The Difference Between an Acquiring Bank and Issuing Bank

According to transactions-worldwide-by-brand-as-of-2011/">industry data, up to 468 billion payment card transactions occur every year around the world. Acquiring banks and issuing banks are two major players in ensuring money from those transactions gets to where it needs to go.

An acquirer is a bank that serves merchants. It is licensed to provide merchant accounts to qualified businesses, enabling those businesses to process payment card transactions. An issuer is the cardholder’s bank. It issues payment cards to authorized consumers.

Any business that accepts payment for goods and services must understand these critical systems and how they work together in the transaction process.

What are Acquiring Banks?

An acquiring bank (sometimes just called an acquirer) serves a merchant by “acquiring” funds from cardholder banks when debit and credit card transactions are processed. These funds are deposited into a merchant's account that the acquirer provides and maintains for the merchant.

Acquirers are members of one or more card networks (examples of debit and credit card networks include Visa®, Mastercard®, American Express®, and Discover®).

A simple way to think about it is that acquiring banks are merchant-facing.

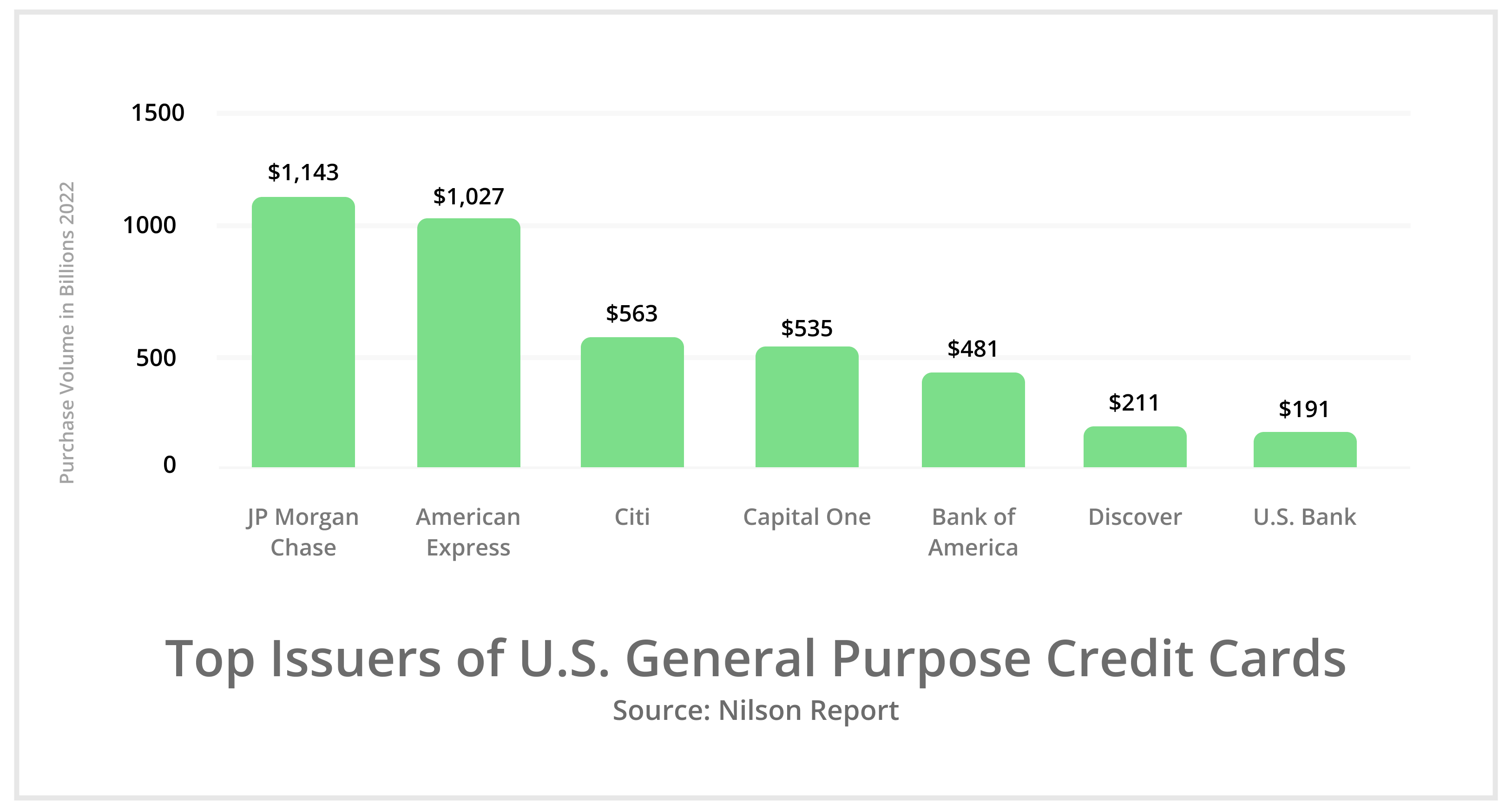

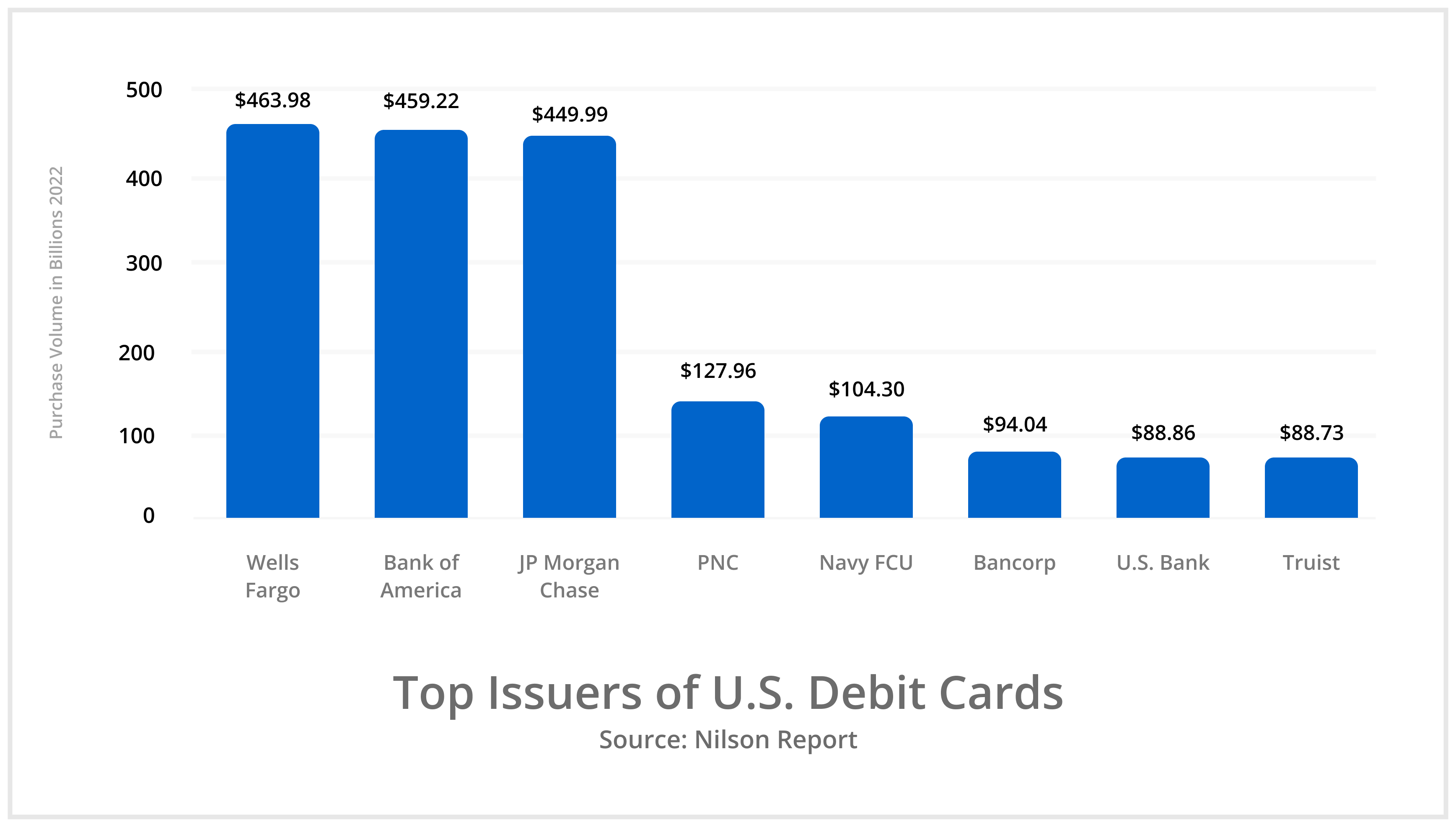

What are Issuing Banks?

Issuing banks, on the other hand, are cardholder-facing. Their primary responsibility is issuing cards to authorized consumers.

Like acquiring banks, they are also in-network with one or many card brands (sometimes called card associations).

It’s easy to think that companies like Visa and Mastercard are issuers. After all, their logos are prominently displayed on most payment cards. However, the card brands don’t typically work with consumers directly. Instead, they let financial institutions (including credit unions) maintain those relationships for them.

Responsibilities of Issuers and Acquirers

The differences between issuers and acquirers are subtle but important. The following table explains the roles and responsibilities of each in the transaction ecosystem.

| ISSUING BANK | ACQUIRING BANK |

|---|---|

| Handles credit card applications | Sets rules and requirements for merchant accounts |

| Offers and maintains debit or credit accounts | Offers and maintains your merchant account |

| Issues credit and debit cards to authorized cardholders | Records merchant account activity (deposits, withdrawals, fees, etc.) |

| Approves or declines cardholder transactions | Forwards authorization requests |

| Releases funds to acquiring banks upon transaction approval | Deposits funds into your account when transactions are processed |

| Allows cardholders to make purchases with payment cards | Allows you to earn money from purchases made with payment cards |

| Initiates the chargeback process on the cardholder’s behalf | Receives chargeback notices and debits your account |

| Reviews chargeback responses and assigns liability | Receives, reviews, and forwards chargeback responses |

