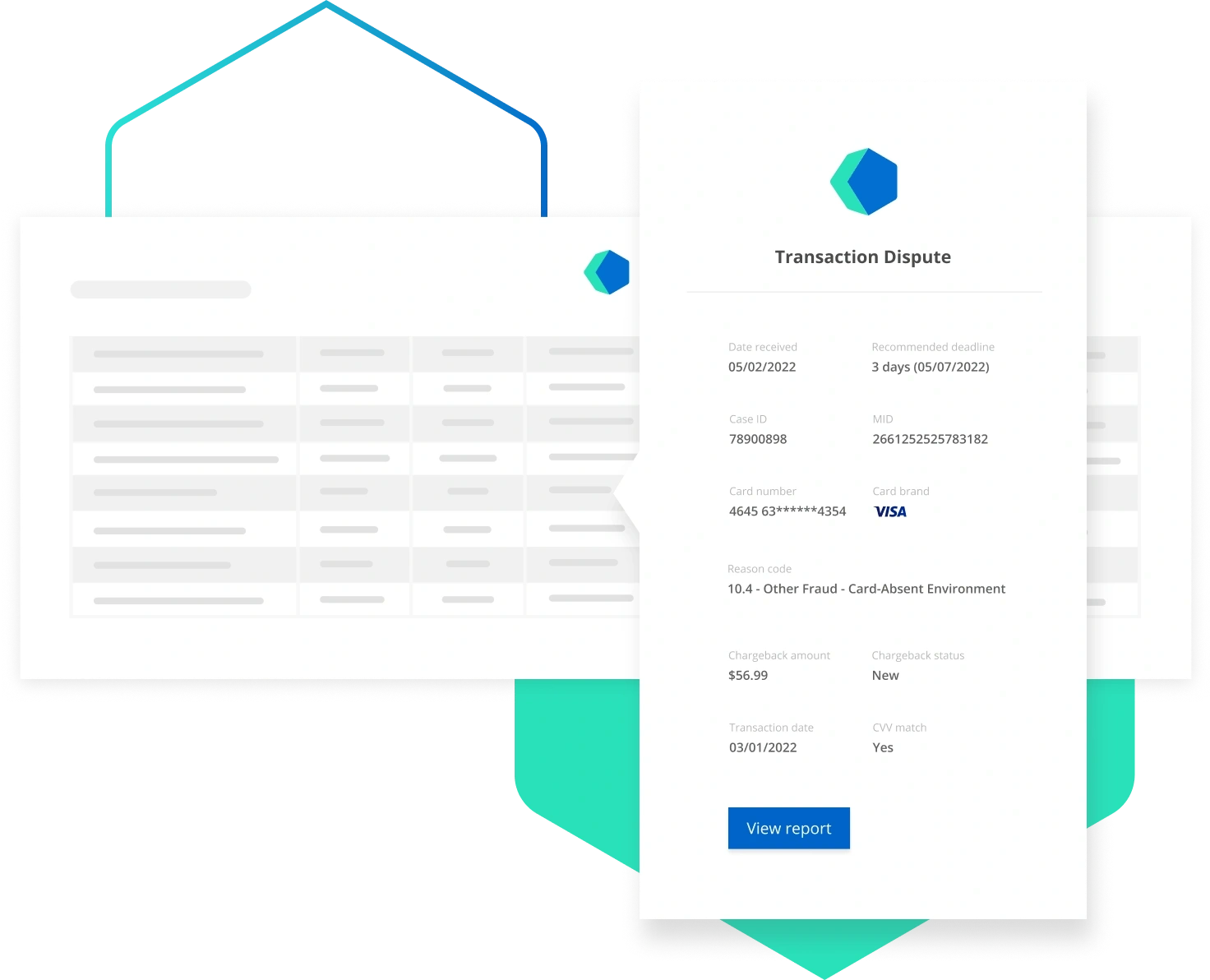

Want to simplify the process of collecting chargebacks notifications?

Keeping track of chargeback activity isn’t an easy thing to do on your own — especially if you have multiple merchant accounts.

But if you work with Kount, it’s easy to ensure you are always in control of your chargeback situation.

- Automatically consolidate all chargeback data into a single portal.

- View chargebacks for an unlimited number of merchant accounts.

- Receive real-time notifications so you can quickly take action.

Sign up for a demo today and our team will show you how to transform your chargeback processes.

