New refund trends reveal changing, morally gray consumer sentiments

When people hear the term “social engineering attack,” they might think of fraudsters manipulating consumers to reveal sensitive information. But many would be surprised to find that, today, consumers are also turning to social engineering. They’re using it to game companies and obtain refunds without returning goods.

In recent years, companies have dealt with out-of-control return rates brought on by increased online shopping. But due to rising inflation and a higher cost of living, return rates are only getting worse — and will be for a long time.

To combat return losses, some companies are deploying not-so-customer-friendly strategies and wising up to popular types of refund fraud. But increased company controls have driven consumers to social engineering.

More and more consumers are using aggressive or manipulative tactics to coerce customer service representatives into issuing refunds — often without returning items. Or they’re hiring professional refunders to do it for them.

For many consumers, it’s a slippery slope from buyer’s remorse to taking advantage of a flexible policy to operating in moral gray areas where intentional social engineering is the norm. That’s the sentiment on open-discussion platforms where fraudsters and consumers post how-to guides on engineering refunds.

“The thing with [social engineering] is that it’s easy to do, and you’re not having to outright defraud companies,” said one commenter. They claim to make “a good living wage” but discovered social engineering on the platform and now use it to get thousands of dollars in freebies, from food to clothes and electronics.

To further investigate social engineering trends and changing refund sentiments, Kount surveyed 1,000 consumers who have purchased items online in the last year and obtained refunds. The survey reveals:

- How often consumers seek refunds and why

- The items consumers refund most often and their average dollar value

- What tactics customers use to coerce service agents into refunding purchases

- If customers have ever hired refunding service providers and how it worked

24% of consumers returned 11-20 online purchases in the last year

In the last year, 24% of consumers surveyed returned between 11 and 20 online purchases for a full refund. 25.5% said the average value of refunded purchases was between $26 and $50. Another 29% said the average value was between $51 and $100.

If a business refunds 11 purchases at a rate of $26, they lose $286 per customer for at least 24% of customers. Now, consider 20 online purchases at $100. That’s $2,000 per customer in 12 months.

And that’s just for online purchases, which see higher return rates than in-store purchases. Unfortunately, today’s merchants are facing unprecedented return rates fueled by post-pandemic spending habits, inflation, and higher living costs.

One retailer even recently announced it would start charging customers to return items after online returns soared beyond pre-pandemic levels and contributed to a 94% fall in pre-tax profits this year. It’s a move that other retailers have already made quietly to offset refund losses. And many more are soon to follow, analysts predict.

Clothing and apparel make up most returned online purchases

Respondents in Kount’s survey said clothing and apparel were their top returned online purchases, which aligns with return statistics from other major research firms. 37.6% of Kount’s respondents reported returning clothes and apparel last year — a rate two times higher than the next most returned goods.

4 in 10 consumers received a refund for a good they kept — returnless refunds may be the cause

In addition to rising inflation rates, merchants are battling growing shipping costs, extraordinary fuel prices, and limited storage space for mounting returns. And considering that the cost of processing e-commerce returns — between labor and logistics alone — often exceeds the product’s value, it’s no wonder that more merchants are turning to no-return refunds.

No-return refunds, or returnless refunds, occur when a merchant allows a customer to “return” an item and receive a refund but keep the item. Essentially, it’s more cost-effective for a merchant to issue a returnless refund than take back an online purchase.

41% of consumers in Kount’s survey report receiving a refund for an item they didn’t return. Though some consumers may reflect a genuine returnless refund, others may not. Customers have caught on that merchants are issuing no-return refunds, and some are purchasing products with the intent to get a refund and keep the product.

Analysts estimated that no-return refunds will cost retailers as much as $4.4 billion in 2021. So while it may be cost-effective for merchants to go the returnless route, they should be careful they don’t welcome abuse.

Almost 40% of people have coerced a customer service rep into refunding a purchase