How Transactions and Chargebacks Work: The Roles of Issuers and Acquirers

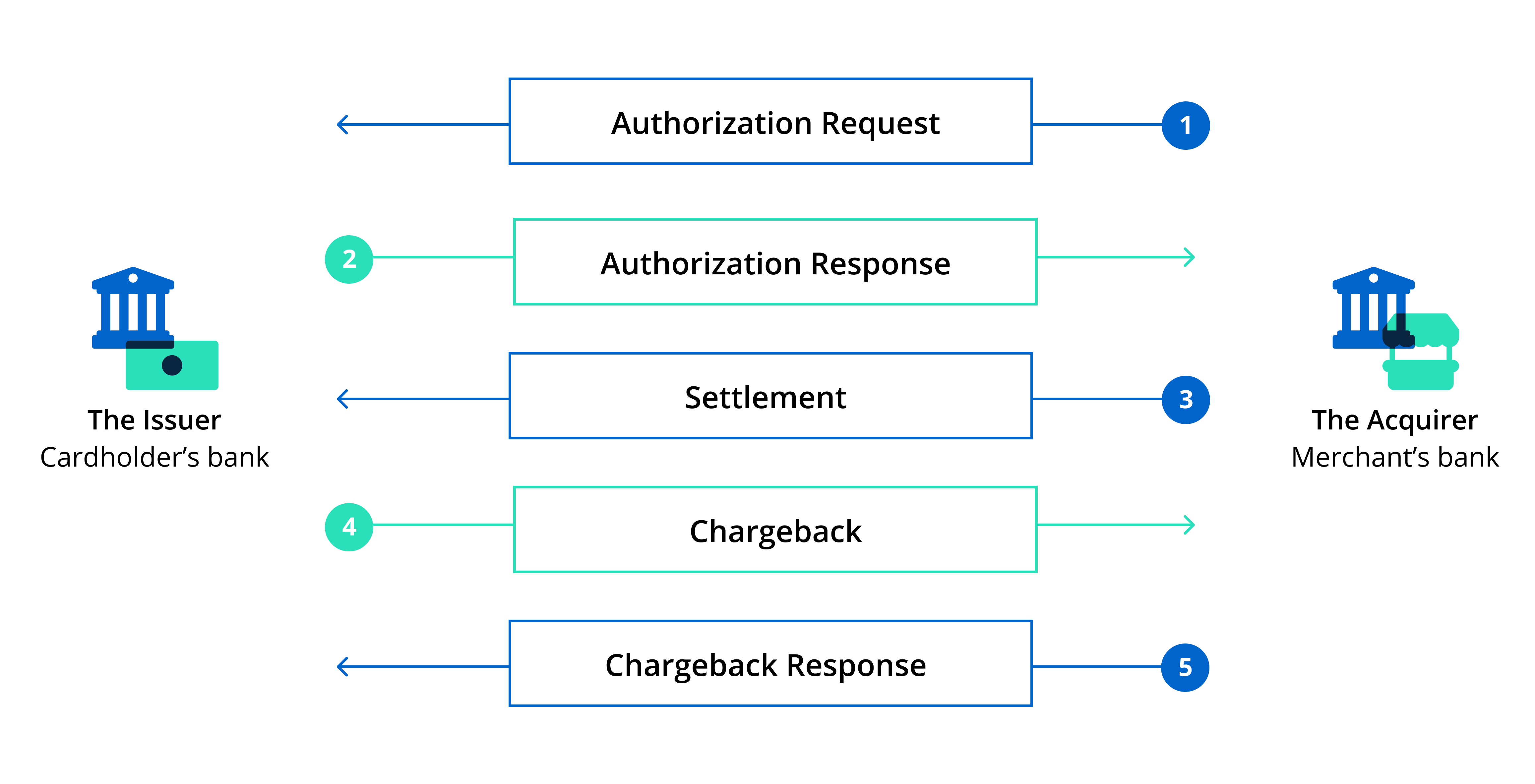

To illustrate the unique roles of issuers and acquirers even more, let’s look at an example transaction flow and chargeback scenario.

STEP ONE:

Authorization Request

A cardholder with purchase intent shops on your site and adds a few products to the cart. As soon as the cardholder enters payment information and clicks the “Buy Now” button, a complex series of events is initiated — beginning with the authorization request.

Your acquiring bank, via your payment processor, submits an authorization request to the issuing bank. The purpose of the authorization request is to determine whether or not the cardholder meets all the necessary criteria to make the purchase.

STEP TWO:

Authorization Response

The issuer checks the status of the cardholder’s account and sends an authorization response back to the acquiring bank.

The authorization response is a suggestion on how you should proceed. There are several response options, but they basically fall into two categories.

Approved Authorization Response

The issuer will return an approved response if the following are true:

- There is enough money in the account (or available credit) to pay for the purchase.

- The card hasn’t been reported lost or stolen.

Declined Authorization Response

The most common reasons for a declined transaction are the following:

- There are insufficient funds or credit to pay for the purchase.

- The cardholder claimed a lost or stolen card, indicating a fraudulent charge.

- A technological malfunction happened somewhere in the transaction pipeline.

- The customer entered important information (such as a billing area code) incorrectly.

STEP THREE:

Settlement

After a transaction has been approved, it needs to be settled.

Transaction settlement is the process of moving funds from the cardholder’s account to your merchant account following a credit or debit card purchase — minus costs like interchange fees, processing fees, etc.

Most card-not-present merchants settle all their authorized transactions in one single batch (as opposed to settling each transaction individually). This is most often done at the end of the business day. However, some merchants may choose to delay settlement.

For example:

- A restaurant may choose to delay its settlement for a few hours until after a patron has submitted a tip.