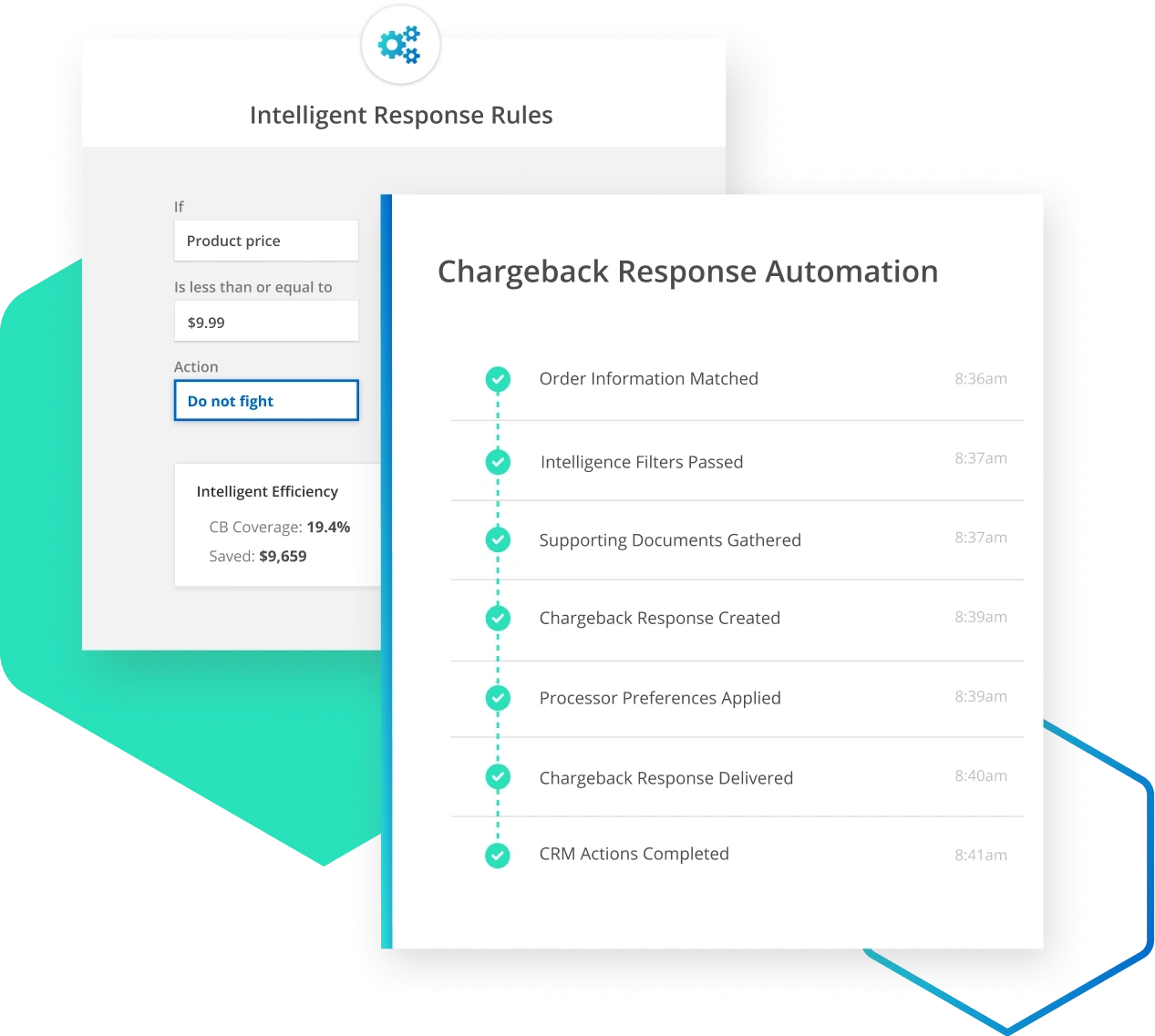

Want to simplify your chargeback fighting decisions?

Creating the perfect balance between fighting and not fighting can be a challenge. That’s why Kount makes it easy to create a cost-effective strategy that achieves the highest ROI possible.

- Reduce costs with technology-enabled pricing so you can fight more chargebacks.

- Quickly review key metrics so decisions are simple and accurate.

- Analyze results by different variables so you can identify areas of improvement and increase future win rates.

Sign up for a demo today and our team will show you how to transform your chargeback processes.

