CASE STUDY

How ClickBank uses Kount to Curb Chargebacks and Grow Revenue

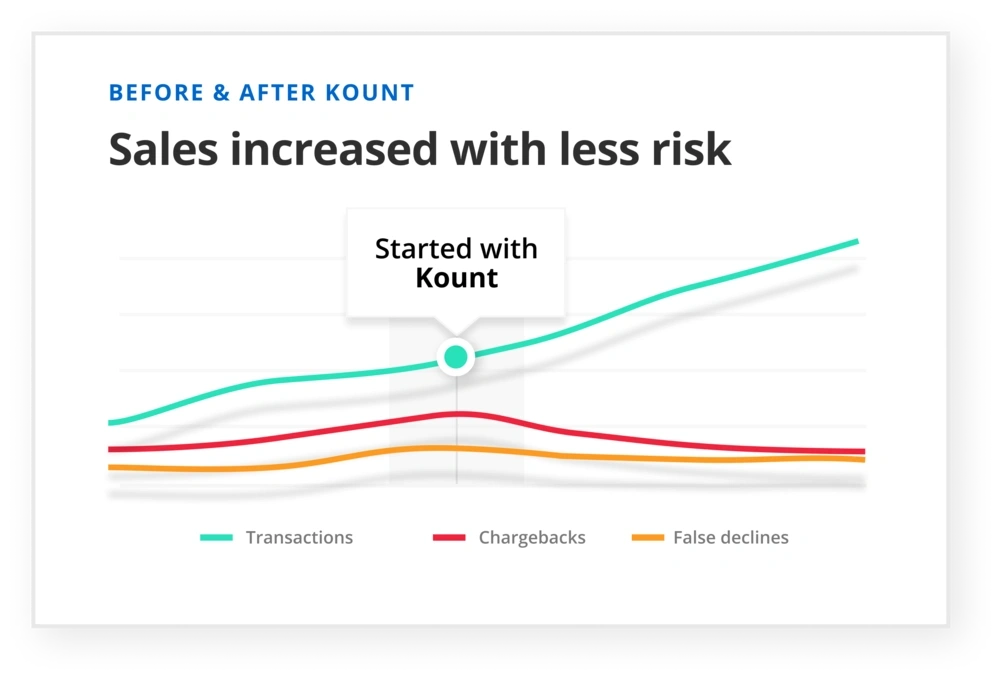

Declines

Stopped declining legitimate customers

Chargebacks

Got chargebacks under control

Transaction volume

Grew transaction volume with less risk

ClickBank is a global ecommerce platform that provides payment services for more than 6 million clients. ClickBank specializes in digital product purchases — such as ebooks, software, and memberships.

THE PROBLEM

High transaction volume. Ineffective risk protection in place.

Because ClickBank handles over 30,000 online transactions a day, fraud risks are high. Before coming to Kount, ClickBank faced two primary challenges:

1. Not being able to recover goods from fraudulent orders

Unlike physical goods, once a ClickBank transaction is approved and the digital merchandise (ebook, software, etc.) has been downloaded, there’s no way to recover the merchandise if the transaction turns out to be fraudulent. So ClickBank was losing the merchandise and revenue from fraudulent sales.

2. Declining legitimate customers to avoid risk

ClickBank wanted the flexibility to fine tune their risk thresholds. It was critical for them to balance chargebacks — and the associated costs and risks — with the need to maximize revenue by filtering out the good customers from the bad. But they had no way to set those thresholds without declining legitimate customers.

THE THE SOLUTION

Automation and customization means better efficiency.

With Kount, ClickBank is able to create custom policies and automate processes to make their fraud prevention workflow more efficient and less time-consuming. Plus, using Kount’s real-time data, ClickBank can always stay one step ahead of emerging threats.

Kount was really easy to set up. And it’s pretty easy to use day-to-day. Other solutions make real-time recommendations, but based on data that’s a day old. Kount accesses that data in real time to keep us ahead of the bad guys.

— Tom Denig, Director, Risk Operations, ClickBank

THE RESULTS

Better fraud management. More revenue saved.

With Kount, transaction volume for ClickBank continues to climb — resulting in higher order authorizations and increased revenue. At the same time, ClickBank now has the ability to dial-in their precise level of chargebacks. Even if a fraudulent transaction goes through, Clickbank is able to avoid chargeback costs and fees thanks to Kount’s notification and alert system.

No longer does ClickBank have to worry about denying legitimate customers or accruing too many chargebacks. Kount covers it all.

Kount really is a one-of-a-kind solution. It has helped us take control of our risk. We can handle 30,000 transactions a day with just a single person managing the entire process. Reliability-wise, you couldn’t do much better.

— Tom Denig, Director, Risk Operations, ClickBank

GET STARTED TODAY

Maximize your revenue growth potential

Have you been struggling to manage risk? Or declining legitimate customers to avoid potential chargebacks? Let us help. We'll take care of fraud so you can focus on what really matters.