- Hotels often delay their settlements for several days to account for potential up-charges or fees incurred by the guest.

The transaction is complete whenever the settlement goes through — unless the cardholder decides to dispute it.

STEP FOUR:

Chargeback

In a perfect world, this would be the end of the story. Both you and the customer would go your separate ways having completed a mutually beneficial transaction.

However, as many of us know, not all customer experiences go the way we want them to. Sometimes, customers initiate chargebacks.

In a chargeback scenario, the cardholder contacts the issuing bank and disputes the transaction. The issuer processes credit for the cardholder’s account and forwards the chargeback notice to your acquirer.

The acquirer receives the notice and debits your merchant account.

STEP FIVE:

Chargeback Response

If you decide the chargeback is invalid — for example, the chargeback was submitted after the deadline or it was the result of cardholder confusion — you can dispute it with a chargeback response.

You would create a rebuttal and send it to the acquirer for review. If the acquirer deems it a solid case, the bank will credit your merchant account and forward the response to the issuer.

The issuer then reviews the case, deciding if it’s a more compelling argument than the initial dispute. If so, the issuer debits the cardholder’s account once again.

NOTE: Up until this point, workflows and roles are pretty standard across all card brands and all situations. And most cases end here. However, some cases do progress even further. In those situations, there are additional responsibilities for acquirers and issuers. However, there is no universal explanation for those stages and tasks. Workflows vary greatly from this point on based on the reason for the dispute, the card brand, and much more.

Issuer and Acquirer FAQ

It can be difficult to understand the differences between all the players in the transaction process and how they work together. Here are some frequently asked questions on the topic of issuing and acquiring banks.

Mastercard and Visa are issuers, right?

No. They are card brands. But American Express and Discover are sometimes both the card brand and card issuer. Check the individual brand articles to learn more.

Do I need to have an acquirer? Or can I do without?

If you want to process credit and debit card transactions, you need a place to put the money. That place is a merchant account. And only acquirers provide merchant accounts.

It’s the acquiring banks’ special relationship with the card brands that allow merchants to accept payment from cards issued by those associations.