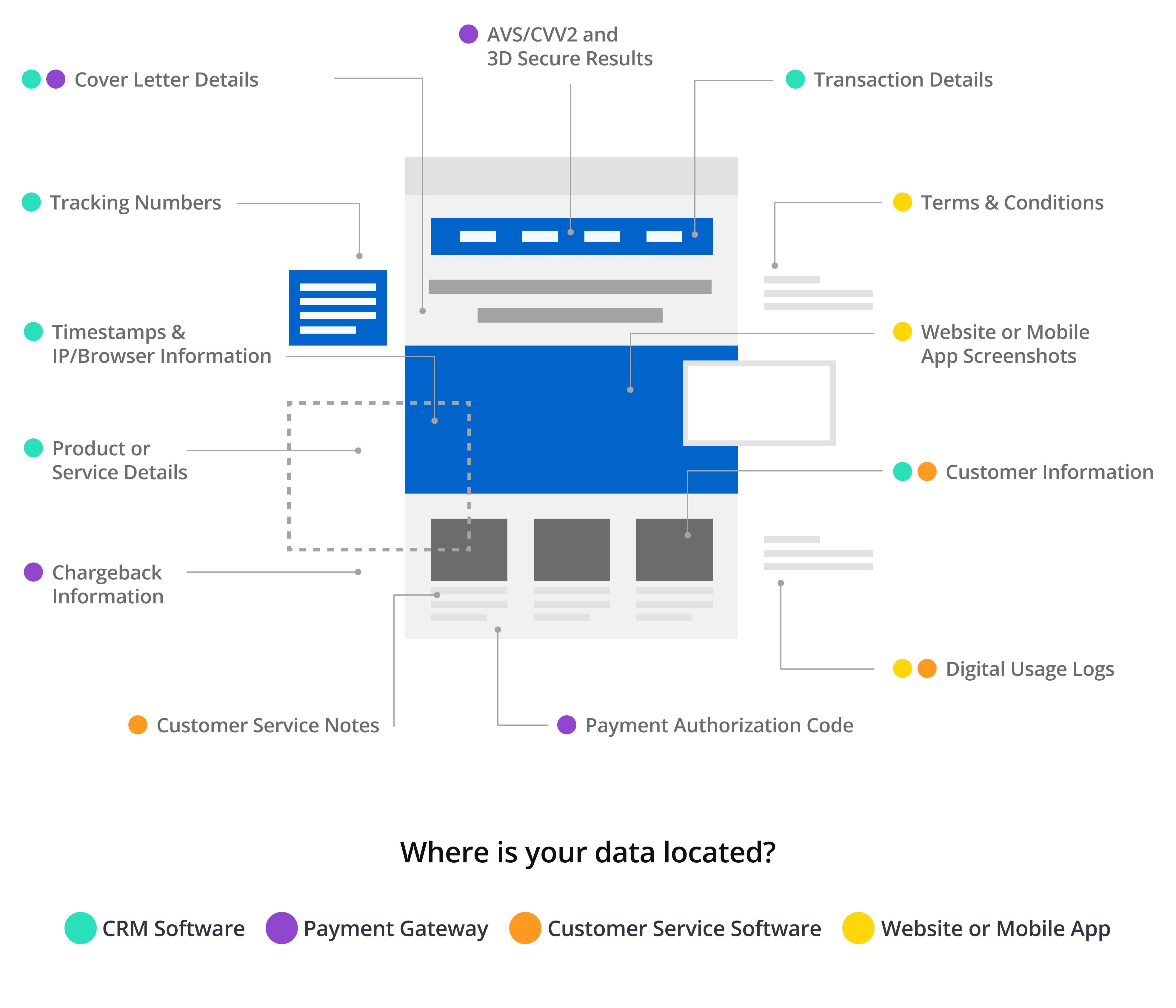

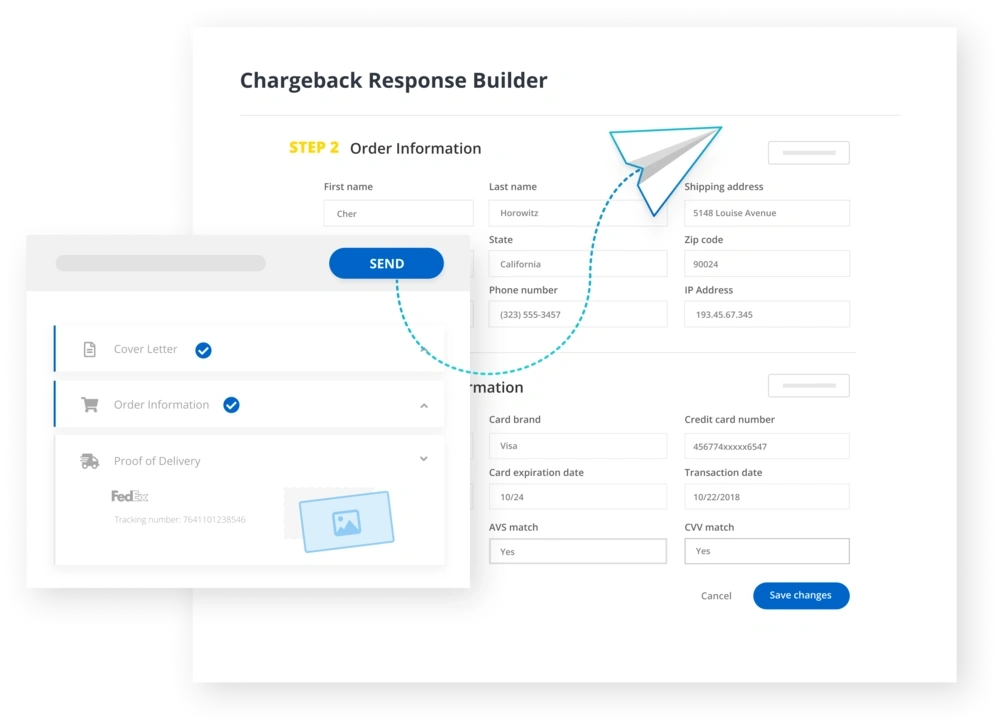

Want help creating compelling evidence packages that actually win?

Creating a compelling case is usually the most time-consuming part of fighting chargebacks. But it is also the most important.

With Kount's help, you can achieve the best results possible with the greatest efficiency. Say goodbye to the cumbersome tasks that are weighing you down.