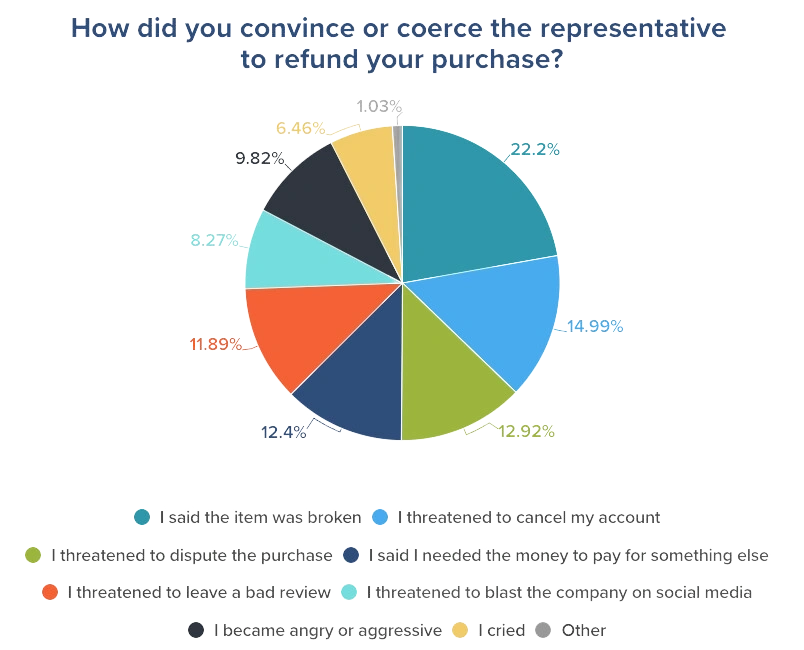

40% of consumers report using social engineering tactics to coerce representatives into issuing refunds. Saying the item was broken or damaged was the No. 1 coercive tactic, followed by threatening to cancel services and disputing the purchase.

Additionally, over a third of all respondents say they’ve lied — another form of coercion — to a business or customer service agent to obtain a refund.

Damaged or broken items were the top reasons consumers sought refunds

Of consumers that used coercive tactics to seek refunds, the highest majority (26%) did so because the item arrived damaged or broken. Other top reasons included:

- Customer service was unhelpful (16.28%)

- There was something wrong with my bill or payment (15.50%)

- The return window had closed/expired (15.50%)

- The company didn’t believe the item was defective (13.95%)

- I wanted to use the item but not keep it (12.14%)

While improved business practices and policies would help curb coercive or manipulative tactics, other reasons for this behavior reflect today’s customer sentiment. Both “the return window closed” and “wanting to use the item but not keep it” show consumers are willing to use subversive tactics.

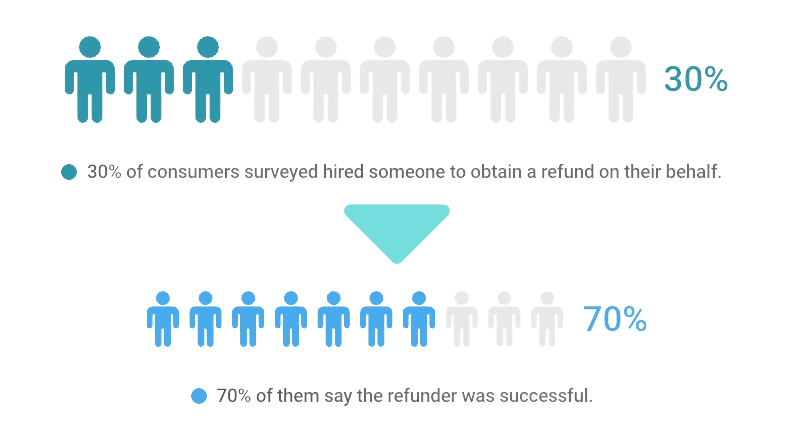

Almost one-third of consumers have hired someone to obtain a refund on their behalf

Refunding services — where “professional refunders” obtain refunds for consumers in exchange for a fee — are increasing in popularity. An eye-brow-raising 30% of consumers report hiring someone to get a refund on their behalf. And 70% of them say the refunder was successful.

Professional refunders also use coercive and deceptive tactics to secure refunds. But often, the methods are more sophisticated — and difficult to catch — than the ones consumers use. Moreover, survey results show that consumers are seeking refunders for more expensive items.

Almost 49.53% of refunded amounts (that consumers paid someone to secure) were between $25 and $100. 28.77% of refunded amounts totaled $101 to $999. And 21% of refunded amounts were between $1,000 to $10,000.

Consumers are also using professional refunders to go after different goods than when they seek refunds on their own. For example, when using refunders, consumers prioritize high-value or luxury items like electronics, skincare/haircare and makeup products, clothes/apparel/shoes, and exercise equipment.

Profits at risk as consumers embrace new refund and return tactics

Almost 30% of consumers say they wouldn’t think differently of a friend or loved one who lied to or coerced a customer representative for a refund. And another 33% said they would think slightly more or significantly more of a friend or loved one who had.

The consumer mindset is changing, and the slippery slope from telling a little white lie to hiring a professional refunder or engaging in aggressive tactics is becoming the norm. Consumers are aware of social engineering and refunding services and embracing both.

Telling a white lie — or paying someone else to — doesn’t seem to carry the same conscious weight for consumers as swapping out a luxury face cream for a drugstore brand and returning the more expensive product.

This moral workaround, however, is still costly for businesses. For example, this year, refunds were more expensive than chargebacks for Kount’s merchants for the first time. So even though it can be good business sense to give customers the benefit of the doubt, merchants must stay vigilant.