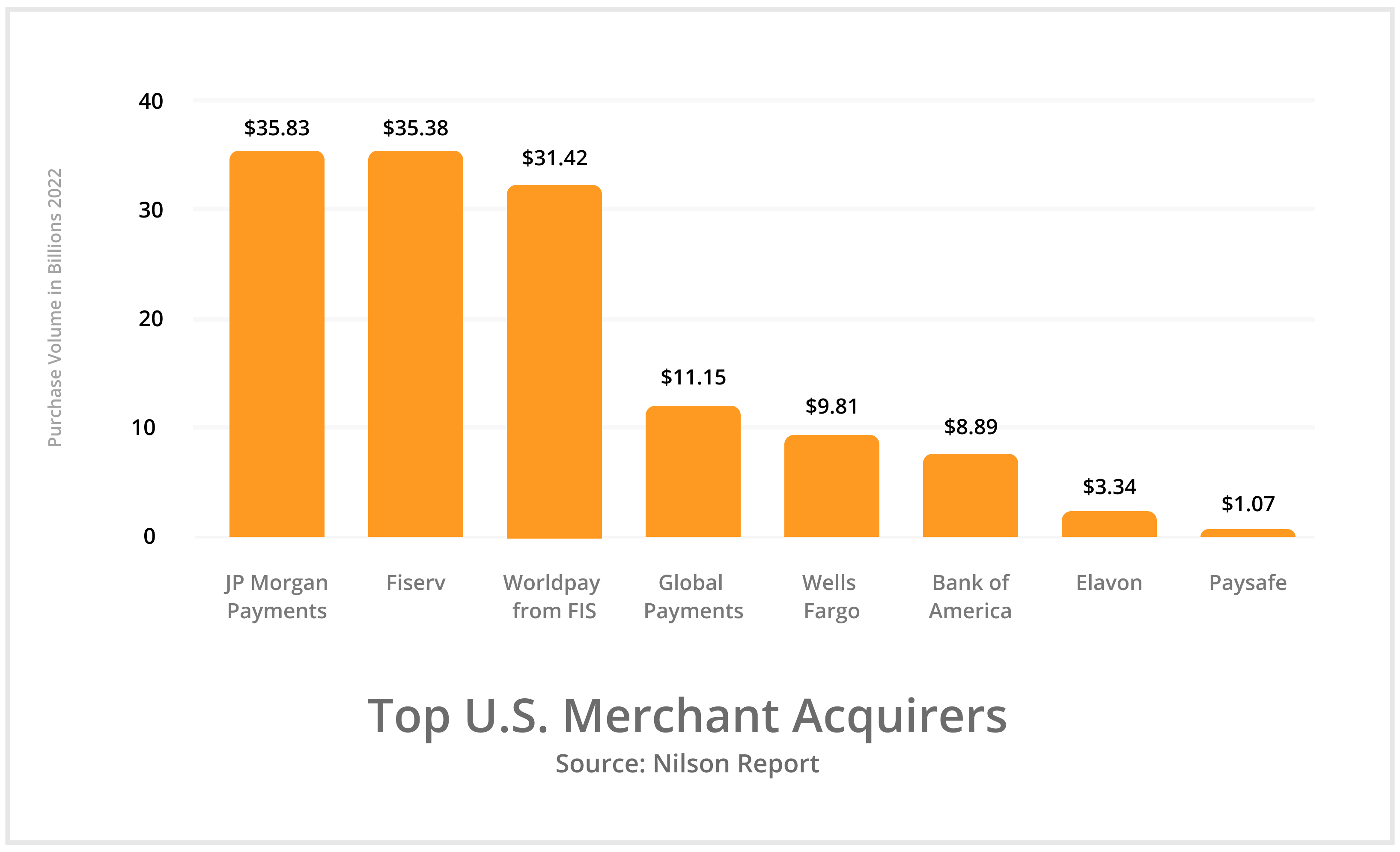

How do I choose the right acquirer?

Merchant accounts are valuable assets. You not only want to work to keep your account safe, but you also want to make sure you start out with the best possible fit for your business.

As you shop for an acquirer, check the following criteria.

- Accepted card brands

- Compatibility with your gateway, fraud tool, etc.

- Allowed transaction volume and ticket amount

- Contractual obligations

- Reserve account requirements

- Fees (set-up, monthly, transaction, refund, settlement, currency conversion, chargeback, etc.)

- Accepted currencies and locations (this is especially important if you’re doing international sales or want to grow into that eventually)

- Customer support hours and channels

- Online reputation and reviews

Can I use a platform like Square, Stripe, Shopify, or PayPal as my acquirer?

If you want to, yes.

All-in-one merchant services — like those provided by Square, Stripe, Shopify, and PayPal — can be convenient solutions for busy ecommerce businesses. They often include everything you need to accept payments, including integration with your website’s payment portal, robust back-end software, payment processing, and even customer relationship management (CRM) capabilities.

But what you gain in convenience, you may lose in customizability. As you grow, you may want to break away from the all-in-one solutions so you can mix and match platforms to better fit your business’s needs.

Should I contact my acquirer if I have questions about my merchant account?

Probably not. Even though the acquirer is your bank, you usually won’t work with the acquirer directly. You’ll likely deal with your payment processor. Your processor probably has an account manager that will be your point of contact for any questions.

Keep up on Payment Industry Terms with Kount

We understand that this post is dense and these terms can be confusing. Trying to understand the complexities of the transaction process in under 3,000 words is like drinking from a firehouse.

That’s why we’ve built a comprehensive library to help you better understand transactions and disputes. Dig into the valuable lessons these resources offer.

- Blog with explainer and how-to articles

- On-demand webinars with industry experts

- Guides with templates, samples, and examples

- Analyst reports with industry insights

If you have specific questions about fraud or chargebacks — and how Kount helps manage them without the accompanying headaches — feel free to reach out to our team of experts.