- Automatically populate certain data points — half the work is done before you even get started!

- Receive prompts on what evidence should and shouldn’t be included so you have the perfect case each time.

- Use saved templates to improve the speed, accuracy, and ease of each response.

Sign up for a demo today and our team will show you how to transform your chargeback processes.

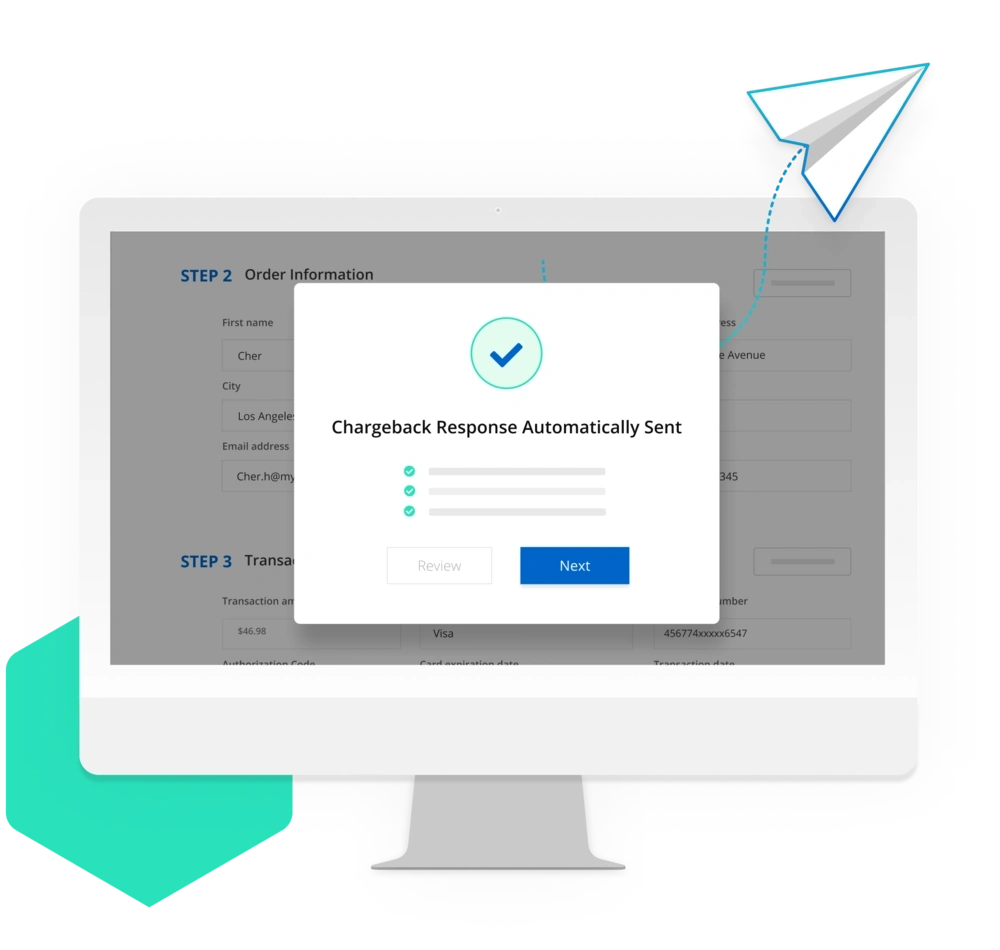

Want to simplify the process of submitting your dispute responses?

Kount has well-established industry partnerships, so we know what processors want. With our insider intelligence, it’s easy to abide by processor preferences.

And because we’ve created efficient technology, the days of fax, email, snail mail, and other manual submission processes are long gone!

- Monitor submission deadlines at a glance.

- Automatically customize responses to exceed processor expectations and have the best possible chance of winning.

- Send dispute responses with just one click.

Sign up for a demo today and our team will show you how to transform your chargeback processes.

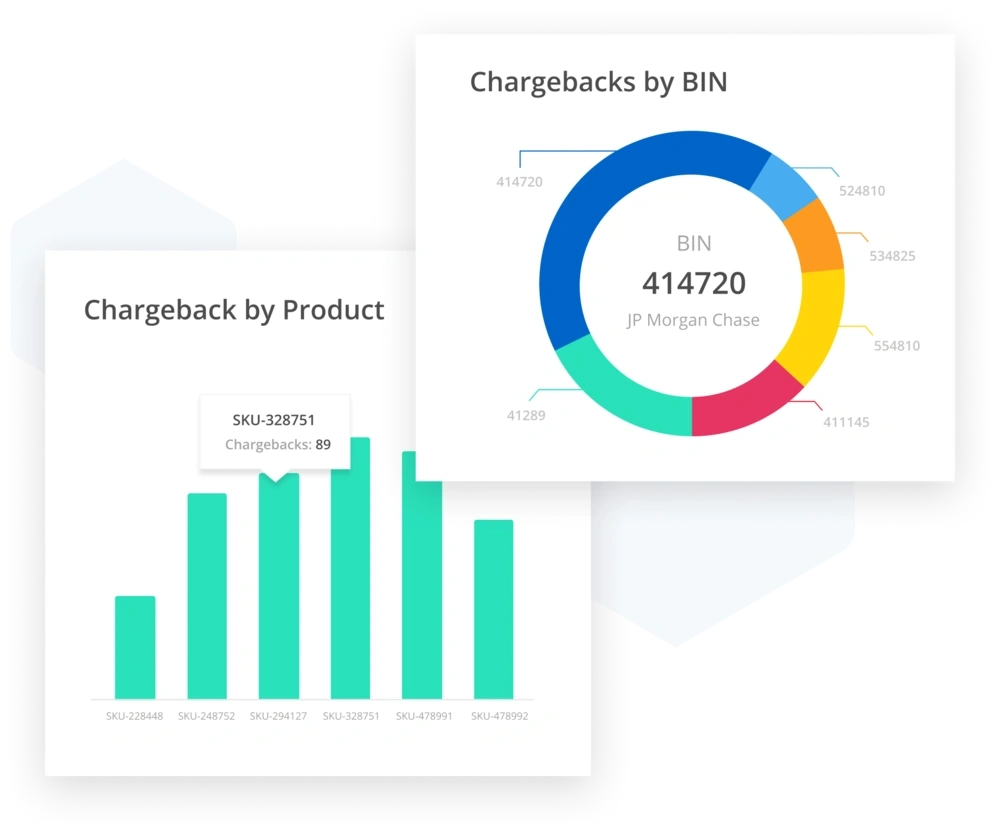

Want to level up your chargeback analytics and reporting?

Don’t waste time searching for results or wondering about outcomes. Kount provides detailed reports for all your dispute responses. Easily monitor your progress and ROI.

- Receive updates on the status of each response so you can accurately evaluate performance.

- Filter reports by relevant metrics so you can monitor what matters most to your business.

- Identify opportunities to optimize success and win more chargebacks in the future.

Sign up for a demo today and our team will show you how to transform your chargeback processes.

TESTIMONIALS

What our clients have to say

"The bottom line is Kount works. It does exactly what was advertised for us, which was reducing friendly fraud."

Lee Schmidt

Founder and CEO

Talk to an Expert

GET STARTED TODAY

Let Kount simplify your payment dispute management today!

Are you ready to see why thousands of companies trust Kount to manage millions of payment disputes with unprecedented ROI? Sign up for a demo today, and see what you’ve been missing!